How to Take Advantage of a Stock Market Crash

Robo-advisors are wonderful during a stock market crash as they insert a layer between your emotions and your investments. Robo-advisors can select the best investments for you during a stock market crash. DIY investors can learn from how robo-advisors invest.

Its rarely wise to let your emotions dictate your investing. In fact, research proves that investors who get scared when markets tank, and sell end up with lower returns than those who stay the course and stick to their investment plan.

When you sell during a market crash you need to be right twice. Once when you sell and again when you decide to buy back in.

There are many investors who sold during the 2008 stock crash and then let fear keep them from getting back into the market. The longer these investors waited, the more they missed out on the rebound and ensuing bull market that continued for the next ten years.

Others have only experienced a rising stock market and don’t know how to take advantage of a stock market crash.

Whether you invest with a robo-advisor now, are considering one in the future, or want to know, “How can I protect my money from the economic collapse?” this article offers tips to take advantage of the stock market crash and wisdom to keep you calm.

We’ll also include videos and resources from our robo-advisor partners to help you learn ways to take advantage of this stock market crash.

[toc]

1. Learn From Robo-advisors: How to Benefit From a Stock Market Crash

How robo-advisors are structured can help you understand the best investments during a stock market crash and how to protect your money from economic collapse. DIY investors can learn from robo-advisor strategies too.

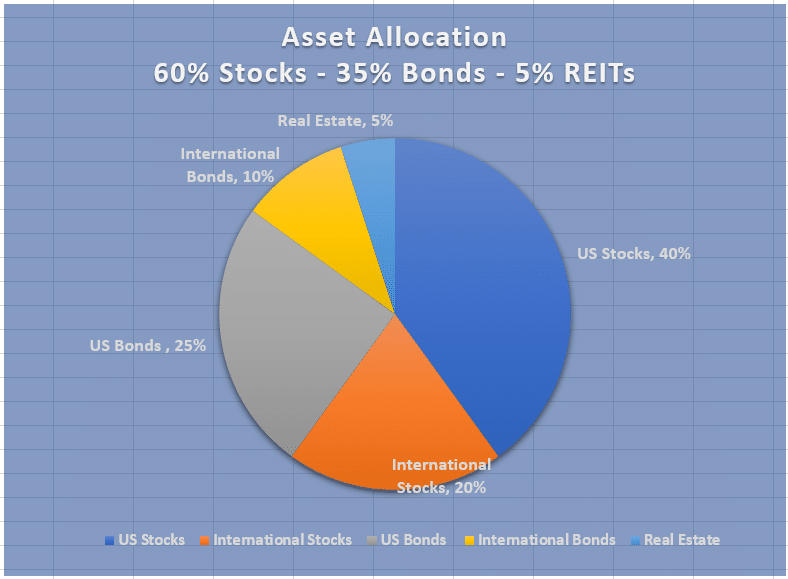

Robo-advisors help you decide your asset allocation before investing. This is the mix of stocks, bonds, cash and alternative assets.

Creating an appropriate asset allocation, in line with your risk tolerance, before you begin investing is important.

If you’re panicked by the market crash, your asset allocation might not be right for you and you might need to adjust it.

Here’s how choosing an asset allocation works – ideas for robo-investors and do-it-yourselfers:

- First, a robo-advisor helps you choose your asset allocation by answering a few questions about your risk tolerance, age, and goals.

- DIY investors also need to decide how much risk they can handle, or take an online risk quiz.

- Next, depending upon your answers to the initial questionnaire, you’re presented with a mix of stock and bond investments. More conservative investors have a greater percent invested in cash and bonds while more aggressive investors own more stocks. This is your asset allocation, as determined by the robo-advisor.

If your portfolio has a greater allocation to stock funds now, you’ve experienced more pain during the recent stock market crash.

You may be wondering, “Are bonds safe in a stock market crash?” or looking for a way to rebound from the stock market crash. During this stock market crash, bonds held up well and gained a few percent. And that’s why you want some bond investments in your portfolio.

But, if you’re investing for long term goals like retirement or to pay for Juniors college in 10 years, then the current stock market decline shouldn’t impact your asset allocation decision.

Initially, you made your asset allocation for a reason, and unless your situation has changed, now is the time to stick with your plan.

When investing with a robo-advisor, if you made a mistake with your asset allocation, you can always go back into the platform and change your answers to the risk quiz and subsequently adjust your asset allocation. (This is the process to change your asset allocation for most robo-advisor platforms.)

When investing on your own, of course you can change your asset allocation as well. Don’t be afraid to include a cash account in your asset allocation. You won’t get a great return with cash, but you won’t lose money either.

In the next section we’ll show you exactly how and why to adjust your asset allocation. It is one of the best ways to take advantage of this stock market crash.

Unlike a self-managed investment account, investing with a robo-advisor places an extra layer of management between you and the “sell” button, and that can keep you from making a rash investment decision – like locking in paper losses by selling during a atock market crash.

2. Rebalance to Take Advantage of a Stock Market Crash

Here’s an example of how to take advantage of a stock market crash by rebalancing.

Let’s assume you have $100,000 invested and your asset allocation was 70% stocks and 30% fixed investments, like bonds and cash. That’s $70,000 invested in stocks and $30,000 invested in bonds and cash.

After the market crash your stock allocation falls 30% and is worth 30% and is worth $49,000 while your cash and bond allocation rises 4% to $31,200.

Because of the diversification or mix of stocks and bonds, your portfolio fell approximately 20% and is now worth $80,200. As painful as this loss might be, there is a way to take advantage of the stock market crash and that is by rebalancing your investments. Simply put, this means buying more stocks to get back to your preferred 70% stock, 30% fixed asset allocation.

The discipline of rebalancing now, forces you to buy stocks while they are on sale, even though it is scary!

With your new portfolio now valued at $80,200, to rebalance you would sell $24,000 of your bond funds and buy stock funds with the proceeds. Or, if you have extra cash you can add to your stock investments and return to your preferred asset allocation.

Dan Egan of Betterment, one of our favorite robo advisors provides guidance and tips to manage your emotions, your finances, and how to take advantage of a stock market crash.

Video source; Betterment

3. Avoid Selling Stocks During a Market Crash

Pippa Stevens in a recent CNBC article explains why you should not sell stocks in a market crash:

It’s nearly impossible to time your investing so that you get out at the right time and then get back in at the exact right time to profit from big comeback rallies.

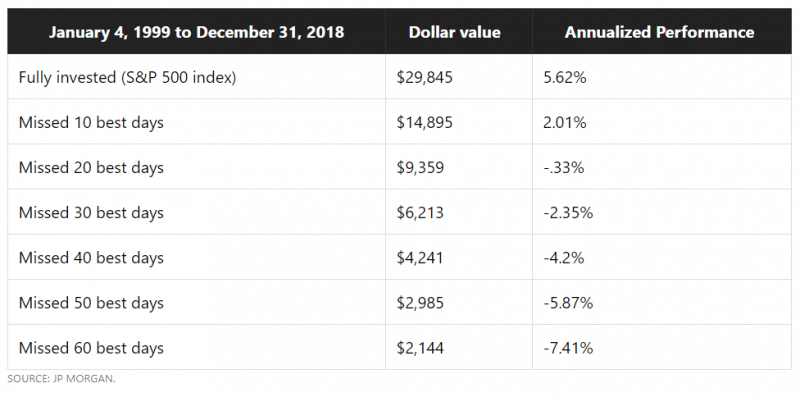

Market timing, or jumping in and out of the investment markets results in lower long-term performance. The data is very clear on this point.

JP Morgan examined S&P 500 stock market data between January 4, 1999 and December 31, 2018 and found that if you were fully invested during that time, you investments would have returned 5.62% annually. But if you missed the 10 best performing days, your annual investment returns drop to 2.01%. If you miss the 30 best days during that 19 year period then your average annual return drops to a negative -2.35% annual return.

‘How to take advantage of a stock market crash?’ don’t sell.

4. What Goes Up During a Stock Market Crash?

Some companies and industries will profit during a stock market crash. The problem is picking these investments before they go up and not overpayng for them.

If youre an active investor and want to pick stocks or sectors, you might want to invest in areas that are profiting from the stock market crash.

To do your own research, think about the profitable industries now.

Everyone needs to eat, so food and grocery stores might be worth a look.

With many people staying home, delivery services are very busy now.

ETF.com has a list of alternative ETFs that are negatively correlated with the stock market. That means their returns don’t move in the same direction as the stock, market. The AGFiQ U.S. Market Neutral Anti-Beta Fund (BTAL) is one of the few funds that have delivered returns opposite of the stock market. This is good as the stock market crashes, but beware during the rebound, when the fund is likely to decline.

Market timing is difficult in any market. We don’t recommend active trading and consider investing a long-term way to grow your wealth.

If you do want to speculate and try your hand at market timing, do so with a sall portion of your investable net worth, 5% to 10%. The Robinhood App or M1 Finance make it easy to buy and sell funds and individual stocks.

Of consider using an active management robo-advisor.

5. Buy More Investments During a Stock Market Crash

Some of the smartest investors take advantge of stock market crashes by buying more stocks and funds during a stock market crash. Great fortunes are made by buying when other investors are selling. You are buying more stock assets when you rebalance your assets during a stock market crash.

If you’ve saved cash and don’t need it for immediate needs, then buying into the stock market during a crash can yield long term gains.

When considering how to take advantage of a stock market crash, don’t expect to buy at the market bottom. It’s tough to pick the market bottom. The best way to invest during a stock market crash is to tread in gradually. Take your available cash and dollar cost average into the market. That means to invest a portion of your cash at regular intervals.

If you’re a robo-advisor client, you can transfer in additional cash to be reinvested. M1 Finance automatically invests new money to maintain your prefered asset allocation.

Just remember that there may be more pain going forward, before the markets return to their historical upward trajectory.

What to do Now if You’re Seeking the Best Investments During a Stock Market Crash

Now is the time to take a long term perspective. Don’t check your investment statements every week. Checking investment values quarterly is more than enough.

When investing in the stock market, you’re buying into companies within the U.S. and global economies. If you’re a stock market investor during a crash, it’s too late to avoid losses. If you sell now, you’re locking in your losses. So, take a long term perspective and realize that all investments have risk. Cash helps to protect your money from the economic collapse. But,in the long-term, holding too much cash will loose purchasing power to inflation.

Over the long term, investment values have gone up, as businesses grow and prosper. From 1928 through 2018, the S&P 500 returned an average 9.71% annually.

Investing, like life, is uncertain. By accepting this reality, you can educate yourself, take a long term view and mitigate risk by keeping your emotions in check.

There are many wonderful online resources to help you stay calm during the current stock market crash.

The Blooom robo-advisor, that manages your 401k offers helpful resources if you’re, “Wondering what to do with your investments when the stock market drops?”

Related Reads:

*Disclosures: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.