Best Robo-advisors for retirement

As you approach or embrace retirement, managing your investments should be straightforward, secure, and tailored to your unique financial goals. That's where robo-advisors come in - your digital financial guides designed to optimize your retirement savings with precision and personalized care.

Broker

Overview

Min. Investment

Fee Structure

Investment Funds

Broker | Minimum Investment | Fee Structure | Investment Funds |

Robo-advisor with human financial advisor collaboration | $100,000 for managed accounts | 0.89% | Individual stocks, ETFs, low-fee bond, and alternative ETFs | Read Review |

Retirement planning with advisor oversight and investing | $1 | $250 / year | Free financial plan and initial consultation | Read Review |

Goals-based digital investment manager with advisors | $0 (No Minimum) | 0.25% AUM above $20,000 | Low-fee ETFs from diverse asset classes; Crypto portfolios | Read Review |

Automated investment with ETFs and stock trading | $500 | 0.25% AUM | Low-fee, diversified stock & bond ETFs; Crypto funds available | Read Review |

Not sure which broker is right for you? Take the Robo-advisor Selection Quiz today.

Discover the Pros and Cons

The best Robo-advisor for retirees is the one that fits your needs.

With the Robo-advisor digital investment manager becoming an increasingly popular choice among early- and mid-career investors, retiring baby boomers might wonder whether they should make the switch to Robo-advising and what are the best Robo-advisors for retirees.

Life has changed drastically over the last few years. Better medical technology means that most people are living longer than their relatives two generations back, which leads to more time spent in retirement. That means that your money needs to last longer in retirement. As lifespans improve, so do investment management choices. And that’s why you might benefit from automated investing with human financial advisors.

Although not retired yet, I am getting closer and have accounts at three Robo-advisors myself!

What is a Robo-advisor?

A Robo-advisor is a broad category of digital financial advisors. These money and financial managers create diversified investment portfolios guided by sophisticated computer algorithms.

The investments are automated by the Robo-advisor to fit specific investment criteria and are based on the well-respected modern portfolio management theory.

Many Robo-advisors offer not only computerized financial management, but also access to human financial advisors. Some also offer high yield cash accounts and borrowing. Most retirees will appreciate access to financial advisors for the money questions that arise. These digital portfolio managers are also known for lower management fees than traditional financial planners.

What are the benefits of Robo-advisors for retirees?

One of the strengths of Robo-advisors is that they are customizable. Retirees benefit from the ability to rev up the aggressiveness in their portfolios, or tone it down to preserve capital for the long term.

Even better: most Robo-advisors are cheaper than traditional investment advisors, making them a great choice for those nearing (or already in) retirement and looking to minimize investment fees.

- Some Robo-advisors like SigFig will manage your investments in your existing accounts.

- While most will transfer your existing assets to their platform, in a manner that will minimize tax liabilities.

- Some Robo-advisors provide access to human financial advisors.

- Robo-advisors typically manage your money with lower fees than human financial advisors.

- Robo-advisors take the guesswork out of picking your own investments.

- Diversified investment accounts like retirement accounts, trust accounts and taxable brokerage accounts are typically available.

Before making any investment decisions, it’s always important to consider your unique situation. Learn about these five excellent choices, and choose the best Robo-advisor to manage your retirement funds.

Pro-Tip

Diversify your investments across stocks, bonds, and alternatives for a resilient portfolio in today's dynamic market. It's a key strategy for managing risks and optimizing returns.

Get a closer look

Empower: Free Retirement Planner and Investment Manager

Empower

Our rating:

4.9

Fees

0%

management fee

Account Minimum

0%

Promotion

None currently.

Empower Overview:

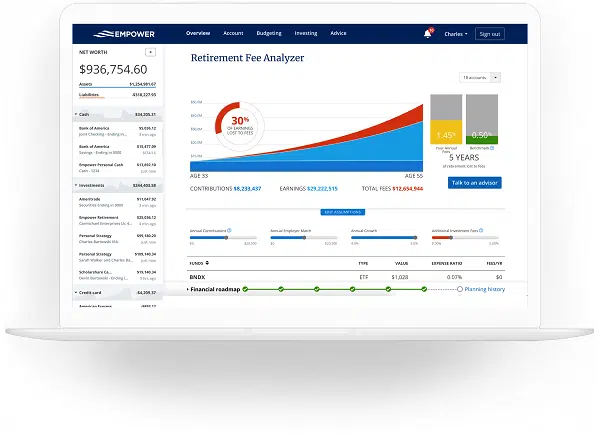

- Empower offers free retirement planning and money management tools.

- Free software includes Net Worth Tracker, Cash Flow Analyzer, Investment Checkup, and more.

Empower Advisors:

- Full-service investment manager for investors with $100,000 or more.

- Personalized strategy guided by a certified financial planner.

- Balanced portfolio, individual stock investing, and cash management.

- Regular portfolio monitoring, rebalancing, and consultations.

Ideal for:

- Investors seeking full-service financial planning and investment management at lower fees.

Empower is a two-fer for your investing and retirement. First are the free retirement planner and money management tools.

Regardless of whether you choose Personal Capital Advisors to manage your retirement savings or not, you must check out the FREE investment management tools.

With a few clicks, you’ll know exactly where you stand relative to your retirement goals. From there, you can view how changes will ultimately impact your financial future.

Additionally, the free Empower software offers these free financial management tools:

- Net Worth Tracker

- Cash Flow Analyzer

- Investment Checkup

- Retirement Planner

- Retirement Planner and Fee Analyzer

- College Education Planner

Next, Empower Advisors is one of our favorite digital plus human advisor – robo advisors.

Empower Advisors

For retirees, Empower is more than just a free retirement and money management tools. The full-service Empower Advisors investment manager offers a personalized investment strategy for investors with $100,000 or more.

Guided by your personal certified financial planner, the advisory option creates a balanced portfolio by sector, geography and market capitalization. The investments are geared for your personal risk level and align with your goals.

Empower Advisors also offers individual stock investing and cash management.

Your individual portfolio is monitored and rebalanced regularly, and your financial planner is available for regular consultation. Typically, Empower financial advisors hold the prestigious Certified Financial Planner designation. Empower offers a range of additional wealth management services for high net worth clients.

Empower is best for the investor who wants a full service financial planning and investment management platform for a lower fees than typical financial advisors.

Retirable: Retirees-only With low Management Fees

Retirable Overview:

- Recently launched platform with automated investing, portfolio management, licensed human financial advisors, and low fees.

Key Features:

- Dedicated financial advisor, diversified investment strategy with low-fee ETFs, and retirement cash flow plan.

- Advisors specialize in retirement issues: income and savings, social security, healthcare, housing, and lifestyle expenses.

- Goal-based investment strategies aligned with personalized needs, goals, and risk tolerance, considering tax implications.

- Investment rebalancing to maintain portfolio alignment with goals.

Eligibility and Consultation:

- Exclusively available to those retired or within 10 years of retirement, aged 50 or over.

- Free Retirable consultation, including a financial plan review, for eligible individuals.

A dedicated financial advisor, sound diversified investment strategy built with low-fee ETFs and a retirement cash flow plan make this new platform worth considering. Every licensed financial advisor has specialized training in retirement issues like:

- Retirement income and savings “decumulation”

- Social security, Medicare/healthcare, housing

- Lifestyle expenses

Retirable’s goal based investment strategies are structured to meet your needs and align your investing to best fit the goal. All strategies consider tax implications and are personalized to meet your goals, needs and risk tolerance. Although Retirable doesn’t call itself a robo-advisor, it does include investment rebalancing, to keep your portfolio in line with your goals.

Anyone who’s retired or within 10 years of retirement is eligible for a free Retirable consultation, which includes a financial plan review.

Retirable is only available to those who are already retired or within 10 years of retiring and over age 50.

Not sure which broker is right for you? Take the Robo-advisor Selection Quiz today.

Betterment: Cryptocurrency and Financial Advisors

Betterment Overview:

- Early Robo-advisor turned comprehensive money management platform.

- Offers diverse investment styles and crypto portfolios.

Service Levels:

- Betterment Digital: Low-fee automated investment management.

- Betterment Premium: Full-service digital and human financial planning for $100,000 minimum investment, 0.40% AUM.

Key Benefits:

- Human advice on all investments, unlimited access to CFP® advisors.

- Tailored packages for retirees: Retirement Planning, Retirement Income, and Cash Reserve.

Ideal for:

- Fee-conscious investors seeking diverse options.

- Interested in crypto and financial advisors at reasonable fees.

One of the earliest robo-advisors, Betterment began as a computerized investment manager and has evolved into a complete money management platform. The Betterment today offers financial advisors (for added fees), cash management (through partner banks) and diverse investment styles. Investors can choose from core, ESG, and crypto portfolios

Betterment’s two service levels are:

Betterment Digital – Low fee computerized investment management with opportunity to purchase low fee financial planning packages.

Betterment Premium – Full service digital and human financial planning services for investors with $100,000 minimum investment amount. With access to Certified Financial Planners, this is an excellent robo-advisor for retirees. Betterment Premium charges an 0.40% AUM investment management fee.

- All the benefits of Betterment Digital

- Human financial advice on all investments, within and outside of Betterment accounts. That includes managing 401(k)s, real estate, stocks and more.

- Unlimited access to CFP® credentialed financial advisors for all life planning decisions that impact your money; retirement, having a child, getting married and more.

Betterment services are ideal for retirees as you can choose the advice level that best fits your needs. If you select Betterment Digital, you can get financial advisor advice by purchasing an a la carte financial planning package. Betterment Digital has a very low investment management fee of 0.25% of AUM.

Betterment Retirement Planning Package – This low cost planning package reviews all client financial accounts and guides clients towards retirement-readiness. In addition to a 60-minute call with a CFP, the investors receive one month of free email access to Betterment financial experts for follow-up questions and advice. Fee – $399

The Betterment platform strives to maximize your investment returns at every risk level. That means, if you’re a conservative investor, the Betterment robo-advisor will give you the opportunity for the highest returns with the least amount of risk.

Betterment Retirement Income – This option for retirees creates an appropriate income stream from your account, to support your financial needs and maintain your assets.

Betterment Cash Reserve – The Betterment cash management solutions, through partner banks, offer retirees the opportunity to have all their finances under one roof. Further, your cash will earn more than the national average.

Betterment is one of favorite robo-advisor due to the availability of diverse investment options and styles, various ways to access financial advisors for reasonable fees. With sound investment management and Betterment could be a sound retirement robo-advisor.

Betterment is best for fee-conscious investors and those seeking crypto and financial advisors, for reasonable fees.

Wealthfront: Best for Digitally Savvy Retirees

Wealthfront Overview:

- Original robo-advisor with state-of-the-art research.

- Crafted portfolios based on risk tolerance using diverse ETFs.

- Digital platform with options for advice and well-trained customer service.

Key Features:

- Customizable portfolios with 200 ETFs and crypto funds.

- Cash Management Account for emergency funds with zero fees.

- Customization options with check writing, bill pay, and ATMs.

- Risk Parity fund for reduced risk and increased returns.

- Smart Beta strategy for factor investing.

- Tax loss harvesting to offset gains and reduce taxes.

- Wealthfront Borrow offers a low-interest portfolio line of credit.

Ideal for:

- Tech-savvy individuals seeking digital financial advice.

- Those wanting flexibility to add ETFs and crypto to their portfolios.

Wealthfront is one of the original robo-advisors, along with Betterment and Personal Capital. Wealthfront employs state of the art research to craft efficient, diversified investment portfolios in accord with your risk tolerance and populated with diverse stock, bond and real estate ETFs. The well diversified digital portfolios now offer investors the opportunity to customize investments by adding additional ETFs, culled from a list of 200 and crypto funds.

Although this is a digital only platform, those seeking advice have options. All customer service representatives are well trained and possess at least a Series 65 securities license. The Path Digital Financial advisor is designed to answer up to 10,000 financial management questions and compares favorably with a human advisor. So, if you’re handy with tech, you’ll be well served by Wealthfront’s digital financial advisor and investment management platform.

Other reasons to like Wealthfront:

Cash management-For ready cash and an emergency fund, the Wealthfront Cash Management Account offers a zero fee, high yield account. The minimum deposit amount is one dollar and the value of your account is secure with up to $2 million FDIC insurance and unlimited transfers. With check writing, bill pay and ATMs, your finances can be consolidated at Wealthfront.

Customization – You can select from hundreds of ETFs to add to your existing Wealthfront account. Or you can create a new portfolio, for Wealthfront to manage. The additional funds Includes Grayscale cryptocurrency funds.

Risk parity fund – The Wealtlhfront Risk Parity fund is an optional strategy for your investments. The approach claims to reduce risk and deliver a small lincreased return. It involves some leverage or borrowing and higher fees, but the proponents believe that these costs are more than offset by the expected higher returns.

Smart Beta – This is a strategy for those interested in factor investing and an investment approach with the opportunity to beat a passive index fund investment approach.

Tax loss harvesting – Offset investment gains with losses and reduce your overall tax bill.

Wealthfront Borrow – If you have an expense, like a vacation or wedding, and don’t want to sell investments, to free up cash, Wealthfront Borrow offers a portfolio line of credit. The loan is available quickly and with a low interest rate and you can use the money for any purpose.

Wealthfront is best for those comfortable with tech and who want investment management with the ability to add additional ETFs and crypto.

SigFig: Balancing the Pros and Cons of Robo-Advisors for Retirees in One Place

- Manages investments in Schwab, Fidelity, and TD Ameritrade.

Free Portfolio Tracker:

- Tracks portfolio with weekly summaries, news alerts, gain/loss notifications, risk analysis, and more.

- Free investment management for accounts up to $10,000.

Managed Portfolio:

- Professionally manages investments in Fidelity, TD Ameritrade, or Schwab.

- Handles retirement accounts without the need to transfer.

- 0.25% AUM for accounts over $10,000 with financial consultant access.

- Personalized portfolio, live chat, phone support, access to advisors, automatic rebalancing, tax optimization, and more.

- Ideal for retirees wanting to keep investments in Schwab, Fidelity, or TD Ameritrade accounts.

SigFig manages your investments owned within Schwab, Fidelity and TD Ameritrade.

SigFig Free Portfolio Tracker

Like Empower, SigFig also offers a free portfolio tracker. The free SigFig portfolio does what it says and tracks your portfolio.

Here’s what the SigFig Portfolio Tracker offers:

- Weekly email summaries of your investment performance

- News that impacts your holdings

- Notifications about gainers and losers

- Risk analysis and diversification advice

- More portfolio insights

- Additionally, all accounts valued at up to $10,000, receive free investment management.

SigFig Managed Portfolio

The SigFig Managed Portfolio professionally manages your investments held within either Fidelity, TD Ameritrade, or Schwab investment accounts.

When you think about robo-advisors for retirees, you need to consider taxes. Since many people nearing retirement have already set up retirement accounts, it can be overwhelming to consider moving everything from a traditional account to a robo-advisor and paying a large capital gains tax bill.

That’s where SigFig comes in.

If your retirement funds are already at Charles Schwab, TD Ameritrade Institutional, or Fidelity, SigFig can manage your investments where they are.

The SigFig managed account charges 0.25% AUM for all accounts valued over $10,000 and offers financial consultant access. This is a fair price for a robo-advisor that also offers financial advisors.

The SigFig managed account lays out a personalized investment portfolio based on your goals and risk tolerance. The platform also analyzes external investments, not held with SigFig.

SigFig managed services include all the offerings of the Free SigFig portfolio tracker plus:

- Live chat and phone support

- Access to investment advisors

- Personalized portfolio in line with your goals and risk level

- Automatic rebalancing and reinvesting

- Tax-optimized sales

- Tax-efficient migration to the SigFig investment recommended portfolio

SigFig is best for retirees who don’t want to move their assets to another platform.

The fact that SigFig allows you to keep your investments in your Schwab, Fidelity, or TD Ameritrade accounts makes this a sound robo-advisor for retirees.

Not sure which broker is right for you? Take the Robo-advisor Selection Quiz today.

Robo Advisors for Retirees at Major Brokerage Firms

Most of the major brokerage firms also offer low cost managed investment accounts. Some of these offers are all digital, like Schwab Intelligent portfolios, Fidelity Go and Vanguard Digital Advisor. While most also have a premium version with higher fees and access to financial advisors. A benefit of selecting an investment manager affiliated with a large brokerage firm is that you'll have ready access to self-directed investing, well trained financial consultants and a breath of other resources.

Robo-advisors from major financial brokerage firms:

Wrapped Up

Many retirees prefer to free up time to enjoy their lives instead of handling their finances. Or you're looking to cut investment management costs by switching to a lower cost solution. Digital investment managers are an ideal tool to aid retirees with their financial management. Whether you like the idea of adding customized ETFs to an all-digital managed portfolio at Wealthfront, or the full service financial planning equivalent at Empower, there's a Robo-advisor for you.

Before making any moves to or between Robo-advisors, be sure to consult your existing investment agreement. You may have some transfer fees. If you sell appreciated investments in taxable accounts, you'll also have to pay taxes on the gains. Still, since robo-advisors are often more affordable than their human counterparts you might find these transfer fees and taxes insignificant in comparison to the money you’ll save on reduced money management fees.

A final positive feature of Robo-advisors for retirees: most come with human support to help you navigate the shift. The best Robo-advisors for retirees, after all, are those that will help make this process easy and headache-free.

Ultimately, investing in a Robo-advisor in retirement is a step towards lower fees, greater wealth and a simpler life.

Related

*Disclosure: Please note that this article may contain affiliate links which means that - at zero cost to you - I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t personally believe is valuable.

Empower compensates Stocktrades Ltd for new leads. Stocktrades Ltd is not an investment client of Empower.

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.