Webull Robo Advisor Review

Our day-to-day engagements may sometimes diminish our ability to manage our investments or even learn how to improve our investment skills. Luckily, AI developers have continued developing new products as technology advances, and the finance industry hasn’t been left behind. The Webull Smart Advisor is here with a robo advisor investment solution.

Many robo-advisory services are available to remedy your investment management challenges. Webull Robo Advisor is one of the online applications that can help with your financial planning services. Like its robo-advisory counterparts, the platform works through automated algorithms and doesn’t require your intervention.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Our Webull Review provides all the vital details you need to know to make an informed decision. We’ll also include information about the Webull platform for self-directed investors.

Webull Smart Advisor

-

Fees

(5)

-

Investment Choices

(4.5)

-

Ease of Use

(4.5)

-

Tool & Resources

(3)

Summary

Passive and actively managed investment portfolio with broad asset classes.

Pros

- Great diversification with stock, fixed and real asset ETFs

- Low minimum and fees

- Well-respected sub-manager – SSGA

Cons

- Limited customer service

- No ESG portfolios

Webull Investment Review – Is This Robo Advisory Right for You?

Our Webull Robo Advisor review covers the service’s features, the sign-up process, the pros and cons, performance, fees, and other relevant information to help you decide if it’s the right investment platform for you.

Webull robo advisor is a fintech platform from Fumi Technology company. The corporation is headquartered in New York, while its technical team is based in Hunan, China. Its founder is Wang Anquan (a Chinese executive), a former Xiaomi and Alibaba Group employer. Additionally, Anthony Denier has been the CEO since its commencement in 2017. The company was approved by SEC to launch robo-advisory services in May 2020.

What Is Webull Robo Advisory?

Webull Robo Advisory is an online fintech app that provides automatic and customized investing services based on the investor’s risk tolerance. It helps you manage your investment through automated algorithms with no human intervention: Manages your portfolio and automatically rebalances it when needed. It’s ideal for auto-investing in exchange-traded funds (ETFs). The combination of passive and active management is a draw for those that strive to beat market returns.

Webull’s Smart Advisor has six diversified risk-adjusted portfolios: Conservative, moderate conservative, moderate, moderate growth, Growth, and maximum growth. Users can access deposit and withdrawal services through bank transfers.

Webull is predominantly known as an online trading platform with free sock, ETF and options trading.

Moreover, the Webull account opening is smooth, fully digitalized, and fast. The app has well-structured and user-friendly trading platforms with multiple order types. It’s an ideal choice for beginner investors. The app is also suitable for more experienced investors looking for an advanced trading platform after updating to Webull 8.0.

Features at a Glance

Webull Robo Advisor has various features that make it suitable for starters, intermediate, and experienced investors seeking an actively-managed digital investment manager.

Minimum Investment Amount

Webull has a $500 minimum investment. Hence, it’s ideal for investors seeking financial markets with low minimum account balances and commission-free trading. You can open an account, deposit a few dollars, and start investing.

The platform’s no-cost and low-minimum requirement approach also appeals to active traders. The attractive features attract the attention of active traders as its competitors charge commissions on these securities.

Top Features

Fee Structure

Webull Smart Advisor Robo Advisory charges 0.20% AUM with a one dollar per month minimum.

Self-directed investors fee structure:

- ETFs trading fee – $0

- Account fees – Asset Under Management: $0

Accounts Available

The Smart Advisor platform supports individual taxable accounts, only.

Webull’s available accounts for self-directed investing includes the following:

- Individual brokerage account (cash and margin trading accounts)

- Traditional IRA

- Roth IRA

- Rollover IRA

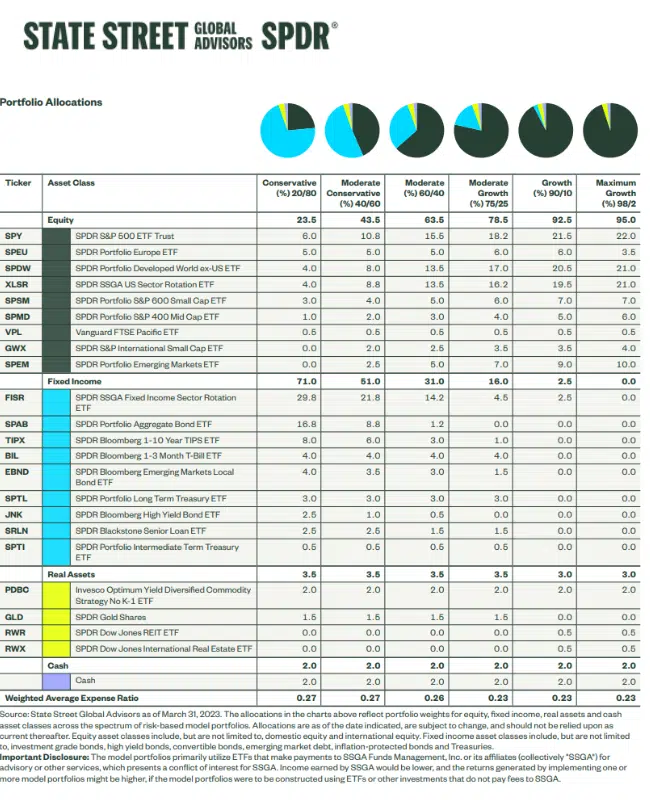

Investment Funds

The Webull Smart Advisor provides investment strategies based upon the State Street Global Advisors Active Asset Allocation ETF Model Portfolios. Although the specific ETFs or asset classes for the robo advisor aren’t listed on the Webull Website, we visited the State Street Active Asset Allocation portfolios factsheet for a list of ETFs. We can assume that your investment portfolio will include many of the model portfolio’s ETFs which are sponsored by SPDR, Vanguard, and Invesco. We’ll delve into the investment strategy below.

The ETF investment funds span the following asset classes:

- Equity

- Fixed Income

- Real Assets such as commodities, U.S. real estate, international real estate and gold

- Cash

Self-directed investments include:

- Stocks

- ETFs

- Options

- Fractional shares

- High yield cash

Contact & Investing Advice:

The platform’s advisors (Webull Advisors LLC/Webull Advisors) provide advisory accounts and services. The LLC is an investment advisor registered and regulated by the Securities and Exchange Commission (SEC) under the Investment Advisors Act of 1940.

You can contact Webull via email (customerservices@webull.us) or call 1-888-828-0618. Also, you can access live brokers via calls and live chats.

Who Is Webull Robo Advisory Best For?

Webull robo advisory is best for the following categories of investors:

- Investors seeking a combination of active and passively managed portfolios.

- Investors seeking a low fee, low minimum robo advisor.

- Those who prefer access to digital investment management and self-directed trading, under one roof.

Webull Features Drill Down

Customer Reviews and Services

You can access Webull’s customer services 24/7 for platform guidance or questions answering. There are standby customer service representatives for that purpose, and you can reach out to them via email (customerservices@webull.us) or call 1-888-828-0618.

Webull App

The Webull App recently added access to the robo-advisor. As the platform is so new, we have not been able to test the Smart Advisor access through the app.

Regarding the self-directed trading portion of the app – most customers are happy with the app due to its excellent features. However, some feel that it is overcrowded with too much information, making it tedious to navigate.

User Experience – Sign-Up Process

Follow the steps below to sign up for the Webull Smart Advisor app today:

- Go to Webull Smart Advisor’s official page and click the ‘Reserve Your Spot Now’ button.

- Follow the subsequent prompts, like entering your phone number and verification code in the provided slots.

- Assess your risk tolerance level and select a portfolio that aligns with your risk.

- Fill out an account application.

It takes 1-3 days to process an account application.

If you would like to change your portfolio composition, retake the risk quiz to receive a portfolio asset allocation with a different allocation to stocks, bonds, real assets and cash.

Access to Human Financial Advice

Webull doesn’t offer human financial advisors. Instead, the platform provides investment management services to individual investors on a discretionary basis. Thus, Webull Smart Advisor can trade within a client’s account and keep up the target investment allocation without informing the client.

If you’re seeking a robo advisor with access to financial advice, you might check out SoFi Invest.

Security

The Smart Advisor, Webull, promises to protect the security of your funds. It provides 128-bit encryption, two-factor authentication, firewalls, and mobile security features. Also, the company provides the standard $500,000 of SIPC (Securities Investor Protection Corporation) insurance for investors, with up to $250,000 in cash.

Additionally, Apex Clearing (Webull’s clearing firm) provides excess insurance. Through Apex’s policy, the firm protects Webull’s customers accounts – for securities and cash up to $150 million. The individual’s customer’s cap is $900,000 for cash and $37.5 million for securities.

Investing Strategy

In the advisory platform’s investing strategy, we look at the investment approach, asset classes, and the securities used by the firm.

Investment Approach

Webull Robo Advisor’s investment strategies are based on a third party’s portfolio models, State Street Global Advisors Active Asset Allocation ETF Model Portfolios (SSGA) in accordance with a model portfolio licensing agreement between Webull and State Street.

They’re actively managed portfolios focusing on evolving market conditions, aiming to outperform their benchmark at the end of a market cycle. Webull relies on the Model Manager’s models to select underlying securities for the client’s portfolio.

The model portfolios are largely occupied by ETFs owned and managed by Model Managers and Proprietary ETFs (affiliates that make payments to Model Managers). The Model Managers favor Proprietary State Street ETFs because they benefit financially from them. In general, the State Street ETFs are reasonably priced and managed, but, on occasion may have lower ratings, higher expenses and fees, or inferior performance than other ETFs in the market.

Once the Model Manager updates the portfolios, Webull Advisors, get the updates. The Smart Advisor platform rebalances the client’s portfolios according to the provided updates, subject to the platform’s discretion.

The Model Manager offers 6 model portfolios for various investment needs. Each has a different balance of fixed income, equity, commodity, and cash, increasing risk and expected return from Conservative to Maximum Growth. The models’ target allocations are tabulated below:

| Fixed Income | Equity | Commodity | Cash | |

| Conservative | 69.50% | 23.00% | 5.50% | 2.00% |

| Moderate Conservative | 49.90% | 43.00% | 5.50% | 2.00% |

| Moderate | 29.50% | 63.00% | 5.50% | 2.00% |

| Moderate Growth | 14.50% | 78.00% | 5.50% | 2.00% |

| Growth | 2.00% | 92.00% | 4.00% | 2.00% |

| Maximum Growth | 0.00% | 94% | 4.00% | 2.00% |

Asset classes

Webull Smart Advisor asset class are typically populated with a variety of fixed income, equity and real asset ETFs and a smidge of cash. several ETFs

Fixed income

Most financial professionals recommend investing in fixed-income securities like bonds and bond ETFs as part of your portfolio. The reason behind this recommendation is the asset’s ability to reduce the portfolio’s volatility and provide you with an extra source of income.

The model portfolios include a range of fixed income funds including actively managed sector rotation, short-term, inflation-protected, Treasuries, corporates, and international bonds.

f you aren’t sure of how much you should invest in bond ETFs, Webull Advisors will take care of that by assessing your risk tolerance level.

Equity

Equity ETFs track equity indexes. The wide range of ETFs included in the Smart Portfolios offers an extensive opportunity to diversify your portfolio. The SSGA model portfolios include U.S. equities including the S&P 500 index, mid- and small-cap stocks, along with an active US Sector Rotation ETF. The model portfolios also encompass a range of international equity ETFs spanning developing and emerging markets, the Pacific and Europe.

Real Assets: Commodities – Gold – Real Estate

The Webull robo advisor offers real estate, commodity and gold ETFs.

ETFs are a great pathway to gain exposure to commodities such as oil, gold, and silver. Commodities are typically less correlated with stocks and bonds. Moreover, considering a straight commodity ETF is sensible if you already have equities in your portfolio.

Real estate ETFs provide exposer to a variety of types of real estate. REITs are required by law to pay out 90% of their income, making them a sound source of ongoing cash flow.

The gold ETF adds a pinch of gold exposure to further diversify your portfolio.

Webull Robo Advisory Pros and Cons

Pros:

- Access to an active Webull community facilitates connection and discussion.

- Well constructed SSGA multi asset and broadly diversified portfolios.

- Low minimum and management fee.

- Auto-investing and self-directed investing in stocks, ETFs and crypto.

- Commission-free trading and fractional shares, for DIY investors.

- Fractional shares availability.

Cons:

- Lacks direct phone customer service.

- Now platform – limited track record.

FAQ

How Do I Fund My Webull Robo Advisor Account?

You can fund your Webull Robo Advisor account through three flexible channels. They include ACH (Automated Clearing House), wire transfers, or your Webull individual account cash balance.

Are There Costs for a Webull Robo Advisor Account?

No, there are temporarily no costs for Webull Robo Advisory accounts. They’ll be waivered during beta testing up to June 30, 2023. After that, the platform will charge the standard annual fee of 0.020% with a $1 minimum monthly fee.

Can I Change My Webull Advisory Portfolio?

Yes, you can change your Webull Advisory portfolio. Go to the ‘Action’ tab and click ‘Revisit Your Portfolio.’ Check the different risk tolerance levels portfolio by sliding the gauge right or left. Fill out the Risk Tolerance Questionnaire to switch to a new portfolio one level higher or lower than your current one. If you wish to move more than one level higher or lower, you must update your risk tolerance level by retaking the risk assessment.

When Will My Portfolio Start Investing After Depositing Funds?

Your portfolio will start investing the next business day after depositing funds. Generally, ACH-transferred funds start investing within 3 to 4 business days, the wire transfer option’s funds take 1-2 days, while the Webull transfers start investing immediately.

Can I Choose the Trading Timing and Investment in My Webull Advisory Portfolio?

No, you can’t choose the trading timing and investment in your Webull Advisory portfolio. Instead, their Advisors make investment decisions on your behalf, as the accounts are entirely discretionary.

Do People Make Money Using Webull Advisory?

People make money using Webull Advisory in many ways. You can earn a return on investment through capital appreciation and dividend payments. Stock and bond ETFs typically pay dividends or interest, which will be reinvested into your assets. Over the long term, diversified investment portfolios have appreciated, and are expected to do so in the future.

Webull Robo Advisory Wrap-up

Webull Robo Advisory – Webull Smart Advisors – provides well managed advisory accounts and services to investors. The Investment Advisor is registered and regulated by the SEC under the Investment Advisor Act of 1940. Moreover, trades in these accounts are executed by Webull Financial LLC, a SIPC member. Therefore, $500,000 worth of assets are protected, including $250,000 in all the cash awaiting re-investment.

Webull Investment Advisors is proud of:

- Its simplicity – small minimum investment and hands-free digital investment management, a

- Ability to offer users peace of mind – monitors portfolios and automatically rebalances them.

- Providing a 2-in-1 app – suits self-directed trading and auto-investing.

The app’s model portfolios mainly use ETFs that pay SSGA Funds Management or its affiliates for its services. Its tools let you view your investments and track your performance. You’re able to adjust your asset allocation by simply changing your risk tolerance.

Moreover, Webull Smart Advisor offers customized portfolios: Expert-built portfolios with various investment assets including equity, fixed income, real asset ETFS, and cash according to your risk tolerance level (conservative to maximum growth). SSGA is a well-respected firm, with low fee and diversified ETFs. Webull Smart Advisor has the potential to become a solid contender in the robo advisory landscape.

Visit the Webull Smart Advisor website.

Related

- Best Low-Fee Robo-Advisors

- Smart Beta Investment Portfolios

- Actively Managed Robo Advisors

- Merrell Edge Guided Investing Review

- Elm Review

Sources:

- https://www.ssga.com/library-content/products/factsheets/model-portfolio/us/factsheet-us-en-210527144129_glblmkt.pdf

- https://www.webull.com/smart-advisor

- https://www.webull.com/ko-yield/Smart_Advisor_Disclosure

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable