One of the premier digital investment platforms, the Wealthfront robo-advisor isn’t resting on its laurels. This robo-advisor is innovating to remain one of worlds the most popular automated investment advisors in the fintech universe.

Is Wealthfront worth it? Yes, we believe it is. Find out why as this expert Wealthfront Review evaluates the pros, cons, funds and specialized features. You’ll be ready to decide if this low-fee robo-advisor is right for you.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Wealthfront Review

Name: Wealthfront Review

Description: Wealthfront is our favorite low-fee digital-only financial manager. Banking and lending add to Wealthfront's benefits.

-

Fees

(5)

-

Investment Choices

(5)

-

Ease of Use

(5)

-

Tool & Resources

(4)

Summary

Best for:

- Investors comfortable with “all digital” investment manager. Their online financial planner is the most comprehensive we’ve seen.

- Investors seeking vast investment diversification including stocks, bonds, real estate, energy and individual ETFs.

- Investors who want tax-loss harvesting.

Pros

- Low investment minimum and management fee.

- Many account types available.

- Can choose & customize your investments.

- Cryptocurrency funds available

Cons

- No human financial advisors.

- $500 minimum excludes smallest investors.

What is Wealthfront?

“Wealthfront is the only automated financial advisor to offer the combination of financial planning, investment management and banking-related services exclusively through software.” ~Wealthfront.com

This means that your investments are managed in a comparable way to a high fee financial advisor, for a fraction of the cost. Wealthfront’s combination of strategies would take an individual investor or investment manager 105 hours to replicate, according to company research.

Wealthfront is one of the largest robo-advisors or digital investment managers with nearly $27 billion assets under management, as of December, 2021 (most recent published data). Wealthfront employs state of the art research to craft and manage an efficient, diversified investment portfolio, all according to your financial goals and risk tolerance level.

Highlights

- Low fee digital investment management.

- Diversified investments including US and international stock and bond ETFs, and real estate or RETs, and more than 100 ETFs for customization.

- Daily tax-loss harvesting

- High interest rate cash account

Features at a Glance

| Overview | Automated investment management robo-advisor with ETFs and stock trading |

| Minimum Investment Amount | $500 |

| Fee Structure | 0.25% of AUM. Zero fees for cash or stock trading account. |

| Top Features | Digital financial planner. Daily tax loss harvesting. Cash account. Loans. Customize with individual ETFs including crypto funds. |

| Free Services | Free Path financial planner and portfolio review. Home buying guide. |

| Contact & Investing Advice | Phone for clients & Email 24/7. Client service reps have Series 7 or CFP designations. |

| Investment Funds | Low fee, diversified stock & bond ETFs. 100+ ETFs. Crypto funds available. Fee free stock trading. |

| Accounts Available | Joint & individual taxable. Trust. Traditional, Roth, rollover, and SEP IRAs. 529 College Savings. |

| Promotions | Free cash bonus for new clients. |

Find out if Wealthfront is worth it, for you?

Wealthfront is best for:

- Investors looking for a middle point between a DIY approach and a full-fledged financial advisor.

- Those who want to create their own portfolios but have them professionally managed, for a low fee.

- Wealthy users who can hire other financial pros for estate, tax, and specialty financial planning questions.

- Investors who want a low fee digital investment manager and the opportunity to customize their investments.

- Those seeking a robo-advisor with access to cryptocurrency investments.

What Differentiates Wealthfront from Betterment and other Robo-Advisors?

At the helm is chief investment officer, Burton Malkiel, PhD, a respected investment researcher. He wrote the classic book, “A Random Walk Down Wall Street,” which spurred the index fund investing revolution.

Wealthfront offers the opportunity to add ETFs to your portfolio-including a bitcoin and ethereum fund! This is a big change and available only at M1 Finance and a few other platforms.

Wealthfront offers many unique features including a free Portfolio Review tool which evaluates your investments across key dimensions that impact future performance.

Wealthfront claims that the daily tax-loss harvesting adds an extra 1.8% to your returns. In fact, a recent study by the firm found that, “over 96% of our taxable Investment Account clients have had their advisory fees fully covered by Tax-Loss Harvesting.” It’s important to note that tax-loss harvesting applies to taxable accounts only, not retirement accounts.

Find out: Which Robo-Advisors Offer Tax-Loss Harvesting

Other unique features discussed more fully below are the Wealthfront Investment Portfolio, Wealthfront’s selling plan, direct investing, and a 529 college savings account.

Check out the high yields offered on the Wealthfront Cash Accounts, now.

How Does Wealthfront Work?

“Our signature suite of investment features is designed to deliver higher returns without more risk.”~Wealthfront.com

Path Financial Advisor

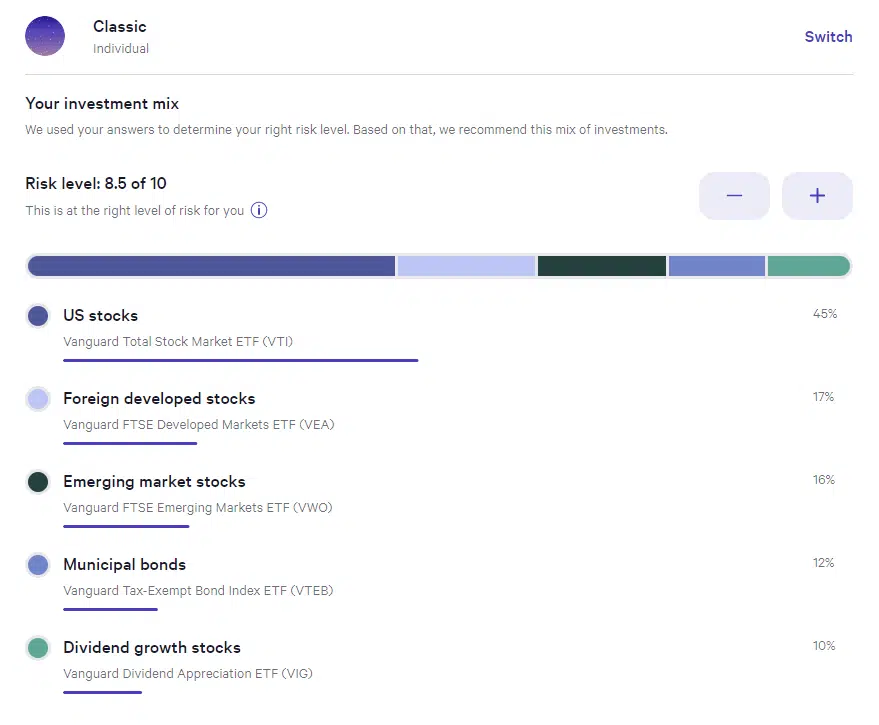

Wealthfront’s initial questionnaire is driven by the Path digital financial advisor. You’re asked several questions about your age, financial status and risk tolerance. Next you choose from three portfolio options: classic, SRI or direct indexing (if you plan to invest at least $100,,000). Then you’re presented with the recommended portfolio, based on your questionnaire responses. You don’t need to input your Social Security number, in order to view the recommended portfolio.

You can add additional ETFs from a list of 100+ or choose another portfolio with a greater or lesser risk level. This gives you the opportunity to customize your portfolio and focus on various sectors or strategies like AI, blockchain, growth or value ETFs. You can even create your own ETF portfolio, for Wealthfront to manage.

After the initial questionnaire, you have an opportunity to answer more questions and receive additional personalized financial advice. Wealthfront Path, the digital financial planning experience claims to provide investment advice, on a par with that of a human financial advisor. The Path digital financial advisor can answer up to 10,000 money and financial planning questions.

If you choose to link external accounts, you can receive money and financial guidance and answers to questions like; Do I have enough money to buy a house? Can I take a year off? How much do I need to save for Jrs. college? You’ll also have access to financial reports and advice pertaining to retirement, saving, spending, investment fees, net worth and more.

College Planning Guidance

The Path Wealthfront College Planning feature helps navigate the complete college planning process. You select a college to see the total cost picture for the school, including room, board, tuition and expenses. Path calculates the financial aid your student can expect from the specific school. With the Wealthfront 529 account, you’ll find out how much your savings will grow and the amount of the expenses your account will cover.

Anyone can use the Path digital financial planner tool, whether they are a Wealthfront customer or not.

Sample Wealthfront Investment Portfolio

Investment Options

Wealthfront’s core ETFs (exchange traded fund) are divided among broadly diversified, low-fee stock, bond and alternative exchange traded funds:

| Investment Fund Category | Index Fund Ticker Symbol |

|---|---|

| US Total Stock Market | VTI and SCHB |

| Foreign Stock - Developed Market | VEA and SCHF |

| Foreign Stock - Emerging Market | VWO and IEMG |

| Dividend Appreciation Stock | VIG and SCHD |

| US Treasury Inflation Protected Bond (TIPs) | SCHP and VTIP |

| US Government Bond | BND and BIV |

| Municipal Bond | VTEB and TFI |

| US Corporate Bond | LQD |

| Foreign-Emerging Market Bond | EMB |

| Real Estate | VNQ and SCHH |

| Natural Resources (Energy) | XLE and VDE |

The core funds are well diversified.

Create Your Own Portfolio

You can select from hundreds of ETFs to customize your investment portfolio. Or you can create your own investment mix, from the available ETFs, and Wealthfront will manage it.

The categories are good for those who want to target their investing and delve into various country and sector funds.

Customizable ETFs include:

- Sectors including financial, healthcare and tech

- New technology like AI and robotics

- Gold

- 5 ESG, socially responsible funds

- Strategy US stock and international funds including small cap, growth, and value

- Bond funds including corporate, tax-exempt and government

- Bitcoin and ethereum funds by Greyscale.

We like the opportunity to customize the pre-made Wealthfront portfolios with low fund management fees ETFs.

Portfolio Rebalancing

All Wealthfront investment portfolios are regularly rebalanced. Rebalancing involves selling funds that are above your target asset allocation and buying those that have drifted below your target percentage. This reduces risk and may also increase returns.

The pre-made robo-advisor portfolios along with any added customized ETFs are rebalanced. Rebalancing maintains your preferred asset allocation.

Learn more about rebalancing in our Robo-Advisor FAQ

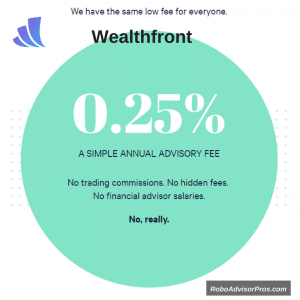

Fees and Minimums

The Wealthfront management fee is 0.25% of assets under management (AUM) annually.

Wealthfront doesn’t charge an account-opening, withdrawal, account-closing, trading, commission or account transfer fees. The 0.25% AUM Wealthfront expense ratio is the entire account management fee.

There are no fees levied upon the Wealthfront cash account.

As with all exchange traded funds, there are investment expense ratios that go directly to the fund manager. The low fund management fees range from 0.06% to 0.13%.

The investment minimum is $500.

What Accounts Does Wealthfront Support?

Wealthfront offers among the largest number of available accounts from the robo-advisor field including the Wealthfront 529 account for college saving. The retirement accounts can be set up directly with the firm or rolled over from another IRA provider or 403(B) account.

Wealthfront account list:

- Individual and joint investment accounts

- Retirement accounts – Traditional, Roth, and Rollover IRA and 401(k)

- Simplified Employee Pension (SEP) IRAs

- 529 college savings plan accounts

- Trust accounts

- High interest cash accounts – Individual, joint, and trust

Wealthfront Performance

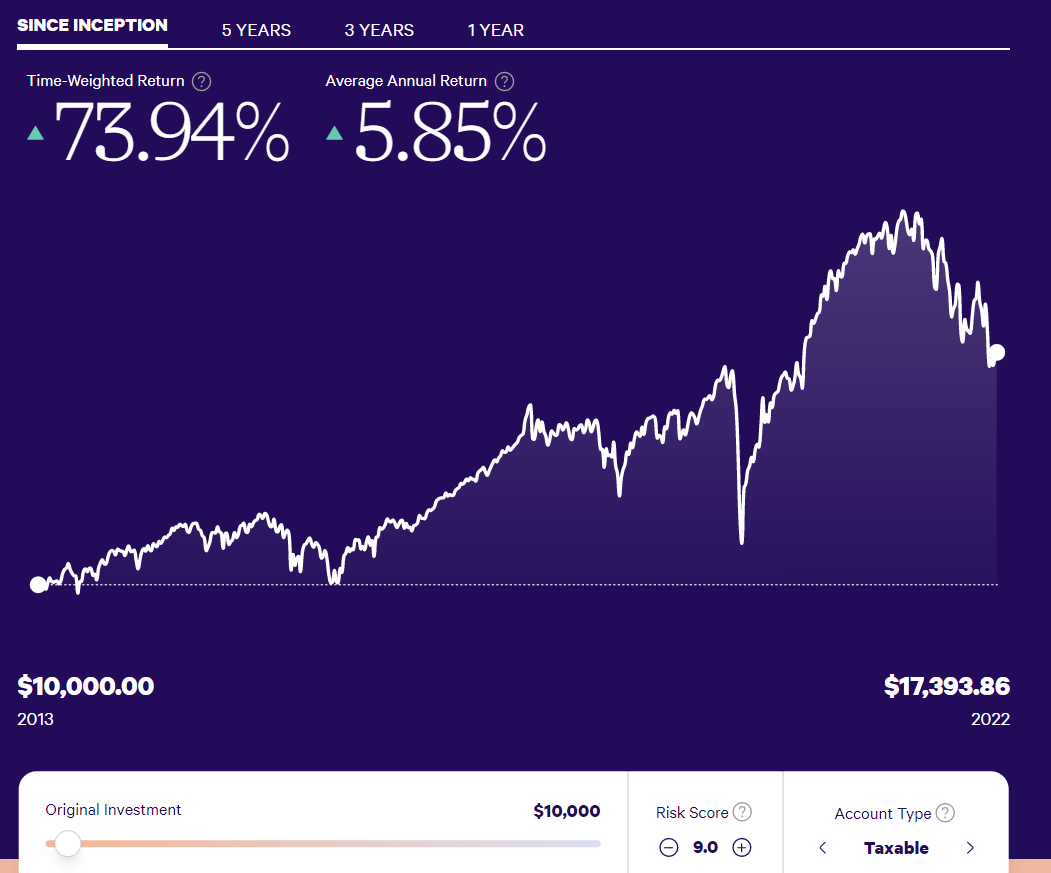

Your Wealthfront returns will be determined by the date you invest and the funds in which you are invested. The image above shows Wealthfront returns from inception in 2011 through October 2022, invested in the 9.0 risk level portfolio. Wealthfront’s performance will be different for each client. Additionally, during various periods of time, specific asset classes will out- and under-perform. This is why you diversify, because the future is unknowable.

We don’t recommend choosing a robo-advisor based upon it’s performance. Evaluate whether the investment funds are well diversified, low-fee, and allocated according to your goals and risk tolerance level.

The Wealthfront’s investment methodology is supported by Modern Portfolio Theory using index funds. This type of investing has been shown to outperform actively managed investing most of the time. We are confident that due to the low expenses, expert managers, and implementation of sound investing practices, that Wealthfront’s performance will be solid over the long term.

Wealthfront Features Drill Down

Wealthfront Mobile App

With an average 4.8 rating from roughly 15,000 reviews on the iOS app store, you can be confident that the all-digital Wealthfront app is great! From Wealthfront Cash on your phone to investment management, the Wealthfront App is among the best. The Wealthfront app makes it easy to see your investments, add money, borrow, and plan for your financial future.

Tax-Loss Harvesting

All Wealthfront taxable accounts are eligible for daily tax-loss harvesting. Wealthfront claims that this feature adds 1.8% to a taxable accounts returns, on average.

This tax-optimization strategy is carried out when one ETF is trading at a loss. Wealthfront sells that fund and replaces it with a similar one which keeps the portfolio asset allocation in line with your original asset mix.

The Wealthfront tax-loss harvesting is unique as other robo-advisors require a certain amount of money for tax-loss harvesting or perform the strategy less frequently.

US Direct Indexing

Wealthfront US Direct Indexing is a stock level tax loss harvesting strategy for accounts worth more than $100,000. By lowering your tax bill you will likely enjoy increased returns. It’s implemented by replacing the US stock market ETF with individual stocks. Then a stock level tax loss harvesting strategy is implemented.

Cash Management Account

Sometimes you need a cash stash. Think – rainy day fund, money for unexpected home repairs, cash for this year’s vacation, or a ‘what if’ fund for the unexpected.

For ready cash or an emergency fund, the Wealthfront Cash Management Account offers a zero fee, high yield account. The minimum deposit amount is one dollar and the value of your account is secure with up to $2 million FDIC insurance ($4 million for joint accounts) through partner banks and unlimited transfers, as previously mentioned.

The combined checking/savings account offers include:

- Interest paid on all deposits

- No fees or minimum deposit

- Free ATMs with debit card

- Direct deposit – with access to cash 2 days early

- Unlimited free transfers

- Automatic bill pay-for standard bills and to friends through Venmo, PayPal and other apps

- Mobile check deposit through app

Whether you have a Wealthfront investment account or not, you can sign up for a No Fee Cash account.

Wealthfront Borrow – Portfolio Line of Credit

If you have an expense, like a vacation or wedding, and don’t want to sell investments, to free up cash, Wealthfront Borrow offers a portfolio line of credit. The loan is available quickly and with a low interest rate. Actually, you can use the money for any purpose.

You can borrow up to 30% of your portfolio value with the Wealthfront Borrow portfolio line of credit. There is has no application fee and the loans are available for all customers with an individual, trust, or joint investment account.

What is the Wealthfront Risk Parity Fund?

The Wealthfront Risk Parity fund is an optional strategy for your investments. The approach claims to reduce risk and deliver a small increased return. It involves some leverage or borrowing and higher fees, but the proponents believe that these costs are more than offset by the expected higher returns.

There’s been quite a bit of press about the Wealthfront Risk Parity Fund. Since it’s an optional service, you can follow the discussion to determine whether it’s appropriate for you or not.

Wealthfront Smart Beta

Also called Advanced Indexing, the Wealthfront Smart Beta is another feature for investors with more than $500,000 invested in a taxable account. This investment strategy adjusts a taxable portfolios asset allocation based on other factors than the typical market capitalization percentage.

Smart beta considers factors such as investment momentum, value, dividend yield, market beta and volatility.

Automated Savings Plan (formerly Wealthfront Self-Driving Money – Autopilot)

The Automated Savings Plan is great if you have a variety of goals that you’re saving for.

The savings plan works with both the Wealthfront Cash account and any external banking account.

Here’s how the Automated Savings Plan works:

- Choose one account to monitor – any checking or your Wealthfront Cash account.

- Set the maximum amount of cash that you need in the account. If you like to keep a robust checking balance it could be $1,000. Or you could select any amount,.

- Select the account you want the excess from the first account transferred into – like your Wealthfront Investing account.

- When the balance exceeds your designated maximum by $100 in the first account, it will automatically be transferred into another cash account.

Customer Service

“All our Client Services team members are Series 7 licensed professionals and several hold CFA (Chartered Financial Analyst) or CFP (Certified Financial Planner) designations. They have experience from traditional firms, but are passionate about changing financial services for the better.”

Wealthfront.com

This isn’t discussed frequently, as Wealthfront is an all-digital financial management and robo advisor platform, but the Wealthfront team of client services specialists have specialty credentials, not usually found among robo-advisor customer service staff.

It’s rare to find a customer service representative at a robo-advisor with an understanding of investing principles.

Is Wealthfront Safe?

We understand that security is paramount when investing. And the short answer to ‘Is Wealthfront safe?’ is yes. Let’s break down all of your questions so you can be confident in Weathfront’s security.

Wealthfront partners with expert security companies to create and maintain secure, read-only links. These firms use bank-grade security and employ state of the art data protection. Wealthfront does not store your account password.

The security companies specialize in tracking financial data; they employ robust, bank-grade security and follow data protection best practices.

Your data is not shared with anyone.

You can be confident that Wealthfront is as secure as any financial institution.

Is Wealthfront FDIC insured?

The Federal Deposit Insurance Corporation is an independent agency of the federal government that banks and savings associations fund, in exchange for insurance for their customers deposits.

The Wealthfront high yield cash account is insured up to $2,000,000 by the FDIC ($4 million for joint accounts) through partner banks, where no insured deposits have been lost since 1933. Your money is spread across four banks, each offering $250,000 of insurance.

Can I lose money with Wealthfront Cash?

Consider the Wealthfront Cash Account as safe as any bank account, with a higher level of FDIC insurance, through partner banks.

The Wealthfront money management account is as safe as your brick and mortar or online savings account.

Although, your Wealthfront investment account is subject to the ups and downs of the investment markets, and there may be periods when your account will lose value. In the past, gaining years in the investment markets are more frequent than losing years.

Is Wealthfront a legitimate bank?

The Wealthfront Cash account stores your money across several legitimate banks including Green Dot Bank. Although, the Wealthfront company is not a bank.

In sum, Wealthfront is as safe as any financial institution. Yet, realize that any money in the investment account can go up and down in value. (Although over the long-term, investment values have gone up). On the other hand, the money in the high yield cash account will not lose value.

Wealthfront Promotion

Sign up for Wealthfront with this link and you’ll receive $5,000 managed for free.

Wealthfront Invite

Once you are a Wealthfront customer, you’re eligible for free investment management. When a friend signs up and funds their account, you get $5,000 managed for free. And your friend also gets $5,000 managed for free! It’s a win – win.

Is Wealthfront Worth it? Pros and Cons

Pros

The Wealthfront management fee is low at 0.25% of AUM after the initial $5,000 and the minimum $500 entrance fee is reasonable.

The opportunity to add ETFs, subtract ETFs, or create a portfolio of your own gives you more control than with most robo investing platforms.

The daily tax loss harvesting might improve performance for taxable accounts.

Loans for existing customers who have cash needs but don’t want to sell their current investments can come in handy for unexpected expenses.

When you transfer in your funds, Wealthfront helps minimize capital gains taxes as your existing assets are sold. For new investors or those with small portfolios, this is a benefit.

The Wealthfront Path financial planning tool is a confidence-builder when you need to understand if you’re ‘on track’ for retirement.

The high yield cash account is a strong sell, and only available at a handful of robo-advisors.

At present, Wealthfront is the best all-digital financial management and advice service that we are aware of.

Cons

The Wealthfront review negatives are slim.

One size fits all doesn’t fit everyone. The lack of a live advisor to consult with may be a negative for some investors. It’s tough to compete with the https://www.roboadvisorpros.com/sofi-wealth-robo-advisor-review/, which offers both human financial advisor access and a fee-free robo advisor.

Wealthfront doesn’t offer reduced fees for larger accounts. This might deter those with large portfolios from investing.

Wealthfront omits small cap and value ETFs from their lineup. These asset classes have long term evidence of outperforming the overall investment markets.

Need someone to talk to? 7 Robo-Advisors with Human Financial Planners

Wealthfront Reddit

Investors seeking questions like, “Is Wealthfront Legit?” or information about the Wealthfront IRA, frequently visit the Wealthfront Review Reddit. Users want input on whether Wealthfront is good, from Reddit users as well. The Wealthfront Reddit is a mix of sound answers to legitimate Wealthfront questions and more questionable advice. Make sure to take the Wealthfront Reddit responses with a grain of salt.

We like that the Wealthfront Reddit gives folks a place to discuss the pros and cons of Wealthfront and get feedback from other Wealthfront users.

If you have Wealthfront questions, an alternative to the Wealthfront Reddit is to visit Wealthfront customer service, where you can email customer service or receive a phone number to call. The FAQ also offer more general information.

FAQ

How good is Wealthfront?

Can I trust Wealthfront?

Can Wealthfront Make You Money?

Is Wealthfront Good for Beginners?

If you don’t meet the minimum investment amount you might consider SoFi Invest which requires $1 to invest and doesn’t charge management fees.

Can you lose money with Wealthfront?

Is Wealthfront Worth it? Final Wrap up

Wealthfront is among the largest stand-alone robo-advisors. They offer transparency, tax-sensitive investing and a sound investment management approach for a low fee. For new investors, it’s an excellent choice. For those with larger portfolios, the tax-optimized direct indexing is a compelling feature. The credentialed customer service representatives are an added bonus to this all-digital investment manager.

Is Wealthfront worth it? Yes, Wealthfront is worth it with it’s vast array of differentiated features including the premier digital financial planner, all for a low cost.

Compare

| Betterment | Wealthfront | M1 Finance | |

|---|---|---|---|

| Overview | A goals based robo advisor with financial planners. | All digital robo advisor with opportunity to customize investments. | Free robo-advisor pre-made and individual investments. |

| Minimum Investment Amount | There is no minimum investment amount required for Betterment Digital. Premium requires $100,000 minimum. | $500 | $100 |

| Fee Structure | Digital-0.25% Premium-0.40% Low cost financial planning. | 0.25% | Zero fees for investment management. $125 for more features. |

| Top Features | Goal-based ETF investment portfolio. Tax-loss harvesting. SRI, smart beta + income portfolios. Human financial advisor access. | Digital investment management. Daily tax-loss harvesting. Path online financial advisor. Can add or create own ETF portfolio. | Thousands of stocks and ETFs. Pre-made investment portfolios. |

| Free Services | Free management promotion. | First $5,000 is managed for free. | No management fees for basic service. |

| Investment Funds | Low-cost, commission-free ETFs. | Diversified low-fee ETFS. Sector, crypto and strategy funds available for customization. | Stocks, bonds, funds, and more. |

| Accounts Available | Single + joint taxable brokerage. Roth, traditional, rollover + SEP IRA. Trust. | Single + joint taxable brokerage. Roth, traditional, rollover + SEP IRA. Trusts. 529 college account. | Single + joint taxable brokerage. Roth, traditional, rollover + SEP IRA. Trust. |

| Visit Website | Free management fee promotion (time limited) | Wealthfront | Free investment management. |

Related:

- Wealthfront vs. Vanguard

- Wealthfront vs. Fidelity Go

- Wealthfront vs Betterment vs M1 Finance

- Wealthfront Borrow

- Is Wealthfront Safe?

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Wealthfront Disclosures:

Robo-Advisor Pros receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. Robo-Advisor Pros is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA / SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront conveys funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Please see the Deposit Account Agreement for details.

Other eligibility requirements for mobile check deposit and to send a check may apply.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $2 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.