M1 Finance is a simple yet powerful platform for trading cryptocurrencies like Bitcoin and Ethereum. In this article, we'll discuss the pros and cons of using M1 Finance in regards to its cryptocurrency platform and how it compares to other traditional cryptocurrency brokerages here.

In the modern age, many platforms have emerged that have opened access to investing to the average person. However, many novice investors have jumped headfirst into asset classes they do not understand. One such platform that many have turned to for guidance in terms of understanding these asset classes, is M1 Finance.

This platform has accrued a significant following in a short time due to its ease of use and the knowledge it provides to investors. Simply put, it is a dream platform for newer investors, primarily because of how convoluted and difficult full-service and DIY brokerages are.

With new product offerings released regularly, M1 Finance has established itself in the financial world, there is no doubt.

Cryptocurrency has become particularly popular in recent years. Still, it is also one of the most complex and risky assets for new investors to trade.

Therefore, learning everything there is to know about M1 Finance's cryptocurrency offerings can help any investor make more intelligent choices when it comes to their portfolios.

M1 Finance Crypto M1 Finance Crypto offers unique features with its “pie” creation capability that allows investors to create their own cryptocurrency ETF. Not literally of course, but it’s undoubtedly one of the best ways to maintain a diverse portfolio. In addition to this, an investor doesn’t need to worry about exceptionally high fees that other sites often charge. While the coins offered at this point are limited in scope, they are the largest and arguably most stable of all the coins, making them more reliable options to have in a portfolio compared to others. Overall, this is the best platform in the country when it comes to beginner and novice crypto investors to get started. Pros Cons

M1 Finance Crypto - Is This The Best Platform to Trade Cryptocurrencies?

What is M1 Finance?

Initially founded in 2016, M1 Finance was designed to revolutionize the investing industry and portfolio management in general.

The business is headquartered in Chicago and has moved around the area for years. M1 Finance started out managing $1 billion in client assets. However, this quickly grew to $5 billion as they began to prove themselves in the industry.

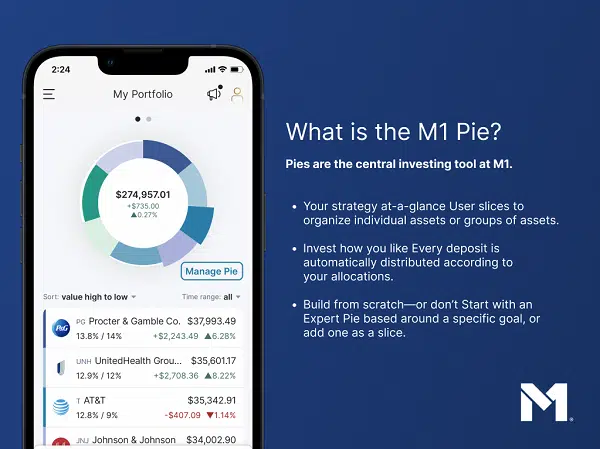

The product offering that M1 Finance provides is a blend of automated investing coupled with customized portfolio building. This takes the form of investment "pies," which comprise a different number of assets, similar to an ETF.

The platform offers over 80 pies for an investor to choose from, but they can also build their own pie if they'd like. M1 Finance offers different types of accounts and services to investors and general individuals alike, including:

- High Yield Savings Accounts

- Owner's Reward Credit Cards

- M1 Checking Accounts with Debit Cards

- Individual, Joint, or Custodial Investment Accounts

- Personal Loans

- Margin Loans

- Traditional, Roth, and SEP IRAs

- Trust Accounts

- Cryptocurrency Investment Accounts

In addition to the above, M1 Finance has become popular because it offers a "knowledge base" that includes topics centered solely around improving personal finance.

We will be focusing on one of their newest offers in this review: its cryptocurrency accounts.

The company's crypto platform will be the main focus in this article. If you're interested in exploring everything M1 Finance is about, I have an entire review dedicated to the platform here.

If you're interested in just hopping on board, for a limited time, they're offering up to $15,000 to transfer an account over to M1. Yes, the threshold to earn this money is high, however any sort of cash-back program is certainly one you'll want to have a peek at.

Click the button below to head to M1, open an account, and claim your cash bonus.

The basics of an M1 Finance crypto account

As with other types of investment accounts through M1 Finance, the services offered by a crypto account can be summarized in three main parts:

- The ability to select a pie to invest in or create your own pie

- The ability to choose what percentage of your deposits go into each slice

- The ability to use automated trading to continue to invest in your account in the long term.

However, unlike other investment accounts offered through M1 Finance, a person can trade crypto seven days a week, given that the crypto market never closes (reserved for M1 Plus members).

Another plus of this type of account is that it is commission-free, but be aware that cryptocurrency trades have associated transaction costs.

M1 Finance Crypto Platform Fees

While M1 Finance will not charge you a commission for the trades you make with cryptocurrency, it's worth noting that you will need to pay a small fee regardless.

This is because M1 Finance partners with Apex Crypto LLC. This company allows broker-dealers and financial advisors, M1 Finance in this case, to meet legal obligations and requirements by holding cryptocurrency in a separate account.

In short, when you have an active M1 Finance cryptocurrency account, your cryptocurrency is stored in a custodial wallet run by Apex Crypto LLC instead of M1 Finance. In return for this service, Apex Crypto LLC charges a 1% or 100 basis point fee on all cryptocurrency transactions that an investor makes through M1 Finance.

M1 Finance's crypto rebalancing

An active cryptocurrency account can be viewed with all of your other accounts in a single place, which is one of the main benefits of M1 Finance.

An investor also has access to M1 Finance's Dynamic Rebalancing tool, which automatically invests new deposits into your pie in such a way that it brings you closer to your target percentages.

These rebalances can even be scheduled ahead of time to occur at regular intervals in case an investor wants to mix up the strategy they are using throughout the year.

Cryptocurrencies you can trade with M1 Finance

The supported coins are admittedly limited because a cryptocurrency investment account is a relatively new concept to M1 Finance. Currently, only the following three coins are supported:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

However, these are no doubt 2 of the 3 blue-chip cryptocurrencies and are what most investors should be buying if they want a long-term buy-and-hold strategy for crypto.

M1 Finance has indicated an interest in supporting more coins in the future, potentially as many as ten in total. Still, they are trying to stay away from more speculative coins, given that cryptocurrency is already inherently riskier than standard assets.

It's worth noting, though, that M1 Finance brokerage and IRA account holders can also enjoy features from M1 Finance crypto by investing in the following related assets:

- ProShares Bitcoin Strategy ETF (BITO)

- Grayscale Ethereum Classic Trust (ETCG)

- Grayscale Ethereum Trust (ETHE)

- Grayscale Bitcoin Trust (GBTC)

- Grayscale Digital Large Cap Fund LLC (GDLC)

- Grayscale Litecoin Trust (LTCN)

There is no doubt that if you're looking to buy Bitcoin, Ethereum, or Litecoin, M1 Finance is one of the best places to do it, and you can get started by clicking the button below.

The pros and cons of an M1 Finance crypto account

Given the social hype cultivated around cryptocurrency in recent years, it's only natural for an investor to want to consider adding this alternative investment to their portfolio.

Before diving into the thick of it and opening an M1 Finance Crypto account, though, consider both the pros and cons:

Pros of an M1 Finance Crypto Account

- Access to the top crypto coins on the market as of this point in time

- The freedom to design a specialized crypto portfolio

- Integrated access to viewing existing accounts with the new crypto account

- Commission-free trading in terms of M1 Finance

- Access to unique investment features such as robo-advising and dynamic account rebalancing

Cons of an M1 Finance Crypto Account

- Apex Crypto LLC will charge a 1% fee on all cryptocurrency transactions

- Unless you are an M1 Plus member, you will have limited windows to place your trade requests

- The current coins offered on M1 Finance are not expansive

- Cryptocurrency is not truly a long-term investment strategy as of now

- Adding expert pies into your investment portfolio may be difficult to understand for beginners

As with any investment account, an investor must consider the pros and cons before committing to use the platform. Use the above benefits and drawbacks when considering whether to sign up for an M1 Finance crypto account.

Is an M1 Finance cryptocurrency account right for you?

First and foremost, it's important to remember that cryptocurrency is inherently risky and that all investors, novice and experienced alike, should take heed before putting money in.

With that said, after performing adequate research, M1 Finance Crypto offers unique features with its "pie" creation capability that allows investors to create their own cryptocurrency ETF. Not literally of course, but it's undoubtedly one of the best ways to maintain a diverse portfolio.

In addition to this, an investor doesn't need to worry about exceptionally high fees that other sites often charge.

While the coins offered at this point are limited in scope, they are the largest and arguably most stable of all the coins, making them more reliable options to have in a portfolio compared to others.

Combining this with the fact that M1 Finance offers many other brokerage products and accounts for long-term investments, branching out into a crypto account through M1 Finance can be a fruitful choice.

I'd argue it's the best platform in the country to buy and sell cryptocurrencies for a beginner to novice investor at this point.

M1 Finance Crypto FAQs

What is cryptocurrency?

Cryptocurrency is a specialized form of digital currency in which the transactions are verified and recorded via a decentralized authority rather than a centralized authority such as a bank or government.

These cryptocurrencies are secured by cryptography, which makes them nearly impossible to counterfeit and even double-spend. However, the value of cryptocurrencies is often not tied to anything specific, which is why the valuation can fluctuate so drastically.

Who is allowed to invest in M1 Finance?

To open an account with M1 Finance of any type, a person must be a United States citizen or permanent resident (green card holder). They must also be over 18 years old and have a current, verifiable, United States address and phone number.

How are crypto assets on M1 Finance stored?

M1 Finance is partnered with Apex Crypto LLC. This financial technology company offers integrated wallets for account holders to store cryptocurrency. In return for this service, Apex Crypto LLC charges a 1% or 100 basis point fee on all an investor's cryptocurrency transactions.

How does a crypto pie work?

One unique feature of M1 Finance compared to other digital portfolios available to investors is that investors have access to expert crypto pies. These pies work the same way as their standard pies: an investor chooses the cryptocurrency assets they wish to make up the pie. Once the assets have been chosen, the investor chooses a total sum to invest and the percentage amount to allocate to each "slice" of the pie.

What are the fees on an M1 Finance crypto account?

Currently, M1 Finance does not charge any commission fees for investing in cryptocurrencies through their site. With that said Apex Crypto is assessing a 1% or 100 basis points fee to all crypto transactions on purchases and sales, though M1 and Apex Crypto have entered into a fee rebate agreement.

Is M1 Finance FDIC or SPIC insured?

Yes, the M1 Finance checking accounts and savings accounts are FDIC insured up to $250,000 through the issuing bank Lincoln Savings Bank. Their investment accounts are also protected by SIPC, given that M1 Finance LLC is a registered broker and dealer with FINRA. However, cryptocurrency is not a covered security, which means any crypto accounts are not protected by SIPC insurance.