In today's fast-paced world, managing our finances can be challenging. Often, we need some sort of portfolio management or budgeting tool to make our lives easier.

Simplifi and Mint are two leading budgeting and financial management apps designed to help users navigate their financial landscape. Both tools have gained popularity due to their user-friendly platforms and useful features, which help individuals save money by creating budgets and tracking expenses.

This kind of oversight of one's money is critical in the age of subscription and digital billing today, where we can easily sign up for forgotten subscriptions or have bills automatically withdrawn without keeping track of them. It helps to have one of these money management apps for sure.

Each app boasts unique strengths, but the choice between the two ultimately depends on user preferences and individual financial needs.

I signed up for both platforms, explored their features and came to a conclusion as to what platform is best so you don't have to. Enjoy!

Lets dive right into a comprehensive guide of the two so you can make a more educated decision.

What is Simplifi?

Simplifi is a personal finance and money management app created by Quicken, a leading financial software company. It aims to give users an easy and efficient way to manage their finances and track their spending.

Utilizing Simplifi by Quicken transformed the way I handle my finances. I found the initial steps super simple in creating an account and linking up my various bank accounts, credit cards, loans, and investments.

The Simplifi dashboard displays my account balances and recent transactions and neatly categorizes my spending. The clean and straightforward design simplifies the process of tracking my financial activity.

Key features of Simplifi

Budgeting and spending tracking

Simplifi allows me to create customized spending plans and monitor my spending, including creating spending watchlists.

It also offers real-time insights into how much money is left to spend within various budget categories. The automatic transaction categorization is a standout feature for me.

While it handles most categorization, I can customize these categories and add notes to transactions as well. This level of customization ensures I have a clearer understanding of my expenditures.

Account aggregation

By connecting various financial accounts (such as checking, savings, investments, credit cards, and loans), Simplifi provides a comprehensive view of one's finances. This feature makes it easier for users to stay on top of their account balances and transactions.

Financial goals

I set up short-term and long-term financial goals in Simplifi and monitor my progress towards achieving them. This feature offers a simple yet effective way to track savings and other financial objectives.

Bill tracking and reminders

Simplifi ensures I never miss a payment by allowing me to track upcoming bills and set up notifications. This is important as it can help me avoid late payment fees and maintain a healthy credit score, which could enable me to get cheaper loans in the future.

Does Simplifi cost money?

Simplifi offers a 30-day free trial for users to try its features before committing to the paid subscription. After the trial period ends, the app has a monthly subscription fee of $2.39 per month, billed annually.

To be honest, this is such a minimal cost in this day and age that I feel it's a no-brainer for those looking to keep their finances in check.

What is Mint?

Mint is a popular financial management app developed by Intuit, designed to help users gain better control over their finances. This free budgeting tool enables users to monitor their expenses, create budgets, track their investments, and understand their financial health. Mint's user-friendly interface allows for simple financial planning.

Using Mint has been a game-changer for managing my finances.

It was easy for me to sign up for an account, as was linking my bank, credit cards, loans, and investments.

Once everything was connected, I found it an excellent way to get a well-organized, clear picture of my money.

Key features of Mint

As soon as I log in, I land on the dashboard. It's like my financial command centre, displaying all my activity and account balances and neatly categorized expenses.

It's so convenient to see where my money is coming from and where it's going using the following tools:

Budgeting

Mint enables me to create and manage budgets by categorizing transactions and setting monthly financial goals.

Expense tracking

I can monitor spending and purchases through my linked accounts - bank accounts, credit cards, loans, and other financial accounts. Mint automatically categorizes transactions in real time.

Investment tracking

Mint allows me to track my investment accounts, monitor performance, and receive personalized investment advice.

Goal setting

The goal-setting feature is another gem. I can create financial goals, whether it's saving for a vacation or paying off a debt. Mint provides visual progress tracking and suggests ways to speed up my progress.

Credit score monitoring

Monitoring my credit score is a breeze. It provides my credit score for free and updates me on any changes. This can be handy for many situations where a glance at the credit score is needed, say between a landlord and a renter.

Bill reminders

I can set up bill notifications for whichever payee I wish to ensure timely payments.

Does Mint cost money?

Mint sets itself apart from other financial management apps by offering its services for free.

While features like investment tracking and credit score monitoring are premium features in other apps, Mint provides them at no additional cost.

The app generates revenue through advertisements, personalized offers, and referrals to partner companies.

So now that we know that Simplifi is a paid platform and Mint is free, lets discuss why we believe Simplifi, despite it having costs, is the better platform.

Overall winner of key features: Simplifi

Financial goals and budgeting comparison

Budgeting with Simplifi

Budgeting in Simplifi is a breeze. I found I was setting set budgets for groceries, entertainment, and utilities in just a few minutes.

Simplifi provides real-time tracking and easy-to-understand visuals that show me precisely how I adhere to my budget. It feels like having a personal financial coach helping me stay within my financial goals.

The savings goals have been super handy for me in putting away some cash for things like the odd vehicle repair that comes in a little heavier than I expected, or building a budget to work with when planning my next vacation.

Budgeting with Mint

One feature I like in Mint is the automatic transaction categorization. Mint labels my expenses for me, but I can customize these categories to fit my preferences.

I even set up some rules to ensure it gets things right. The budgeting tools are a lifesaver. I set budgets for various categories, like groceries, entertainment, and dining out. It keeps me informed about my spending against these budgets. It sends me notifications if I'm nearing the limits I've set.

Mint's budgeting system also lets me create budget categories as flexible or fixed. Flexible categories can roll over unspent funds to the next month.

Overall winner of budgeting: Mint

Account management and transactions

Account Management in Simplifi

- Users can effortlessly add and sync their financial accounts to Simplifi.

- Allows monitoring different spending categories, providing useful insights into the user's spending.

- The detailed reports and insights thoroughly explain my financial habits and patterns. This insight helps me make well-informed financial decisions.

- Users can set up customized spending targets for different categories, encouraging them to reach their financial goals.

- The bill management tool keeps tabs on all my bills and their due dates, sending timely reminders. This feature has saved me from late fees and missed payments.

Account Management in Mint

- Enables users to link all their financial accounts to the app and regularly syncs all transactions for seamless account management.

- The trends and insights section analyzes my financial data. It offers valuable insights into my spending habits, income patterns, and net worth. It's like having a financial advisor or planner tool at my fingertips.

- Mint offers advanced budgeting features, allowing users to establish monthly budgets and track them through visual progress indicators.

- The platform also includes bill reminders and notifications, ensuring users stay on top of their financial commitments.

Overall winner of account management: Simplifi

Security

Security in Simplifi

Simplifi takes security measures seriously to protect users' financial data. The platform employs 256-bit encryption to ensure the safety and confidentiality of users' information.

For the layperson who has no idea what encryption even means, like me, lets just say this level of encryption is considered highly secure. Financial institutions and government organizations commonly use it to safeguard sensitive data.

In addition, Simplifi offers multi-factor authentication to add an extra layer of security to its user accounts. This verification process requires multiple forms of identification before granting access to an account, significantly strengthening the account's protection against unauthorized access.

When it comes to security, Simplifi leaves no room for compromise. I'm confident that my sensitive information is in safe hands.

Security in Mint

MInt employs bank-level encryption and multi-factor authentication to protect my financial data. When I was using the platform, not once did I feel like my information was at risk of being compromised.

Just like Simplifi, Mint provides multi-factor authentication as an optional security feature. Users can enable this additional layer of protection, which requires multiple forms of verification before granting access to their account. This helps prevent unauthorized access and enhances overall account security.

Both Simplifi and Mint take extensive security measures to protect their user data. These platforms maintain a secure environment for managing personal finances through password-protected login, advanced encryption technologies, and multi-factor authentication.

Overall winner of security: A draw

User experience on mobile devices

Simplifi's Mobile App

Simplifi's flexibility shines through its mobile app, available for iOS and Android devices. I can manage my finances from the comfort of my home or while on the move, providing unmatched convenience.

Some key features I liked on the mobile app include:

- Budgeting: Users can set spending limits and monitor their progress all on their phones.

- Alerts: The app can send notifications about upcoming bills, budget progress, and more. Even when you get off track.

- Account Connections: Users can link their accounts from various financial institutions and have a comprehensive view of their financial outlook.

The effectiveness of using a tool like Simplifi is definitely increased by accessing all the data via my smartphone. It makes it easier to keep an eye on things.

Mint's Mobile App

Mint's mobile app, also available for iPhone iOS and Android devices, is designed to be a one-stop-shop for your finances.

Its user-friendly interface provides an overview of users' financial activities, including spending, bills, savings, and investments. Mint's mobile app offers an array of features for its users to stay on top of their financial game.

Some of the features I liked are:

- Budget Creation: Users can create and track budgets by categories and get insights into their spending trends.

- Bill Tracker: The app conveniently integrates upcoming expenses and due dates into the main dashboard.

- Investment Tracking: Users can review their investment portfolios and track performance over time.

The convenience of mobile access is a real plus. One quick download of this free budgeting app from the app store, and I was able to manage my finances from the Mint website or their mobile app, making it easy to stay on top of things even when I'm on the go.

The mobile app continually evolves to provide a better user experience by incorporating user feedback and updating its features.

After playing around with both of them, I'd put these two at a stalemate. They are both outstanding.

Overall winner of mobile app functionality: A draw

Investment tracking and management

Investment Tracking in Simplifi

Simplifi offers investment tracking capabilities on top of budgeting functionality.

Users can easily link their investment accounts to the platform to monitor their investments in real time. The software categorizes investments, providing a clear overview of the user's portfolio and performance.

In Simplifi, the key features for investment tracking include:

- Portfolio view: Users can see the overall value of their portfolio and track individual investments.

- Performance overview: The platform displays the total percentage gains or losses, making it easy to assess the performance of the investments.

- Account linking: Simplifi supports linking with various financial institutions, ensuring seamless integration with the user's existing investment accounts.

Investment tracking in Mint

Mint, which is owned by Intuit, commonly known for Quickbooks, also enables users to track their investments. Like Simplifi, Mint facilitates linking investment accounts for an integrated view of the user's financial portfolio. In addition to monitoring investments, Mint offers tools for analyzing the performance of various assets.

Key investment tracking features in Mint encompass:

- Portfolio breakdown: Mint presents a detailed breakdown of the user's portfolio, including asset allocation and overall performance.

- Custom notifications: Users can set up personalized notifications for changes in their investments, ensuring they are promptly informed of significant developments.

While both Simplifi and Mint enable users to track investments and provide valuable insights into their portfolios, I believe Simplifi's to be the better and more comprehensive platform.

However, if I had a choice, I'd likely choose neither for investment tracking

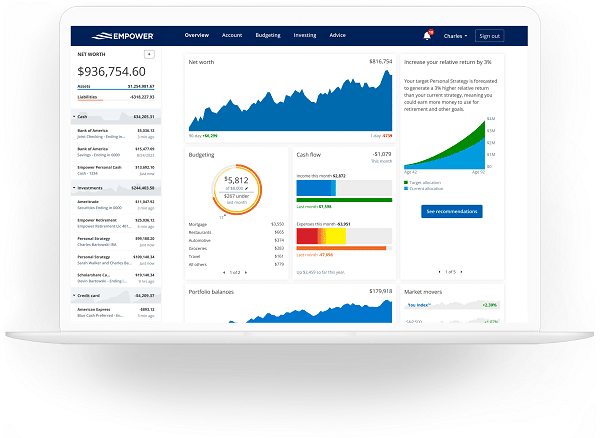

I'd instead head to a platform like Empower and grab their free tools. It's arguable one of the most comprehensive suites of tools in the country when it comes to tracking your investments and retirement.

Alerts and notifications

Alerts in Simplifi

Simplifi offers a variety of alerts and notifications to help users manage their finances effectively. These alerts can be customized according to individual preferences.

- Transaction notifications: Simplifi sends notifications whenever a new or unusual transaction occurs in linked accounts. This helps users to stay on top of their financial activities and flag any unauthorized transactions.

- Budget alerts: Users can set up budget goals and receive notifications when they approach or exceed their spending limits. This helps in keeping spending in check and achieving financial goals.

- Bill reminders: Simplifi also enables users to set up notifications for upcoming bills, ensuring timely payments and avoiding late fees. These can be customized for individual bills or set up as recurring notifications for regular expenses.

Alerts in Mint

Mint also provides a comprehensive alert system to manage one's finances efficiently. These alerts cover various aspects of financial management, assisting users in staying on track with their goals.

- Transaction alerts: Similar to Simplifi, Mint notifies users of any new or suspicious transactions in their linked accounts. This ensures that individuals control their financial activities, promptly detecting any discrepancies.

- Budget notifications: Mint allows me to create budget goals and sends notifications when my spending limits are approached or exceeded.

- Bill reminders: These are great. I never miss a bill payment thanks to the bill reminder feature. Mint keeps me on track by sending notifications about upcoming due dates, saving me from late fees more than once.

- Credit score notifications: Unlike Simplifi, Mint provides notifications for changes in the user's credit score, allowing them to monitor their financial health more effectively.

Overall winner of alert functionality: Mint

Is there an alternative to Simplifi or Mint?

When considering personal finance management tools, exploring various options is important to find the right fit for your needs. While Simplifi and Mint are popular choices, another noteworthy alternative might suit your preferences better, and it's completely free.

Empower

Its tools are better explained in a comprehensive article, of which I made not too long ago. You can click the button below to read all about Empower's free tools, which I believe are the best free tools on the planet.

Should I get Simplifi or Mint?

Simplifi and Mint are both popular financial management tools. In terms of pricing, Simplifi offers a subscription-based model. Users need to pay an annual fee to access its services.

On the other hand, Mint has a free version. This factor might encourage price-conscious users to lean towards Mint as their choice.

In my experience, using Simplifi is like having a personal finance whiz in my pocket, and with its low cost I view it as the clear cut winner of the two.

It streamlines the process of managing my finances, from tracking expenses to setting and achieving goals, setting up custom watchlists, and ensuring I stay on top of bill payments.

With its user-friendly interface and powerful features, Simplifi has been an invaluable tool for taking control of my finances and making good financial choices.

That said, using Mint is like having a trustworthy personal financial coach. It simplifies tracking my finances, setting and achieving goals, and keeping my credit score in check. It just isn't as in-depth and because Simplifi's costs are so little, I'm not too worried about paying for it.