Choosing between robo-advisors can be hard when you’re stuck between two well-known, strong contenders. Betterment vs. Vanguard Personal Advisor Services is a particularly difficult choice, as both robos have human financial professionals available to their clients, and we like both.

In fact, Betterment and Vanguard are number three and number one respectively on the list of the robo-advisors with the most AUM.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Before you flip a coin, there are some important differences between these robo-advisors you should be aware of.

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Betterment vs Vanguard Digital and Personal Advisor Services – Overview

What is Betterment?

Betterment is one of the earliest robo-advisors and as of April 30, 2023 manages more than $36 billion.

Betterment offers two investing levels, a low fee, the Digital plan and Betterment Premium, with financial advisors for all clients, for a higher price point.

Betterment highlights:

- Low fee, goal-based investment management.

- Various types of investing strategies available including smart beta, socially responsible, income and crypto portfolios.

- Cash management including fee-free debit cards, checking, Betterment Cash Reserve – a high yield cash account – are administered through partner banks.

- Financial advisor access for all clients – including goal specific, low cost planning packages or financial planners for Premium clients for additional management fee.

Betterment can meet the needs of beginners to advanced investors. In fact, it’s great for millennial investors.

What is Vanguard Personal Advisor Services and Digital Advisor?

Vanguard is the well-known financial management firm, founded by John Bogle, who launched the first index fund. They’re known for their low fees.

Vanguard also offers two plan levels, like Betterment.

The Vanguard Digital Advisor is a basic robo advisor and offers low-fee investment management driven by your risk level and goals.

The Personal Advisor Services is a hybrid model that offers both human advisors and a digital investment platform. You can be as involved as much or as little as you’d like.

The Vanguard robo-advisor highlights:

- With Personal Advisor Services, human financial planners lead investment advice and provide a customized investment plan

- The Digital plan considers all of your investments when creating your portfolio and provides several strategies including passive index fund portfolios or a mix of active and passively managed funds

- ESG investing is also available

- Low 0.20% management fee and $3,000 minimum investment for Digital Advisor

pardon our dust, we’re updating this article now.

Betterment vs Vanguard Top Features

Betterment vs Vanguard Robo Advisor—Who Benefits

The Betterment vs Vanguard robo match up is a difficult contest.

Betterment and Vanguard Personal Advisor Services each boast some of the most desirable robo-advisor features, including a human touch, reasonable fees, and portfolio review and rebalancing.

We like both and believe that most investors could be satisfied with either. That said, here’s how you might benefit from each.

Betterment

We like that Betterment is a robo-advisor first and is advised by one of the top investment pros of our time – Burton Malkiel (author of a Random Walk Down Wall Street). This is in contrast with in contrast with Vanguard which is a large financial powerhouse

Betterment Digital doesn’t require a minimum investment amount, and only $10 to begin investing. So if you’re a small investor, then choose Betterment.

If you want access to financial advisors you have two choices at Betterment. Digital customers can pay for discrete financial planning packages for low fees. Premium customers can pay 0.40% AUM for digital investment management and unlimited access to financial advisory meetings.

Betterment is also a wise choice for investors seeking smart beta, income, or dcrypto.

If you think you might need to chat with a financial advisor for occasional concerns such as an investment portfolio review or college planning, but aren’t qualified or interested in the Premium option, then choose Betterment. The a la carte Betterment financial planning packages start at $299 and provide access to financial advisor guidance.

Vanguard

Vanguard Digital might be best if you’re seeking a combined index and actively managed investment portfolio with a reasonable 0.25% a rock bottom investment management fee and the $3,000 investment minimum.

Vanguard is a good choice for investors who already have accounts with the firm.

For investors seeking financial advisor access, passive and actively managed portfolios along with automated investment management Vanguard Personal Advisor Services has a lower management fee and investment minimum.

Other robo-advisors with active management strategies include Elm, Titan, Merrill Edge Guided Investing and Zacks Advantage.

Quick Summary

- Betterment is best for small investors with no investment minimum required and only $10 to begin investing.

- Betterment is best if you want the Digital level and appreciate the opportunity to purchase individual financial planning packages.

- Vanguard is best if you’re seeking a hybrid robo and human advice model and prefer lower management fees of 0.30% AUM with the lower $50,000 minimum investment amount.

Fees and Minimums

Winner: It’s a tie. Betterment wins with no investment minimum while Vanguard claims lower fees.

| Vanguard | Betterment | |

|---|---|---|

| Minimum Investment | Digital-$3,000 Personal Advisor-$50,000 | Digital-No minimum, $10 to invest Premium-$100,000 |

| Fees | Digital-0.20% AUM for all index funds – 0.25% AUM for index + active portfolio Personal Advisor Services-0.30% | Digital-.25% Premium-.40% |

Deep Dive

When it comes to Betterment vs. Vanguard Personal Advisor Services and Vanguard Digital, which one is the better depends upon your individual financial situation and goals. Although, there are a few defining features that set these robo-advisors apart.

Human Financial Advisors

Winner: Betterment squeezes out a win witha la carte financial planning packages.

Betterment

Human financial planners are available to all Betterment clients, Digital (Financial Planning Packages) and Premium for additional fees.

Betterment Premium customers qualify for in-person meetings with Certified Financial Planners.

The a la carte financial planning services, however, might be the best solution for many clients who need short-term face-to-face advice for low fees.

Vanguard Personal Advisors

Vanguard Digital lacks access to financial advisors. Although I assume that since Vanguard is such a large firm, you might be able to access some rudimentary financial information from a customer service representative.

Wealthier investors might lean towards Vanguard with the vast range of services.

With Vanguard Personal Advisor Services, human financial planners are an integrated part of the package. Clients have unlimited access to human financial planners who are hands-on throughout the entire process. For investors with at least $50,000, the 0.30% annual fee of assets under management (AUM), is lower than Betterment’s 0.40% AUM investment management fee and $100,000 minimum.

Tax Loss Harvesting

Winner: Betterment offers tax loss harvesting for all taxable accounts.

Betterment

Betterment offers tax-loss harvesting in their taxable accounts. Although, it is not automatic, you need to turn it on.

Vanguard

Unlike other robo-advisors, Vanguard Personal Advisor Services provides tax-loss harvesting on a case-by-case basis. At Vanguard Digital, you can request tax loss harvesting as well. Vanguard Personal Advisor Services works with you to ensure proper asset location for the best tax treatment, as well.

Investments

Winner: It depends. For passive index fund portfolios, Betterment wins for the Digital contest with much greater diversity than Vanguard. Although, if you want active management, you’ll need to go with Vanguard. Vanguard Personal Advisors has access to a wide stable of Vanguard funds.

Betterment

Betterment delves into diverse corners of the investment universe to capture various U.S. and international stock and bond funds.

Betterment also offers smart beta, socially responsible, and income portfolios.

Betterment Investments:

Stock Funds

- Total U.S. Stock Market ETF (VIT, SCHB, ITOT)

- U.S. Large-Cap Value ETF (IVTV, SCHV, IVE)

- U.S. Mid-Cap Value ETF (VOE, IWS, IJJ)

- U.S. Small-Cap Value ETF (VBR, IWN, IJS)

- International Developed Market Stock ETF (VEA, SCHF, IEFA)

- International Emerging Market ETF (VWO, IEMG, SCHE)

Bond Funds

Betterment offers 8 bond ETFs spanning U.S. corporate, high yield, short term, municipal and treasury bonds. Additional bond categories include both developed and emerging market bond funds.

Vanguard

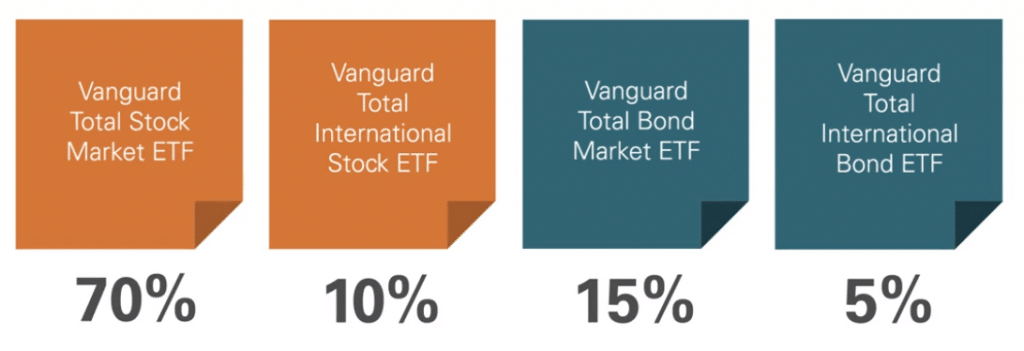

Vanguard Digital robo advisor creates all portfolios with just 4 ETFs:

- Vanguard Total Stock Market ETF

- Vanguard Total International Stock ETF

- Vanguard Total Bond Market ETF

- Vanguard Total International Bond ETF

Although these four ETFs offer broad diversification, we would like to see a real estate investment trust (REIT) ETF.

The active funds will add in additional actively managed Vanguard funds.

Vanguard Personal Advisor Core Investments:

Vanguard Personal Advisor lists only its core funds. The only way to know the other investment funds they use is to open an account. Since Vanguard uses best practices investing and is known for low-fee funds, I would be confident in their fund offerings.

- Total U.S. Stock Market Index Fund (VTSMX)

- Total International Stock Index Fund (VTIAX)

- Total Bond Market Index Fund (VBTLX)

- Total International Bond Index Fund (VTABX)

- Intermediate-Term Investment Grade Fund (VFIDX)

- Short-term Investment Grade Fund (VFSUX)

- Intermediate-Term Tax-Exempt Fund (VWIUX) (for taxable accounts only)

Rebalancing

Winner: It’s a tie. Both Vanguard and Betterment offer rebalancing.

Rebalancing is the most universal characteristic of robo-advisors.

Simply, when you begin your investment with a firm, you answer a few questions and choose an investment portfolio which allocates a portion of your money to stock, bond and other asset classes. The firm will rebalance your investments back to your original choice periodically. This ensures that your investments stay in the proportions that you initially selected.

Retirement Planning

Winner: Betterment

Betterment

Betterment offers retirement goals for all service levels.

The Retirement Savings Calculator uses 20 inputs to figure out how much you’ll need to have in order to meet your individual retirement spending goals. Then the guide tells you exactly how much you’ll need to save and in which accounts in order to reach your retirement plan.

Vanguard

Vanguard Personal Advisor Services offers individual guidance and retirement planning. While Vanguard Digital is limited and actually states that their services is not for those in retirement.

Although you can save and invest for retirement in a traditional or Roth IRA with Vanguard Digital, this service is more basic with fewer funds and fewer types of available accounts for retirement saving. For example, Vanguard Digital doesn’t doesn’t offer any type of business retirement account.

Customer Service

Winner: Betterment

Betterment

Betterment provides phone support Monday through Friday. Email and text support are available 7 days per week.

We like that all Betterment customers can text with financial advisors 7 days per week. This is an outstanding feature as financial questions don’t stop on the week-ends!

Vanguard

Vanguard also offers phone support Monday through Friday. You can contact the firm via email 24/7, although you’ll expect responses during week days.

Mobile App

Winner: Betterment

Since Betterment is a robo-advisor focused platform, their app is more targeted than Vanguard’s. The app is comprehensive with mostly favorable ratings.

We like that Betterment responds to problems and concerns with the app and then proceeds to fix the bugs.

Vanguard recently introduced a new app – Vanguard Beacon. There’s not a lot of feedback regarding the new app, but they don’t have a robo-advisor specific app. Thus users have one app for the entire Vanguard website. For that reason, we prefer Betterment’s app.

Security

Winner: It’s a tie.

You can be confident with top level security for Betterment and Vanguard.

Betterment offers the strongest available browser encryption, secure servers, and two-factor authentication.

As Vanguard is one of the most prominent Finance companies in the U.S., you can be confident that they implement the highest security protocols.

Cash Management

Winner: Betterment

Betterment

Betterment checking and cash reserve offers has a suite of tools including:

- Fee-free high yield cash account with no minimums or withdrawal limits

- No-fee checking account and Betterment Visa Debit Card

Betterment Checking and Cash Reserve are offered in conjunction with several partner banks.

Vanguard

The Vanguard robo-advisors don’t offer cash management or checking within their platforms. Although if you open a separate brokerage account at Vanguard you can invest in a high yield money market account or brokered certificate of deposit.

Vanguard doesn’t offer typical checking accounts.

FAQ

Is Vanguard Digital Free?

Is Betterment better than Vanguard?

The premium versions of both platforms are quite good. Ultimately, consider what you are seeking in an investment manager to make your choice easier.

Visit the Robo-Advisor Selection Wizard, take a quick quiz, and find out which robo-advisor is the right one for you.

Betterment vs Vanguard — Wrap Up

Is Vanguard Personal Advisor Services worth it? Absolutely.

Is Betterment worth it? Yes it is.

Each robo-advisor is a good choice, for the right investor.

If you’re seeking a basic low-fee goal based robo-advisor with an index fund strategy, we recommend Betterment.

Betterment Digital is superior to Vanguard Digital because it offers greater account types, substantially more investment funds and investment styles.

Betterment Digital is ideal for new investors – requires no minimum investment amount and only $10 to begin investing.

If you prefer active and passively managed strategies, then you’ll choose Vanguard.

Ultimately, if you need an occasional sit-down with a financial advisor, Betterment offers their a la carte financial planning packages.

For investors seeking a hybrid financial advisor with unlimited access to financial advisors, the choice is a bit more difficult.

If you only have $50,000 to invest, then you’ll pick Vanguard, due to the lower minimum required.

If management fees are a concern, then Vanguard Personal Advisor Services wins with a low 0.30% AUM investment management fee. This is in contrast with Betterment’s 0.40% fee.

If nominal fee differential or minimum investment requirement isn’t pressing issue, then we believe both Vanguard Personal Advisor Services and Betterment Premium are sound investment management choices.

You might have a bit more input into portfolio construction with Vanguard although we are comfortable with both platforms’ investment management and construction.

Finally, your choice between Betterment or Vanguard depends upon your own personal investment situation. Whichever platform you choose, you can rest assured that each are well regarded robo-advisors.

Read: Betterment Review

Read: Vanguard Robo-Advisor Review

Related

- Betterment vs Wealthfront vs Vanguard

- Betterment vs. Wealthfront vs. M1 Finance

- M1 Finance vs Vanguard

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.