Titan Robo Advisor – Expert Analysis

Titan Investing wants to help the little guy or gal invest like a big-time hedge fund manager. This Titan Invest review digs into every corner of the Titan app, including the strategy and Titan mobile app design. As a former portfolio manager, I put Titan under the microscope, investigated the features, and compared the Titan app against other robo-advisors.

The company began with the Titan Hedge Fund strategy portfolios where investors have a chance to compete with the formerly inaccessible traditional hedge fund players. Titan Investing answered the call for cryptocurrency investing with the Titan Crypto actively managed fund and a range of actively managed alternative investment options. The aggregate Titan cost is declining, as Titan offers expand with the introduction of the fee-free stock and bond automated investing. Titaninvest now offers both passive and active management robo-advisor portfolios that combines stock picking, influenced by hedge fund investment choices, ETFs, and alternative funds with regular rebalancing and portfolio management.

Included in the investment choices the Titan App recently paired with Cathie Wood to offer the ARK Venture fund. Forward-looking investors might consider this new offer that provides large and small, non-accredited investors access to disruptive innovations in the public and private markets.

Titan offers hedge fund, crypo, venture capital, private credit, automated stock and bond portfolios, and cash investments:

- Titan Flagship Fund – U. S. large cap fund

- Titan Opportunities Fund – Small- and mid-cap fund

- Titan Offshore Fund – International fund

- Titan Crypto – Actively managed portfolio of cryptocurrency assets

- ARK Venture Fund – Venture capital fund investing in innovative technologies

- Carlyle Tactical Private Credit Fund – Private fixed income and credit instruments.

- Apollo Diversified Real Estate Fund – Private real estate securities.

- Automated Stocks and Bonds

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Titan Invest Review

-

Fees

(3)

-

Investment Choices

(4.5)

-

Ease of Use

(5)

-

Tool & Resources

(4)

Summary

Best for:

Investors seeking to beat the market.

Small investors seeking hedge-fund, private equity, credit and real estate strategies.

Pros

- Transparent hedge fund investment approach

- Low minimum

- Opportunity to beat the market

Cons

- High-ish management fees

- Unproven over the long term

What’s Hedge Fund Investing?

A hedge fund employs a variety of investment strategies with the goal of earning alpha, or above market investment returns. Frequently hedge funds use leverage and derivatives. Hedge funds are predominantly available to accredited investors (those who have a high net worth and or income).

Titan Invest is breaking down the hedge fund style investing wall, providing access to any investor with $500.

Who is Titan Invest Best For?

Titan Invest might be a good fit for the investor seeking a wide range of managed investment choices. The hedge fund and alternative portfolios are suitable for moderately aggressive to aggressive leaning investors. If you strive to beat the market over the long term then Titan might be worth a look. Titan’s main objective is to deliver outstanding long-term investment returns (net of fees) in excess of the stock market averages.

Titan is built for the investor interested in actively managed investing strategies.

Titan investing might be for you if you want to combine a passive investment portfolio and want to dip your toes into active investing. Titan could be a way to try out hedge fund and alternative investing strategies.

Titan Crypto is ideal for investors who want a managed crypto fund with a $500 minimum investment amount and low management fees.

How Titan Works? Titan’s Investment Strategy

This Titan Invest Review (also referred to as Titanvest Review) will cover the hedge fund strategy employed with the Flagship, Opportunities and Offshore funds as well as provide an understanding of the crypto, ARK Venture, private credit, and real estate fund offers. Titan also offers passively managed US and international stock market index funds and bond funds without any portfolio management fees.

Titan offers four stock, a crypto, venture capital, private credit and private real estate investment strategies:

- Titan Flagship – Large-cap, US focused stocks with an average market cap of $500 billion. Seeks companies that can beat the returns of the S&P 500.

- Titan Opportunities – Small/mid-cap US focused stocks with an average market cap of $10 billion. Seeks small companies with the potential to grow at exceptional rates.

- Titan Offshore – International growth companies from emerging and developed markets.

- Titan Market Index (IVV) – S&P 500 passively managed index fund.

- Titan Crypto – Five to ten crypto coins designed for long term returns with lower correlations to the stock market.

- ARK Venture Fund – Access to venture capital, early stage private companies in innovative industries.

- Carlyle Tactical Private Credit Fund – Income stream from a range of global credit instruments.

- Apollo Diversified Real Estate Fund – Invests in large private real estate funds and public real estate securities.

The fee free automated stock and bond investing is most similar to a traditional robo-advisor.

Titan Hedge Fund Strategy

The Titan investment strategy invests each investor’s money in two ways. The first is the core stock investment portfolio.

The second is a hedge security which aims to protect against large losses in your Titan portfolio during market downturns. The Titan hedge is discussed below.

Titan Review of Stock Selections – How Titan Identifies Portfolio Holdings

SEC rules require large hedge fund managers to report their holdings quarterly. While these filings often can offer great insights, for many reasons they can also be misleading and filled with pitfalls for casual readers. Titan’s proprietary algorithm analyzes investment activity across thousands of hedge fund filings, ultimately only filtering insights from about ~5% of the total pool.

The Titan hedge fund investment algorithm filters through these filings by examining a host of factors ranging from turnover (how long a hedge fund owns a stock, on average) to concentration (how many stocks a hedge fund owns, on average). The goal is to invest in only those stocks with the greatest growth potential.

Titan Stocks – Part 1 of Titan Hedge Fund Strategy

After this extensive filtering process, the algorithm returns from 15 to 25 stocks to invest in for each of the funds.

These stocks are updated and rebalanced once a quarter, with about one or two changes being made on average each quarter.

Titan selects sound firms with strong cash flow, high return on capital, wide moats, sound management team and growth potential.

Titan’s goal is to invest in businesses with the highest chance of delivering strong long-term returns.

Personalized Titan Hedge Investment – Part 2 of the Titan Hedge Fund Strategy

Titan Invest hedges part of your investment according to your individual risk tolerance. Your risk tolerance is determined by a number of factors, including your investing time horizon, investing experience, net worth, income and more.

Generally, more aggressive investors tend to be comfortable with greater market volatility in order to achieve higher long-term returns, while more conservative investors prefer smaller ups and downs in their investment values (even if it means lower long-term returns).

Each Titan investor will have a unique percentage of their portfolio invested in its core stocks. The remainder of your investment will be in the personalized hedge.

The Titan hedge works by investing in an inverse S&P 500 ETF. Here’s how the dynamic inverse S&P 500 ETF works:

- Part of your money is invested in an exchange traded fund or ETF that effectively “sells short” the S&P 500.

- The hedge aims to rise in value when the market drops in value.

Should the S&P 500 stock market index continue to grow, the hedging strategy would likely incur losses and temper the portfolio gains from the stock portion of the portfolio. However, if the stock market took a major dive, the hedging strategy would more likely yield investment gains, tempering losses from the stock portion of the portfolio.

It’s a way to achieve diversification without owning bonds or other non-stock investments.

We think this is an interesting strategy, with potential to beat the market in the long run. The Titan Invest Flagship performance has suffered during the market downturn of 2022 as of June, despite trouncing the S&P 500 between February, 2018 and June, 2021.

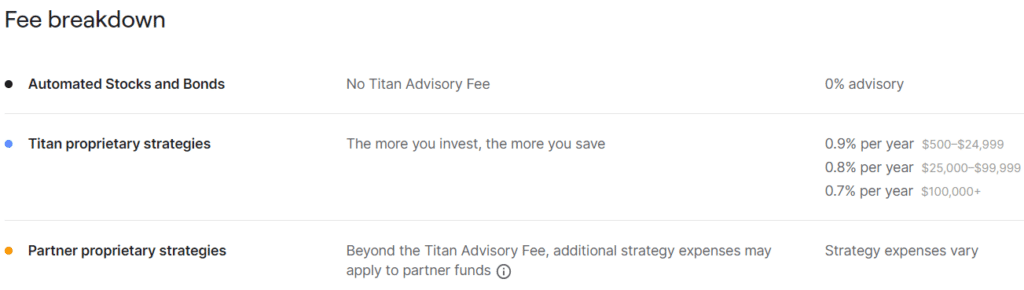

Titan Invest Fees and Minimums

The Titan Advisor Fees are based upon the amount of assets managed.

- 0.90% AUM: $500 – $24,999

- 0.80% AUM: $25,000 – $999,999

- 0.70% AUM: $100,000+

The investment minimum for most strategies is $500.

Some strategies may have higher minimums and fees.

Titan Crypto

The Titan Crypto fund is an actively managed group of cryptocurrency assets. The Titan team researches the crypto market to choose the highest quality digital coins that are expected to outperform during the upcoming 3 to 5 years. The team avoids riskier assets and choose the weights within the portfolio based upon utility, adoption and pricing.

The portfolio is rebalanced to maximize returns while minimizing risks.

Titan Crypto Fees

The fees are straightforward and the minimum is $500.

Crypto includes the Titan Advisor Fee

- $500 – $24,999: 0.90% AUM

- $100,000+: 0.70%

- $25,000 – $999,999: 0.80% AUM

The Titan crypto custodian levies an additional .15% fee per trade.

Titan Cost Summary

Titan ARK Venture Fund

The ARK Venture Fund, only available on Titan is committed to giving all investors access to innovative public and private companies, as they grow. The current holdings include Epic Games, Chipper Cash, Mosaic ML, Flexport and Freenome. These firms represent the gaming, financial services, machine learning, supply chain and biotech industries.

You are eligible for withdrawals from the fund, quarterly.

ARK Venture Fund Fees and Minimum

- Minimum investment: $500

- Manager fee: 2.75% (other distribution fees may also apply)

The ARK Venture Fund does not charge the Titan Advisory Fee.

Apollo Diversified Real Estate Fund

Unlike publicly traded real estate investment trusts or REITs, this fund gives smaller investors the opportunity to invest in established private real estate funds along with public real estate securities. This offer is crafted to offer both income and capital appreciation, with moderate volatility and lower correlation to the broad investment markets.

Fees and minimums are listed on the prospectus, accessible through the Titan website.

Carlyle Tactical Private Credit Fund

Another choice for income, the Carlyle Tactical Private Credit Fund or CTAC invests in global credit. The experienced fund managers choose a range of types of credit with diverse credit ratings. There are 459 debt instruments in the fund, so the risk is well diversified. Withdrawals are available quarterly. Users will pay the 1.0% Titan management fee, or $5 per month for accounts smaller than $10,000, in addition to the following fund charges.

Carlyle Credit Fund Fees and Minimums

- Minimum – $2,000

- Management Fee – 1.00%

- Performance Fee (once hurdle rate is achieved) – 15.0%

Titan Cash

A high yield cash account is becoming commonplace among many robo-advisors, like Betterment, Wealthfront and M1 Finance. The Titan Cash offer is unique in that it doesn’t require you to open a new “cash account.”

- Can clients open a “cash” account and receive interest payments if they have $1,000 invested in a strategy fund?

- Yes, clients are eligible for the interest payment on cash if they have $1000 invested in strategies. The cash balance sits within a client’s brokerage account, so clients don’t need to open up a separate cash account.

- – Is the “cash” account a separate account?

- No, the cash balance is part of the brokerage account

- – Where is the cash housed?

- Same as above

Here’s how Titan Cash works:

- Clients with at least $1,000 in any Titan Strategy fund are eligible for the Titan Cash high yield and don’t need to open a separate account.

- The cash balance is maintained within the existing brokerage account.

- The prevailing high interest rate listed below will be paid on the first $10,000 in cash and any cash above $10,000 will receive the prevailing market yield.

Titan Returns

While investors love to read about robo-advisor returns and performance, we advise against making investment decisions based upon past performance.

The Titan Invest Portfolios are relatively young, and the oldest Flagship fund is barely four and a half years old.

Titan Flagship portfolio launched roughly four and a half years ago, a short time during which to evaluate performance. While the Opportunities Fund commenced in the summer of 2020 and Titan Offshore began in 2021.

Some of the stock funds have performed better than a typical U.S. stock fund, while others have lagged.

You can find the updated returns on the Titan website.

Performance data must be viewed with caution as the past does not determine tomorrows returns. Short term returns don’t predict long term returns.

Accounts

The Titan app is available to U.S. citizens, green card holders, and holders of certain visas.

Account types include individual investment taxable accounts, Roth, Traditional and Rollover IRAs.

Titan IRA

Due to their long-term nature, Titan believes that their investment strategy is ideal for IRA retirement accounts.

“Titan’s flagship investment strategy invests your money in what we like to call “long-term compounders” – businesses whose characteristics make them ideal for a long-term portfolio.” ~Titanvest website

The companies in the Titan IRA are typically high-quality firms with high return on capital and excellent growth prospects.

Titan offers both traditional and Roth IRA accounts.

Titan Invest Promotion

Titan’s Referral program allows you to invite others to sign up for a Titan account, through the mobile or web apps. When the person that you invited funds the account with at least $100 and maintains the account for at least 180 days, you’ll receive a reward of one Titan Portfolio, worth at least $25 and up to a $10,000 value. Each person that you refer also receives a 100 day fee-free trial to Titan. Click here for additional disclosures.

Is Titan Invest Safe?

Titan Invest is a registered investment advisor and bound by the legal requirements of the Securities and Exchange Commission (SEC). All accounts are SIPC-insured up to $500,000.

The accounts are held and cleared through Apex Clearing, one of the leading financial technology custodians.

The custodian for Titan Crypto is Apex Crypto.

The Titan Invest app protects all your personal data and financial information with SSL and 256-bit encryption.

Note that investments in stocks are subject to principal risk (you may lose part of your investment if you sell after a stock’s value declines).

Read on to find out how the robo-investing app has performed so far.

Titan Invest AUM

As of September 27, 2022 Titan boasts $792.1+ million assets under management (AUM) and 43,800 accounts. Titan’s AUM is published quarterly in the SEC mandated ADV*** form.

For comparison, check out our Robo-Advisors With the Most Assets Under Management.

Mobile App

The Titan iOS and Android apps are geared for simplicity. They are available in the Google Play and iTunes stores. The sign-up process is quick and within a few minutes you’re invested in a basket of high-quality stocks.

Although Titan replicates hedge fund investments, the investment strategies do not not seem overly speculative or aggressive for an actively managed portfolio. You’ll be investing in many high-quality companies.

Transparency

Titan Invest strives for transparency which is why they have beefed up their performance and reporting data:

Titan provides comparisons of their returns against popular investment benchmarks. Titan also discloses their investment portfolio!

Titan Invest Pros and Cons

Pros

- Invests in high-quality stocks for long-term wealth building.

- No lock ups, you can access your money within 2 to 4 business days for Titan funds and quarterly for other strategies.

- Titan Invests investment strategies with the potential to beat the market over the long run.

- Offers a unique mix of private investments typically unavailable to small investors.

- Direct access to their Investment team and customer support team is available through email, live chat, and phone.

- Syncs with Mint, Empower (formerly Personal Capital), and TurboTax.

Cons

- The major disadvantage of Titan is the fee structure, which is higher than most robo-advisors. Most robo-advisor platforms, even those that are actively managed, charge less than 0.9%. There are even lower-priced platforms that provide investment management and financial advisors such as SoFi Invest and Ellevest.

- Titan is a new investment app and has a short evaluation window. In the short term, it’s difficult to judge an investment strategy’s success.

- Does not offer tax-loss harvesting, live advisors, financial planning or other features available at competitors. Other robo-advisors with tax-loss harvesting are available.

- Some Titan strategies require longer lock up periods with less liquidity and higher fees.

Comparison

The Titan Invest platform is unique, so all comparisons should be viewed through that lens.

When compared with a typical hedge fund, Titan Invest is more affordable and transparent. The small investor can invest with Titan, and there’s one management fee, not performance fees like at the typical traditional investment manager. Finally, your money is liquid and can be withdrawn from the Titan Invest app, at any time.

Comparing Titan Invest with other robo-advisors is a challenge.

The first hedge fund robo-advisor, Hedgeable, closed its doors to retail investors. Thus, for investors seeking an active hedge fund robo-advisor with no minimum investment amount, Titan doesn’t have many competitors.

Most robo-advisors follow a passive, index fund-based investment strategy. While Titan created the automated stock and bond investing, their other strategies can’t accurately be compared with most passively managed robo-advisor portfolios. We aren’t aware of any robo-advisors that have Titan’s original investing approach.

It’d be appropriate to compare Titan against other actively managed robo-advisors, but not many exist. And, each actively managed robo-advisor offers their own strategy, highlighting the difficulty of comparison.

M1 Finance comes close as a “DIY” investing / trading platform. It has a hedge fund-type portfolio investment option, although it simply copies hedge fund filings verbatim instead of cleansing the filings according to specific long-term focused factors like Titan does. The basic M1 Finance investment option is free.

Empower (formerly Personal Capital) uses several active strategies, and also offers financial advisors for an 0.89% AUM fee.

There are several other actively managed robo-advisors including T.Rowe Price ActivePlus Portfolios and Merrill Edge Guided Investing.

The addition of the venture, private credit and real estate moves the Titan comparison group to also include various crowdfunding apps. So, Titan is actually in a class by itself. For the riskier portion of your portfolio, Titan investing packs a lot of investment options into one app.

Conservative investors might prefer to supplement the Titan Invest account with bond or cash-type fixed income exchange traded funds, target date funds, or another robo-advisor.

FAQ

Is Titan Invest a Hedge Fund?

Yet, you might think of Titan as a hedge fund because it does effectively “short” the stock market index to dynamically hedge your stock market exposure. Also, Titan replicates the stock selections of successful hedge funds.

Is Titan Investing Legit?

How do you withdraw money from Titan?

What is the Titan App?

Titan Invest Review Wrap Up – Is it Worth it?

Titan Invest’s mission is two-fold:

- Grow your capital at a high rate of return over the long term.

- Empower you to become a better investor.

It’s too soon to evaluate whether Titan has achieved its long-term objectives.

What we like is that the investment approach is sound and easy to understand. Choosing top stocks based on what the world’s best investors own, filtered by profit- and quality-focused metrics, seems like a reasoned investment approach. Hedging the portfolio with a “short” fund may also make sense for the more conservative investor.

How the approach plays out over the long term remains to be seen.

The beginning 0.90% management fee is high when compared with other robo-advisors. Yet Titan aims to outperform other robo-advisors net of its fee.

The $500 minimum investment amount makes titan off-limits for the newest and smallest investors. We think that’s wise, as Titan offers riskier investment strategies than many competitor robo advisors.

The new additions of venture capital, private real estate and credit provide greater access to the private investment markets for small players.

All in all, we like Titan as a supplement to your other investments. For investors seeking the opportunity to beat the market, this is a viable option. For a more balanced and diversified portfolio we recommend adding the free automated stock and bond investments at Titan to the active hedge fund and alternative strategies.

To learn more, visit the website.

As a reminder, all investments in the financial markets are subject to risk as investment values go up and down.

Related

Active Management Robo Advisors

Best Cryptocurrency Robo Advisors

Merrill Edge Guided Investing Review

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

This is a sponsored post with Titan Invest (“Titan”). All opinions are our own. This is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services. Titan uses a proprietary algorithmic strategy in selecting recommendations to advisory clients. Please see Titan’s website (https://www.titanvest.com/) and the Program Brochure (available on the website) for more information. Certain investments are not suitable for all investors. Before investing, consider your investment objectives and Titan’s fees. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested. Titan’s registration as an SEC registered investment adviser does not imply a certain level of skill or training and no inference to the contrary should be made. Nothing here should be considered as an offer, solicitation of an offer, or advice to buy or sell securities. The above content is for illustrative purposes only to demonstrate products, services and information available from Titan. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections, are hypothetical in nature and may not reflect actual future performance. Performance results are net of fees and include dividends and other adjustments. 2020 YTD results are from 1/1/20 through 1/17/20. 2018 results are from Titan’s launch date of 2/20/18 through 12/31/18. All-Time IRR is from Titan’s launch date of 2/20/18 through 1/17/20. All-Time IRR is the actual internal rate of return. All performance figures represent performance of a hypothetical account created on Titan’s inception date of 2/20/18 using Titan’s investment process for an aggressive portfolio, not an actual account. All Titan performance results include the use of a personalized hedge for a hypothetical client with an “Aggressive” risk profile; clients with “Moderate” or “Conservative” risk profiles would have experienced lower returns. Please visit https://support.titanvest.com/

By signing up for Titan from this page, you acknowledge your receipt of the Wrap Fee Brochure and Solicitor Partner Compensation Disclosure. In addition, you understand the new account opening requirements. Solicitors may receive compensation for funded account openings on the Titan app that occur through this referral landing page.

***https://cdn.titanvest.com/disclosures/TitanInvest_FormADV_Part1_Wrap_Brochure.pdf