Where do you turn when you’re looking for a robo-advisor with medium to low account management fees and a low investment minimum? The good news—and the bad news—is that there are a lot of robo-advisors with low fees and minimums.

We’re here to help you make sense of your options. Today we’re putting Wealthfront and Fidelity Go head to head so that you can determine which robo-advisor meets your financial needs.

Wealthfront vs. Fidelity Go – Overview

Wealthfront is one of the premier robo-advisors and offers clients quite a few investment options. In addition to the traditional retirement accounts, Wealthfront clients can also invest in 529 college savings accounts and high yield cash accounts.

Beyond offering varied account types, Wealthfront takes great care to understand their investors. The Wealthfront sign-up process is among the most comprehensive. The Path digital financial advisor within the Wealthfront platform is designed to mirror a human financial advisor’s questions. Your risk tolerance, goals, and financial situation are accounted for before your portfolio is created.

We also like Wealthfront’s high yield cash account with debit card and free ATM withdrawals. And not resting on it’s laurels, Wealthfront just launched access to two cryptocurrency funds and hundreds of ETFs that clients can add to their portfolios.

Wealthfront also offers a Risk Parity fund and the opportunity to add custom ETFs and crypto funds to a portfolio.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Fidelity Go offers free investment management for accounts worth less than $25,000, which is great for those just getting started. For larger investors, with more than $25,000 all investors have access to a financial coach or financial advisor to handle money and investing questions. Investors seeking a robo-advisor attached to a major investment broker, might consider Fidelity Go.

Wealthfront vs. Fidelity Go Comparison – Top Features

Wealthfront top features:

- Daily tax-loss harvesting

- Customize you investments -or create new – with 100’s of diversified ETFs

- Cryptocurrency funds available

- Path financial planner – a comprehensive digital financial advisor

- 529 college savings accounts

- Direct indexing for larger accounts

- High yield cash management account

- Borrow against your investments

Fidelity Go top features:

- Predictions for likelihood of achieving target goals

- Automated suggestions for reaching financial goals

- Short-term investments available

- Only $10 required to start investing

- Offers fee-free index mutual funds

Read: Fidelity Go Review

Wealthfront vs. Fidelity Go – Who Benefits?

Fidelity Go

Fidelity Go is best for new and smaller investors with the low minimum investment.

Investors who want their robo-advisor to be connected to a larger family of investment services would benefit from working with Fidelity Go.

If you want your robo to include fee-free passively managed index funds, then Fidelity Go is the best option. Although, Wealthfront offers greater diversification within their investment portfolios.

Fidelity Go is part of a full service financial management company which offers services such as life insurance, wealth management, and retirement services.

Fidelity Go would also benefit investors who like more frequent check-ins. On their website, Fidelity Go states that investors can expect summary emails and check-ins to ensure they are investing with your most up-to-date information possible.

Bonus: Personal Capital vs. Mint vs. Quicken Review – Which Financial App is Best for You

Wealthfront

Wealthfront is best for new to experienced investors seeking smart digital investment management with a variety of strategies and diverse investments.

Investors seeking tax-loss harvesting will benefit from Wealthfront. Additionally, Wealthfront offers daily tax-loss harvesting for investors.

Wealthfront also offers a greater, more diverse selection of investments and strategies.

Recently added to the platform are additional ETFs so that you can customize your investment portfolio. Or you can create your own investment portfolio, from the available ETFs, and Wealthfront will manage it. The hundreds of ETFs span a range of categories, sectors, and countries including bitcoin and ethereum.

Wealthfront’s .25% investment management fee is also lower than Fidelity Go’s management fee for larger accounts. Although Fidelity does offer free investment management for accounts valued under $10,000. This contrasts with Wealthfront’s free investment management for accounts valued at $5,000 or less.

Wealthfront’s high yield cash account is enticing for investors seeking higher yields for short term cash.

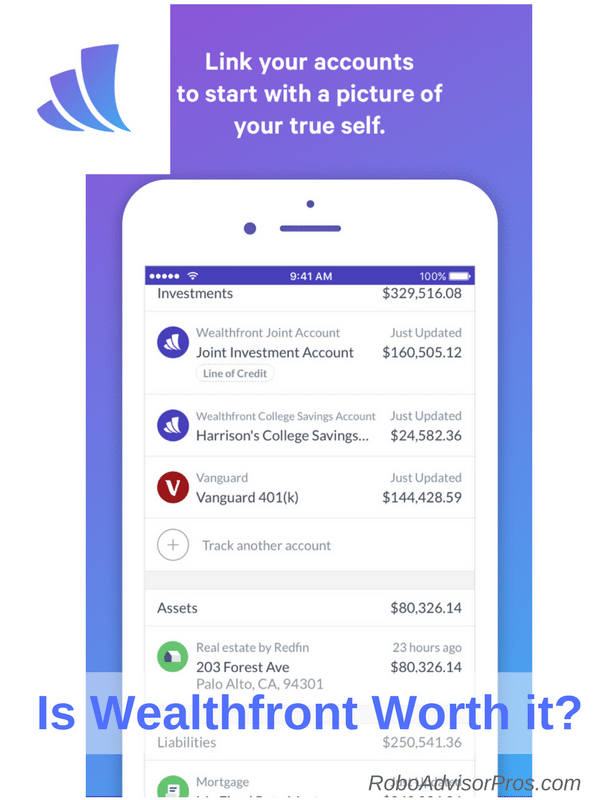

Wealthfront also offers a free portfolio review, which incorporates all of your investment accounts – not just those at Wealthfront.

Wealthfront vs. Fidelity—Fees and Minimums

Minimums Winner: Fidelity Go doesn’t have a minimum. Although you’ll need $10 to get started investing.

Fees Winner: Fidelity wins for this one. Small investors get fee-free investment management, and larger investors get human advisors, for a reasonable 0.35% AUM. Although Wealthfront offers the first $5,000 managed for FREE.

Wealthfront

Wealthfront requires a minimum initial investment of $500—a relatively low minimum.

While no-minimum investment robo-advisors do exist, in the grand scheme of things a $500 minimum investment amount is affordable.

Wealthfront is also middle of the road in terms of their management fees: .25% AUM. This fee puts them in line with other heavy hitters like Betterment and SigFig.

Fidelity Go

On the other hand, investors who don’t have $500 handy or want to test the robo-advisor market with a smaller initial investment will love Fidelity Go. You can get started with no minimum investment, and just $10 to invest, with this robo-advisor!

Fidelity Go’s fee structure is great for small investors with up to $25,000-free investment management.

For investors with a $25,000+ portfolio, the 0.35% AUM fee, which includes financial advisor access, is reasonable.

Wealthfront vs. Fidelity Go – Deep Dive

Wealthfront and Fidelity Go are relatively affordable, with low (or no!) minimum investment requirements and fees well below those charged by traditional financial planners. So what really sets the two apart?

Wealthfront vs. Fidelity—Performance Awards

Performance changes daily, and will ultimately reflect the investors asset allocation. You can visit the individual investment managers website’s and search around for recent performance data, or call customer service. As of June 30, 2022, the recent three-year annualized returns for Wealthfront and Fidelity Go was in the mid-four percent range.

In short, robo-advisor performance can fluctuate just as much as any other investment option out there. However, the fact that both robo-advisors have been ranked as strong performers for multiple years shows they’re doing something right.

Wealthfront vs. Fidelity—Retirement Planning

Winner: It’s a tie.

In 2017, Wealthfront rolled out the Path Financial Planner, an in-depth retirement planning tool. This tool links your existing accounts to determine your current financial situation. It then looks at your goals, your financial choices, and factors outside of your control (like inflation and social security) and determines whether you are on the path to success.

If that isn’t enough, Path also helps investors allocate their savings across all platforms. This includes accounts held outside of Wealthfront.

Like many other robo-advisors, Fidelity Go manages and monitors your portfolio to ensure that your allocations and risk stay in line with your goals; however, they don’t have the sort of comprehensive retirement tool that Wealthfront does.

For larger accounts, Fidelity’s financial coaches can assist with retirement planning.

Wealthfront vs. Fidelity—Tax Loss Harvesting

Winner: Wealthfront

Many robo-advisors offer tax-loss harvesting, though not all. Fidelity Go is in the latter category.

The Fidelity Go robo-advisor does not offer it.

This leaves Wealthfront as the clear victor in this category—if tax-loss harvesting is something you are interested in! Just remenber, that tax-loss harvesting only matters for taxable accounts, since IRA and other retirement accounts are not taxed while the investments are owned within the account. And, Roth IRA distributions aren’t taxed either if they meet certain conditions.

Wealthfront believes that their daily tax-loss harvesting is more beneficial than the TLH offered less-frequently by competitors.

Wealthfront vs. Fidelity – Investments

Winner: Wealthfront wins with greater diversification along with, smart beta and risk parity funds.

Fidelity Go Investments

Fidelity Go offers fee-free Fidelity Flex mutual funds. Like most robo-advisors, after a completing a quick questionnaire, you’ll receive a sample investment portfolio with stock and bond funds in a mix that fits with your risk level and time horizon.

“In selecting mutual funds for Fidelity Go® accounts, Strategic Advisers LLC may look at multiple factors, including but not limited to investment philosophy (whether the funds are actively or passively managed), risk and return characteristics (how closely the security tracks an underlying index), assets under management, and tax efficiency. The Fidelity Flex® mutual Funds or number of Flex Funds in which your account invests may change over time depending on the investment strategy you select.”

~Fidelity Go Website

The portfolios range from conservative to aggressive.

Following are sample Fidelity Flex Funds, which do not have fund management fees:

| Sector | Fidelity Investment Fund | Ticker Symbol |

|---|---|---|

| U.S. Large-Cap Stocks | Fidelity Flex 500 Index | FDFIX |

| U.S. Mid-Cap Stocks | Fidelity Flex Mid-Cap Index Fund | FLAPX |

| U.S. Small-Cap Stocks | Fidelity Flex Small-Cap Index Fund | FLXSX |

| Foreign Stocks | Fidelity Flex International Index Fund | FITFX |

| Municipal Bonds | Fidelity Flex Municipal Income Fund | FUENX |

| Short-Term Municipal Bonds | Fidelity Flex Cons. Income Municipal Bond Fund | FUEMX |

| Short-Term Cash | Fidelity Government Cash Reserves | FDRXX |

If you’d like part of your investments managed by the Fidelity Go robo-advisor and another portion managed with a financial advisor, you might consider Fidelity’s Portfolio Advisory Services for those with greater than $50,000.

Fidelity does not disclose the full number of funds available through the robo-advisor before signing up.

Wealthfront

Wealthfront offers a variety of stock and bond exchange traded funds (ETFs).

Wealthfront stock funds cover the U.S. and international markets including both developed and emerging markets as well as a dividend appreciation ETF. The bond ETFs span government, treasury inflation protected bonds, U.S. corporate bonds, a foreign emerging markets bond fund and municipal bonds for those with a taxable account in a high tax bracket.

The final two sector funds cover the U.S. real estate sector and Energy Select Sector SPDR ETF (XLE), an energy or natural resources fund.

For accounts valued at more than $100,000 Wealthfront replaces the domestic ETF with individual stocks, reducing fund expense ratios.

Wealthfront investment funds included in the automated portfolio:

| Investment Fund Category | Index Fund Ticker Symbol |

|---|---|

| US Total Stock Market | VTI and SCHB |

| Foreign Stock - Developed Market | VEA and SCHF |

| Foreign Stock - Emerging Market | VWO and IEMG |

| Dividend Appreciation Stock | VIG and SCHD |

| US Treasury Inflation Protected Bond (TIPs) | SCHP and VTIP |

| US Government Bond | BND and BIV |

| Municipal Bond | VTEB and TFI |

| US Corporate Bond | LQD |

| Foreign-Emerging Market Bond | EMB |

| Real Estate | VNQ and SCHH |

| Natural Resources (Energy) | XLE and VDE |

There are hundreds of additional ETFs that span any category you might desire. The Greyscale bitcoin and ethereum funds are unique among robo advisor competitors.

Additionally, Wealthfront offers a RIsk Parity Fund that attempts to minimize downside risk.

Wealthfront also offers a Smart Beta fund that attempts to outperform the market.

Wealthfront manages and rebalance all investments, whether they are in the automatically created portfolio or within your customized funds.

FAQ

Is Fidelity Go worth it?

Is Wealthfront Safe?

Wealthfront vs. Fidelity Go – The Takeaway

Since Wealthfront’s business is rooted in robo investing, it does it very well. We are very happy with the opportunity to add ETFs and cryptocurrency funds to an existing portfolio. Add on cash management, tax-loss harvesting, borrowing options and one of the best digital only Financial Planning questionnaires, overall, we prefer Wealthfront.

Although, Wealthfront has a higher initial investment requirement, which can put it out of reach of some beginning investors. That being said, at only $500 the Wealthfront minimum investment is still low. Coupled with their .25% AUM fee, Wealthfront is an affordable option.

Wealthfront’s benefits also include more diverse investment options than those at Fidelity. Wealthfront is also a good match for wealthier investors seeking the opportunity for single stock index investing, which reduces overall fees.

If you want a 529 College Planning account, then Wealthfront is for you. Actually, Wealthfront has more types of accounts than Fidelity Go.

Fidelity Go is most appropriate for small, new investors or those seeking the benefits of investing with a large financial firm. Existing customers might appreciate the opportunity to invest with Fidelity Go.

If you’re a small investor, just getting started, or with less than $25,000, you might prefer the free management at Fidelity Go. Also, if you want ready access to financial coaches and can amass more than $25,000, you might lean towards Fidelity Go.

Fidelity Go also has the Fidelity branch network, which might be helpful for in person questions.

It’s a close contest between Wealthfront vs Fidelity Go.

Choose Wealthfront if you are seeking:

- Tax loss harvesting

- Superb digital financial planner – with detailed risk assessment

- More diversified investments including cryptocurrency funds

- Greater types of accounts, including 529 college accounts

- Single stock investing for higher net worth customers

- Lower fees for larger accounts

Choose Fidelity Go if you are:

- An existing small investor with Fidelity

- You’re a new investor, just getting started.

- Want access to all of the services and physical branches that Fidelity offers

- If you’re a larger investor seeking managed accounts and/or the ability to trade, all within one platform

- If you have $25,000 and want access to financial advisors.

Whether you choose Fidelity, Wealthfront or another robo-advisor, the best advice for building wealth is to begin investing today, for the long term!

Get $5,000 managed for free with the sign up below:

Read the Complete Wealthfront Review

Read the Complete Fidelity Go Review

More Robo-Advisor Comparison Articles:

- Betterment vs. TD Ameritrade Essential Portfolios Comparison

- Wealthfront vs Acorns

- Wealthsimple vs. Betterment Comparison

- M1 Finance vs. Robinhood – Which Free Stock Trading App is Best?

- SigFig vs Personal Capital

Visit the Robo-Advisor Selection Wizard, take a quick quiz, and find out which robo-advisor is the right one for you.

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Wealthfront Disclosures:

Robo-Advisor Pros receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. Robo-Advisor Pros is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA / SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront conveys funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Please see the Deposit Account Agreement for details.

Other eligibility requirements for mobile check deposit and to send a check may apply.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $2 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.