The Wealthfront Cash Account is unique. It is a combined high-yield savings and checking account. It’s unusual to find a “banking account” that offers both high interest and bank features like a debit card, direct deposit and zero fees.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Wealthfront is an affordable, user-friendly digital robo advisor with low-fee investment management and unique customization options. This Wealthfront Cash Account review explains all of the features of this high yield savings account with bill-pay, ATM card, FDIC insurance through partner banks and exceptional interest rates.

The Wealthfront Cash Management Account is safe and protects your cash from loss with Wealthfront FDIC insurance through partner banks up $5 million for individual accounts.

Wealthfront Cash Review

Name: Wealthfront Cash

Description: Free high-yield cash management account with no minimum and free ATMs.

-

Fees

(5)

-

Investment Choices

(4.75)

-

Ease of Use

(5)

-

Tool & Resources

(5)

Summary

Best for:

- Current Wealthfront customers

- Anyone seeking a bank account with free ATMs, high yields, and $5 million FDIC insurance through partner banks ($10 million for joint accounts).

Pros

- Great app

- High interest rate on deposits

- Early access to direct deposit funds

Cons

- No physical bank branches

- Checking only available for individual accounts

This Wealthfront high yield savings account review will answer all your questions, like “How does Wealthfront cash work?” and “Is Wealthfront cash account safe?”

How Does Wealthfront Cash Work?

Wealthfront’s Cash Account functions much like other online, high yield savings accounts. All the paperwork to open the account is completed online.

The Wealthfront high yield savings account offers substantially better interest rates than brick and mortar competitors, especially traditional bank savings accounts.

The Wealthfront interest rate will change, as market interest rates adjust. So you’ll benefit from the current rising interest rate environment with higher interest payments.

How to Open a Wealthfront Cash Account

New Wealthfront users can open a Wealthfront Cash Account either online or through the iOS or android mobile app.

Click the Sign up for Wealthfront Cash button below, and then click “Start saving with $1.” Answer a few simple questions about your goals and the type of account you prefer. Select “Open a Cash Account.” Link your bank account and transfer funds.

Once the account is open you can set up regular deposits and direct deposit for your paycheck.

How to Access Wealthfront’s Checking Features

Individual accounts are eligible for checking features.

After funding your account, you’ll receive a prompt to request checking features. Follow the prompts and you’re good to go.

High yield savings accounts are not investment accounts. Here’s how Wealthfront makes money and offers higher than average cash account interest rates. Wealthfront has automated many of their services and has low-overhead costs by operating only online and not with a physical location.

If you choose to link outside accounts as well, the Wealthfront Path, digital financial advisor can provide detailed money, saving, debt, and investing advice to help you prepare for the future.

Top Features

Besides being housed under the umbrella of a reputable robo-advisor, the Wealthfront Cash Account has several great features:

- $1 minimum to open an account. Additionally, Wealthfront has no minimum balance required for accounts to earn interest or to remain open.

- No account management fees. You don’t have to worry about reading any fine print: your account will always remain free.

- FDIC insurance through partner banks for up to $5 million ($10 million for joint accounts).

- Unlimited free transfers.

- High interest rates that change in line with market rates.

- Wealthfront Debit Card – Free ATM withdrawals. Make purchases and withdraw cash.

- Free bill pay. Can auto pay bills like cable, rent, and mortgage. Can pay friends with apps like Cash App, Venmo, and PayPal.

- Direct deposit allows cash access two days early.

- Mobile check deposit.

- Send checks (individual accounts only).

- Free overdraft protection.

- Existing Wealthfront customers with taxable investment accounts can move money between those investments and their Cash Account.

The Wealthfront Cash account is administered in partnership with Green Dot Bank. Your money might be held in one or more partner banks.*

Who Benefits?

Whether you have an investment account with Wealthfront or not, we like the abundant features of this cash account.

The Wealthfront Cash Account is good for people who:

- Need relatively easy access to their money. Clients can easily transfer money between investment and cash accounts. External transfers might take a few days.

- Have short-term plans for their money. Investing in the market remains the best way to grow your money over the long term.

- Want to earn interest on their ready cash.

- Want early access to their paycheck. You get access to your paycheck two days early, with direct deposit.

- Don’t need access to a brick and mortar bank.

- Already invest with Wealthfront.

Fees and Minimums

Wealthfront is a low-fee robo-advisor, so it shouldn’t come as any surprise that their Cash Account is free from account fees.

In fact, Wealthfront offers their Cash Account with no fees and no investment minimums.

Users can get started with as little as $1. There are no minimum balance requirements to earn interest on your account.

Wealthfront Cash Account Review – Deep Dive

Is the Wealthfront Savings Account FDIC Insured?

This is one area where Wealthfront knocks the competition out of the park. Because they’re not a brick and mortar company, Wealthfront deposits your money at four different banks*. Instead of the typical $250,000 FDIC insurance, the Wealthfront FDIC insurance through partner banks, for joint accounts is $10 million for joint accounts and $5 million for individual accounts.

Read: Robo Advisors With High Yield Cash Accounts

There is one catch: if you have other money saved at one of Wealthfront’s four partner banks, you will only have the typical $250,000 FDIC insurance across all accounts held at that institution.

Wealthfront Interest Rate

Like any savings account, Wealthfront’s interest rates are subject to market fluctuations. As market interest rates change, so will the rate on your Wealthfront savings account

You can be confident that as interest rates rise, so will the Wealthfront Savings Rate.

Wealthfront Debit Card

The Wealthfront debit card provides these features:

- Free debit card

- 19,000+ fee free ATMs

- Early access to funds with direct deposit

Wealthfront Cash Account Types

Wealthfront Cash Account users have access to 3 account types:

- Individual

- Joint including joint tenants with rights of survivorship, or JTWROS

- Trust

Only the individual accounts have access to the checking features.

Wealthfront App

The Wealthfront Mobile App is easy to use and highly regarded.

You can pay others through Venmo, Paypal and other platforms with the Wealthfront app.

The app also allows you to seamlessly integrate Apple Pay and Google Pay.

“Easy to use and very clear. I like being able to see my pending interest. Wealthfront as a whole is a much better experience than I’ve had with big banks- they make things easy to understand and are upfront about things like interest rate changes.”

~S.E.P. Google app user

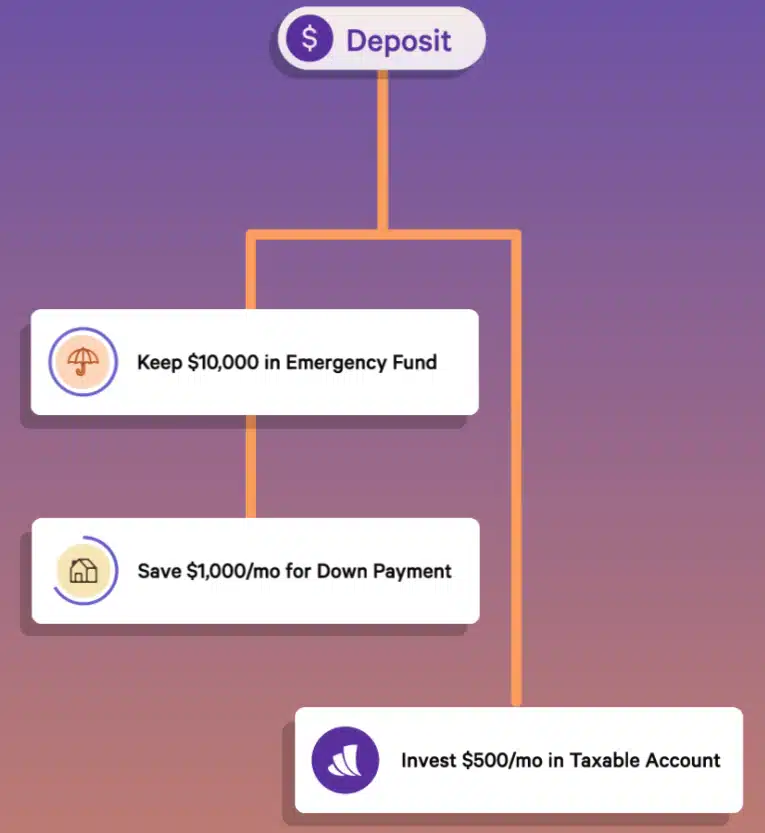

Wealthfront Automated Savings

Wealthfront’s Automated Savings is another way to use your Wealthfront savings account to gain control of your finances and maximize your money. This feature enables you to direct your cash towards various Wealthfront accounts.

Here’s how Automated Savings works:

- Go to the transfer tab on the web or mobile app. Follow the prompts to set up your Automated Savings Plan.

- Select the Wealthfront accounts and designate the target amount of money to be transferred into each account.

- You can fund the automated savings with money from your Wealthfront Cash account or from an external bank account.

- Choose the amount of money that you want to remain in the designated account, and when the balance is above $100, it will automatically transfer to your chosen Wealthfront accounts.

- Turn on your automated savings plan.

This is a great way to make sure that all of your money is working for you.

If you monitor your Wealthfront Cash account and then have it transferred into your Wealthfront investment account you can ensure that all of your money is invested for your future.

Compare Robo-advisor High Yield Cash Accounts

Wealthfront Cash vs Betterment vs Chime

FAQ

Is Wealthfront a Good Company?

Is Wealthfront Cash Account Safe?

Can Wealthfront Be Trusted?

Is Wealthfront a Robo Advisor?

What is a cash account?

What is the difference between Wealthfront savings account and Wealthfront Cash Account?

Can you lose money with Wealthfront?

If you have an investment account with Wealthfront, you can lose money when your investment funds or ETFs decline in value, as has occurred during 2022. This is one of the characteristics of stock and bond funds – and the price you pay for access to higher long term returns. Although, in the long term, Wealthfront returns have been positive.

Wealthfront Cash Account – Pros and Cons

Pros:

- FREE – No fees or hoops to jump through to keep your account free.

- Unlimited ACH transfers and withdrawals. Most bank money market accounts limit monthly transactions.

- FDIC insurance through partner banks goes above and beyond, insuring up to $5 million for individual accounts and $10 million for joint accounts).

- $1 minimum to open an account.

- No minimum balance to earn interest and keep your account open.

- No market risk. Your money is safe from short-term volatility.

- Direct deposit and access to your funds two days early.

- Bill pay.

- Peer-to-peer a transfers.

- Check deposits with mobile phone.

- Free overdraft protection.

- The Wealthfront Interest rate is much higher than typical bank savings accounts.

Cons:

- Only individual (at present) cash accounts are eligible for checking features.

- No option for in-person banking.

- No cash deposits into the account.

Wealthfront Cash Account Review – Wrap up

The Wealthfront cash account checks all the boxes. It is a combined high yield checking and savings account. This high yield cash account is a good, safe way to make sure your liquid assets are accessible while still earning more than the interest paid out by brick and mortar banks.

The Wealthfront Cash account receives high marks for your emergency fund, vacation fund, or cash that you’ll need within the next one to three years. This high yield account are still pays more in interest than most traditional banks, making them a good place to keep your assets.

Wealthfront is also a strong company overall, and clients might appreciate having their savings accounts, loans, and investment accounts all under one roof.

Overall, the Wealthfront Cash Account is comparable to other high yield savings accounts offered by competitors like Betterment and Personal Capital. All three offer higher interest rates than their brick and mortar competitors; they are also free with no minimum balance requirements.

Finally, for wealthier clients, the $5 million FDIC insurance through partner banks is a big draw.

Related:

- Best Robo-advisors With High Yield Cash Accounts

- Wealthfront Review – Is Wealthfront Worth It?

- Wealthfront vs Fidelity Go

- Betterment vs Wealthfront vs M1 Finance

- Ally Invest vs Betterment vs Wealthfront

- Is Wealthfront Safe?

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Wealthfront Disclosures:

Robo-Advisor Pros receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. Robo-Advisor Pros is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA / SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront conveys funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Please see the Deposit Account Agreement for details.

Other eligibility requirements for mobile check deposit and to send a check may apply.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $2 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.

Corporation. ©2021 Green Dot Corporation. All rights reserved.