Should I Open a Retirement Account with M1?

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Retirement planning is crucial today. Even if you already have a 401K(k) account at work you will benefit from creating an M1 Finance Roth IRA retirement account!

M1 Finance, one of the fastest growing robo-advisors today and offers investors three free ways to save for retirement – a Roth IRA, a Traditional IRA and a rollover IRA. Even if retirement is a long way off, starting now makes building your retirement cash easier.

[toc]

The free M1 Finance Roth IRA and the free M1 Traditional IRA are investment solutions for retirement savings and undoubtedly worth exploring.

We love M1 Finance and wouldn’t hesitate to open an IRA there because it offers:

- FREE IRA investing

- over 6,000 investments,

- Free investment management,

- Pre-made investment portfolios

- DIY investing

In this review you’ll get a brief summary of the nature, pros, and cons of the Roth IRA and the Traditional IRA.

Next, you’ll learn how to open an IRA account at M1 Finance.

Then you’ll learn about how to invest the money in your IRA.

Finally, get answers to frequently asked questions about investing with M1 Finance.

This M1 Finance Roth IRA review will help you make up your mind about which IRA is the one for you, how to roll over your account, and whether M1 Finance fits your needs.

What is an IRA?

IRA stands for Individual Retirement Account and it’s a type of account, set up at a financial institution that allows you to invest – tax-free. There are various types of IRAs, and choosing between these can be confusing. This review should help!

Here’s an explanation of each type of IRA.

If you already understand IRA’s, then click here and go directly to the M1 Finance IRA details.

Annual Contribution Limit for Roth and Traditional IRA.

In 2020, the maximum annual IRA contribution is $6,000 or $7,000 if you are over 50 (this is the combined limit for all your IRA accounts).

Roth IRA – Pros and Cons

The Roth IRA is an individual retirement account that allows you to:

- Invest after-tax earned income

- Allow that cash to grow tax-free

- Withdraw the money in retirement tax-free

You are eligible to invest in a Roth IRA if earn less than a specific amount. This limit changes yearly.

Income limit – In 2020, you can invest in a Roth IRA if you’re an individual earning of up to $130,000 and jointly earn up to $206,000.

Roth IRA Pros

- Tax-free growth and withdrawal.

- You can withdraw your contributions, but not investment earnings, any time with no penalty.

- You can continue to contribute to your account after the age of 70 ½.

- You do not have to start withdrawing at age 70, like with a traditional IRA.

- The Roth IRA can be inherited tax-free.

Roth IRA Cons

- There are limits on income eligibility.

- There are limits on contribution amounts.

Finally, it is worth noting that a Roth IRA is like a lovely tax-advantaged wrap around your retirement investments – you choose the investment manager and then invest any way you desire.

Traditional IRA – Pros and Cons

A traditional IRA is an individual retirement account where you:

- Invest pre-tax dollars

- Benefit from tax-free investment growth

- Pay tax when you withdraw the money – in retirement

Income limit – You can contribute to a Traditional IRA if you, or your spouse, earn taxable income and are under the age of 70 ½.

The traditional IRA is undoubtedly appropriate for you if you exceed the annual earning qualifying you for a Roth.

Traditional IRA Pros:

- It is a tax-deferred account – your money isn’t taxed until it’s withdrawn in retirement.

- If you’re not covered by a retirement plan at work, you can deduct your IRA contribution on your income tax return.

- There are no earnings limits for qualifying.

- It can be inherited.

Traditional IRA Cons:

- Age restrictions on withdrawal (must begin withdrawals at age 72).

- Early withdrawal (before age 59 ½) carries a 10% penalty on top of taxes.

- Distributions in retirement are taxed as regular income.

Roth and Traditional IRA Comparison:

| Roth IRA | Traditional IRA | |

| Contribution from… | After-taxed income | After or Pre-tax income |

| Tax-free investment growth | Yes | Yes |

| Tax-free drawdown | Yes | No |

| Compulsory draw down after age 72 | No | Yes |

| Can contribute after 70 ½ | Yes | No |

| Eligibility | Taxable earning below a certain threshold | Taxable earnings. Pre-tax contribution of no work retirement plan. |

| Contribution limit | In between all IRAs – 2020: $6,000 ($7,000 if aged 50 and above) | In between all IRAs – 2020: $6,000 ($7,000 if aged 50 and above) |

| Early withdrawal rules | Can withdraw contribution with no penalty at any time | Penalties for early withdrawal unless you meet an exception |

| Pros | Tax-free growth and withdrawal. You can continue contribute to your account after the age of 70 ½. Penalty-free withdrawals of your own contributions. No RMD | Tax-free growth. There are no earnings limits for qualifying. |

| Cons | Eligibility phased out for higher incomes | Deductions may be phased out Age restrictions on withdrawal (must draw down when 70 ½). Early withdrawal carries a 10% penalty on top of taxes. Distributions in retirement taxed as regular income. |

Next, find learn about M1 Finance’s free IRA investment solutions.

What is M1 Finance?

M1 Finance is one of the most comprehensive and versatile robo-advisor platforms offering access to thousands of investment options for free.

This platform charges no management or trading fees, and you can also rebalance your portfolio without charge. However, what makes M1 Finance stand out in comparison to other similar platforms is that they offer access to thousands of ETFs and individual stocks.

It is straightforward to see what is in your portfolio because your investments are visualized as a pie. You can choose to build your pie from the stocks and ETFs on offer, or you may decide to go with one of the pre-made expert pies.

You can read our comprehensive review of M1 Finance and have a look at the platform’s features on the chart below.

M1 Finance – Features at a Glance

| Overview | Free robo-advisor with opportunity to customize investments. Access to stocks, ETFs crypto and custom portfolios. |

| Minimum Investment Amount | $100 for typical brokerage account. $500 for retirement account. |

| Fee Structure | $0.00 Basic account $125 per year - M1 Plus with added features. |

| Top Features | Choice to use pre-made portfolios or to create your own. M1 Finance manages + rebalances. M1 Borrow + M1 Spend offer lending and banking. |

| Free Services | Account creation, management + rebalancing. Investment trading. |

| Contact & Investing Advice | Email or phone 9-5 M-F CT + on-screen help button. |

| Investments | 6,000+ stocks and/or ETFs traded on the NYSE, NASDAQ + BATS exchanges. Custom ETF portfolio. Digital crypto coins. |

| Accounts Available | Individual and joint taxable accounts; traditional, Roth, SEP and rollover IRAs; corporate, trust, LLC + partnership business accounts. |

| Promotions | Current promo includes limited interest free loan from M1 Borrow |

Fee-Free Roth, Traditional and Roth IRA

Many firms charge a fee to manage your retirement investments, but not M1 Finance. All of your money goes into your account and works for you.

You can save thousands of dollars by investing for free, instead of paying an investment management fee.

Invest $500 per month for starting at age 35 and at age 65 you could have over $600,000 in your account. (assumes a 7% average annual return).

Benefits of Investing in an M1 Finance IRA

Many Investments Available

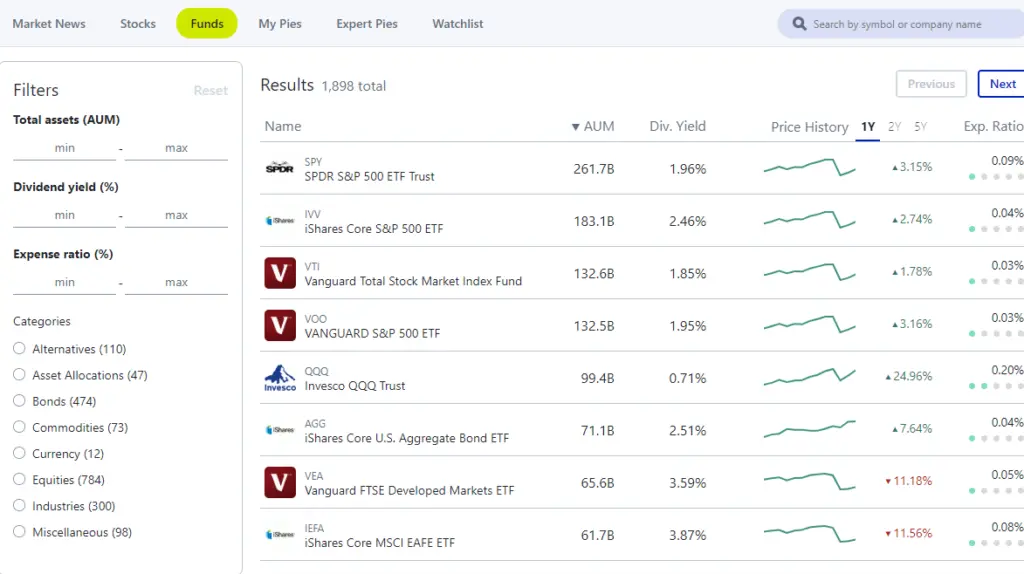

Do you remember that I was telling that M1 Finance offers access to thousands of stocks and ETFs?

This choice presents the opportunity to create a genuinely diverse and versatile portfolio, and you can rebalance for free.

Easy to Use – Concierge Service

Yes, investing with M1 finance, including investing in an IRA is so easy that even an absolute beginner can manage it – you probably will need to select an expert made portfolio if you are a beginner.

M1 offers a concierge to help with IRA rollovers and when setting up your IRA account.

How to Open a Roth IRA or Traditional IRA at M1

To open an M1 retirement account, you need a $500 minimum deposit. Also, M1 Finance offers great customer support to help with the process.

1. Open an account with M1 Finance

Start the onboarding process here. When you sign up, you will be guided through a process to build up your portfolio or pie. You have a choice of self-directed pie or expert pie. If you build your own portfolio (or pie as M1 calls it), you can have up to 100 stocks/ETFs.

In the next section we’ll delve into choosing the investments for your IRA.

2. Click on ‘Retirement Account’ when selecting an account type.

After opening an account with M1 Finance, you will be guided to create your brokerage account, including specifying the account type. Choose retirement account.

Not only can you open a Roth or Traditional IRA, but also a SEP IRA account. In fact you can open multiple accounts at M1 including a taxable brokerage account for investing outside of retirement. (The minimum investment amount for a taxable brokerage account is $100)

The simple onboarding process directs you to answer a few questions regarding name, age, Social Security number and other personal information. This is customary information needed to open any sort of investment account.

3. Link your bank account to your M1 Finance account. Typically, it takes three business days to link your bank account and to fund your M1 Finance account. (You need a $500 initial deposit to open the account.) Just follow the steps on the easy set-up screen, or call customer service for help.

Opening an IRA account with M1 Finance is as easy as 1, 2, 3 indeed.

Which Investments to Choose for Your IRA?

When investing with M1 Finance, you can either choose the self-directed route and create your custom portfolio or select one of seven pre-set portfolios designed by investing experts.

Custom Portfolios (or Pies)

You can set up a custom portfolio, or pie, for your IRA. It means that you select your combination of investments by choosing from thousands of stocks and ETFs.

It is important to remember that you can include up to 100 stocks/ETFs in your pie.

You can set up multiple pies with various investments in each.

M1 Finance will rebalance these investment portfolios back to your preferred allocation!

M1 even has a handy investment screener to help you choose your stocks or funds. Since this is a “retirement portfolio” you may want to tilt your portfolio to faster growing stock-type investments if you’re a long way from retirement. Stocks and stock funds tend to offer greater returns, with an accompanying higher risk.

Pre-made Portfolios (Pies)

M1 Finance also offers the option to invest in pre-made expert portfolios. This is great for new investors or those that want to follow a certain “expert” strategy.

Depending on your investment risk tolerance, you might choose from the “stocks and bonds” pre-made investment pie. These vary from an ultra-conservative pie (90% bonds and 10% stock) to ultra-aggressive pie (92% stock, 7% REIT, and 1% bonds).

Here’s a list of the pre-made pies:

- General Investing – perfect for well-balanced investments that match up with your risk level (like a typical robo-advisor).

- Plan For Retirement

- Responsible Investing (Socially Conscious)

- Income Portfolios

- Hedge Fund Followers

- Industries + Sectors

- Just Stocks and Bonds

- Other Strategies

Decisions regarding selection of investment options are essential. Visit the M1 blog to learn how to invest, choose your risk tolerance and more.

FAQ

Is M1 Finance an IRA?

Does M1 Finance have a Roth IRA?

Does M1 Finance work?

Is a Fee-Free M1 Finance IRA Right for You? Wrap up

M1 has proven itself to be a low-fee leader in financial management. With zero management fee IRA’s and the opportunity to both select your own investments and choose from expert pies, we recommend investing for retirement with M1.

Saving for retirement is one of the most important steps you can take to secure your financial future. The chance of Social Security being cut in the future suggests that the better you prepare for yout own retirement, the easier your future life will be.

The power of compounding shows that investing small amounts of money over the long term and investing wisely can yield great returns.

Investing with M1 for your retirement means that all of your dollars will go into the investments you choose, not into a fund managers pocket!

Related

- M1 Finance Promo Codes

- M1 Finance vs. Betterment

- M1 Finance vs. Vanguard Personal Advisor Services

- M1 Finance vs Robinhood

Disclosure: Barbara A. Friedberg, MBA, has an account with M1 Finance and and Schwab.

Although M1 Finance doesn’t charge management fees, if you invest in ETFS (exchange traded funds), there will be a small management fee levied by the fund.

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable