Betterment vs. Wealthfront vs. Vanguard – Which Robo-Advisor is Best For You?

What is the most important feature to consider when choosing a robo-advisor? For some people, low minimum investments or low fees may be the deciding factor. For others, the option for socially responsible investments can make the decision for them.

Another popular feature for robo-advisors is access to human financial planners. Whether you’re looking for a hands-on, actively managed account or simply the ability to reach out to Certified Financial Planners (CFPs) when you need them, the three robo-advisors we’ll review today – Betterment, Wealthfront, and Vanguard – will have something for you.

[toc]

In this Betterment vs. Wealthfront vs. Vanguard review, you’ll learn the answer to all your questions:

- Which robo-advisor is the most affordable?

- Which robo-advisor is best for beginners?

- Which robo-advisor is best for wealthy investors?

- How do I choose between Betterment vs. Wealthfront vs. Vanguard?

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Features at a Glance

Betterment vs. Wealthfront vs. Vanguard – Overview

What is Betterment?

Betterment is a goals-based robo-advisor that combines digital investment management with human financial planning services, for an additional fee. Though they’re a great option for new investors due to their $0 minimum investment amount – and $10 to begin investing, Betterment also appeals to wealthier investors because of their financial advisor access (for an added fee).

Betterment is one of the pioneering robo-advisors, launched in 2010. The decade-old company has consistently demonstrated its commitment to affordable, quality investment advice since its inception. It is the largest independent robo-advisor in terms of assets under management.

What is Wealthfront?

Wealthfront is an all-digital automated investment management robo-advisor. Wealthfront has leapt to the front of the pack of digital-only robo advisors with new features, in addition to the already robust, Path automated financial planner and well-diversified Core investment portfolios.

Wealthfront’s PATH, online, all-digital financial advisor strives to compete with human planners and can answer up to 10,000 money, investment and financial planning questions.

Wealthfront’s unique features:

- Diversified investments including US and international stock and bond ETFs, and real estate or RETs, and hundreds of ETFs for customization.

- Daily tax-loss harvesting

- Fee free stock and ETF investing

- High interest rate cash account, through partner banks

Like Betterment, Wealthfront is also one of earliest stand alone robo advisors and holds a place in the top robo advisors based upon AUM, The Wealthfront cash account, makes it a more attractive one-stop-shop option for electronic investors.

Wealthfront promotional offer:

What is Vanguard?

Vanguard may be best known as a powerhouse investment company, but it also has two robo-advisor offerings: Vanguard Personal Advisor Services and Vanguard Digital Advisor. These two distinct services give clients the ability to choose their level of human support. Both robo-advisor options come with higher minimum investment requirements than Betterment and Wealthfront, which makes Vanguard a better option for wealthier investors.

Vanguard takes the top spot in terms of robo-advisor AUM. The Vanguard Digital Advisor recently added actively managed funds to their passive index fund offer, for investors striving to beat the market..

Robo-Advisor Selection Wizard – 4 Question Quiz to Help you Choose a Robo-Advisor

Betterment vs. Wealthfront vs. Vanguard – Top Features

Betterment Top Features

- Smart Beta and several Socially Responsible investment strategies

- Individualized, a la carte financial planning packages, for low fees

- Digital and Premium hybrid management options (additional fees for access to Betterment Premium with financial advisors)

- Betterment checking and cash reserve, through partner banks

Wealthfront Top Features

- High yield cash account available

- Customized options for Core Portfolios or create new ones with hundreds of ETFs

- Fee-free stock and ETF trading

- Daily tax-loss harvesting

- Loans available

- 529 Plan account

- PATH all-digital financial planner

Vanguard Top Features

- Video or face-to-face conversations with a dedicated financial advisor with Personal Advisor Services package

- Retirement planning features

- Digital Advisor allows clients to link other accounts from different companies to help with more accurate forecasting

- Actively managed funds available with both Digital Advisor and Personal Advisor Services

- Belongs to the Vanguard family with vast financial services

Betterment vs. Wealthfront vs. Vanguard – Quick Take

Financial Planners

If you want access to human financial planners, you will benefit from Betterment or Vanguard Personal Advisor Services.

- Betterment Premium ($100,000 minimum) offers unlimited financial advisory meetings to all clients for 0.40% AUM fee. Betterment Digital clients can access low-fee Financial Advice Packages.

- Vanguard Personal Advisor (minimum $50,000) offers financial advisor access to all clients for 0.30% AUM.

Investment Minimums for human financial advisor access:

- Betterment Premium – $100,000

- Betterment Digital – No minimum – $10 to begin investing. Can purchase a la carte financial planning packages from $299 to $399.

- Vanguard Personal Advisor Services – $50,000

Winner – for human financial advisor access pick Betterment or Vanguard.

Low Minimum

If you want a robo-advisor with a low initial investment, you will benefit from Betterment Digital and Wealthfront.

- Betterment Digital is one of a few $0 minimum investment robo-advisors – and $10 to begin investing on the market. You’ll need $100,000 to invest in Betterment Premium, but Digital still offers many of the features that make Betterment an attractive option for investors.

- Wealthfront also has a relatively low minimum investment, although low investment minimum robo-advisors on the market that beat its $500 minimum.

Winner – for no investment minimum – $10 to begin investing – pick Betterment.

Investment Variety

Betterment, Wealthfront and Vanguard robo advisors all offer various investment assets and strategies.

If you’re looking for hundreds of ETFs for customization and stock and ETF trading, you’ll need to look toward Wealthfront. Betterment offers digital coin – crypto currency portfolios. While Wealthfront has crypto ETFs available. is the only robo-advisor on this list to offer cryptocurrency portfolios.

Betterment also offers several impact investing portfolios.

All of the Vanguard robo-advisor portfolios have actively managed funds available.

Winner – It’s a tie, depending upon your preferences, Wealthfront, Vanguard or Betterment robos are a sound choice for investment variety.

Wealthier Investors

If you’re a wealthier investor, you’ll discover a lot to like at Vanguard Personal Investors. The $50,000 minimum for their Personal Advisor Services and low 0.30% management fee are difficult to beat. However, they reduce their account management fees as client account values grow. With $5 million AUM, you’re fees will drop to a lower tier. For their wealthiest clients – those with a minimum of $25 million invested – Vanguard charges only 0.05% AUM and provides clients a dedicated financial planner. Overall, Vanguards fees are among the lowest for hybrid robo advisors for wealthy investors.

Wealthfront also offers investors with over $100,000 a single stock diverification plan where individual stocks replace ETFs, thereby reducing fees. Wealthfront also offers a risk parity fund which strives to reduce risk while maintaining returns.

Winner-Vanguard or Betterment with financial advisor access. Vanguard for the lower minimum of $50,000 and lower investment management fees.

One-Stop Investment Portal

If you want a one-stop-shop robo-advisor, you could benefit from all three of these robo-advisors.

- Wealthfront is quickly becoming a solid go-to option. They have individual stock trading, lending, high yield cash and ETFs for customization. These add ons make it easy to keep all your financial products within one company.

- Vanguard is also a great option for investors who want to keep all their finances under one roof. Vanguard is a low-fee investment brokerage firm first!

- Betterment offers checking and high yield cash options, through partner banks, and crypto, in addition to their investment products.

Winner-No clear winner here. Wealthfront, Betterment and Vanguard Advisors each offer comprehensive financial and investment services.

Betterment vs. Wealthfront vs. Vanguard – Deep Dive

Fees and Minimums

Betterment Fees and Minimums

Digital:

- $4.00 per month for accounts worth less than $20,000

- 0.25% AUM for accounts worth more than $20,000 or with $250 per month auto deposit.

Premium: 0.40% AUM

Crypto:

- 1.0% AUM per month – plus trading fees for Digital clients

- 1.15% AUM – plus trading for Premium clients

Financial Advice Packages

Prices range from $299 to $399 per financial advice package

Cash accounts (through partner banks) do not charge management fees.

Betterment doesn’t require a minimum investment amount, although you’ll need $10 to begin investing.

Wealthfront Fees and Minimums

Wealthfront offers fee free high yield cash account, through partner banks. The stock and ETF trading is commission- and management fee-free as well.

The robo requires a $500 minimum investment and charges a flat rate of 0.25% AUM for asset management, regardless of account size.

Free cash promo:

Vanguard Fees and Minimums

Vanguard has two robo-advisor services: Digital Advisor and Personal Advisor Services.

Vanguard Digital Advisor:

- All passive index fund ETF portfolio – 0.20% AUM

- Combination index and active fund portfolio – 0.25% AUM

Investment minimum: $3,000

Vanguard Personal Advisor:

- 0.30% AUM on accounts up to $5 million

- 0.20% AUM on accounts between $5-10 million

- 0.10% AUM on accounts between $10-25 million

- 0.05% AUM on accounts over $25 million

Investment minimum: $50,000

Human Financial Planners

As the name would suggest, Vanguard offers human financial planners with their Personal Advisor Services option. This hybrid robo uses robo-advisor algorithms to help you assemble your portfolio while financial advisors help you to establish and maintain that portfolio. Investors with over $500,000 under management will be assigned a dedicated financial advisor, which those with lower assets will have access to a shared team of advisors.

If access to advice by human financial planners is important to you then choose either Betterment Premium or Vanguard Personal Advisor Services. Wealthfront and Vanguard Digital Advisor are not good options. Digital Advisor is Vanguard’s way of keeping account management costs low by eliminating the human aspect of investing, while Wealthfront has relied on digital investment strategies since the beginning.

Although, Betterment Digital clients have access to low fee financial planning packages for discrete life and money issues such as retirement, planning for college, or a financial check up.

Although Wealthfront doesn’t provide human financial planners, don’t write them off. All of their customer service representatives are licensed stock brokers and have a wide understanding of investment concepts. Additionally, the PATH digital financial planner is programmed to answer more than 10,000 questions and is as close as you can get to an AI powered financial advisor.

Tax-Loss Harvesting

This feature only applies to taxable investment accounts, not retirement accounts.

When your portfolio may be subject to capital gains taxes due to growth, some robo-advisors use tax-loss harvesting to reduce those taxes. Tax-loss harvesting works by selling off investments at a loss to offset investment gains and reduce the income you need to pay taxes on.

All three robo-advisors offer tax-loss harvesting in some form.

Wealthfront stands out in the robo-advising world because they offer daily tax-loss harvesting on accounts. They claim this generates more savings over other robo-advisors who do less frequent checks.

Vanguard offers tax-loss harvesting, on a case-by-case basis. This might be a distinct advantage, since human oversight into the tax-loss harvesting process can help make tax time less of a headache.

Investments

Betterment Stock Investments

| Sector | Ticker |

|---|---|

| U.S. Total Stock Market | VTI, SCHB, ITOT |

| U. S. Large-Cap Value | IVTV. SCHV, IVE |

| U.S. Mid-Cap Value | VOE, IWS, IJJ |

| U. S. Small-Cap Value | VBR, IWN, IJS |

| International -Developed Market | VEA, SCHF, IEFA |

| International - Emerging Market | VWO, IEMG, SCHE |

Betterment Bond Investments

| Sector | Ticker |

|---|---|

| U.S. High Quality Bnds | AGG, BND |

| U.S. Municipal Bonds | MUB, TFI |

| U.S. Inflation-Protected Bonds | VTIP |

| U.S. High-YIeld Corporate Bonds | HYLB, JNK, HYG |

| U.S. Short-Term Treasury Bonds | SHV |

| US Short-Term Investment-Grade Bonds | NEAR |

| International Developed Market Bonds | BNDX |

| International Emerging Market Bonds | EMB, VWOB, PCY |

Betterment also offers crypto portfolios, smart beta, and several ESG investment choices.

Wealthfront Investments

| Investment Fund Category | Index Fund Ticker Symbol |

|---|---|

| US Total Stock Market | VTI and SCHB |

| Foreign Stock - Developed Market | VEA and SCHF |

| Foreign Stock - Emerging Market | VWO and IEMG |

| Dividend Appreciation Stock | VIG and SCHD |

| US Treasury Inflation Protected Bond (TIPs) | SCHP and VTIP |

| US Government Bond | BND and BIV |

| Municipal Bond | VTEB and TFI |

| US Corporate Bond | LQD |

| Foreign-Emerging Market Bond | EMB |

| Real Estate | VNQ and SCHH |

| Natural Resources (Energy) | XLE and VDE |

Wealthfront also offers hundreds of ETFs to add to existing portfolios, or to use to create new ones.

Clients can also trade stocks and ETFs for free at Wealthfront.

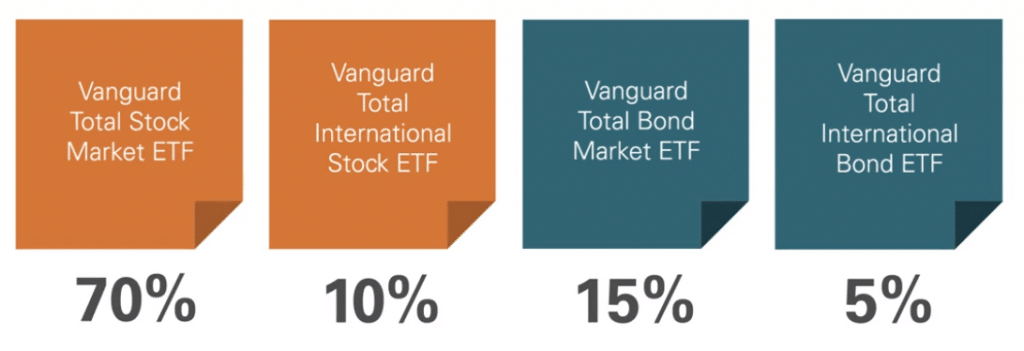

Vanguard Investments

Vanguard Digital Investors can also select combined passive index fund portfolios or one that adds in actively managed Vanguard funds as well.

| Investment Fund Category | Index Fund Ticker Symbol |

|---|---|

| US Total Stock Market | VTIAX |

| Total Bond Market Index Fund | VBTLX |

| Total International Bond Index Fund | VTABX |

| Intermediate-Term Investment Grade Fund | VFIDX |

| Short-term Investment Grade Fund | VFSUX |

| Intermediate-Term Tax-Exempt Fund (taxable accts only) | VWIUX |

Account Types

These three robo-advisors all provide the basic account types, including various IRA, trusts, and taxable accounts. In this case, Wealthfront stands out as being the only robo-advisor of the three to provide 529 College Savings Accounts.

Betterment Account Types

- Individual taxable accounts

- Traditional, Roth, SEP, and rollover IRAs

- Trusts

Wealthfront Account Types

- Personal and joint investment accounts

- Trusts

- Traditional, Roth, SEP, and transfer IRAs

- 401(k) rollovers

- 529 College Savings Accounts

Vanguard Account Types

- Individual and joint investment accounts

- Traditional, Roth, SEP, Simple, and rollover IRAs

- Trusts

FAQ

Which robo-advisor is best for beginners?

Is Betterment better than Vanguard?

Is Betterment better than Wealthfront?

Are Vanguard Personal Advisors worth it?

What are the similarities between Betterment, Wealthfront, and Vanguard?

- Tax-loss Harvesting – Each robo-advisor offers tax-loss harvesting, though they differ on how frequently they do so; Wealthfront relies on daily tax-loss harvesting as part of their strategy, whereas Vanguard does tax-loss harvesting on a case-by-case basis.

- Accounts – All three robo-advisors offer the standard IRAs and taxable account options.

- Fees – Account management fees for Betterment, Wealthfront, and Vanguard are all comparable.

- Investments – Each offers diverse investment options from a healthy mix of stocks and bonds to crypto at Betterment, and individual stocks and ETFs at Wealthfront.

What are the differences between Betterment, Wealthfront, and Vanguard?

- Financial Planners – Only Betterment and Vanguard Personal Advisor services offer access to human financial planners – for added fees.

- 529 Account – Only Wealthfront offers 529 College Savings Accounts.

- Minimum Investment Amount – The minimum balance requirements are divergent, from Betterment’s Digital, with a $10 to begin investing to Vanguard Digitals $3,000 minimum and Vanguard’s $500. For premium with financial advisor access – for additional fees – Vanguard Personal Advisors requires a $50,000 minimum investment and Betterment Premium users need $100,000.

- Fees – Vanguard rewards wealthier with the lowest management fees with 0.30% of AUM up to $5 million and declining to 0.05% AUM for accounts valued over $25 million.

- Investing Style – Wealtlhfront stands out with individual ETFs, stock and ETF trading along with a risk parity strategy. SRI, Smart Beta and crypto portfolios are only available through Betterment. While active investment portfolios are available at Vanguard.

Betterment vs. Wealthfront vs. Vanguard – Which is Best? The Takeaway

All three of these robo-advisors offer sound value for their reasonable account management fees.

Each platform has diverse investment options, multiple account types available, and a history of providing exceptional support in terms of account management.

However, investors should take careful note of the differences between the robo-advisors. The level of support by human financial professions differs and the investment styles and assets are distinct at each. Which robo you choose will depend on your needs as an investor and your values.

Realize that Betterment and Wealthfront are robo-advisors first, with access to banking and lending (Wealthfront) services.

While Vanguard is a full-service financial firm with a robo-advisor.

The best robo-advisor for you is the one that suites your specific needs.

Take a look around each website and decide which one is the best robo-advisor for you.

More Comparison Articles

- Betterment vs. Axos Invest Managed Portfolios

- Betterment vs. Vanguard

- Wealthfront vs. Fidelity Go

- M1 Finance vs. Vanguard Personal Advisor Services

Read the full Wealthfront Review

Read the full Betterment Review

Read the full Vanguard Review

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Wealthfront Disclosures:

Robo-Advisor Pros receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. Robo-Advisor Pros is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA / SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront conveys funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Please see the Deposit Account Agreement for details.

Other eligibility requirements for mobile check deposit and to send a check may apply.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $2 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.