If you're looking for a simple, easy-to-use app to keep your wealth in check, look for none other than Empower.

Although the digital wealth management platform has paid advisory and wealth management services, today I will speak on their free tools, which are available to you even if you don't utilize the wealth management end of Empower.

I'd even go as far as to say it's one of the best suites of tools for tracking your retirement, spending, saving, and investments, even among paid platforms.

This review provides an in-depth understanding of the various free tools, pros and cons, the app's alternatives, and more. It helps you to know if it's the ideal choice for your financial management efforts. Let's dive in.

What is Empower?

Empower is an online wealth management company and a finance app that offers paid and free services. The paid version caters to investment management and advisory services. At the same time, the free one, which we will talk about today, helps track net worth, retirement planning, saving, and so much more.

As of the time of writing, the company controls over $1 trillion worth of assets, serving over 12 million customers.

Empower has three offering categories to its users, including the following:

- Free financial dashboard: This lets you link your financial accounts to manage and track them in one place. This is what we'll speak on today for the most part.

- Cash management account/Empower personal cash: A high-yield account offering up to $2 million in FDIC insurance coverage

- Wealth management services: Tiered services you can access with a $100,000 minimum account balance.

How does Empower Work?

As noted earlier, Empower works through free (the Empower free Financial Dashboard) and paid (Empower Wealth Management) services.

Although the services are related, their functions differ. Fortunately, even if you can't afford the paid option, Empower free tools still helps to track all your financial accounts.

Let's dig into what they're all about.

Empower's Free Financial Tools

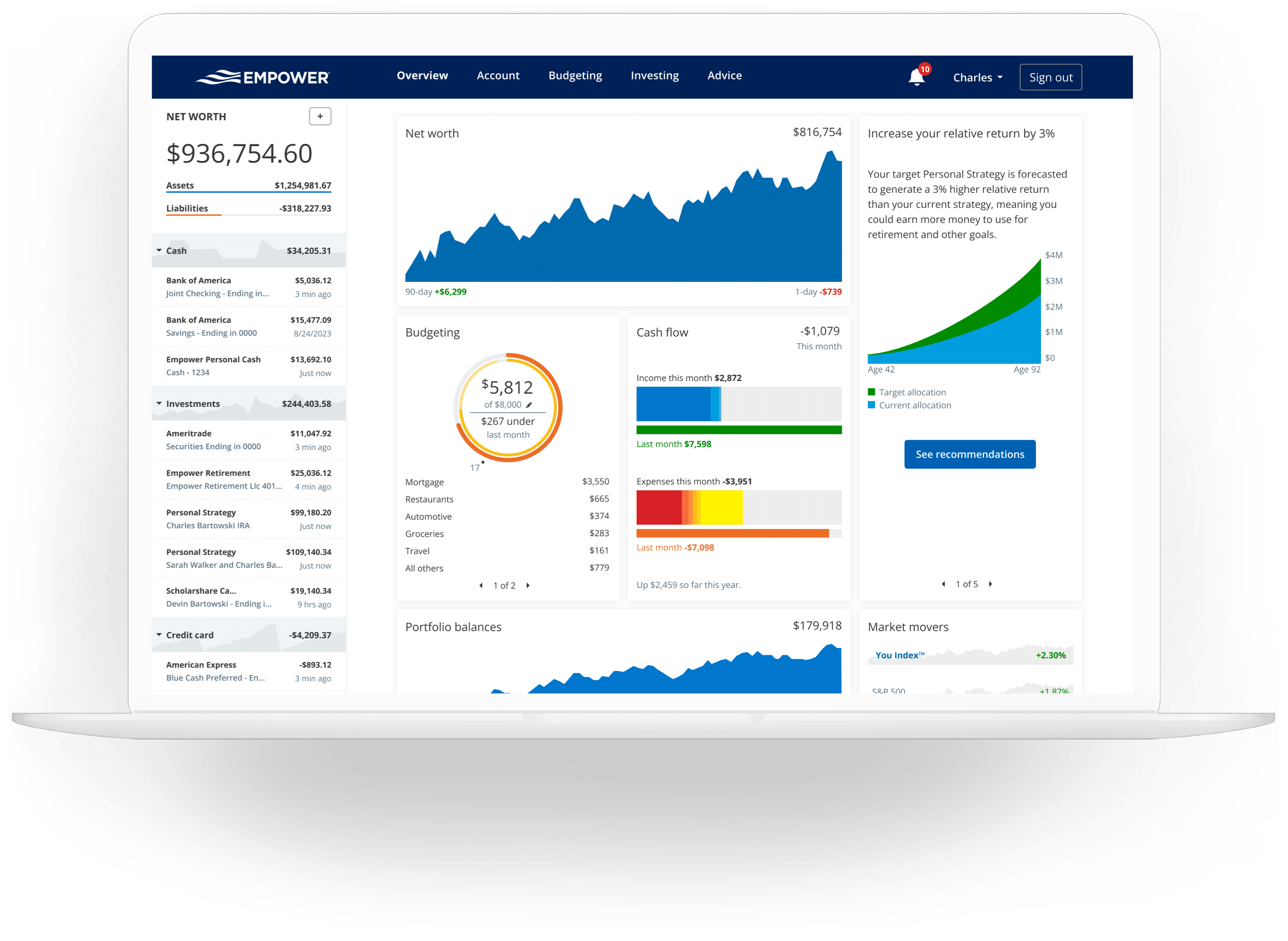

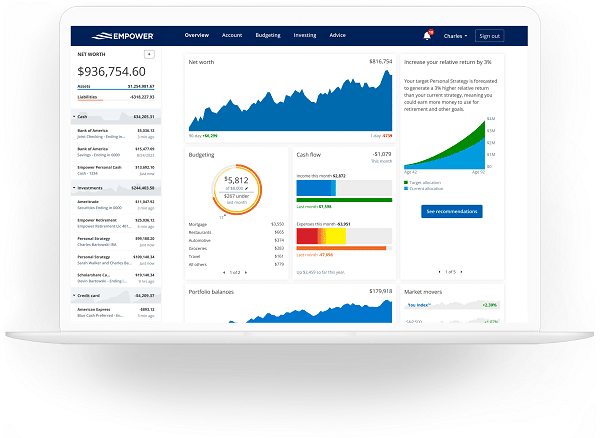

Empower gives you an overview of all your financial accounts, tracks your investments on a single dashboard, lets you calculate your net worth, analyzes the fees you pay, plans your budget, and so much more, absolutely free.

The free tools include the following:

- Free Networth Planner

- Investment Checkup

- Retirement Planner

- Portfolio Tracker

- Savings Planner

- Fee Analyzer

- Budgeting

- College Savings Planner

- Cashflow Management

Let's go over each tool individually.

Net worth tracker

For these tools to be helpful, you'll need to link accounts. After that, Empower can update your net worth automatically, utilizing the connected accounts you've given it. The planner lets you view and track your net worth over time. Also, you can even narrow it down to a specific date range.

I believe an excellent financial app should summarize your financial position without hassle. The Empower net worth report places your investment holdings, cash flow, and balances in one place. One unique feature is that it provides daily property value updates by integrating with real estate websites. I haven't witnessed this in too many other places.

The best part about the net worth tracker is how the information is displayed. It's visually pleasing and very easy to understand.

How the net worth calculator works

Total assets: The Empower net worth calculator figures out all of your current assets. Common assets include your retirement accounts, checking and savings accounts, brokerage accounts, vehicles, your home, and anything else that would have financial value.

Total liabilities: The calculator also gives you a complete view of your liabilities (debts or financial obligations). They include credit card debt, mortgages, student loans, and car loans. However, liabilities don't include monthly bills like rent and utilities unless you're past the due date.

Net worth calculation: After obtaining your assets and liabilities, the Empower planner helps you calculate your net worth. It simply takes all your assets, subtracts your liabilities, and gives you your net worth.

Benefits of the net worth tracker

- Motivation: A positive change in your net worth encourages you to put more effort into your investing and saving plans.

- Financial health assessment: The net worth value over time can give you a picture of your overall financial health.

One good thing about Empower is that it allows you to add an account if you can't find it in their database. Also, they'll conveniently email you a weekly print of your current net worth. The snapshot contains stock market updates, insightful blog posts, and upcoming bills.

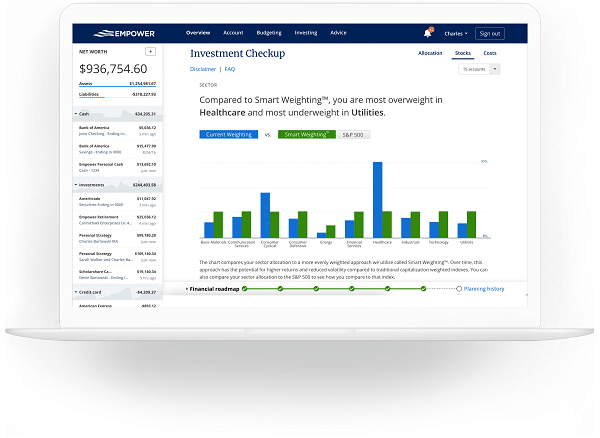

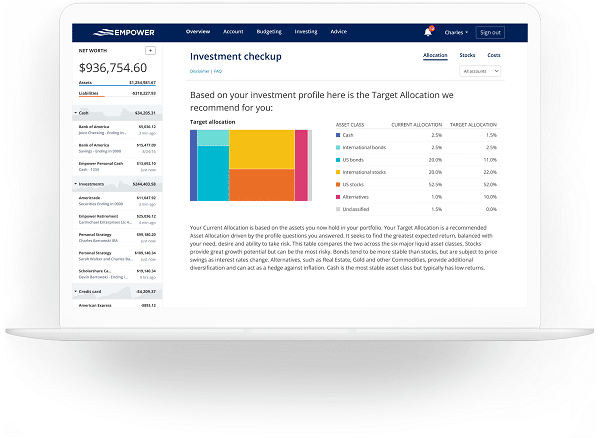

Investment Checkup

The Empower investment checkup feature analyzes your investment portfolio holdings according to style, size, and economic sector. It helps you avoid investment pitfalls and find ways to earn returns from your portfolio.

Besides asset allocation, the tool recommends changes to your portfolio based on your current holdings and account information.

Features

The investment checkup tool has three key features, including the following:

Asset allocation: This allows you to see your target allocation and potential areas of improvement with your portfolio. Your current allocation is your portfolio holdings, while your alternative asset allocation results from the answers you give the investment checkup.

Stocks: This lets you see if one of your positions is overweight or underweight. The investment checkup tool recommends changes to align you with your target allocation. The tool displays various target allocations against current allocations depending on different risk levels. Thus, you can identify those that need adjustment based on your overall strategies.

Cost: This shows your accounts' annual cost and if you're paying a bit too much in terms of overall fees. Also, the tool will let you know if the funds you hold are performing well, above average, or below average.

Benefits

The investment checkup tool has the following advantages:

- Portfolio benchmarking: Establishes your portfolio's benchmark and determines if your portfolio is underperforming or outperforming.

- Portfolio risk assessment: Informs you when you're taking on too much risk and suggests ways of achieving equivalent performance with less risk.

- Model customized asset allocation: This shows an alternative asset allocation (with the highest asset blend) to attain a specific risk-adjusted return.

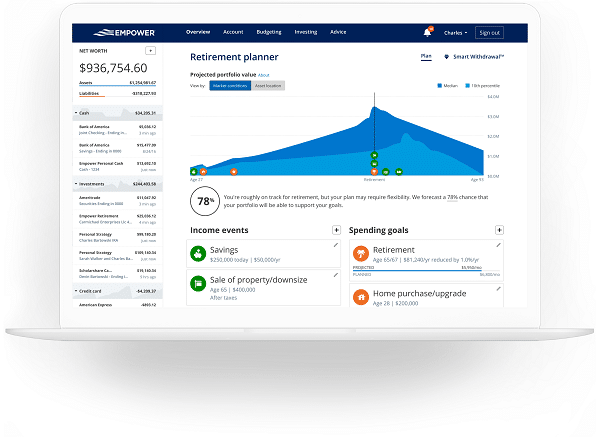

Retirement Planner

Planning for your retirement is complex, but Empower removes a large amount of difficulty with its free planner. The planning tool helps you know if you're in good shape for retirement.

Features

The retirement planner tool has four key features, including the following:

Different scenarios: The planner requires you to create several income and expense-based scenarios to determine the feasibility of your retirement goals. Once you plan for several scenarios and analyze them against your current plan, you can create a contingency plan to prepare for emergencies during retirement. Also, the tool recommends what you should do to correct the situation if you're off track.

Income event addition: This lets you include additional income sources to the planner and assess their impact on your retirement plan. Potential sources may include but are not limited to pensions, inheritances, property sales, annuities, and social security.

Expenses anticipation: This allows you to add your potential expenses to the retirement planner and see how they impact your plan. The expense scenarios may include education, home upgrade/purchase, vacations, healthcare, and dependent support.

Spending plan: This helps determine how much you'll spend in retirement. Also, the retirement planner uses various sections of your tax information to form a retirement withdrawal strategy with minimal penalties and taxes. As a result, your money in retirement can go that extra mile.

Benefits

The retirement planner tool has multiple benefits. However, here are some core ones:

- Goal feasibility assessment: Empower's retirement planner helps determine if you're on the right track and recommends adjustments.

- Income and expenses addition: The tool allows you to include potential expenditures and earnings outside of the norm, and lets you know how they could impact your retirement.

- Spending arrangements: It lets you know your total retirement and average monthly spending.

Portfolio Tracker

Empower portfolio tracker monitors your investment portfolio and provides you with some outstanding information that can help you improve your portfolio.

Features

One of the key features of the portfolio tracking tool is simply the way it displays information. It's easy for people to understand and can make managing their portfolio much easier. Lets go over some of the things it highlights.

- Allocation: Visually displays the weights of your portfolio's asset classes using boxes.

- Holdings: In-depth data on all of your current holdings.

- Performance: Tracks your portfolio's historical performance.

- Portfolio: Displays the fluctuating value of your overall investment portfolio.

'You Index' is a unique feature of the portfolio tracker that compares your portfolio with the broader market. The feature uses charts to display the performance of your mutual funds, ETFs, stocks, and cash against the S&P 500 and DOW Jones, along with bond and foreign market indexes, if necessary.

Benefit

The main benefit of the Empower investment tracker is that it allows you to track your portfolio at the same level that many major brokerages offer.

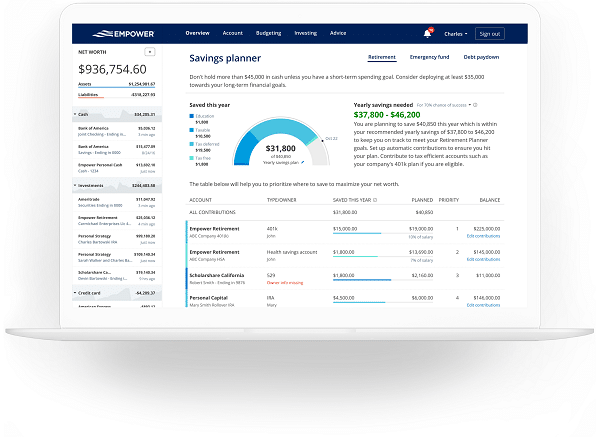

Savings Planner

Along with investment and retirement-type tools, the free savings planner tool helps you to achieve your saving goals. It lets you see your total savings, and it keeps you on track for retirement. Also, if the tool finds you're veering off track, it facilitates making necessary adjustments.

Features

The saving planner tool has three key features, including the following:

Emergency fund saving: Calculate the money you need for a 3-6 month emergency fund. It compares your cash against your monthly budget and suggests a dollar figure to cater to emergencies within that timeframe.

Retirement saving: Indicates what you must save for a 70% chance of hitting your retirement goals. The tool summarizes your progress by comparing your year's savings with what you must save to attain your retirement goals.

Debt down: The tool provides your current debt situation overview: It displays all your debts and their interest rates. Also, it gives an overall picture of the estimated payment length of your existing debts. This way, you can decide if you should first handle one of the debts or allocate money to your investments.

Empower financial advisors can offer financial support if you need more help with a larger saving goal, like college savings. They discuss with you the ideal methods for funding education expenses. That way, you'll save and pay for either you or your child's college tax-efficiently.

Benefits

The saving planner tool has the following advantages:

- Emergencies preparation: The tool calculates your monthly expenses and suggests an amount of money to set aside incase you have an emergency.

- Target savings: It lets you know the amount of money you need to save to achieve your retirement goals.

- Debt management: The savings planner displays your debts, their interests, and payment urgency/duration.

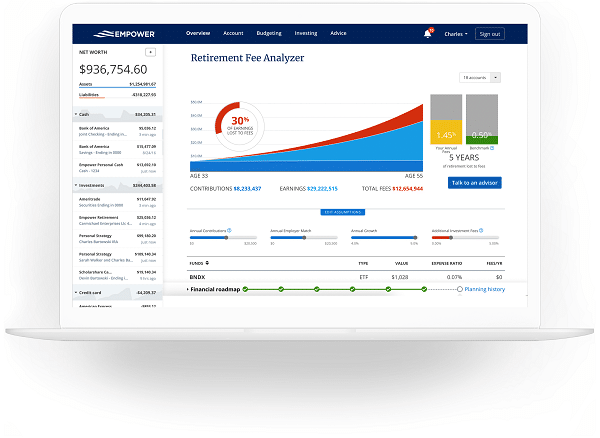

Fee Analyzer

Empower's fee analyzer supports your retirement savings by determining the annual fees you pay inside your portfolio. It details how much you could lose (numerically and visually) to yearly fees from funds.

The tool will find out what funds you own via your linked accounts and display the fees you're paying. Additionally, the analyzer indicates the retirement years you'll lose to the fees you are paying while you're working. If you own a lot of high-fee ETFs or mutual funds, you will be shocked at how much this is.

The results can help you adjust your portfolio to reduce fees all while targeting the same performance return-wise.

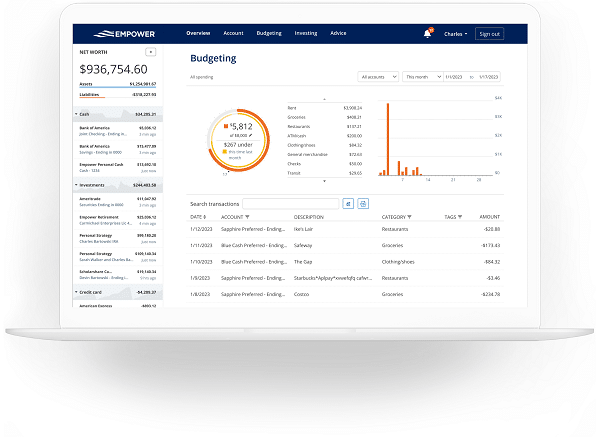

Budgeting

The budgeting tool is another one of Empower's free tools to track your cashflows and spending habits. It automatically organizes your savings and spending by category, date, or merchant. This way you can quickly tell when you're over or under your target budget.

Features

The budgeting tool has three key features, including the following:

Detailed budget: The tool helps allocate your money by identifying, evaluating, prioritizing, and monitoring expenses to meet your goals. It automatically imports data from your linked financial accounts, such as savings, checking, and credit card statements. It organizes your related transactions in categories like 'food' and 'entertainment.'

Budget adjustments: Empower's budgeting tool breaks down your expenses by category, helping you identify areas requiring trimming in regards to spending. Also, it uses the spending data to set a default monthly budget. You can modify your monthly budget as your lifestyle or income changes.

Spending full view: The feature uses interactive charts, pie charts, and graphs to display your spending budget and total daily or monthly spending. These charts make it much easier to see if you're on track.

Benefits

The budgeting tool has the following advantages:

- Spending tracking: Shows where your money goes.

- Spending monitoring: Keep your spending in check by setting saving goals.

- Goal achievement: Helps stay on budget to ensure you're going to meet your goals.

Cash flow Management

Tracking your spending and income is essential to your money management efforts. Empower Personal cash account is an easy, flexible, and secure cash management account with a competitive interest rate.

The cash flow charts and reports provide information to help you see inflows and outflows. The Empower cash flow management tool displays your spending, the most consuming categories, and the weekly average spending.

The app's full-featured personal finance manager automatically aggregates your expenses and income and displays the data in easy-to-read charts. The cash flow management tool and net worth planner work together better to understand your money's allocations and financial destination.

However, cash flow is more important than net worth because the former is more accurate while the latter is subjective to the value of your assets.

Benefits

The cash flow management tool has the following advantages:

- Monthly bills payment with ease due to checking account linking

- Simplifies your funds with a joint account if needed

- No minimum account balance requirement

- Allows direct deposits for your paychecks

- Allows up to $100 daily withdrawals.

- Unlimited monthly transfers

College Savings Planner

The college or education-saving planner is an excellent tool for returning to college or saving for your kid's education. Unlike other features, the education planner doesn't have its section on the dashboard. Instead, you'll find it under the retirement planner tool.

Determining your ability to afford your child's college tuition during retirement is the function of this tool. It helps you create scenarios to see if your current financial position is enough to help afford your child's education. Therefore, the app gives dollar figures for the average private institution, in-state, and out-of-state tuition.

Also, you can enhance the accuracy of your planning by adding a specific college.

How to get started

So, you're convinced that this completely free suite of tools will help you improve your net worth and manage your spending. Let's go over the sign-up process.

Getting started with Empower takes about 10 minutes at most. Below are the steps to follow to get started with these free tools:

Step 1: Sign Up for an Account

Start by providing your phone number and email address, then create a password. Next, answer questions to help Empower determine your financial and retirement goals. The queries include: When you expect to retire, how much you have invested, and so on.

Step 2: Link and Sync Your Accounts

Connect all your financial accounts ( including your checking, 401(K), IRA, and any investment accounts). If you can't find your institution, type it in the search bar. Empower is constantly adding new financial institutions.

Step 3: Check Cash Flow and Net Worth

View your current net worth and cash flow on the dashboard. The app shows your spending and income for the past month, portfolio balances, and allocation statuses.

You can click the 'Banking' tab and select 'Cash Flow' to get a new screen for organizing and categorizing expenses and income.

Also, click the 'All Account' tab to access your net worth summary (assets, liabilities, and investment accounts). View your current financial position by toggling between cash, credit, mortgage, or other loan accounts to get a 90-day history instantly.

Step 4: Set Up a Monthly Budget

Select 'Budgeting' from the 'Banking' tab to see all your transactions (past month, past 90 days, past year, or enter a unique date). Also, you get more visually displayed data about the transactions.

Alternatively, go to the circle chart on the right-hand side and set up your goal by editing the middle number. Also, you can view and track bills that are due from the 'Banking' tab and select the 'Bills' option.

Step 5: Review Your Investments

Go to the 'Investing' tab and view your holdings, track your investment account balance, view your investment performance, or check out investment allocations or sectors.

The 'Holdings' section compares your investments with major indexes to show their performance relative to that index. 'Allocations' and 'Sectors' sections help you diversify your portfolio, a great tool for portfolio asset allocation.

Step 6: Checkout Your Retirement Plan Feasibility

Visit the retirement planner and have a look at your retirement plan. The feature helps you determine if you're on track, need to save more or spend less. Also, it shows you the likelihood of meeting your goals depending on your current saving and investing strategy.

Create a new scenario and see how your portfolio would have fared during the past market downturns. You can even select a specific time and see how much money you'd have after a past market crisis and how long it would take to recover.

Step 7: View Recommendations and Act

Go through Empower's recommendations and take action to improve your retirement and investment plans. Thankfully, you can access financial advice at a fee if you can't handle the matter on your own.

Also, you get a personal financial advisor if you attain the $100,000 minimum balance.