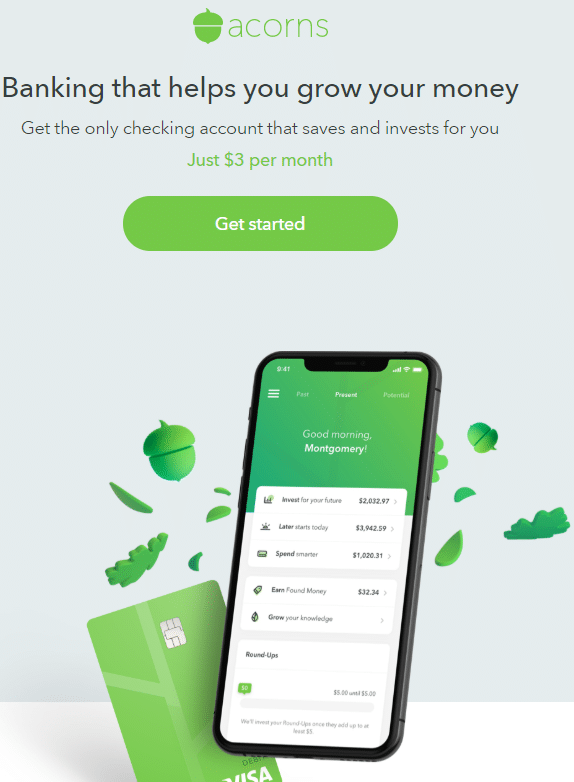

Acorns Review – Turn Your Spare Change into an Investment Portfolio

Acorns App Expert Review

If you’ve had difficulty saving money in the past, Acorns could be the app you’ve been waiting for. Not only does it help non-savers become savers, but it also turns those savings into investments. And as it does, Acorns manages those investments for you. This Acorns investing review will arm you with the information to decide if Acorns is worth it – for you.

Acorns is both a micro-savings app, and a robo-advisor investment platform all in one. Plus with Acorns Spend you also get an Acorns checking account and Acorns debit card.

Acorns App Review

-

Fees

(4)

-

Investment Choices

(4)

-

Ease of Use

(4.5)

-

Tool & Resources

(4.5)

Summary

| Acorns App allows you to save and invest money while you spend on everyday expenses; “Found money” partners, such as Lyft and Walmart, automatically add to your account. |

Pros

- Low-cost, commission-free ETFs from Vanguard, Blackrock + iShares.

- Taxable brokerage accounts, IRAs, and a checking account with attached debit card.

- Put spare change to your future goals.

Cons

- Small amounts of money take awhile to grow.

- Limited customer service.

- Fees add up on small investment amounts.

The app enables you to save money by collecting what it refers to as virtual spare change. It does this by rounding up your purchases to even numbers, and then moving the change into your investment account. Once there, your account is invested in a professionally managed portfolio of funds that represent thousands of individual securities.

Acorns is a simple app that enables you to both save money and invest for the future, even if you’ve never been able to save money in the past.

[toc]

You don’t even miss the money, and before you know it, you’re building wealth for the future. If you’re wondering, “Is Acorns worth it,” you should try it out now – the app download is free.

Sign up with Acorns, and get a $20 bonus!

Acorns Investment Review – Robo Advising Features at a Glance

| Overview | Automated investment management robo-advisor that invests your “spare change” in a portfolio of exchange traded funds (ETFs). |

| Minimum Investment Amount | There is no minimum investment amount required. The app will automatically invest your Round Ups once the total reaches $5 or more. |

| Fee Structure | $3/month-Personal $5/month-Family |

| Top Features | App allows you to save and invest money while you spend on everyday expenses; “Found money” partners, such as Lyft and Walmart, automatically add to your account. |

| Contact & Investing Advice | Available by on-site email or by phone, 6:00 AM – 5:00 PM PST, Monday through Friday. |

| Investment Funds | Low-cost, commission-free ETFs from Vanguard, Blackrock + iShares. |

| Accounts Available | Taxable brokerage accounts, IRAs, and a checking account with attached debit card. |

| Visit Acorns Now | Acorns Website |

What Differentiates Acorns Robo Investing From Competitors

Acorns has many of the same investment qualities that other robo-advisors have. But where Acorns differs from other robo-advisor investment apps is in how the money goes into your investment account. As a robo-advisor platform, Acorns provides you with completely passive investing. At the same time, the Round-Up feature (see below) of the app enables you to passively save money, as well.

Acorns isn’t the only app that allows you to invest spare change. But unlike similar spare change apps, Acorns gives you the ability to link an unlimited number of debit and credit cards-including an Acorns debit card, if you choose their Acorns Spend account. That means that you can have change moving into your investment account from multiple sources, accelerating the savings process.

Bonus; 5 Free Robo-Advisors – Best Way to Manage Your Money

Who Benefits from the Acorns Financial Advisor Robo? – Is Acorns Worth It for Me?

Acorns can be the perfect investment platform for the new investor and the person who has been unable to save money in the past. The automatic savings feature makes saving money effortless. All you have to do is go about your normal spending routines, and money will automatically find its way into your investment account.

It’s also perfect for college students, as a way to get themselves into the habit of saving and investing money early. The kickstart they get from the platform can set them up for a lifetime of saving and investing money.

Click to start building wealth now:

Acorns App Review Drill Down

Acorns Round-Ups

Here’s how Acorns round-ups works. If you purchase an item for $3.27, the app rounds the purchase up to $4.00 even, then moves $.73 into your designated checking account. This is a process that is referred to as Round-Ups.

Each time a Round-Up reaches or exceeds $5, the money is transferred into your investment account. (Savings accounts should not be used for this purpose, since federal law prohibits more than six outgoing transfers per month and you’ll likely exceed that limit.)

Is Acorns worth it if you’re only investing spare change?

The answer depends.

Since you likely make dozens of purchases in the course of a month, the amount that is actually transferred into your investment account can be substantial. For example, 100 purchases with an average of $.50 in change can amount to $50 going into your investment account for that month.

You can also add “multipliers” to your Round-Ups to increase the amount of money that’s flowing into your investment account. Let’s say you make a purchase for $2.50. The default Round-Up allocation will transfer $.50 to your investments. However, with a 2x multiplier enabled, that investment becomes $1.00. Investors looking to really rev up their passive investments can even add a 10x multiplier to their Round-Ups!

Sign up with Acorns, and get a $20 bonus!

Acorns Found Money

Acorns has several business partners who will contribute additional cash back to your Acorns account. That’s in addition to your normal Round-Ups. This can quickly up your savings and investment contributions.

Partners include Walmart, Lyft, Groupon, Blue Apron, AirBNB, Dollar Shave Club and Direct TV, among others. You can determine exactly who the current business partners are once you sign up for the app, but note that on occasion the partners change.

Acorns Spend

Acorns Spend is a unique feature that includes checking, a debit card, and investing account all rolled into one. Acorns Spend is akin to a complete money managementp portal and includes these features:

- A checking account with a debit card that saves and invests for you.

- Free bank transfers, no overdraft or minimum balance fees and 55,000 fee free ATMS reimburseements.

- Spend strategies and tips.

- Checking account FDIC protection (Federal Deposit Insurance Corporation) for up to $250,000 plus fraud protection and all-digital card lock.

Acorns Later

Acorns later helps you ramp up retirement saving. This new Acorns feature gets you on the right path for retirement savings.

Here’s how Acorns Later works:

Acorns later is an IRA or indvidual retirement account.

After answering a few questions, Acorns Later suggests the appropriate type of IRA account for you.

Sign up with Acorns, and get a $20 bonus!

You can start investing in Acorns Later with as little as $5, although we recommend investing more, or it will take too long to build up your retirement nest egg. If you can start with a $50 to $100 per month auto deposit, you’ll build your retirement stash more quickly. You can also make a one-time contribution into your Acorns Later acount.

If you’re an existing Acorns Invest customer, after the Acorns login, click on the “Acorns Later” menu item to sign up.

New Acorns Later customers must first sign up for an Acorns Invest account and then for the Acorns Later account.

What does Acorns Later cost?

Acorns Later costs a a flat $3 per month until your account value reaches $1 million.

Acorns Later-The easiest way to save for retirement.

Acorns Early

As parents, we want to give our kids a leg up with their financial future. Acorns Early is the custodial account, that enables you to begin investing for your children. It works like Acorns Invest and Acorns Later where you can invest as little as $5 in a diversified portfolio of exchange traded funds.

Your kids can access the Acorns Early money when they reach adulthood, from age 18 to 25, depending upon your state of residence.

Fees

Acorns Personal – $3 per month

- Investment

- Retirement

- Banking

- Metal debit card

- Bonus investments

- Money educational advice

Acorns Family – $5 per month

- Personal and custodial investment

- Retirement

- Checking

- Metal debit card

- Bonus offers and content

The fees are transparent, although for small accounts the percent of assets under management or AUM can be quite high. For example, if your account is worth $500, then $3 per month equals 7.2% of your account value for fees. Contrast that with Betterment’s 0.25% AUM fee. For the same $500 you’ll pay $1.25 per year management fees versus $36 at Acorns. Here’s how Betterment, Acorns and Robinhood match up.

Security

All of your data is protected with 256-bit encryption and is never stored on your phone, tablet or computer.

Acorns Securities, LLC is also a member of the Securities Investor Protection Corporation (SIPC) which protects customers of its members for up to $500,000.

Users who also have Acorns Spend are protected for up to $250,000 under the FDIC – Federal Deposit Insurance Corporation, as mentioned above. This is the organization that insures bank accounts.

Click the image to sign up now. What do you have to lose?

Acorns Investment Mix

Acorns investment methodology is similar to other robo-advisors, in that your portfolio is based on modern portfolio theory (MPT). That investment theory considers diversification among asset classes to be the primary investment objective.

Acorns invests your portfolio exclusively in exchange traded funds (ETFs). Not only does this provide broad diversification across a very large number of stocks, but it also does so at minimal cost. Acorns does not permit investment in non-ETF investments, such as individual stocks and bonds. Acorns also offers a bitcoin ETF for crypto enthusiasts.

Acorns starts by determining your investor profile. This is comprised of a variety of factors, including your age, investment goals, time horizon, income and your risk tolerance. Once this is determined, you will be categorized into one of the five following investor profiles:

- Conservative

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

Which category you fall into will determine the asset allocations within your portfolio. Your portfolio is invested in six broad asset classes that include:

- Large company stocks

- Small company stocks

- International large company stocks

- Government bonds

- Corporate bonds

- Real estate stocks

Sign up with Acorns, and get a $20 bonus!

Each asset class is represented by a single ETF. With just six ETF’s, your money will be invested across literally thousands of individual securities. The current lineup of ETFs used by Acorns includes the following funds:

- iShares IBoxx $ Investment Grade Corp Bond Fund (LQD)

- iShares 1-3 Year Treasury Bond ETF (SHY)

- Vanguard REIT Index Fund ETF Shares (VNQ)

- Vanguard Emerging Markets Stock Index Fund ETF Shares (VWO)

- Vanguard 500 Index Fund ETF Shares (VOO)

- Vanguard Small-Cap Index Fund ETF Shares (VB)

How much of each fund you are invested in is determined by your investor profile. For example, with the Acorns aggressive portfolio, 100% of your investments will be invested in stock ETF’s. If you are considered conservative, then only 20% will be in stocks, with the remainder in bonds. Each investor profile has its own unique allocation.

When the stock market is very volatile and experiences large gains and losses the Acorns aggressive portfolio will be impacted the most, so during declining markets, like the one during the Corona Virus outbreak, aggressive investors must be prepared to handle 5% to 10% daily market declines. If this isn’t right for you, then you’re better off investing in the Acorns moderately agggressive portfolio or the moderate portfolio. A more moderate portfolio won’t experience such drastic increases and decreases in value.

An advantage of investing with Acorns that you have the option to change your investor profile. For example, if you want attempt to improve long-term investment returns, you can change your profile from Moderate to Moderately Aggressive. Of course, greater risk or investment volatility accompanies a more aggressive portfolio.

Once your portfolio is established, Acorns provides automatic rebalancing, to make sure that your portfolio percentages remain within the recommended allocations.

Sign up with Acorns, and get a $20 bonus!

Acorns Grow Magazine

Acorns partnered with CNBC, a premier financial news network to provide top-notch money content. The Grow vertical on the app includes educational and entertaining stories such as; “3 Ways Your Student Loan Debt can Affect Your Credit,” “How Happy Couples Handle Money” and “What You Can Learn From the Money Moves of Sports Stars Like LeBron James and A-Rod.”

Whether you sign up for the Acorns App or not, I’d check out the inspiring and educational content on the Acorns Grow Magazine.

Acorns Review App – Sign-up Process

The Acorns app is available at either the iOS App Store or Google Play, and is free to install. One of the advantages is that once you sign up for the app, you can link as many spending accounts as you like.

You must be at least 18 years old, and you’ll need to provide the following information and documentation:

- A valid email address

- Your checking account and routing numbers.

- Your legal first and last names

- Your birthday

- Your physical address (no P.O. boxes or business addresses are allowed)

- Your Social Security Number.

Acorns will ask you a series of questions to determine your account type, including:

- Employment status

- Yearly income

- Net worth

- Initial investment

- Time horizon

- Investment goals

- Financial knowledge

Once you’re signed up, you can link your checking account and as many debit and credit cards as you like. As you spend money, your investment account will gradually be funded. But you are also able to fund your Acorns investment account with direct contributions, the way you would any other investment account.

Acorns App Review Pros and Cons

Acorns Robo Advising Pros

- Acorns offers a truly passive way to save money. This can be a critical strategy in turning non-savers into regular savers. Since you can save money by spending money, no special effort is required on your part.

- Acorns app requires zero minimum account balance. This is perfect for new and small investors. Once your account is opened, you can fund it with “Acorns Round-up,” lump sum deposits or automatic deposits.

- There’s no limit on the number of accounts and cards that you can link to the app. That means that you will have multiple spending accounts from which you can contribute money into your Acorns account.

- Acorns Later is a great way to get younger adults in the habit of saving for retirement or future goals.

Sign up with Acorns, and get a $20 bonus!

Acorns Robo Advising Cons

- No tax-loss harvesting (TLH). Many investors have come to expect TLH from robo-advisors, making its absence a potential negative. However, since the typical Acorns investor is more interested in building an investment portfolio from the ground up, this may not be a big deal.

- Customer service is limited. This may not be a deal-breaker, but new and small investors may prefer more generous customer contact.

- No advisory service. Robo-advisors are light on person-to-person advice, but more are beginning to offer it. Acorns hasn’t, at least not yet.

- For small investors, the $3 per month fee can be a great percentage of assets managed (AUM). Although M1 Finance doesn’t offer round ups it is free and has no management fee.

- When investing just a few bucks a month, it will take a very long time to build up a significant amount of money.

Acorns Robo-Advisor Review Wrap Up

Acorns is well-suited for college students, young adults and older adults who haven’t been able to master the process of saving money regularly. Acorns makes investing automatic, and provides just the incentive that you need to become a committed saver.

Although, Betterment has just upped it’s game and includes Betterment Cash Reserve, a cash management system with very high returns.

Acorns is worth it for those who want a passive, automatic way to make investments a little at a time. How quickly your account grows is based on how many purchases you make each month and whether you add any additional deposits.

Sign up with Acorns, and get a $20 bonus!

Not only is saving money automatic with the app, but so is investing. It’s perfect for the new investor too, since your portfolio is professionally designed and managed. Acorns handles the entire process for you. And the Grow online magazine by Acorns offers top-notch financial advice.

With the emphasis on new and small savers and investors, Acorns is not a preferred investment platform for seasoned investors who may be looking for more sophisticated investment options. Investors with larger incomes and those seeking a more comprehensive investment platform would be well served to look elsewhere.

Related:

- Robinhood vs. Acorns vs. M1 Finance Comparison

- Stash vs. Robinhood vs. Acorns

- Need help choosing a robo-advisor? Visit our Robo-Advisor Selection Wizard

- Wealthfront vs Acorns Comparison

- Robinhood vs Betterment vs Acorns

- Betterment vs Acorns

- Acorns vs Qapital

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up through the affiliate link. That said, I never recommend anything I don’t personally believe is valuable.