WiseBanyan is Now Axos Invest-Managed Portfolios

Axos Financial (AX) is a publicly traded financial company that provides consumer and business banking products including checking, savings and lending solutions.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

The addition of Axos Invest Managed Portfolios to its offerings gives users access to banking and lending products in addition to investment management. This places the Axos Invest robo-advisor in closer competition with other robo-advisors delving into banking and lending like M1 Finance, Betterment, Personal Capital, and SoFi Invest.

Axos Invest Managed Portfolios Review

Name: Axos Invest

Description: Free robo-advisor with access to wide array of financial services through Axos Bank.

-

Fees

(4.5)

-

Investment Choices

(5)

-

Ease of Use

(5)

-

Tool & Resources

(3)

Summary

Best for:

- Beginning investors seeking low-fee investment management.

- Investors who want a robo-advisor connected to a financial institution.

Pros

- Diversified investment choices.

- Low-fee investment management.

- Access to tax-loss harvesting and customized portfolios.

Cons

- Must transfer assets into Axos to use platform.

- Limited account types – no joint accounts.

This comprehensive Axos Invest Managed Portfolios review will provide answers to all of your questions including a features overview, the sign up process, investment style, list of available funds, Fees, Mobile App, and pros and cons.

Ultimately, this Axos Invest review will help you decide if this is the right robo-advisor for you.

Products and Services – At a Glance

What is Axos Invest Managed Portfolios and How Does it Work?

Launched in 2014 as WiseBanyan, Axos Financial acquired the WiseBanyan robo-advisor in 2019.

Herbert Moore and Vicki Zhou, the co-founders of WiseBanyan created the original Axos Invest app (formerly WiseBanayn) as a robo-advisor for the small investor. The company has since been sold to Axos Bank.

The company focuses on offering sound financial management regardless of the amount of money that you have.

The investment strategy includes:

- Diversified investment portfolio designed for your specific risk score and investing preferences.

- Passive management or buy and hold approach to minimize taxes and maximize returns.

- Smart rebalancing approach.

- Tax-loss harvesting for taxable accounts.

After answering a few questions about your income, goals, and risk tolerance you receive a custom portfolio.

The platform is simple and incorporates choosing your goals, or milestones like retirement, saving for Jrs. college education or buying a jet ski.

You can choose from several taxable-favored strategies including:

- Tax-loss harvesting

- Selective trading

- IRA Automation

Next, the Axos Invest app automates your financial journey. Axos Invest provides its clients with tailored and optimally diversified portfolios to achieve their financial goals. The Axos robo-advisor automates everything from portfolio rebalancing to dividend reinvestment and recurring deposits.

Interested? Here’s a detailed drill down into how the platform works.

We’ll walk you through the sign up and initial questionnaire. In the end, you’ll get a summary of the Axos Invest pros and cons.

Other robo-advisors that are part of a larger financial firm include Ally Invest, Fidelity Go, Vanguard Personal Advisor, SoFi Invest, and Schwab Intelligent Portfolios.

Sign up now for the Robo-Advisor Comparison Chart.

Who is Axos Best for?

- The small investor who is just starting out an ideal user. Two other robo-advisors that cater to the new investor and offer zero investment management fees are M1 Finance and SoFi Invest.

- Investors seeking a one-stop financial firm. Axos Invest users can also participate in the firm’s banking and lending services. Although, if you also want the opportunity to open your own investment trading account you might prefer M1 Finance or one of the larger financial firms like Schwab or E*TRADE.

- The investor who wants to target specific investment goals, such as saving for a home and planning for retirement.

- Those who want an automated investment manager and the opportunity to customize investments. We like the Portfolio Plus option that offers 30 plus investing categories to add to your investment account.

Features – Drill Down

Fees and Account Minimum

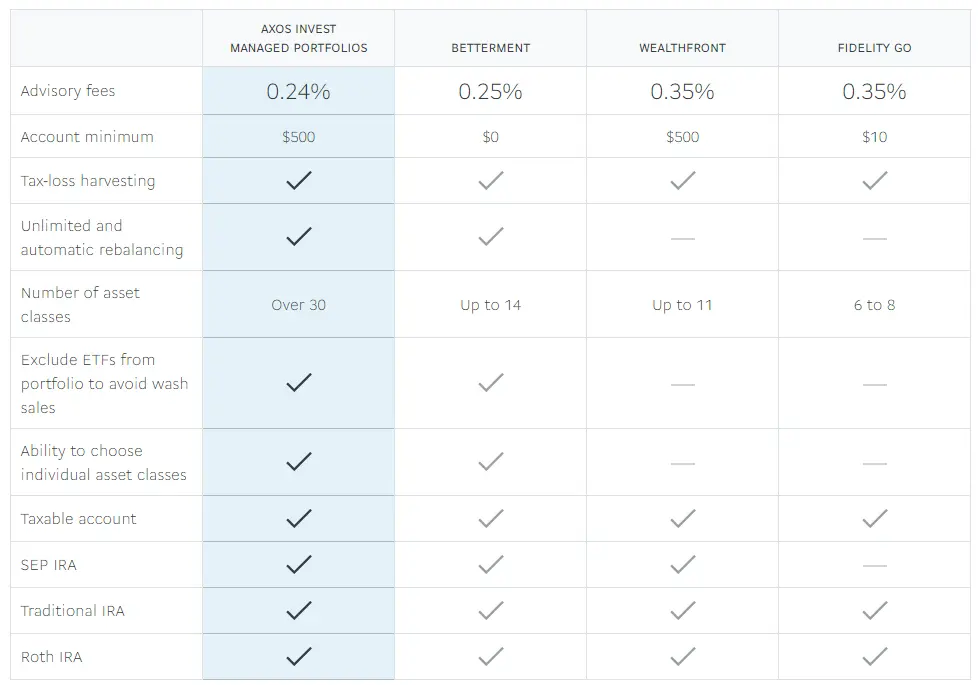

The annual investment management fee is a flat 0.24% of assets under management for accounts worth more than $500.

The account minimum is $500. This is in line with Wealthfront and roughly in the middle range of comparable services.

Apex, the securities clearing company, may have fees that go directly to their company for paper check deposits, wire transfers, returned checks, and account transfers to another brokerage firm. This fee does not go to Axos Invest, nor do they receive any kickbacks or compensation from this underlying fee.

All exchange traded funds levy management fees that go directly to the ETF company. The selected Axos Invest ETFs charge an average 0.12% management fee. This fee does not go to Axos, nor do they receive any kickbacks or compensation from these fund fees.

This average management fee is quite low.

User Experience and Sign up

When you click on Axos Invest you’ll be invited to become a client. Just plug in your email address to get started. You can begin exploring the platform without signing up.

Here’s how “Simon” our fictional user progressed through the platform

1. Simon visited the homepage, input his email.

2. Next, Simon answered a few basic questions: birthday, annual income, and net worth. Simon, was born in 1980, earns $70,000 and has a net worth between $5,000 and $25,000.

3. Next, on to the goals page where you choose among the following milestones:

- Rainy Day

- Save Cash

- Retirement

- Custom

Don’t worry, you’re not locked in and you can add more milestones later. The opportunity to customize your goals gives you a chance to save for those special items like a llama for your back yard or start-up capital for a new business venture.

4. Simon chose the “Retirement” milestone.

The platform auto populated this customizable goal:

“Have $45,500 per year at age 70.” They don’t disclose the “account value” but only the amount of income from this portfolio.

5. Next, you’re presented with 4 portfolio options:

- Aggressive growth

- Steady growth

- Moderate growth

- Loss avoidance

6. Given that Simon is 30 years old and has time to make up any investment losses he selected the “Steady growth” option.

7. Next come a few risk questions that determine how you’ll respond to various levels of losses.

It’s important for investors to realize that when investing in the stock market you must be prepared for periodic drops in your investment values. And you don’t want to get scared and sell after a market decline.

8. Then you select your preferred investment portfolio. The choices include potential return levels:

- 14% – High risk

- 10% – Medium risk

- 7% – Low risk

- 3% – Minimal risk

Simon chose the “Medium risk” option.

We believe that the potential return levels are a bit high, setting the user up for somewhat unrealistic expectations.

9. Next you choose the portfolio composition:

- Stocks and bonds

- Stocks, bonds, and cash

- Cash

Consistent with his prior choices, Simon chose “stocks and bond.”

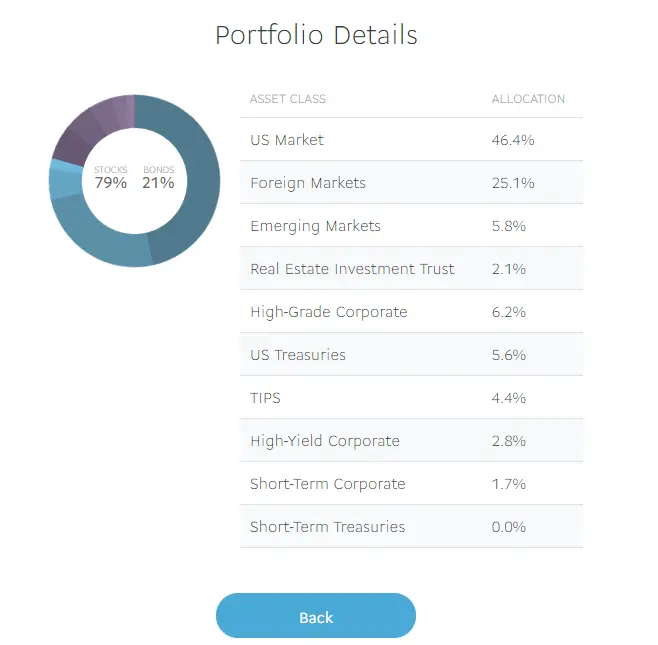

Next you get the Axos Invest Managed Portfolios portfolio recommendation. Simon received an asset allocation or investment fund mix of 79% stock funds and 21% bond funds:

The investment portfolio presented was reasonably diversified and in line with the stated preferences.

Compare: M1 Finance vs. Vanguard Robo-Advisor – Should I Pay for a Robo-Advisor?

The entire process is fast. If you need explanations for any part, click on a clarification tab.

To find out which funds are recommended for your personal portfolio, you hover over each of the colored sections of the circle and a ticker symbol for the fund appears.

For financial advisor access, free investment management, zero management fees and no minimums, check out SoFi Invest.

Customer Service

Customer service is available by phone Monday through Friday from 8am to 4pm PST.

Email support is available 24/7.

Investment Philosophy and Choices

Axos Invest investments are well diversified with roughly nine exchange traded funds in each portfolio. Axos attempts to minimize fees and taxes for each client.

Like most robo-advisors, the investment selection adheres to Modern Portfolio Theory which strives to offer the highest returns for each risk level. This is where diversification helps to smooth out the inevitable ups and downs of investment returns.

The initial interview guides your investment portfolio with more conservative investors having greater percentages in bond investments and aggressive investors leaning towards more stock funds.

Investment Funds

Following are the list of available Axos Invest, low-fee exchange traded funds (ETFs). The nine available low-fee ETFs bring you exposure to vast segments of the stock, bond and real estate markets. All of the funds levy low investment management expense ratios.

Compare: M1 Finance vs. Vanguard Robo-Advisor – Should I Pay for a Robo-Advisor?

Axos Invest Funds

| BOND FUNDS | |

| iShares TIPS Bond | TIP |

| Vanguard Intermediate-Term Govt Bond ETF | VGIT |

| SPDR Blmbg Barclays ST HY Bond ETF | SJNK |

| Vanguard Short-Term Corporate Bond ETF | VCSH |

| iShares iBoxx $ Invst Grade Crp Bond | LQD |

| STOCK FUNDS | |

| Vanguard Total Stock Market ETF | VTI |

| Vanguard FTSE Developed Markets ETF | VEA |

| Vanguard FTSE Emerging Markets ETF | VWO |

| REAL ESTATE FUND | |

| Vanguard REIT ETF | VNQ |

| Edit (Investment choices are subject to change) |

Accounts

Axos invest offers these accounts:

- Individual investment accounts

- Retirement accounts including: Roth IRAs, traditional IRAs, SEP-IRAs & retirement fund rollovers.

This is a narrower list than some of the other robo-advisors on the market today although suitable for most investors.

M1 Finance is another robo-advisor with scores of portfolio choices and the option to invest in individual stocks, funds and cryptocurrency. only competitor that we know of that offers this type of flexibility in investment options.

Tax Strategies

If you’re interested in tax-minimization strategies, you’re come to the right place.

The three options include:

- Tax-loss harvesting – This is for taxable accounts only. This strategy works to lower your taxes on your investment gains and might boost returns.

- Selective trading – You can exclude or include specific ETFs from your portfolio. There are many reasons from personal preference to coordinating your investing over multiple portfolios. This is a rare feature for robo-advisors like Axos Invest.

- IRAutomation – This refers to the availability of 3 IRA offerings: Roth, Traditional, and SEP.

Quick Deposit and Auto-Deposit Scheduler

These two features give you faster access to your money. Quick deposit invests your money on the same or next trading day, putting your money to work faster.

Auto deposit scheduler coordinates your automate deposit payments with your pay periods.

We believe that these are “nice” features, but rather inconsequential.

Axos Invest Mobile App

Unlike other robo-advisors that are part of large financial firms, Axos Invest has a dedicated app. This is easier than wading through all of the offerings to find the digital investment choice on a large financial firms app.

The reviews on the Axos Invest App are good, with one complaint about difficulty depositing funds. Although another review claimed that bugs were fixed rapidly.

As with all technology, there’s no perfect app!

Axos Invest Formulas

Using the Financial Wallet feature, you can access some of the features available in spare change apps.

After a formula is set up, the system uses the cash in your Axos Wallet to capture investing opportunities.

Formulas has four offerings to help you ramp up your investing;

- Round-Up – Top off your milestones each day with your cash. This option is similar to the round up features on other spare change apps.

- Dividend Match – This formula adds money to mirror your dividend payments. This investing boost brings you to your investment goals faster.

- Bargain Hunting – When stock prices drop, this formula automatically buys more shares of the investment. This is an enactment of the “buy low” philosoph.

- Level Up – Take your milestone up to the next $1,000 level. This formula adds funds to reach the next $1,000 amount in your portfolio.

The formulas are only available in the taxable personal investment accounts, not retirement accounts.

Are Axos Invest Managed Portfolios Safe?

if you’re comfortable banking online then you should be fine with Axos Invest’s safety features. The Axos robo-advisor uses bank-level security. Your personal information is encrypted, securely stored, and protected by Axos’ state-of’the-art technology.

The two-factor authentication requires you to input a code, sent to your personal device, before providing account access.

Need help choosing a robo-advisor? Try the 4-question Robo-Advisor Selection Tool

Pros and Cons

Advantages

- Diversified selection of low fee ETFs-Broad exposure to U.S. and international stocks, U.S. bond universe and real estate.

- The Portfolio Plus is a game-changer and adds targeted investing. This is an easy way to personalize your investments, in line with your own interests.

- Ability to set up multiple portfolios for a variety of goals.

- Cash option great for emergency funds.

- Easy sign up with ability to change allocations and seamlessly add goals.

- Selective trading offers more investment customization than competitors.

- Access to other financial services through Axos Financial including high yield savings and formulas is a good feature.

Disadvantages

- Limited account availability, no joint accounts, no trusts.

- Rainy day milestone design is somewhat risky for short term goals. You need to select ‘cash milestone’ for your emergency funds.

- The expected returns for specific risk levels seems high. It’s unlikely that a “low risk” portfolio” will yield 7%.

- No financial advisors available. This isn’t a huge negative, as there are other robos like Axos that lack live advice.

FAQ

1. How does Axos invest work?

2. Which investment site is best?

3. Which robo investor has the best returns?

Axos Invest Managed Portfolio Review Wrap Up

There’s a lot to like about Axos Invest. The fees are reasonable and the customization is outstanding. In fact, there’s not another platform like Axos Invest. The platform is excellent for those with little investing experience to more seasoned investors.

We like the automation of the Formulas. You’ll benefit financially, any time you automate investing, to deploy additional dollars into the market, without having to manually make a decision.

For the new investor, there is minimal downside; it’s an easy way to begin investing.

Axos Invest is also a viable option for investors seeking a variety of distinct investment portfolio choices. Even sophisticated investors can find what they want with the Portfolio Plus options. Although, SoFi Invest offers zero minimums, zero management fees and financial consultants. Other robo-advisor options for investors include Betterment or Personal Capital.

The only downside is that there are competing robos with free investment management like Schwab and M1 Finance. Although, we believe the 0.24% annual fee is quite reasonable.

Related:

- Free Robo-Advisors

- Betterment vs. Wealthfront vs. M1 Finance (free robo-advisor)

- Ally Invest Review

- Robo Advisor News – Axos, Vanguard and More

- Titan Invest Review – Hedge fund Investing App

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Disclosure: I have an account with Axos Invest.