Betterment Cash Reserve and Checking – Earn a Higher Yield on Your Money

The Betterment high yield Cash Reserve and checking account review delves into every corner of these fee free accounts. Betterment is on the road to becoming a full service financial management platform.

Betterment Checking and Cash Reserve Review

-

Fees

(5)

-

Features

(4.5)

-

Ease of Use

(5)

Summary

Best for:

- Savers seeking high yield cash account.

- Individuals who want no-fee ATM transactions.

- Betterment customers.

Pros

- Part of the top-rated Betterment robo-advisor.

- $2,000,000 FDIC insured (indiv. accts.) cash-reserve account, through partner banks.

- Unlimited, no-fee transactions.

Cons

- No bank branches.

- Betterment checking doesn’t pay interest.

Betterment is one of the premier robo-advisors with over 1 million accounts, as of April 2023.*** Known for its smart and affordable investment management, the checking and savings accounts, administered through partner banks are another plus for this already excellent platform.

The current Betterment cash reserve interest rate is 4.50% APY.** The rate will vary, based upon market interest rates.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

What is Betterment Checking and Cash Reserve?

Think of Betterment Checking and Cash Reserve as the cash management arm of your finances. Both accounts are fee-free and without management fees. Both Betterment Cash Reserve and Betterment checking are only available to clients of Betterment LLC, which isn’t a bank. Cash is transferred to program banks through your brokerage account.

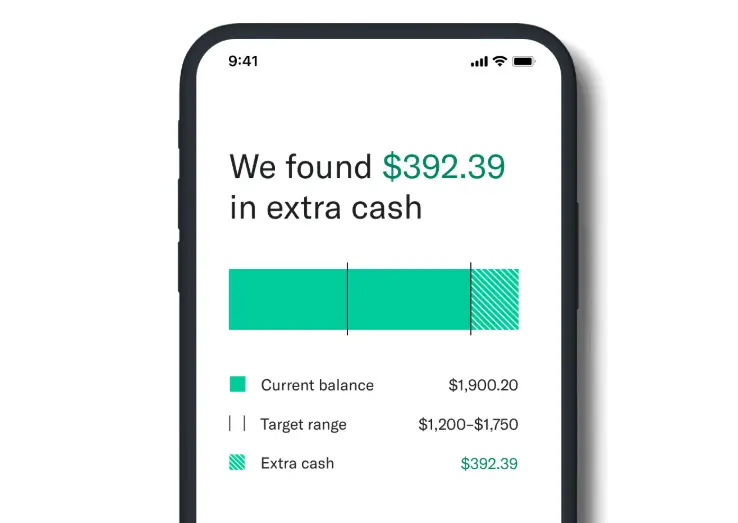

Betterment Cash Reserve

Get high yield cash management, with zero fees.

The interest rate will change according to current market rates.

Your funds are held several partner banks that are associated with Betterment.

Features:

- High yield (interest rate) cash account – adjusts depending upon market interest rates

- Zero fees

- Access to cash within 1-2 business days

- Unlimited withdrawals

- No minimum balance required

- FDIC insurance coverage up to $2 million for individual and $4 million for joint accounts, through Betterment’s program banks.

Betterment Checking*

Betterment checking is a mobile-first checking account paired with a Visa Debit Card for spending. The checking account and Visa Debit Card are provided by and issued by NBKC Bank. The Betterment checking account does not offer interest payments.

Features:

- Fee free checking

- Cash back available through the debit card spending

- All ATM fees are reimbursed – worldwide

- No foreign transaction fees.

- FDIC insured up to $250,000 per depositor through NBKC Bank. Joint accounts receive $250,000 FDIC insurance for each depositor.

Here’s why you need both cash accounts.

You need cash to pay for regular expenses, emergencies, and to have on hand for expected expenses that will crop up during the next few years. Cash is important to pay for an upcoming vacation, an unexpected car repair, and for a home down payment needed in a few years.

- Checking account – For your day-to-day financial transactions.

- Cash reserve account – A high yield cash account that offers high returns for the ready cash that you’ll need in the short and intermediate term.

Betterment Cash Reserve Current Interest Rate

The current Betterment cash reserve interest rate is 4.50% APY.** The rate will vary, based upon market interest rates.

Fees and Minimums

The Betterment Cash Reserve and Betterment Checking are fee-free. These accounts don’t charge fees.

The Betterment Cash accounts don’t require a minimum investment amount either.

These are sound accounts to use for your cash needs – both for checking and building savings for tomorrow.

FAQ

How Long Does it Take to Withdraw from Betterment?

What Type of Accounts are Available at Betterment?

Are Betterment Checking and Cash Reserve Safe?

Money held in checking is insured by the FDIC up to $250,000 for individual accounts and $500,000 for joint accounts, through Betterment’s partner banks .

Two-factor authentication adds to the apps security.

How often does Betterment pay interest?

Betterment Checking and Cash Reserve vs Wealthfront Spend

Both Betterment and Wealthfront are among our favorite robo-advisors. The cash management features are excellent additions to their platforms.

| Betterment | Wealthfront | |

| Services | Checking and high cash account, through partner banks. | High yield savings account with checking features, through partner banks. |

| Fees | zero | zero |

| Minimums | No minimum. | No minimum. |

| Transfers | Unlimited | Unlimited |

| Best for: | Betterment customers | Wealthfront customers |

Betterment offers two separate accounts, a non-interest bearing checking and a high yield cash reserve. Wealthfront provides one account with high returns and checking features. Both platforms administer their banking through affiliated external banks.

DIY Alternatives to Betterment Checking and Cash Reserve

Since cash seems so easy to handle, many investors are content with either leaving it in a savings account or trying a do-it-yourself option for earning high returns on cash. Unfortunately, not all DIY options are that much better than savings accounts.

Robo-advisor cash accounts – Many competitor robo-advisors also offer high yield cash accounts. You can view a list of features of “Robo Advisors With High Yield Cash Accounts.”

High yield bank money market – Money market accounts do typically pay greater returns than savings accounts, but aren’t overly impressive: a quick search on Google makes it clear that money markets at traditional banks aren’t going to wow anyone with their interest payouts anytime soon.

While bank money market accounts are FDIC insured, they also come with one big limitation: account holders can only withdraw money up to 6 times per month. While Betterment checking and savings allows unlimited withdrawals.

Certificates of deposit – These are another option for investors to earn high returns on cash, but they too come with some limitations. These funds tie up cash investments for a year or so, depending upon the terms of the CD. This makes them less liquid than investors might like.

Money market mutual funds – These are available through investment brokerage firms and own short term corporate and government debt. Interest payments are higher than bank money market accounts.

The current Betterment cash reserve interest rate is 4.50% APY.** The rate will vary, based upon market interest rates.

Betterment Checking and Cash Reserve Pros and Cons

Pros

- High interest rates – Betterment Cash Reserve rates are competitive with many high yield cash accounts.

- All ATM fees reimbursed – worldwide.

- FDIC insured.

- A Visa debit card is available.

- Unlimited withdrawals are unlike comparable high yield bank accounts which typically limit withdrawals to six per month.

- No fees or minimum balance requirements.

- The opportunity for investing and cash management services within one platform.

Betterment Cash Management Cons

- No bank branches. (Although that’s common with other online cash management options.)

- Phone support only available on week-days.

- Withdrawing cash takes a day or two.

- Like all cash accounts, the interest rate fluctuates, based upon market interest rates.

Betterment Checking and Cash Management Wrap Up

Betterment is one of our favorite robo-advisors with low fees, excellent investment choices and financial advisor access. The addition of savings and checking products is icing on top of an already delicious investment management cake!

Betterment’s higher yields and lack of fees make the cash management solutions, through partner banks, integrate with your complete money management.

It’s just so much easier to keep investing, cash management, and spending all under one roof.

If you’re seeking a high yield account, checking with refundable ATM fees and no limit on transactions, then Betterment is worth a look.

We continue to rank Betterment as one of our favorite robo-advisors and the cash management solutions only add to their benefits.

Methodology

To determine star ranking, the cash reserve and cash management accounts rank the following features:

- Yield range – higher yields receive higher scores

- Number of fee-free ATM withdrawals

- Checking account features

- Availability of interest payments on checking account

- Fees

Since most robo-advisory platforms with cash management lack physical bank branches, and include FDIC insurance, these are not included in our ranking system.

Related Reading:

- Best Robo Advisors With Cash Management

- Betterment Review

- Robo-Advisor with Financial Planner-Betterment Offers a Menu of Investment Advice Options

- Wealthfront Review – Is Wealthfront Worth It? With Wealthfront cash account info!

- Betterment vs. Fidelity – Which Robo-Advisor is Best for You?

- Robo-Advisor Fees From Lowest to Highest

- Find out how Nobel Prize winner Richard Thaler Influenced Betterment.

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

*‡ Checking accounts and the Betterment Visa Debit Card provided by and issued by nbkc bank, Member FDIC. Funds deposited into Checking are FDIC-insured up to $250k for individual accounts and up to $250k per depositor for joint accounts. Betterment Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted. Checking accounts do not earn APY (annual percentage yield). Betterment Cash Reserve and Betterment Checking are separate offerings and are not linked accounts.

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.

*** Data source: https://betterment-prod-cdn.s3.amazonaws.com/agreements/Betterment_LLC_ADV_2023_05_01.pdf