Betterment vs. Acorns — Overview

When it comes to investing, sometimes simple is best. There are nearly unlimited options available to investors, from real estate to small-change investing. A straightforward, easy-to-use robo-advisor is often preferred by investors who’d just like to get started or learn as they go,

Fortunately, there are many such robos on the market today. Betterment and Acorns, the two we put head-to-head today, both strive to be intuitive, user-focused investment tools that help clients start putting their money to work immediately.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Quick Summary: Acorns vs. Betterment

- Betterment is best for serious investors. With no investment minimum, $10 to begin investing, extensive investment options and goal-based investing,

- Clients who want to get started investing with spare change will like Acorns best.

- Betterment benefits investors who want human financial advice, for low fees..

- Both options offer low fees and both are acceptable options for the beginner investor.

- Crypto funds are available at both Betterment and Acorns

What is Betterment?

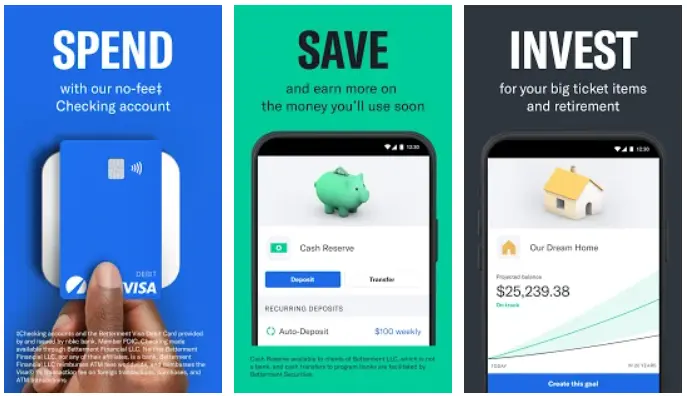

Betterment is a well-known robo-advisor, and for good reason. One of the largest stand-alone robos, Betterment is over a decade old. Betterment serves beginning and advanced investors alike, with services ranging from the basics, like automatic rebalancing, to more high-end options, like human financial planners, for additional fees.

Betterment robo investing accounts are goals-based. The robo uses your risk tolerance and your financial goals to create the appropriate investment mix for you. The basic digital Betterment has no account minimum with $10 to begin investing. All clients can access socially responsible portfolios, crypto and financial advisors (fees are extra for financial advisor access). They also offer a tax-loss harvesting to save money on taxes. Those that strive to beat the market can opt for Smart Beta portfolios and retirees might prefer the Income Portfolio.

What is Acorns?

Acorns is an investment platform that focuses on “spare change” investing. Though not a full-fledged robo-advisor, Acorns offers users the ability to invest their leftover change from purchases into fractional shares of ETFs (exchange traded funds). The idea behind the Acorns platform is that investing should be easy, automated and available to everyone.

There are many account types available at Acorns. Acorns offers an online checking account, with a Visa debit card. They also offer retirement and custodial accounts. All of the Acorns investment accounts invest in low-fee exchange traded funds (ETFs). And, Acorns recently added a Bitcoin cryptocurrency fund, the ProShares Bitcoin Strategy ETF (BITO), for those interested in adding a bitcoin futures fund to their portfolios.

Betterment vs. Acorns — Top Features

Betterment Top Features

- Low fees and no minimum balance requirements for Betterment Digital – $10 to begin investing

- Human advisors available for all clients – for additional fees

- Socially Responsible and Smart Beta portfolios available

- Tax loss harvesting available

- Comprehensive cash management, through program banks

- Crypto currency funds

Sign up with Acorns, and get a $20 bonus!

Acorns Top Features

- Low fees and commission-free ETFs

- Automated investing based off everyday purchases

- Additional accounts available at higher fee tiers, including debit cards, IRAs, and children’s accounts

- Bitcoin ETF

- Acorns Sustainable – ESG portfolio

- Side hustle – jobs service available to earn extra cash

Betterment vs. Acorns — Who Benefits?

Acorns is a great starting place if you don’t have much to invest but would like to make your everyday purchases count. Acorns uses a “round up” feature that rounds your purchases to the nearest dollar, then invests the spare change. You might not get rich quickly this way, but every little bit helps!

Betterment robo investing is better for investors who want a human to talk to. Betterment digital clients can purchase a low cost financial planning package. If you’re looking for many account types and several ESG sustainable portfolios, then Betterment will best meet your needs.

Both of these robo-advisors are good if you don’t want to spend too much in fees. Acorns charges a flat rate of $3 or $5, depending on your chosen plan. Betterment’s 0.25% AUM for their Digital plan, or $4 per month for accounts worth less than $20,000, puts them squarely in line with what other robo-advisors of their caliber are charging. (0.25% AUM management fee applies to small investors with minimum of $250 per month auto deposit)

Either robo will work for the beginner, though Betterment has more features and investment options.

Fees and Minimums

Though these may be very different investment tools, Betterment and Acorns do have one thing in common: they aim to be affordable.

Of course, some robo-advisor do offer free investing; robos like M1 Finance, for instance, offers a myriad of account types for no management fee and a small account balance requirement.

Sign up with Acorns, and get a $20 bonus!

Betterment Fees and Minimums

Betterment Digital

Betterment does not require a minimum balance for Betterment Digital investment accounts- although you’ll need $10 to begin investing.

Digital:

- $4.00 per month for accounts worth less than $20,000

- 0.25% AUM for accounts worth more than $20,000 or with $250 per month auto deposit.

Premium: 0.40% AUM

Crypto:

- 1.0% AUM per month – plus trading fees for Digital clients

- 1.15% AUM – plus trading for Premium clients

Financial Advice Packages

Prices range from $299 to $399 per financial advice package

Cash accounts (through partner banks) do not charge management fees.

Betterment Premium

If you want to open a Premium Betterment account, you’ll have to put up a little more up front: the account minimum is $100,000. Clients will pay 0.40% AUM for Premium accounts.

Acorns Fees and Minimums

There is no minimum investment required for an Acorns account. Investments will be made on your behalf automatically once your round ups reaches $5. Of course, you can always add an auto-deposit regular transfer to build your investment portfolio more rapidly.

Account fees are quite reasonable at Acorns as well. Clients can expect to pay $3 per month for Acorns Personal, which includes an Acorns Portfolio, an IRA, and a checking account. This amounts to an annual fee of only $36.

The fees rise to $5 per month for Acorns Family, which includes everything from Acorns Personal plus “Acorns Early,” which is an investment account for children. This amounts to an annual fee of $60.

Betterment vs. Acorns — Deep Dive

There are many other things that set these two investment options apart, from available help to extra services. Read on to see which robo-advisor might be the best fit for your individual needs.

Betterment vs. Acorns — Human Financial Planners

Of the two, only Betterment offers human financial advisors. Betterment Digital clients can purchase a low cost financial planning package targeted to specific goals like portfolio review, retirement, or college planning. While Premium clients pay an additional 0.15% for unlimited financial advisor access.

Acorns, on the other hand, is truly designed to be an all digital automated investment tool.

Betterment vs. Acorns — Tax-Loss Harvesting

Betterment includes tax-loss harvesting for taxable brokerage accounts in its repertoire. This is unsurprising, as many robo-advisors offer tax-loss harvesting as par for the course. Tax loss harvesting offsets investment gains with losses to lower your total tax bill. This ultimately saves you money and is useful for standard investment accounts, not your IRA.

Acorns does not offer tax-loss harvesting. While this may seem unfortunate, it makes sense: though Acorns can accommodate larger investments, its “found money” model does not position it as a first-choice robo-advisor for wealthier investors. Investors who are adding a few dollars at a time to their account are less likely to need tax-loss harvesting.

Betterment vs. Acorns — Investments

Again, in this category, Betterment has more options. Betterment clients have a variety of choices from Core to three Socially Responsible-ESG, Smart Beta and Crypto portfolios.

Acorns offers a core or a sustainable managed portfolio with three risk tolerance levels in each.

Betterment Investments

- US. Total Stock Market Stocks; Large-, Mid-, and Small-Cap Value Stocks

- International Developed and Emerging Market Stocks

- US. Bonds including: High Quality Bonds; Municipal Bonds; Inflation-Protected Bonds; High-Yield Corporate Bonds; Short-Term Treasury Bonds; Short-Term Investment-Grade Bonds

- International Developed and Emerging Market Bonds

- Socially responsible investment funds

- Income and Smart Beta portfolios

- Crypto portfolios

Acorn Investments

- Large Stocks

- Small-Cap ETFs

- Corporate Bonds

- Government Bonds

- Emerging Markets ETF

- Real Estate

- Bitcoin ETF

Sign up with Acorns, and get a $20 bonus!

Betterment vs Acorns – Performance

Many investors consider returns as a factor in choosing a robo-advisor. But, that might not be as important as you would think, and here’s why.

Betterment, Acorns and many popular robo-advisors strive to match the returns of the overall investment market. This is wise as active portfolio managers rarely beat the returns of a passively managed market-matching portfolio.

Within each robo-advisor portfolio, you’ll have an allocation of low-fee ETFs from various asset classes, such as US stocks, International stocks, corporate bonds, real estate etc. During any one year, one asset class will have better returns than another. But, over time, there is not one asset class that outperforms the other consistently. During certain periods the US Stock market performs exceptionally. While other years you might experience a loss. But historically, the U.S. stock market has returned an average of 9% annually. During some years international stocks have prevailed and even bonds. That’s why it’s important to own a diversified portfolio.

The best performing robo-advisors any year will have greater allocations to outperforming asset classes. It’s unlikely that one winning robo advisor will continue that outperformance over long periods of time.

Another factor when comparing Betterment vs Acorns performance is your asset allocation. Greater allocations to stocks typically yield higher returns as over long periods of time, stocks have outperformed bonds.

You might want to view recent data from Backend Benchmarking, and compare returns of a variety of robo-advisors, including Betterment and Acorns. Just remember that returns will vary, based upon your asset allocation and how various categories of investing are performing.

Betterment vs. Acorns — Which is Best? The Takeaway

From the Deep Dive above, it may seem like Acorns has no chance. Betterment clearly offers a deeper pool of investment options and tools, with its inclusion of human financial advisors (for added fees), tax-loss harvesting, myriad investment strategies and more.

However, it’s important to note that Acorns is not trying to be Betterment. Acorns is quite good at what it set out to do: help investors invest their small change, which will gradually turn into more impressive investment portfolios.

Acorns is a good option if you want an investment platform to get your feet wet. It’s also a nice way to set up an automated investment account for your children for a low fee. Just realize that by adding more money to your account, your capital will grow more quickly. Investing only small change, means it’ll take a long time to build up significant wealth.

Sign up with Acorns, and get a $20 bonus!

Betterment, on the other hand, is the right choice if you’re looking for a full-fledged robo-advisor. Betterment offers more tools, portfolios and features. The platform also gives clients benefits like Socially Responsible Investing and Smart Beta portfolios, which are not available at Acorns.

Overall, two questions remain: Are you hoping to build your portfolio slowly with your forgotten pennies? Or are you looking for an established robo-advisor with more bells and whistles to help you manage a larger portfolio?

Read the Betterment Review

Read the Acorns Review

Sign up with Acorns, and get a $20 bonus!

FAQ

Is Acorns a bad idea?

Who is better than Acorns?

Can you Get Rich Using Acorns?

Check out our FREE robo-advisor comparison chart for ideas.

Betterment vs M1 Finance

Sign up with Acorns, and get a $20 bonus!

More Comparison Articles

- SoFi vs Acorns

- Robinhood vs Betterment vs Acorns

- Wealthfront vs. Acorns

- Betterment vs. SoFi Invest

- Personal Capital vs. Mint Vs. Quicken

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.