JP Morgan Robo Advisor (formerly Chase You Invest Portfolios)

JP Morgan Automated Investing (formerly You Invest) is the robo-advisor offered by the JP Morgan Chase brand. The JP Morgan Chase Automated Investing robo-advisor has replaced the Chase You Invest robo-advisor. You’ll find digital investment management, a $500 minimum investment amount and a 0.35% AUM fee. All the portfolios contain proprietary JP Morgan ETFs. Although you can chat with licensed customer service representatives, this robo advisor doesn’t provide financial planning.

JP Morgan Chase is one of the largest financial brands with nearly $2.5 trillion under management as of December, 2022. The company provides a large stable of banking, lending and investing products.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

In this JP Morgan Automated review you’ll discover the features of JP Morgan Automated Investing Portfolios and find out whether the JP Morgan Chase robo-advisor is right for you.

-

Fees

(3.5)

-

Investment Choices

(3)

-

Ease of Use

(4.5)

-

Tool & Resources

(4.5)

Summary

JP Morgan Automated investing is a digital investment manager from the JP Morgan Chase brand.

Pros

- Access to JP Morgan Chase products and service

- Branch access

- Monday through Saturday phone customer service

Cons

- Only JP Morgan branded ETFs

- No personal financial planners

- High-ish management fees

JP Morgan Automated Investing Robo-Advisor Features at a Glance

| Overview | JP Morgan Chase digital investment manager. |

| Minimum Investment Amount | $500 |

| Fee Structure | 0.35% AUM, charged quarterly. |

| Top Features | Core portfolio. Glidepath Portfolio for those investing for retirement. |

| Free Services | Wealth Plan - Digital budgeting and financial planning tool. |

| Contact & Investing Advice | Monday - Saturday phone customer service. Representatives are credentialed investment advisors. |

| Investment Funds | JP Morgan ETFs |

| Accounts Available | Individual and joint brokerage accounts. Traditional, Roth and Rollover IRAs. |

What is JP Morgan Automated Investing?

The JP Morgan Chase Robo Advisor is a digital investment manager, monitored by a team of JP Morgan investing specialists. This investment manager offers a way to grow your wealth for retirement, build up cash for a home down payment or any future goal. The JP Morgan robo automated investment advisor is priced higher than competitors like Schwab and Fidelity Go with a 0.35% AUM expense ratio. The $500 is a low-ish minimum investment amount although SoFi and M1 Finance get you investing for less.

So, is investing with JP Morgan Automated Investing good?

If you’re looking for a robo-advisor backed by a solid financial institution, then it’s worth a look.

As is customary with robo-advisors, you’re presented with a short questionnaire that assesses you financial goals, time horizon and risk tolerance. We like that you can take the financial goals and risk quiz and review all of the investment portfolio choices before signing up.

However, the JPMorgan robo-advisor is limited in terms of fees, investment choices and add on services. You’ll need to look elsewhere if you want a robo-advisor with the lowest management fees. M1 Finance, Schwab and SoFi Invest all offer robo-advisors with zero management fees.

Lowest Fee Robo-Advisors

What Differentiates the JP Morgan Robo-Advisor from Competitors?

JP Morgan Automated Investing is backed by the huge JP Morgan Chase brand, which spans global investment markets and many banking, investing, investment management and lending products. This makes it different from the many standalone robo-advisors on the market and places it in the camp with large financial firms with robo advisors like Schwab Intelligent Advisors, Fidelity Go and Merrill Guided Investing.

Robos like Betterment and Ellevest do not have the same institutional backing as JPMorgan; as such, Automated Investing clients have the option to visit a Chase brick and mortar branch for assistance while Betterment clients will need to stick to virtual customer service. Additionally, if you want all of your financial transactions under one roof, you might consider the JP Morgan Automated Investing robo-advisor.

Visit the Robo-Advisor Wizard, answer four questions and find out which robo is best for you.

Who Benefits from the JP Morgan Automated Investing Platform?

Current Chase or JP Morgan customers might appreciate the ability to keep all of their products under one roof. Of course, Automated Investing is available to non-customers as well. By opening an account, you will gain access to the JPMorgan Chase family.

JPMorgan Chase offers these financial services:

- Checking and Savings Accounts

- Credit Cards

- Mortgage and Car Loans

- Investing options for do-it-yourselfers and those seeking managed accounts

The JP Morgan Automated Investing robo-advisor might be beneficial for existing Chase and JP Morgan customers looking for digital investment management, access to the JPMorgan Chase family of products and services, and Monday through Saturday customer service. Although, we prefer Wealthfront’s all-digital platform, which also offers hundreds of ETFs for portfolio customization options.

Bonus: FREE Portfolio Management Software

How Does the JP Morgan Automated Investment Work for Robo Investors?

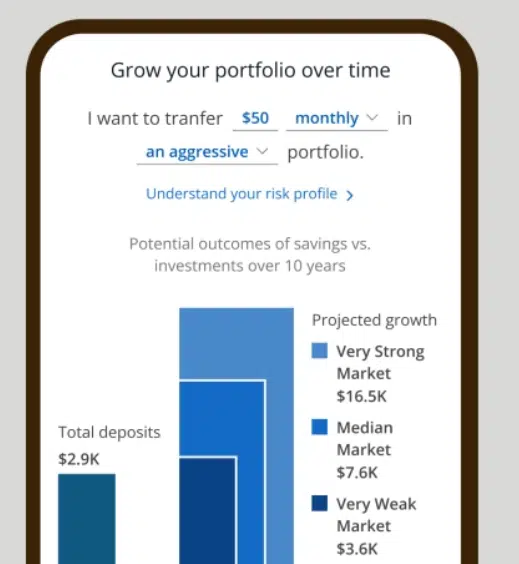

Using robo-advisor algorithms or computerized investment programs, the platform provides recommended portfolios, based upon the answers to the initial questionnaire and calculates your chances for reaching your target goals.

Investors are directed into two broad categories of Investment portfolios:

- Portfolio – Core diversified investment portfolio comprised of JP Morgan ETFs in four asset allocations, depending upon your risk tolerance: Conservative, Moderate, Growth and Aggressive.

- Glidepath – Designed for those saving for retirement. The Glidepath portfolio changes the asset allocation as the retirement date approaches, becoming more conservative over time. This Glidepath portfolio choice is similar to a target date fund.

Before signing up, you can take the financial goals and risk tolerance quiz and view the portfolios and specific funds within them. Clients can change their specific portfolio if they so desire.

Bonus: Best Investments During a Stock Market Crash

Fees and Minimums

Investors can open an account with a $500 minimum investment.

The management fee is 0.35% AUM in account management fees, charged quarterly.

With these fees, a client whose account is valued at $100,000 can expect to pay just over $29 per month in account management fees.

JP Morgan Robo-Advisor Investments

Portfolio Asset Allocation

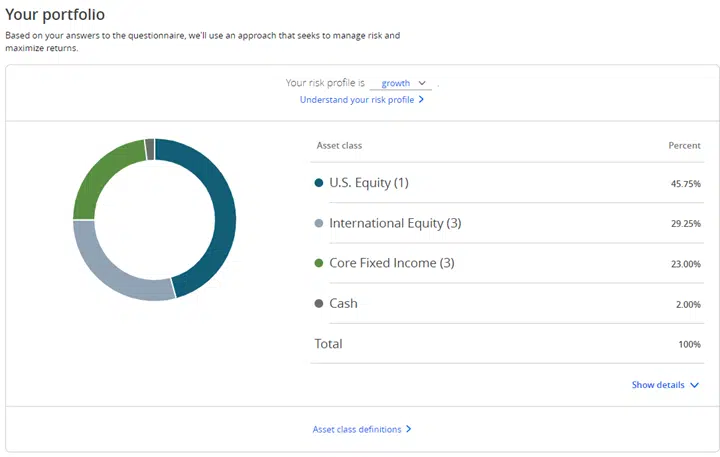

The four risk tolerance level Portfolios include the following percentages of stocks vs fixed income assets:

- Conservative portfolios: approximately 75% fixed income and cash/25% US and international equities

- Moderate portfolios: approximately 50% fixed income and cash/50% US and international equities

- Growth portfolios: approximately 25% fixed income and cash/75% US and international equities

- Aggressive portfolios: approximately 10% fixed income and cash/90% US and international equities

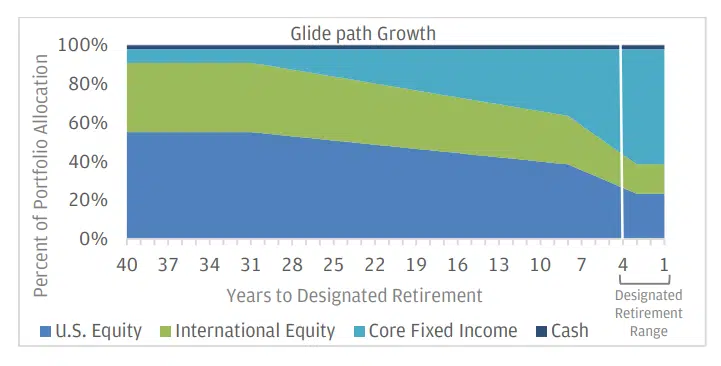

Glidepath Portfolio Asset Allocation

For those clients investing for retirement, here’s how the Growth asset allocation glidepath will evolve:

The Glidepath portfolios are also designed to accommodate the four risk levels.

Investment Funds

These are the basic funds used to construct the porfolios. Depending upon your risk tolerance, you’ll receive varying percentages of each fund.

- JPMorgan BetaBuilders U.S. Equity ETF (BBUS)

- JPMorgan Diversified Return Emerging Markets Equity ETF (JEMA)

- JPMorgan BetaBuilders International Equity ETF (BBIN)

- JPMorgan BetaBuilders Canada ETF (BBCA)

- JPMorgan BetaBuilders 1-5 Year U.S. Aggregate Bond ETF (BBSA)

- JPMorgan U.S. Aggregate Bond ETF (JAGG)

- JPMorgan Core Plus Bond ETF (JCPB)

These portfolios come with the benefit of professional monitoring and periodic rebalancing to keep your investments in line with your financial goals.

Is JP Morgan Robo-Advisor FDIC Insured?

JP Morgan Automated Investing is not FDIC insured. The Federal Deposit Insurance corporation (FDIC) insures cash held in a savings or checking account at a bank, should the bank fail. The reason that You Invest Chase isn’t FDIC insured is because it is not a savings account.

Investment accounts are likely to fluctuate in value, and losses are to be expected at some point over the life of the investment account. Investments will be insured by the Securities Investor Protection Corporation (SIPC) up to $500,000.

The Securities Investor Protection Corporation protects investors should their financial firm go bankrupt. The SIPC also protects the cash and securities held within your Chase You Invest accounts up to $500,000.

Customer Support

Customer support is available to You Invest clients Monday through Friday from 8:00 am to 9:00 pm and Saturday from 9:00 am to 5:00 pm ET.

Additionally, since You Invest is part of JPMorgan Chase, clients also have the option to visit a Chase bank branch to discuss investment products. All customer service representatives are licensed with at least a Series 7 Investment Advisor designation. This means that they can answer financial and investment related questions, but not provide personal financial planning.

JP Morgan Wealth Plan

Called a Digital Money Coach, this added feature is a useful computerized financial planner. With the Wealth Plan, you can budget, set goals, save and invest. By linking external accounts you get a 360 degree of your total finances in one dashboard. The goal tracking helps monitor whether you’re on track to meet your financial goals. The tool offers prompts and suggestions to help you meet your future goals and dreams.

JP Morgan Automated Investing – Pros and Cons

Pros

- Glidepath and Core Portfolios

- Connection to a large financial institution

- In-person branch support available

- Large investor education section on the site

- Monday through Saturday phone access.

Cons

- The investment minimum of $500 may be too high for beginning investors. Many low minimum robo-advisors are available.

- The Portfolios only invest in the JPMorgan ETFs. We believe this is a big negative, as there are many excellent and lower fee ETFs available.

- The management fees are in the upper-middle range of robo-advisors. Here’s a list of robo-advisor fees from lowest to highest.

- In a robo-advisor comparison, there are other robo-advisors with more features, such as tax-loss harvesting, access to human financial advisors, active investment choices, and more diverse ETF choices.

JP Morgan Robo Advisor – Wrap Up

Is investing with Chase good?

Well, it depends.

The investment Portfolios give investors the support of a professionally created robo-advisor, but that’s typically available at basically all robo advisors. The Glidepath Portfolio is unique, yet you can also get that for a lower fee with a typical target date ETF or mutual funds. There’s not a lot to set this platform apart.

If you’re looking for a robo-advisor that’s part of a larger financial institution, Schwab Intelligent Portfolios offers free investment management and so does Fidelity Go, for accounts worth up to $25,000. While SoFi Automated Investing provides half hour financial planner appointments and no investment management fee.

All in all, if you’re an existing customer and want to keep all of your finances under one roof, JP Morgan Automated Investing might be worth checking out.

Visit JP Morgan Automated Investing Website

Related

- Personal Capital vs. Betterment Robo-Advisor Comparison

- Wealthfront vs. Vanguard – Which Robo-Advisor is Best for You?

- Betterment vs. Ellevest Comparison

- Titan Invest App – Hedge-fund Portfolio

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

Sources

- https://am.jpmorgan.com/us/en/asset-management/institutional/about-us/

- https://www.chase.com/personal/investments/online-investing/faqs/portfolios

- https://static.chasecdn.com/content/dam/legal-agreements/library/en/dwm_yip_wrap_fee_prog_la/versions/dwm_yip_wrap_fee_prog_la.pdf

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.