Clarity Money Review – Clarity Money Alternatives

Another financial app – bites the dust. Now that clarity is no more, consider checking out Quicken vs Personal Capital. These are two money management apps might replace Clarity Money. Or you might like our lists of best investing and money apps:

Clarity Money has been making waves since it first hit the market. In its first week, 40,000 users downloaded the Clarity Money app. In the beta test, Clarity Money saved users an average of $300 per year by slashing wasteful spending.

According to the BusinessWire press release, which was published one week after Clarity Money’s launch, the Clarity Money app analyzed $5 billion in transactions and saved users over $300,000 in cancelled subscriptions in its first month alone.

A lot has changed since its January 2017 launch, however. One of their biggest moves yet came in early 2019, when Goldman Sachs acquired the app. This means a few changes for users, including more available products.

This Clarity Money Review delves into what’s great about Clarity Money, and what’s not.

[toc]

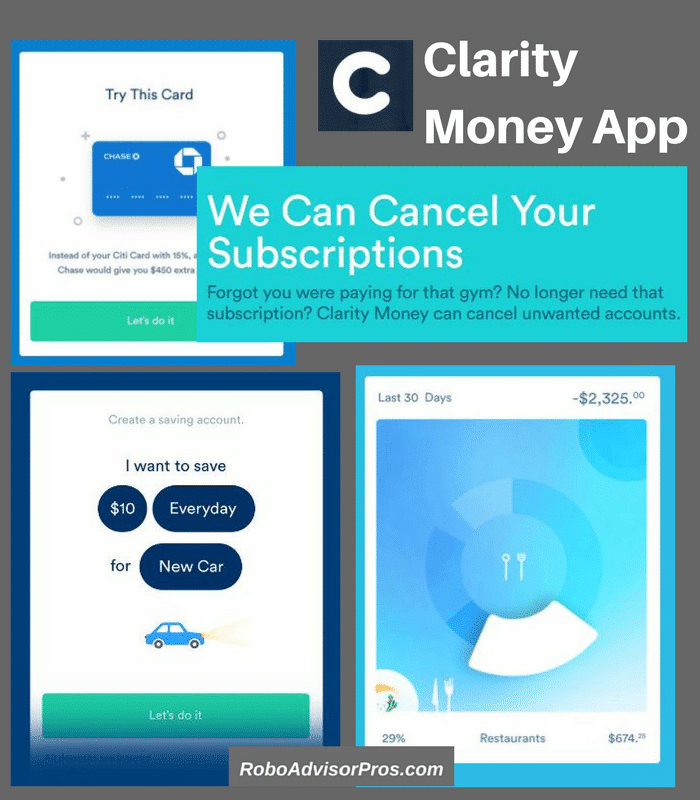

Clarity Money is designed to be your financial advocate. Founded by Adam Dell, the company wants to help solve the financial literacy crisis. Although not a typical robo-advisor, it will analyze your spending, give you big=picture overviews of your spending habits, make suggestions for reducing recurring spending, and even help you to cancel accounts.

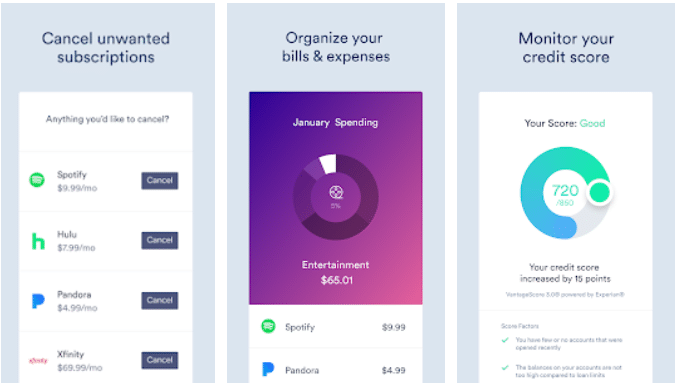

Additionally, through the Goldman Sachs acquisition, clients will also have access to higher-yield savings accounts—as of December 2019, savings accounts rates were 1.70%.

Clarity Money stands out as an attractive budget management and planning option for smartphone users looking for easy control over their financial lives. I signed up for Clarity Money in under 5 minutes and linked my main credit card, put in my income and had useful data. Next, I’ll link my bank account and see what I can save!

What is Clarity Money?

Clarity Money is like having a personal banker in your pocket. This app, which is available for both iOS and Android devices, is an all-in-one answer to any financial question you have. From savings accounts to unwanted monthly payments, Clarity Money is there to help you get started.

Clarity Money is free to use, though they note that users may still get charged for overdrawing or exceeding transaction limits for connected, third-party accounts.

Partnership Between Clarity Money and Acorns

Since Clarity Money is not a traditional robo-advisor and does not give investment advice, users will need to look elsewhere for this sort of financial support. That being said, Clarity Money does make it easy for customers to use Acorns’ automated investing features. Acorns investors are then able to see a snapshot of their investing activity in the Clarity Money app.

Go directly to the Acorns site.

This is one of our favorite features of this Clarity app review. Although cutting spending is very important, it won’t get you all the way to financial security. To build wealth long term, you need to invest. If you’re just starting out, linking your Acorns account with your Clarity Money App is a smart way to start saving and investing.

Partnering up creates benefits for both Clarity Money and Acorns users. If this arrangement can get more people investing and saving money, then it’s a great thing!

However, the Acorns app is only a basic investment tool. Users who are hoping for more sophisticated robo-advisor offerings in connection with budgeting and spending management might want to consider a robo-advisor like Betterment or Wealthfront.

Is Clarity Money Safe?

You can be confident that the Clarity App is safe. The company employs multi-level safeguards to protect your data. Data is transmitted encrypted with Transport Layer Security (TLX) 1.2 and sensitive information is stored encrypted. When signing in from a new device or browser you’ll typically need to provide additional verification details.

Is Clarity money safe for each type of app?:

- Clarity Money app iOS – To open the app you’ll need a passcode, touch ID and face ID authentication.

- Clarity Money app android – To open the app you’ll need a PIN and fingerprint authenitication.

For help choosing a digital investement manager, visit our Robo-Advisor Selection Wizard.

What are the Top Clarity Money App Features?

The free Clarity Money app is very similar to money-management apps like Mint, though many of their features are less customizable. Clarity Money accesses your financial accounts to analyze your spending and keep track of recurring bills you can either eliminate or reduce. The app even offers savings accounts with higher interest rates than brick-and-mortar banks.

- Savings accounts. Clarity Money offers high-yield savings accounts through Marcus by Goldman Sachs. These savings accounts have no minimum balance and no fees. Additionally, users can set up recurring deposits to their Marcus savings accounts.

- Monthly subscription cancellation. This is one of the app’s most appreciated features. Clarity Money can actually cancel your gym membership! No more excuses about not having enough time to cancel – now you can eliminate unnecessary costs quickly and easily.

- Spending tracker. No good budgeting app would be complete without a way to see where you spend your money. Clarity Money gives you percentage breakdowns of your spending categories, and keeps you on track with your budget.

- Support team. There is a built-in chat feature that allows users to chat with a support team any time. This feature can be used for troubleshooting, or to figure out how to make Clarity Money meet your unique financial needs.

- Clarity Money App – Loans. Yes, you can even get a home improvement loan through Clarity Money. Since the app is designed with your best interests in mind, Clarity Money draws on its connections with high profile lenders to help you score a low-interest loan.

Bonus: 6 Best Portfolio Management Software Tools for Investors

Pros and Cons of Clarity Money App

Clarity Money Pros

The positive aspects of Clarity Money are numerous. The fantastic free features speak for themselves. Each one can help people pay better attention to their finances, and, if used frequently, can drastically improve one’s financial health.

The wide spread of options also means that the service you need is available immediately. No more searching around for another app or financial professional to help you.

Ease of use is another benefit to using Clarity Money. Everything is on the go these days, and your finances shouldn’t be the exception to that rule. When your savings accounts, spending habits, and debt information are all accessible in one place, you are more likely to make smart financial decisions instead of spur-of-the-moment purchases.

The app saves you a lot of time in terms of identifying and cancelling unnecessary recurring bills.

Bonus: Top Money and Investing Apps

Clarity Money Cons

Of course there are limitations to the app.

If you’re looking for a free investment or robo-advisor, you’ll do better with Personal Capital’s free financial management tool or M1 Finance free robo-advisor. Many users have noticed that Clarity Money offers only a brief overview of monthly spending. Users cannot currently customize their transactions and budgeting to the level of a more complex app like Mint.

Clarity Money does offer customer support teams, but the human touch is largely absent. That may not be a problem for most people, particularly those who are used to virtual banking, but it may certainly be a stumbling block when looking for specific financial advice. In this case, you would need to branch out and find a robo-advisor or a human financial planner.

Clarilty Money App – Wrap Up

In sum, Clarity Money promises to be a useful, engaging app, that is quite competitive compared to others that offer similar (and often fewer!) services. The all-in-one, portable approach to finances meets the needs of everyday people, from entrepreneurs to CEOs alike. By putting all of your finances in the palm of your hand, Clarity Money is providing people with a tool to meet their financial goals quickly, effectively, and easily.

To sign up visit the Marcus Clarity Money App.

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.