Ellevest Membership delivers accessible, personalized digital money management, financial coaching and education, starting at $5 per month.

You’ll get a personalized investment portfolio with no minimum investment amount required!

Financial coaching sessions, with Certified Financial Planners, are available a la carte for reduced fees!

The learning resources, including on demand email courses, live workshops, and progress reports to keep you on track are free for members.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

If you were on the fence about investing before, there is nothing to stop you now.

This Ellevest Review will evaluate the Ellevest membership site including coaching and a wealth of financial planning and money management options. You’ll have all the information in this Ellevest Review to decide if this robo-advisor is for you.

Ellevest Review

Name: Ellevest Review - Robo-Advisor for Women

Description: Ellevest is designed with women's lifespan, work history and needs in mind.

-

Fees

(4.75)

-

Investment Choices

(4.75)

-

Ease of Use

(5)

-

Tool & Resources

(5)

Summary

Best for:

- Women

- Fee-conscious investors

- Investors that might need financial advisors or career consultants

Pros

- Diversified investments

- Low subscription pricing

- Socially responsible investing available

Cons

- No tax-loss harvesting

- No week-end customer service

What is the Ellevest Robo-Advisor?

Ellevest – Where Women Money. That’s the whole point of Ellevest. It’s a robo advisor investment platform and money membership site designed specifically for women. You might be surprised to find out that, women’s investment returns typically trump those of men!

Investing is scary, and this Ellevest Review will answer the question ‘What is Ellevest?’, discuss Ellevest pricing, explain the Ellevest investments, and arm you with all the information you need to decide if Ellevest is worth it for you.

Ellevest was co-founded by CEO, Sallie Krawcheck, and tech entrepreneur, Charlie Kroll.

Sallie realized the investing industry has been “by men, for men” — and has historically kept women from achieving their financial goals. She’s made it her life’s mission to empower women financially and get them to invest for their biggest goals.

Sallie previously held positions with Merrill Lynch, Smith Barney and Citi Private as CEO, and was called “The Last Honest Analyst” by Fortune Magazine and one of Fast Company’s “Most Creative People in Business.” Ellevest was conceived and designed with their clients in mind, not just for them. They worked with real women on what investment guidance need — and created Ellevest together.

Ellevest Robo Advising Features at a Glance

How Does Ellevest Work?

What Differentiates Ellevest Robo Investing From Competitors?

Ellevest uses different methodologies than other investment managers.

If you’ve ever seen those impressive looking investment projections that will turn you into a millionaire in 20 or 30 years, but doubted their reliability, you’ll appreciate how Ellevest calculates these – with a healthy dose of real world cynicism. After all, you’re not likely to earn 10% (or more) on your money each and every year over that time frame when predictable events are cutting into that return.

Ellevest accounts for realities such as taxes and fees, down markets, and other factors, and builds layers of conservatism into their projections.

For example, Ellevest:

- Includes more poor market scenarios that are consistent with prior investment market performance. Ellevest portfolios recognize the major market reversals that began in 1987, 2000 and 2007. Recognizing poor market situations can lead to more realistic performance projections.

- Accounts for real world realities such as taxes, fees, and inflation. Typical investment projections seldom account for these realities, making projections overly optimistic.

- Accounts for the sequence and magnitude of investment returns, known as compounding (averages published in the press aren’t usually compounded.)

All of these acknowledgements can lead to more accurate investment results than is frequently presented by other investment funds.

And as is the case with most investment platforms today, Ellevest does rely on Modern Portfolio Theory (MPT). MPT is the theory that it’s possible to maximize expected returns for a given level of risk in a portfolio by selecting the right mix of investment assets.

Take a quick goals and risk quiz. Choose from a Core or Sustainable investment portfolio and you’re ready to transfer your money in to start investing.

Ellevest uses a goals-based investment approach:

The goals based approach considers your timeline, savings and risk tolerance to help you understand what it takes to achieve your dreams.

Sample goals include:

- Retirement

- Emergencies

- Build Wealth

- Home Down Payment (using Zillow data)

- My Business

- Kids

Plus Members can invest in one build wealth goal. Executive members can invest for multiple goals.

Ellevest Review – Who Benefits from the Women-Focused Advisor Robo?

In a word – women!

According to a recent study by Strategy Marketing, 85% of advisors are men.

Ellevest is specifically designed with you in mind. That means that the apparently “gender-neutral” investment industry is tailored primarily to men’s salaries, career paths, preferences, and lifespans.

“By age 41, college-educated women see their salaries peak at about $61,000. Meanwhile, men continue seeing increases up until age 53, at which point they’re earning about $95,000,” Payscale survey, reported at CNBC.com

Clearly, women’s lifetime income is lower than that of their male counterparts.

What’s more, a woman can expect to live to age 81, according to womenshealth.gov. up to five years longer than a man on average. That means that a woman must provide for a longer retirement, but do so with less money.

Ellevest is looking to balance the scales.

Ellevest is committed to:

- Getting you to your financial goals.

- Helping you understand life’s financial tradeoffs.

- Prioritizing your investment goals with you.

- Planning the best life possible for “future you”.

- Giving you tools to take control.

Ellevest Review Features – Drill Down

- Customized portfolios — Ellevest has hundreds of unique portfolios, that are tailored to women’s specific goals and timelines.

- Holistic investing — When you first sign up with Ellevest they ask you to provide information on other investment accounts that you have. This enables Ellevest to build your portfolios while being fully aware of your entire investment situation. (We love this feature!)

- Compatibility with Mint.com — eSign in on the Ellevest Dashboard and you can view your account on Mint.com.

- Guidance and advice – Ellevest offers fee-for service access to Certified Financial Planners. This is available to non members at retail price or members at a 30-50% discount. The pricing ties vary per plan. We like this because you only pay for the amount of guidance that you need. Perfect for life events planning too!

- Ongoing management and alerts — Ellevest monitors your portfolio daily, and rebalances if needed. If you fall off track, they email you and give you a “heads-up” to let you know what to do to get back on course.

- Account custodian – Folio Investing is the broker/dealer and custodian for your Ellevest account. Folio is an SEC-registered broker/dealer and custodian. As the custodian, Folio safeguards the securities and cash in your account.

- Email, text and Phone Support — Available during regular business hours.

- Account protection — Your account is protected from broker failure though Folio, which is a member of the Securities Investor Protection Corporation (SIPC). That means that up to $500,000 in cash and securities, including up to $250,000 in cash, are protected. Wondering if Ellevest is FDIC insured? FDIC insurance is for cash in a bank account. Since sunsetting the Ellevest bank vertical, FDIC insurance doesn’t apply.

- Automatic deposits – You can set these up by connecting your bank account to your Ellevest account.

- Ellevest Magazine – We like the wealth of educational resources to help with money, life, and career planning.

Ellevest Investing

Ellevest’s computer algorithms are designed with a carefully considered mix of stock, bond and alternative funds. The highly diversified portfolios are designed to help reduce your portfolio’s risk.

Here are the steps Ellevest takes to construct your personalized investment portfolio:

- Design an asset mix or allocation that fits with your risk level, goals, and timeline

- Choose investments

- Forecast likelihood of reaching goals – with Monte Carlo simulations

- Ongoing portfolio management

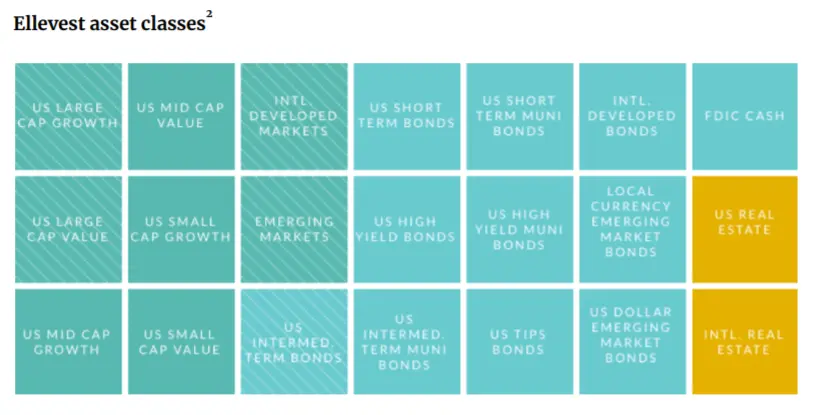

Unlike many competitors, Ellevest uses up to 21 different asset classes across the goal-based portfolios. Their widely diversified portfolios include global real estate funds, inflation protected securities and other unique asset classes.

For investors interested in an in depth explanation of the Ellevest investment methodology, check out the this white paper which is written by Sylvia S. Kwan, Phd, CFA, chief investment officer.

With an investment of just $150 per month, here’s how your investment dollars might grow, when compared with simply leaving the money in a low interest rate bank account. (This is for reference only and was created based on specific inputs. Your returns may differ, depending upon future returns and assets.)

Investment Mix

Ellevest uses low cost index-based exchange traded funds (ETFs) in the construction of portfolios. They invest in 21 different asset classes, with one ETF for each class.

Following are the 21 asset classes, and their representative ETFs.

Funds

| Stock Funds | Bond Funds | Other Investment Funds |

|---|---|---|

| US Large Cap Value (VTW) | US Total Bond (BND) | FDIC Cash (FDIC CASH) |

| US Mid Cap (VO) | US Short Term Bond (BSV) | US REIT - Real Estate Fund (VNQ) |

| US Mid Cap Value (VOE) | High Yield Bond (JNK) | International REIT - Real Estate Fund (VNQI) |

| US Small Cap (VB) | US Municipal Bond (VTEB) | |

| US Small Cap Value (VBR) | US Short Term Municpal Bond (SHM) | |

| International Developed markets (VEA) | US High Yield Municipal Bond (HYD) | |

| International Emerging Markets (VWO) | US TIPS (treasury inflation protected) Bond (SCHP) | |

| International Total Bond (BNDX) | ||

| US Dollar Emerging Market Bond (EMB) | ||

| Local Currency Emerging Markets Bonds (EMLC) |

Impact Investing

Today’s investor strives to invest with their values while earning competitive investment returns.

The Ellevest impact investing impact portfolios invest in:

- Companies with women in leadership

- Companies with higher standards for sustainability and ethical practices.

- Companies that provide loans to support community services, women-owned businesses, and those in need.

Fees and Membership Levels

What Does Ellevest Pricing Include?

All members have access to Investment management with core or impact portfolio, Learning and Discounted Financial Coaching.

Investing

- Ellevest creates and manages a personalized investment portfolio for you. You can change it at any time.

- The computerized algorithm takes into account women’s financial realities such as pay gaps, career breaks, and longer lifespans.

Learning

- This is another place where Ellevest shines.

- Your membership entitles you to unlimited access to online workshops, email courses and videos from financial planners and career coaches.

- Learning topics include career, money, and investing choices.

Coaching and Financial Planning Access

- All members have access to discounted sessions with career coaches and certified financial planners.

- Ellevest offers individual and small group coaching sessions.

- Ongoing, annual financial coaching packages are available.

Retirement Planning

- Advice about how much to save to meet your retirement goals.

- Receive a personalized investment plan that includes all of your accounts, not just those managed by Ellevest.

Multi-Goal Investing

- Executive Plan members have access to multiple goals.

- You get up to six customized investment accounts for each of your money goals.

- With each goal you get a forecast and information about how changes affect the achievement of all your goals.

What is the Investment Minimum?

There is no minimum to become a member.

Although there may be a small minimum amount before your funds will be invested in a diversified portfolio. These amounts will range from $1 to $240.

Tax Minimization

Unlike some robo-advisor competitors, Ellevest doesn’t offer tax-loss harvesting. But they construct and manage portfolios with tax efficiency in mind. We don’t think this is a huge drawback. But, if you’re set on a robo advisor with tax loss harvesting, then Ellevest probably isn’t for you.

Private Wealth Management

For wealthier clients, with a minimum of $1 million, Ellevest offers private wealth management and a dedicated financial advisor. The services are designed for wealthier investors with more complex financial needs.

Women with stock options or high tax bills profit from targeted private wealth management.

Fees vary depending upon which services are selected.

Ellevest Mobile App

Ellevest offers both and android and iOS app. The comments were generally favorable regarding the app and excellent scores for both android and apple devices. These scores are quite good and it’s obvious the company has put a lot of work into the app. Developers respond promptly to user comments.

It’s easy to get started with the app and every step is explained in easy-to-understand language. You can use it to help with goal setting, saving and investing.

Sign up

Investing Set Up

The Ellevest sign-up is easy with a simple online process:

- Answer a few questions about your goals, time horizon and risk tolerance level.

- Choose your portfolio; Core or Impact.

- Get your financial plan – you can adjust your time horizon, one time deposits, recurring deposits, risk level or choose to invest for impact.

- Set up the financial transfer.

- Start Investing.

Your portfolio set up is complete and Ellevest manages it and will send you monthly progress reports.

FAQ

What goes into your Ellevest goals?

To calculate your best portfolio Ellevest asks about your age, salary, education, current account balances and what goals you wish to accomplish, and when.

Is Ellevest a good company?

Ellevest has received funding from Melinda Gates, Elaine Wynn (Co-founder of Wynn Resorts), Eric Schmidt (former executive chairman of Google, Valerie Jarrett, Mastercard and other. There are many smart and successful people backing Ellevest.

Can I put a 401k into Ellevest?

Ellevest Review – Pros and Cons

Advantages

- Women-centric investing, specifically taking into account the unique investment needs and challenges of women.

- Subscription pricing is reasonable at all levels.

- The discounted financial advisor access is affordably priced.

- Ellevest looks at all of your financial accounts, not just the ones that they manage. This creates more accurate investment management.

- No minimum account balance. This is perfect for new and small investors. Once your account is opened, you can fund it with automatic deposits.

- In addition to stocks and bonds, Ellevest also invests in US and International real estate. This provides a higher level of diversification than most investment platforms offer.

- Unique opportunity to view your Ellevest account through Mint.com.

- Eduicational resources go above and beyond.

Disadvantages

- Customer service is available only during regular business hours. No weekend or after-hours availability.

- Their tax minimization methodology is not a strict tax-loss harvesting feature. For investors seeking specific tax-loss harvesting, this could be a negative feature.

Ellevest Robo-Advisor Review Wrap Up

If you’re wondering if Ellevest is worth it? Our answer is yes.

The new lower subscription pricing model is very competitive. We hope that they keep it at this level! If you have greater assets, the fee as a percentage of your assets can be very low.

Ellevest raised venture capital dollars, ensuring that it’ll be around for awhile. Included among the Ellevest investors are the prestigious Morningstar investment research company along with former Commerce Secretary Penny Pritzker’s PSP Capital, Rethink Impact and others.

Finally, there aren’t many investment platforms available that are designed specifically for women. Ellevest does this by recognizing the gender pay gap, longer lifespans and specific goals that female investors have.

This will make it easier for women to establish and fund investment portfolios for specific needs.

Since Ellevest has no required minimum initial investment or account balance, it favors new and small investors. Since this describes the investment profile of many women, who may be totally new to investing, the lack of a minimum balance requirement is a major plus.

But, women with greater assets will also be well served by Ellevest. They also have a private wealth offering for those looking to invest $1 million or more

The fact that Ellevest is conservative with their investment projections makes them more realistic, and therefore more valuable for planning purposes.

Though Ellevest has been designed specifically for women, it’s a platform that men might want to take a look at as well, for all of the same reasons that will appeal to women. And with the low membership fee structure, it’s a solid competitor to Betterment and Wealthfront.

Related

- Betterment vs Ellevest

- Wealthfront Review

- Ally Invest Managed Portfolios Review

- M1 Finance Roth IRA Review

- Morgan Stanley Access Investing Review

- Chase You Invest Return

- Webull Smart Advisor Review

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

Sources

- http://production.assets.ellevest.com/documents/Ellevest-White-Paper.pdf

- https://www.cnbc.com/2018/11/02/the-age-at-which-youll-earn-the-most-money-in-your-career.html

- https://www.womenshealth.gov/30-achievements/

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.