Fidelity Robo-Advisor Review by Professional Investor

Fidelity Go is an online, automated investment platform, commonly known as a robo-advisor. It is the robo-advisor arm of Fidelity Investments. Fidelity Investments is one of the largest investment brokerage firms in the world, offering brokerage services, a large family of mutual funds, retirement services, wealth management and life insurance.

“Fidelity recently dropped it’s minimum investment amount and eliminated management fees for accounts worth less than $25,000. All former Fidelity Personalized Planning and Advice customers will be transferred to Fidelity Go. Other updates include:

-Fee free investment management for all accounts worth less than $25,000

-New, lower fee structure for hybrid robo investing and human advisory investment management of 0.35% of assets under management (AUM). This places Fidelity head to head with the Vanguard Personalized Planning hybrid robo advisor.

-All accounts valued at more than $25,000 AUM have access to financial coaches and planning.

In addition the other services that the firm offers, the Fidelity Go robo-advisor provides free professional investment management for accounts valued up to $25,000 and a low 0.35% AUM for accounts greater than $25,000. Those with account values above $25,000 have access to licensed Financial coaches and advisors for personalized advice.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Fidelity Go Review

-

Fees

(4.25)

-

Investment Choices

(4.5)

-

Ease of Use

(4.75)

-

Tool & Resources

(4.5)

Summary

Fidelity Go robo-advisor is a basic digital investment manager with financial advisor access for wealthier investors. Best for:

- New, small investors

- Existing Fidelity customers

Pros

- First $25,000 managed for free

- Part of the Fidelity fund family

- Fee-free investment funds

Cons

- Fidelity Go lacks a wide range of investment choices

- Few account types for Fidelity Go users

What is Fidelity Go?

The Fidelity robo-advisor is designed for investors who prefer to have their money professionally managed, without high fees.

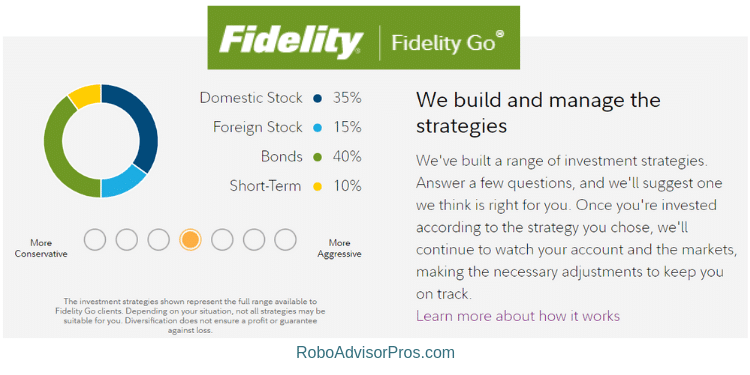

You complete a questionnaire that forms the basis of your portfolio allocation, and then the platform handles all the investment management for you. The management is guided by experts and implemented with technology.

You don’t need a minimum initial account deposit in order to create an account, although you will need to transfer in at least $10 to begin investing. The investment portfolios are based upon your answers to the questionnaire and your money is invested in fee-free diversified Fidelity Flex mutual funds, in an asset allocation that aligns with your financial goals, age and time horizon.

How Does Fidelity Go Work?

The sign up couldn’t be easier. Simply answer a few questions about your age, income, financial goals, account type and your risk level. Then Fidelity comes up with a a diversified investment portfolio based on your responses. You can even take the questionnaire and view potential investments before signing up and funding an account. Your account can be created for a particular goal, like retirement or college for junior. One drawback to Fidelity Go is that if you’re investing for several goals, you need to create multiple accounts – one for each goal.

The Fidelity Go team chooses your investments, monitors the investment markets and keeps your strategy on track. All of the funds are invested in diversified Fidelity Flex mutual funds, which do not have any expense ratios. This will save you an average of 0.05% to 0.13% in overall expenses and works to offset the 0.35% management fee for accounts worth more than $25,000.

Fidelity Go is appropriate if you’re looking for a low advisory fee investment manager that creates an investment portfolio, manages and updates your investments for you. If you’re an existing Fidelity customer, it’s worth a look.

Although if you’re seeking low fee investment management you might consider these robo-advisors.

Lowest Fee Robo-Advisors

Fidelity Managed Accounts

Fidelity Go Robo-Advisor Review – Features at a Glance

Who is Fidelity Go Best For?

Existing Fidelity customers seeking free to low cost investment management will find a basic service. Beginners can invest with ten bucks and receive fee-free management until their account value reaches $25,000. This places Fidelity Go among the lowest fee robo advisors for beginners.

Current Fidelity customers can use the platform’s comprehensive suite of investment tools and have a portion of their money in a passively managed index fund portfolio.

For investors seeking digital investment managers with broad customization, the chance to choose ETFs or add in crypto, then you might prefer Wealthfront. Likewise if you’re looking for a robo platform with access to multiple goals, then Betterment might be better for you.

In this way, Fidelity Go isn’t just managing your investments. They are also providing you with overview strategies that might help you to reach your investment goals.

Fidelity Go Robo-Advisor Features

Sign up Process and User Experience

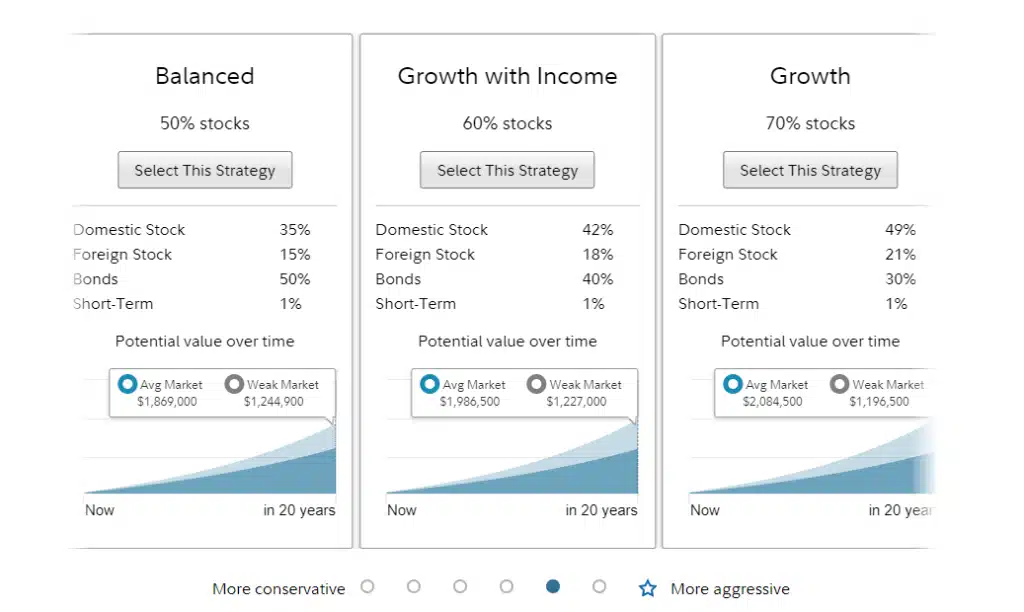

Answer several questions that cover your age, when you’ll need the money, whether the account will be for retirement or another goal and your risk tolerance level.

Next, you’re presented with your recommended investment portfolio.

The analysis includes the future investment value of your portfolio, in an average market. You can also view expected value during best and worst case scenarios.

We don’t like that Fidelity Go lacks some of the diversification found on other platforms, like real estate, international bond funds, commodities and more. We prefer more diversification, although many investors are okay with just the basics, and only the future will determine if greater diversification will benefit returns.

You can adjust your risk tolerance if you’re too heavily weighted towards stock funds (riskier) or over-weighted in bond investments (more conservative).

The platform is easy to test drive, before signing up. Customers can view their portfolio holdings and progress with the click of a button. Every customer with more than $25,000 in their account can schedule 30 minute financial coaching and advice sessions with licensed advisors.

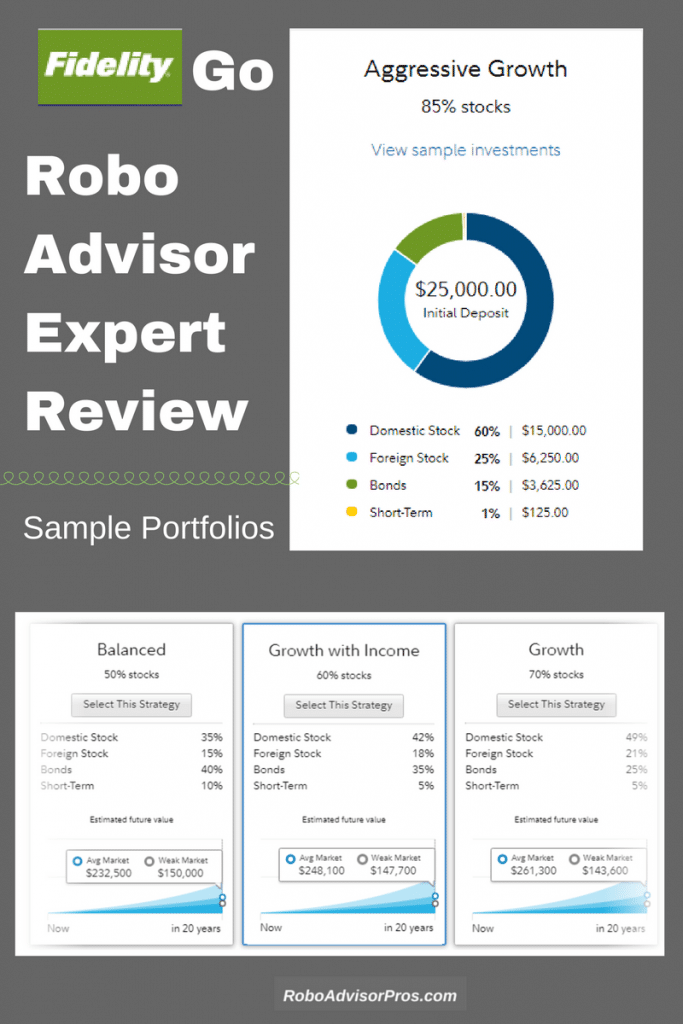

Fidelity Robo-Advisor Investment Mix

Your Fidelity Go investment mix includes passively managed US and international stock and bond funds from the Fidelity Flex family.

Fidelity has upended the investment industry with the introduction of Fidelity Flex Funds. These are similar, although not identical to, the existing Fidelity low-fee index mutual funds but the Fidelity Flex funds do not charge a management fee. SoFi is the only other robo that we’re aware of that also offers fee-free funds.

This is a game-changer, as most robo-advisors invest in ETFs with investment management fees. Although, the typical fund expense ratios of passively managed index funds are low and range from 0.04% to 0.90%.

Keeping fees low (or non-existent) can improve investment performance.

Sample Fidelity Flex Funds Include:

| Sector | Fidelity Investment Fund | Ticker Symbol |

|---|---|---|

| U.S. Large-Cap Stocks | Fidelity Flex 500 Index | FDFIX |

| U.S. Mid-Cap Stocks | Fidelity Flex Mid-Cap Index Fund | FLAPX |

| U.S. Small-Cap Stocks | Fidelity Flex Small-Cap Index Fund | FLXSX |

| Foreign Stocks | Fidelity Flex International Index Fund | FITFX |

| Municipal Bonds | Fidelity Flex Municipal Income Fund | FUENX |

| Short-Term Municipal Bonds | Fidelity Flex Cons. Income Municipal Bond Fund | FUEMX |

| Short-Term Cash | Fidelity Government Cash Reserves | FDRXX |

The municipal bond funds are only included in taxable not retirement accounts. Since Fidelity Go lacks tax loss harvesting, the muni bond funds help minimize taxes for those in higher tax brackets.

Fidelity Go Review of Target Tracking

Once your account is open, you can choose a target dollar amount for your portfolio to reach by a certain date. Once you choose that amount, the robo estimates the likelihood that you will reach that goal. If it appears that you won’t, they will offer suggestions to improve your chance of hitting your goal.

Fidelity Go Account Types

Fidelity Go offers the following types of accounts:

- Single and joint taxable investment accounts

- Roth, traditional, and rollover IRAs

- Health Savings Accounts (HSA)

Fidelity Go is one of the only robo advisors that we cover with an HSA. One caveat is that HSA accounts aren’t eligible for the financial planning services. Some competitors also have custodial, trust and business accounts. Betterment and Wealthfront each offer more account types than Fidelity Go.

Top Robo-Advisors

Fidelity Go Performance

Investors appreciate performance statistics, with the belief that prior outperformance will lead to over performance in the future. Most robo advisors craft your investment portfolio with a mix of passively managed ETFs in varying percentages of stocks versus bond funds. Others include value, growth, small and mid cap ETFs. Some throw in a smattering of real estate or other assets, but in general, the basic allocations can be similar. Your investment performance in Fidelity Go and any other robo advisor that owns passively managed index ETFs will closely match the returns of the underlying market sectors. For example, should the S&P 500 stock market index rise 3% during the quarter, so will the percent of your portfolio that’s invested in an S&P 500 index fund. And that is why we don’t worry too much about performance.

But, for those who want to know about the recent annualized Fidelity Go Performance, we reviewed data provided by the Backend Benchmark Robo Report for most of the major robo-advisors during the prior 1-, 3-, and 5-year terms. We also looked at a typical 60% stock and 40% bond allocation benchmark. Fidelity go outperformed the 60%/40% benchmark during each of those periods by a small margin. In contrast with competing robo-advisors, the Fidelity Go returns were roughly in the middle of the pack.

Vanguard’s research into the benefits of investing in the market through passively managed index funds, instead of trying to beat it is promising. Most of the time, the returns from passively managed index funds beat those of active management. (1)

Although the Fidelity Go performance information is interesting, it shouldn’t drive your investment decision. Your returns will vary based upon your asset mix and account type. Additionally, previous performance data doesn’t determine future returns.

Rebalancing

Rebalancing means buying and selling funds to return the investment percentages back to your preferred mix. So if you chose to have 70% invested in stock funds and 30% in bond funds, and after a time the mix grew to 75% stock funds and 25% bond funds, Fidelity go would sell a portion of the stock funds and buy bond funds to return to your pre-selected 70% – 30% allocation.

Fidelity Go continuously monitors your portfolio and the investment environment. If the markets move significantly in either direction, causing your portfolio to stray from the preferred allocation, the company rebalances it back to your preferred percentages.

Fidelity Go Tax Loss Harvesting is Tax-advantaged Investing

Fidelity Go does not offer tax-loss harvesting for their taxable investment accounts (the option is unnecessary with IRAs, since they’re tax-sheltered accounts). The Fidelity robo-advisor’s nod to tax efficient investing is the availability of a municipal bond fund for the taxable brokerage account.

Fidelity Go considers tax-advantaged investing synonymous with investing within a retirement account. One area where the platform departs from typical robo-advisors is that they do not offer a specific tax-advantaged investing option. For a basic robo-advisor that offers tax-loss harvesting, consider Betterment or Wealthfront.

Want help choosing a robo-Advisor? Try our Robo-Advisor Selection Wizard

Fidelity Go Fees and Investment Minimums

Fees

Like Ellevest, Fidelity has recently improved their fee structure.

Fidelity Go offers free investment management for accounts valued at less than $25,000.

Once you reach the $25,000 account value amount, you’ll pay 0.35% of assets under management.

All accounts worth more than $25,000 also have access to unlimited half hour video meetings with trained financial coaches.

You’ll pay no advisory fee for a balance under $25,000.

Fidelity Go is great for small investors.

There are no trading fees, transaction fees, or rebalancing fees.

For investors seeking lower fee robo-advisors, check out our list of robo-advisor fees from lowest to highest.

Minimum

There is no investment minimum to open an account. You’ll need $10 to begin investing. Although, anyone who’s serious about growing their finances, should consider creating a regular automatic transfer into the Fidelity robo advisory account.

Is Fidelity Safe?

Fidelity security is top priority. The firm safeguards your account with encryption, firewalls, secure email and 24/7 system surveillance. Fidelity also offers 2-factor authentication and money transfer lockdown which blocks your account from unauthorized withdrawals.

For additional Fidelity security you may use Fidelity MyVoice technology so that your voice pattern is recognized and verified. Finally, security text alerts are available so that you’re informed when specific transactions or updates are made to your account.

Fidelity also offer SIPC(2) insurance, which protects your account from the remote possibility that Fidelity goes bankrupt.

Insurance does not protect your account from the normal ups and downs of the financial markets.

Fidelity Spire App

Although not technically part of the Fidelity Go robo-advisor, the Fidelity Spire App(3) is a new tool to help you manage and master your money.

The Spire App helps you set goals, save, and invest.

The best part of the app is its ability to help you keep your money plans organized. You set goals and the app helps you to meet and keep track of your financial priorities.

You can also link your Fidelity Go and any other Fidelity or external accounts to the Fidelity Spire App, for more holistic financial management.

FAQ

Is Fidelity Go good for beginners?

Is Fidelity Go a Roth IRA?

Is Fidelity or Schwab better?

Is Fidelity Go tax-efficient?

Is Fidelity Go worth it?

Pros and Cons

Pros

- $25,000 fee-free investment management is great.

- We like the addition of Fidelity Spire to the platform to help keep users honest with their financial plans.

- No-fee Flex funds reduce overall investment costs.

- The 0.35% AUM fee for customers with more than $25,000 is reasonable.

- Access to financial coaches for those with accounts valued at greater than $25,000 is beneficial.

Cons

- Fidelity Go’s annual management fee of 0.35% for accounts worth over $25,000 is in the mid-range for robo-advisors with financial advisors. SoFi Invest offers fee-free investment management also provides financial advisory access. Schwab’s Intelligent Portfolios Premium and Ellevest charge low subscription pricing.

- Fidelity Go doesn’t offer tax-loss harvesting.

- The Fidelity robo-advisor offers fewer account types than many competitors including Betterment, Wealthfront and Personal Capital.

Fidelity Go Robo-Advisor Review Wrap Up

Due to the free investment management, Fidelity Go is a solid robo advisor choice for small investors with less than $25,000 to invest. We also like the fee-free Fidelity Flex funds, which minimize the mutual fund expense ratios. Overall, we also like the Fidelity brokerage firm and for existing customers, the ease of having managed automated investing and self-directed accounts under one roof.

The $25,000 investment minimum for access to hybrid robo plus financial advisor services is comparatively lower than many competitors.

Fidelity go lacks the breath of diversification and specialty portfolios found at other robo advisory competitors. We’ve come to appreciate the added diversification options like including additional ETFs to a Wealthfront portfolio. The lack of tax-loss harvesting could be a deal breaker for those in higher tax brackets.

We like Fidelity Go as a basic robo-advisor, especially for existing Fidelity customers and newbies. The addition of financial coaches for those with $25,000 or more is good for anyone with basic financial management questions.

Fidelity Go has enough advantages in its favor to merit consideration. Check out Fidelity Go’s website and see if the platform will work for you.

Bonus: Free Robo-Advisor Comparison chart (no sign up required).Find out how Fidelity Go stacks up against the robo-advisory competition.

Fidelity Go Alternatives

Betterment vs Fidelity Go vs M1 Finance

Go directly to the robo-advisor websites:

Related

- Wealthfront vs Fidelity Go

- Betterment vs Fidelity Go

- Wealthfront vs Acorns

- M1 Finance vs Robinhood

- Betterment vs Ellevest

- Fideltiy vs Vanguard

Sources

1) https://corporate.vanguard.com/content/dam/corp/research/pdf/the_case_for_low_cost_index_fund_investing_052022.pdf

2) https://www.sipc.org/for-investors/what-sipc-protects

3) https://www.fidelity.com/spire/overview

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.