Interactive Advisors | Robo-Advisor Supermarket from Interactive Brokers 2023

One of the greatest benefits to robo-advisors is how diverse and customizable they are. In this Interactive Advisors Review you’ll discover how the company goes above and beyond their competitors. Few robo-advisors have as far a reach as Interactive Advisors.

Interactive Advisors is the robo-advisor arm of Interactive Brokers LLC. Interactive Brokers is a large online brokerage company. Through the platform, clients gain access to approximately 75 different passively- and actively-managed robo-advisor portfolios.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

In 2015, Interactive Brokers acquired Covestor — a robo advisory business that later became Interactive Advisors. The change from Covester to Interactive Advisors expanded the platform to go beyond proprietary portfolios. The basic Interactive Advisors robo-advisor is the offshoot of Covester and offers a diversified investment portfolio aligned with your goals and risk tolerance with a low management fee starting at 0.08% of AUM.

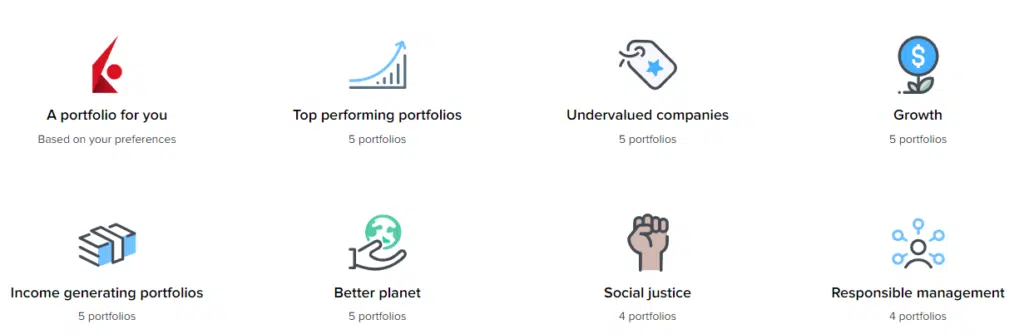

In addition to the basic Interactive robo-advisory offer Interactive Advisors is like a supermarket filled with managed portfolios offered by a variety of investment firms and spanning various strategies, prices and investment minimums.

Interactive Advisors

-

Fees

(4)

-

Investment Choices

(5)

-

Ease of Use

(4)

-

Tool & Resources

(3.75)

Summary

Interactive Advisors is a unique platform that offers users access to scores of managed portfolios with a range of fees, styles, and minimums.

Best for:

- Investors seeking managed solutions with diverse strategies

- Fee conscious investors

- SRI investors

Pros

- Many investment choices

- Active, passive and strategy choices

- Low fee, low minimum portfolios available

Cons

- Mobile app could be improved

- No financial advisors

Features at a Glance

Who Are Interactive Advisors Robo-Advisors Best For?

- Casual investors

- Advanced investors

- Investors who want Socially Responsible Investments

- Clients who prefer Smart Beta and/or diverse investing strategies

- Investors who want the ability to customize their portfolio with multiple investment strategies

How Interactive Advisors Robo-Advisors Works

Clients fund their accounts through Interactive Advisors, then select a portfolio that best aligns with their goals. The platform can recommend a portfolio for you, or you can choose one from their extensive list. The basic Interactive Advisors robo advisor is structured like most competitors. You’ll answer a few questions related to your goals and risk tolerance. Then you are presented with a basket of investments suitable for your financial needs.

A benefit of investing through Interactive Brokerage or IBKR is that clients can select a specialty portfolio that is managed through other financial advisory firms. This lets clients keep their investments under one roof while still benefitting from a wide range of digitally managed portfolios.

Investment options range from Interactive Advisors Smart Beta portfolios to portfolios made up of socially responsible stocks and bonds, and many more.

The image below shows the performance of three portfolios with conservative, moderate and aggressive asset allocations from the basic Interactive Advisors robo advisor.

The 75 portfolio options are run by Interactive Advisors and many other investment managers and include offers with a range of fees and minimums. Following is a sample of the available choices from the the robo-advisor arm of Interactive Brokers:

Portfolio Construction

Interactive Advisors’ description of asset allocation is straightforward and detailed. While other robo-advisors might promise a diversified portfolio, they actually tell clients exactly what that means and why.

Portfolios are made up of different allocations of stocks, bonds, and commodities or real estate. The capital allocation within each asset class will adjust based on your risk tolerance.

These asset classes were chosen because each one performs differently as market conditions fluctuate. Some investments might grow quickly in one year, for example, while another asset class stays stagnant or drops in value. This is similar to other robo-advisors because investment styles go in and out of fashion, causing one robo to outperform one year and another to win the race, when the markets prefer another investing emphasis.

By diversifying your investments in this way, you’re moderating losses and maximizing gains.

Interactive Advisors also offers fractional share investments, so clients can further diversify within their different asset classes.

Clients who want to make a difference in the world can do so by investing in one of Interactive Advisors’ Socially Responsible Investing portfolios. Companies with positive ESG factors (environmental, social, and governance factors), LGBTQ+ supporting companies, and others appear in this category.

Lowest Fee Robo-Advisors

Diverse Portfolios

Currently, the platform offers 75 portfolios available through their robo-advisor or other brokerages’ managed accounts. While Interactive Advisors’ basic portfolios come with a low fees and $100 minimum investment amount, other portfolios might require larger minimum investments and sport higher management fees.

One example is Elite Wealth Management’s “Global” portfolio, which requires a minimum investment of $50,000 and comes with a 0.75% management fee.

All portfolios have a brief description on the website. Within these descriptions, potential clients can read about the benefits of each portfolio, see the growth trends over time, and learn about the risk score and investment strategies of each portfolio.

How to Choose an Interactive Advisors Managed Portfolio

To access the basic Interactive Advisors Robo-Advisor, just visit the home page. From here you can take the initial financial goals and risk quiz and obtain a sample portfolio.

To access the scores of externally managed Interactive Advisors portfolios visit the portfolios home page.

From there you can screen the universe of portfolios based upon:

- Risk: Cautious, Growth, Growth Plus, Aggressive or Speculative

- Performance

- Sharpe Ratio

- Cost: 0.25% or less, 0.26% – 0.99% or 1.0% or higher of assets under management (AUM)

- Minimum Investment: $100 or more than $100

- Portfolio Composition: Stocks, Mixed or ETFs

- Management Company

Interactive Advisors Drill Down

Fees and Account Minimums

The account minimums at vary widely, from a $100 minimum on some managed investment portfolios up to a $50,000 minimum on another! The smaller $100 minimums may make Interactive Advisors affordable for a wider range of clients, but many of the higher minimum portfolios are out of reach of those who are just getting started.

Likewise, Interactive Advisors charges management fees between 0.08% and 0.75% on their portfolios. Fortunately, their portfolios are quite transparent: each shares the account management fees with a slider for clients to calculate how much they will pay in fees each year.

Hybrid Robo-Advisors with Financial Advisors

Account Types and Sign Up

Interactive Advisors offers joint and individual brokerage accounts and most types of retirement accounts. They do not offer SEPs, though. They also offer other types of accounts, for a variety of client needs.

Before you can fund a portfolio, you’ll need an Interactive Brokers account. After providing your identifying information, you’ll answer a few questions to get a portfolio recommendation.

While you can accept the recommended portfolio, you can also look at the 70+ portfolios Interactive Advisors offers and choose one of theirs.

One thing to note: Interactive Advisors will assign you a risk score after your initial screening questions. You will not be able to invest in any portfolios that are ranked above your risk tolerance.

Security

SIPC insurance is provided for investment accounts. SPIC insurance guarantees that up to $500,000 of your portfolio — which includes $250,000 cash — is protected in the case of company malfeasance or bankruptcy.

Interactive Advisors also employs high-level security, such as encryption, to keep your information safe.

Access to Human Advisors

Interactive Advisors client services representatives are able to assist with both the platform and basic investment management issues, according to the IA customer service relationship document.

Some portfolios are run by the Chief Investment Officer, his or her investment management team, or other Registered Investment Advisors. These human advisors will manage your account, though often with a higher fee than their passive robo-advisor counterparts.

Unlike other robo-advisors like Betterment, SoFi, Vanguard, and Schwab, you won’t have access to Certified Financial Planners for broad investment and financial planning services.

For Canadian readers, you can find details on Interactive Broker’s Canadian offering on PiggyBank.

Mobile App

Interactive Advisors does not offer a mobile app for either Android and iOS accounts. You can access your account and the website through the browser on your iOS or android phone or tablet. IBKR does have an app, but it doesn’t include access to the interactive brokers robo advisory and managed portfolios.

Investing Strategy

No matter which investment strategy you’re looking for, Interactive Advisors is likely to have it. They have over 70 potential portfolios, which includes actively managed portfolios and those which are passively managed. These portfolios come with a wide range of account minimums and fees.

The company is well-known for their Socially Responsible Investments. These take a look at various Environment, Social, and Governance components to help clients choose portfolios that represent their values. The robo-advisors can be screened based on SRI preferences, exclusions by stock, and practices to avoid.

They also offer Smart Beta portfolios. Smart Beta strategies use both active and passive account management strategies to help clients try to beat the market.

Regardless of portfolio makeup, the firm is committed to diversifying clients’ portfolios by incorporating three distinct asset classes into portfolios. This buffers clients’ portfolios during market downturns.

Portfolios managed by one of Interactive Advisors’ professional portfolio managers will be rebalanced according to their investment methods.

Overall, Interactive Brokers has ensured that their robo-advisor clients have a good deal of information upfront. Potential clients can look at historic performance of different portfolios to gauge whether it’s something they would be interested in. One downside, however, is that clients cannot see the nitty-gritty breakdown of any portfolio until after they have signed up.

Pros and Cons

Pros

- One stop shop for many managed investment portfolios with a range of strategies.

- Well-researched investment strategy is explained clearly in layman’s terms.

- Low account management fees available.

- Fractional shares.

- Socially Responsible Investments.

- Passive and actively-managed accounts.

- Access to the Interactive Brokers investment resources.

Cons

- Website navigation could be improved.

- Minimal information about portfolio breakdowns available unless you create an account.

- High minimum investments and/or fees for some portfolio options.

Wrap up

Interactive Advisors, the robo-advisor arm of Interactive Brokers, offers a wide range of actively managed portfolios, passively managed portfolios, Smart Beta choices, asset allocation models and more. Clients can open individual, joint, and retirement accounts and have a wide range of investment choices.

While a portfolio manager handles some of the actively managed portfolios, don’t expect detailed investment advice. Investors with active and passive portfolios alike may run into issues and need to speak with someone, but the website doesn’t share how to get in touch with portfolio management.

Still, the wide range of investment asset class and diverse strategy portfolios makes Interactive Advisors very appealing for the experienced investor and newbie alike. Account minimums vary, but new investors or those on a fixed income might appreciate the low cost investments. Ultimately, the fact that users must take a risk quiz, receive a risk score and cannot invest in more aggressive portfolios than their score allows, is a sound stop gap to save investors from themselves.

Investors who want portfolio management that includes a low management fee, diverse investment choices, and a variety of available portfolios will appreciate Interactive Advisors.

How Does Interactive Advisors Compare?

Interactive Advisors vs M1 Finance

Related

- List of Robo-Advisors | Top 35 Digital Investment Managers

- Best Robo-Advisors

- 6 Low Fee Robo-Advisors

- Personal Capital Review – Free Investment Management Tools and Premium Services

- Best Robo Advisors For Wealthy Investors

- Vanguard Robo-Advisor Review

- Webull Robo Advisor Review

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Empower compensates Stocktrades Ltd (“Company”) for new leads. Stocktrades Ltd is not an investment client of Empower.