M1 Finance vs Stash Comparison Review – Learn similarities and differences to choose the best financial app for you.

Stocks in high-performing companies are skyrocketing, making them difficult to attain for beginning investors. Additionally, there are so many options out there for investments: thousands upon thousands of companies and industries compete for your attention, making it hard to decide which will best bring you to your financial goals.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

M1 Finance and Stash are tools that will make your investing experience easy, intuitive, automatic – and affordable.

I’ve used the M1 app for a while and really like their pre-made investment portfolios, called Expert Pies. While Stash offers a lot for beginning users.

Each platform lets you invest in fractional shares which is great for those who want to invest, but lack a big account balance. Fractional shares are portions of larger stocks that come at – you guessed it – a fraction of the price. For mere pennies, clients can invest in companies like Amazon, McDonalds, and more.

M1 Finance and Stash are great for those who like a DIY approach to investing. They both offer customizable portfolios through their many stock and ETF options, but also have pre-made portfolios or customized portfolios to help you choose investments that match your values and goals. You’ll find dividend reinvestment, Roth IRAs and other retirement accounts along with zero commissions at each platform.

Next find out core details and differences at each app.

What is M1 Finance?

M1 Finance is a one-stop shop for all of your financial needs. In contrast with Stash, M1 Finance offers investment management and tax minimization.

Their free investment portfolios can be fully customized or created from a list of pre-made expert pie portfolios. The user-friendly app offers a bank checking account and line of credit for clients with accounts with $10,000 or more.

Though M1 Finance is best known as a free investment platform, they do offer M1 Plus – a premium low cost offering, with benefits like cash back on debit card spending and lower interest rates on their line of credit.

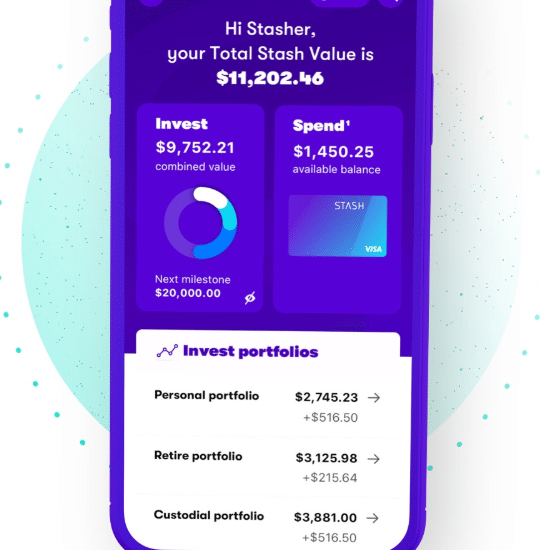

What is Stash?

Stash is an investment app that offers a variety of account types including custodial accounts for children.

Stash offers a curated list of equities, deemed appropriate for new investors and pre-made, customized portfolios.

One of the features that makes Stash stand out are its educational articles. These articles cover a wide range of investment topics, designed to help clients understand all facets of investing, from how COVID vaccines might influence the market to general financial tips.

In fact, even non-Stash users can subscribe to the newsletter and read the articles!

Stash also offers round ups, similar to other spare change apps like Acorns. Round ups take the difference between your purchase price and the next whole dollar and automatically transfer it into your investments.

M1 Finance vs. Stash – Top Features

M1 Finance Top Features:

- Free account management

- Multiple account types

- Commission free trading of thousands of stocks and ETFs

- Fractional shares and dividend reinvestment

- Pre-made investment portfolios or “M1 Finance expert pies”

- M1 Spend bank account with cash back debit card

- M1 Borrow margin account

Stash Top Features:

- Individual stock and ETF trading and pre-made investment portfolios

- Fractional shares in high-performing companies

- Broad investment educational resources

- Affordable account management fees

- Stock-back debit card

- Round ups

M1 Finance vs. Stash – Who Benefits?

Beginners will like both M1 Finance and Stash. Both are designed to make investing easy and affordable, no matter how much experience you have. Stash and M1 each offer dividend reinvestment and a wide range of pre-made portfolios, individual stocks and ETFs.

Both offer Socially Responsible Investing (SRI) which is a great option forthose who want to align their money with their values.

M1 Finance

Small to experienced investors will profit from this platform. With $100 minimum balance, individual stock and fund investing, and fee-free management this is a sound choice for most.

Add in margin, a high yield checking account, no charge ATM use (4 times per month), and a wide selection of ready-made portfolios, and this service is tough to beat.

More sophisticated investors will lean towards M1 with over 6,000 investment choices and borrowing.

Stash

If you have kids, Stash+ is for you. At $9/month, this option includes custodial UTMA or UGMA accounts. This is an affordable option for a product that can house your individual investment portfolio, IRA, and children’s money all under one roof.

Stash is geared toward investing beginners. The exchange traded funds (ETFs) are categorized by sectors, like real estate or tech.

Instead of using the actual name of a fund, they assign a more descriptive one, that might appeal to new users, although I found it confusing. For example, in their “Diversified Mix” portfolios, the “Fallback Fund” is represented by by the Goldman Sachs Access Treasury 0-1 Year ETF (GBIL). This is a short-term Treasury bill fund which can be used for ready cash.

M1 Finance vs. Stash – Deep Dive

Fees and Minimums

Minimums Winner: Stash.

Fees Winner: M1 Finance

Each investing platform offers zero commission trading, and thats where the fees and minimums similarity.

M1 Finance

The minimum investment for M1 Finance is $100. This is one of the lowest minimums available, save robo-advisors with no minimum investment.

M1 Finance is also a free robo-advisor/investment manager at the basic level. While there are many low-fee robo-advisors available, you can’t beat free!

Clients also have the option of opening an M1 Plus account, which is M1 Finance’s premium account type.

It costs $125 per year and comes with a few extra perks:

- Two daily trade windows

- “Smart Transfers”: automated, easy money management

- Checking account with 1% APY, no international fees, 4 ATM fees covered per month, 1% cash back, and a daily ACH limit of $50,000

- Better interest rates on M1 Borrow lines of credit

While $125 seems like a hefty price tag against Stash’s $9 per month top plan, remember that this is $125 per year; that makes the cost of M1 Plus approximately $10.42 per month.

Stash

Stash requires a minimum balance of only $1 to get started, which is why it takes the victory over even M1 Finance’s reasonable $100 minimum investment.

The monthly fee for a Stash account ranges from $1 to $9 per month, depending on the account type:

Stash Beginner: $1/month

- Ideal for first-timers

- Saving and budgeting tools

- Fractional shares

- Personal investment account

- Stock-Back Card

Stash Growth: $3/month

- Ideal for long-term investors

- Everything from Stash Beginner, plus

- Roth or Traditional IRA

- Digital retirement advice

Stash+: $9/month

- Ideal for savvy investors, families, and those who like to pay with a debit card

- Everything from Stash Beginner and Stash Growth

- Two UTMA/UGMA accounts

- Stock-Back Card bonuses: 2x rewards and additional rewards on some purchases

- Market Insight reports, sent out monthly

M1 Finance Expert PIe – Berkshire Hathatway

Investments

Winner: M1 Invest includes many more investments than Stash.

Both services offer a wide variety of investment options from a myriad of companies and industries. Both offer customizable portfolios, too.

M1 Finance Investments

M1 Finance has more than 6,000 assets to choose from and allows clients to create their own portfolios or choose from pre-made portfolios or expert pies.

The firm has a screener which helps the DIYer narrow down their investing options.

The Expert Pies specialize in specific investment areas and/or focus on particular financial goals:

- General investing portfolios, with varying degrees of risk tolerance

- Retirement

- Socially-conscious portfolios

- Income portfolios

- Stocks and Bonds only

- Income portfolios

- Hedge Fund portfolios

- Industries and Sectors portfolios

I invest in two expert pies from the “Stocks and Bonds only” and “Income portfolios”.

Stash Investments

Stash includes a range of carefully selected equities and ETFs. Their investments span the following categories:

- Bonds

- Consumer Staples (e.g. B&G Foods, Inc, Coca-Cola, and General Mills)

- Diversified Mixes

- Energy

- Finance

- Global Exposure

- Health Care

- Industrials (e.g. the Canadian National Railway Co and Delta Airlines)

- Materials

- Media

- Missions and Causes

- Real Estate

- Retail

- Technology and Innovation

- Utilities

The pre-made portfolios are included in the “Diversified Mixes” category.

Something we really like about Stash is how easy it is to find investments which align with your values. Their investments page is intuitive, and clicking on any of the available stocks or ETFs provides a bit more information and a tracker that shows how the investment has performed over time.

We don’t love the “cutesy” names they assign their investments, as it’s difficult to understand the sector and types of assets that you are actually selecting. For example “Up and coming” refers to the Vanguard Emerging Markets ETF (VWO). Who knew?

Stash has fewer invesetments than M1. This is appropriate as Stash is geared towards new investors.

Rebalancing and Investment Management

Winner: M1 Finance

Since Stash doesn’t offer rebalancing or investment management, M1 Finance takes the win.

M1 Finance rebalances portfolios a little at a time while you deposit or withdraw money from your portfolio. They call their process “Dynamic Rebalancing,” rather than automatic rebalancing, and believe this is a better option than rebalancing on a schedule.

You can also trigger a rebalance with a click on your dashboard view.

The rebalancing feature, which means buying or selling funds of securities to return the asset mix to your initial preference. If you start out with a 60% equity and 40% bond mix and the stock investments drift up to 70%, rebalancing returns the portfolio to it’s initial mix.

Tax-Loss Harvesting

Winner: M1 Finance.

M1 Finance practices tax minimization on taxable investment accounts. They wrap this feature into their overarching “tax efficiency features,” which includes rebalancing. This feature aims to reduce taxes when selling securities.

Stash does not offer tax-loss harvesting.

Customer Support

Winner: M1 Finance

M1 Finance’s support hours are weekdays, 9:30 am – 4:00 pm ET. These hours follow the US Market hours. M1 Finance also heavily emphasizes their online FAQ and help sections, encouraging clients to seek out their own solutions before contacting customer support.

They also offer onboarding guidance and an IRA rollover concierge.

Stash does list a phone number and email address on their website, but they do not post their available support hours. Like M1 Finance, Stash relies on their extensive FAQ section, chat, and encourages clients to send an email for assistance.

Cash Management and Margin

Winner: It’s a tie for spending accounts; While only M1 Finance offers lines of credit.

M1 Spend, is an account that includes a with 1% cash back debit card and a cash checking account. This is available with the M1 Plus membership.

M1 Borrow is a lending or margin account for those with more than $10,000. Thirty five percent of the portfolio value can be borrowed for interest rates from 2% to 3.5%. The money can be used for anything with no payment schedule.

Stash offers a free cash account with a debit card. In lieu of cash back on purchases, users receive fractional shares of stocks in various companies.

Additionally, direct deposit users get access to their paycheck up to two days early.

Account Types

Winner: It’s a tie.

Both apps offer varous types of accounts. Stash offers custodial accounts for minors while M1 has joint and trust accounts.

Although, M1 doesn’t charge for any type of account, while retirement accounts at Stash cost $3 per month and custodial accounts require the $9 per month plus service.

M1 Finance Accounts:

- Individual and joint brokerage

- Traditional, Roth, SEP, and Rollover IRA retirement

- Trust

Stash Accounts:

- Individual brokerage

- Traditional, Roth, SEP, and Rollover IRA retirement

- Custodial-UTMA and UGMA

Mobile App

Winner: It’s a tie. M1 is ranked higher, but Stash customer service responds to complaints.

The M1 mobile app reviews average an impressive 4.6 out of 5.0 on google play. In general, users like the app although, there are several technical glitches mentioned. Unlike Stash, there don’t seem to be customer services responses to the problems.

Users seem to like the Stash mobile app and give an average 4.1 stars out of 5.0 on Google play. There are the to-be-expected tech glitches, but nothing insurmountable. The company responds to complaints and offers assistance, which is quite refreshing.

One main complaint that the app offers delayed, not real time price quotes. Although, this shouldn’t be a problem for long term investors.

Human Financial Planners

Winner: Neither.

Neither of these investment apps offers human financial planners.

FAQ

Is M1 Finance trustworthy?

Understand that regardless of insurance, your account balance will go up and down along with the markets.

Can you actually make money on Stash?

Both apps can assist with growing and compounding your money.

Which one is better: Acorns or Stash?

Which is better: Robinhood or M1 Finance?

If, however, you want more comprehensive, pre-made investment portfolios, cash management, and rebalancing, you’ll want to invest with M1 Finance.

For more details, head over to our M1 Finance vs. Robinhood comparison post.

M1 Finance vs. Stash – Which is Best? The Takeaway

M1 Finance comes out ahead of Stash Invest in key areas, including tax minimization, rebalancing, and the ability to borrow against your portfolio. M1 also offers nearly three times as many investments. These areas won’t be important to all clients – some might actually prefer to take tax-loss minimization into their own hands – but they are worth considering.

M1 also offers free investment management and trading. This is a draw for the cost-conscious individual.

Stash has some features that make it unique, however: their investments page is easy to navigate, and their educational articles are detailed and comprehensive. For new investors who might feel overwhelmed, these are two benefits that can’t be overlooked.

The round ups feature is also a nice way to increase cash into the markets, although it will take a while to build up a larger account balance with this feature. Although M1 users can invest cash back rewards into fractional shares.

With the Stock-Back card, investors can earn shares from the places they shop (like Amazon!).

In terms of fees, the fee-free basic plan puts M1 ahead of Stash. Although investors need $100 to get started with M1 Finance.

One downside to both M1 Finance and Stash is that they do not offer human financial planners and their customer service hours are limited. This is likely because they aim to be automated, affordable investment tools.

If you are a beginner investor who isn’t tech-shy, you can’t go wrong with either of these options.

Intermediate and advanced investors will generally prefer M1 Finance.

Read the complete M1 Finance Review.

Related

Personal Capital vs. Mint vs. Quicken

7 Best Robo Advisors for Millennials

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable