M1 vs Vanguard Robo Advisor Comparison

Although both M1 Finance and Vanguard are considered investment brokerage firms, this article will focus predominantly on their robo-advisory managed investment offers. Both M1 Finance and Vanguard Digital Advisor are great for investors who want their investment portfolios rebalanced and managed for free or low fees. Each platform is good for those seeking a smidge of active management as well. If you want a managed portfolio with access to financal advisors, then you’ll need to choose the Vanguard Personal Advisor, an automated investment manager with financial advisors to guide the process.

So whether you’re seeking an all digital robo advisor or one with access to financial advisors, you’ll find what you need here. Plus, both M1 Finance and Vauguard also offer brokerage services like stock and ETF investing, margin borrowing, and cash management through their platforms. Though, only M1 has digital coin cryptocurrency investing.

The Vanguard robo-advisor is part of a full-service brokerage, founded in 1975. The two Vanguard robo-advisors; Digital Advisors and Personal Advisor Services charge reasonable fees and offer two distinct services.

While M1 Finance is an investment platform with management, trading, borrowing, and a cash account. This upstart launched in 2015. The service offers free investment management with additional fees for an upgraded service.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Today we’re looking at M1 Finance vs Vanguard Robo Advisors — two investing options that come with different price tags and features.

Each of the platforms are unique and will appeal to distinct investors. You’ll discover the top features, who benefits and finally a deep dive into the specific features of each service.

What is M1 Finance?

M1 Finance is a customizable robo-advisor that offers “pie” style investing: that is, investors select from over 6,000 investment options, with each investment in their portfolio making up a slice of the overall pie. The total pie, is your investment portfolio. Users can trade shares commission free.

Top Features:

- Pre-made expert pies or portfolios

- Choose your own investments of stocks and ETFs

- Rebalancing

- Tax minimization

- M1 Spend – Cash management

- M1 Borrow – Margin or lending account

- M1 Credit Card

- Cryptocurrency investing

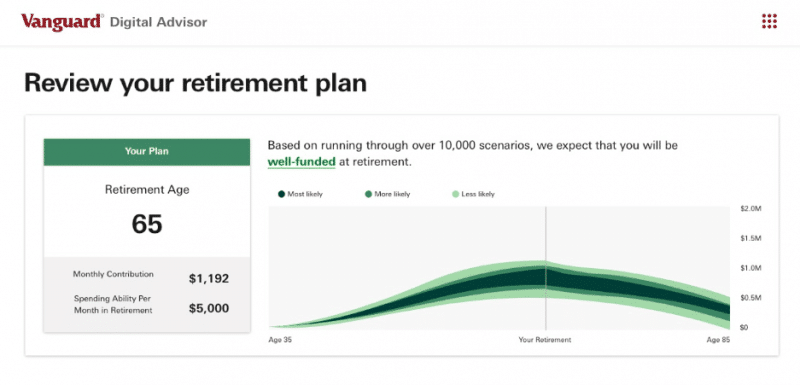

What is Vanguard Personal Advisor Services and Digital Advisor?

The Vanguard brokerage financial firm is known for low cost investment products. And the robo-advisors are a low-fee alternative to higher priced financial advisors.

Vanguard Digital Advisor:

- Computerized investment manager

- Investment portfolios in line with your risk tolerance

- Portfolios include passive index funds and actively managed funds

- Rebalancing

Vanguard Personal Advisor Services:

- Live financial advisor led hybrid investment manager. Incorporates both computer algorithms and live advisor guidance.

- Rebalancing

- $50,000 minimum

- Various investment styles including stocks, ETFs, and mutual funds

Who Benefits?

M1 Finance is best for:

- Investors who prefer FREE investment management

- Long term investors seeking commission free trading

- Small investors to larger more experienced traders

- Those who prefer fee-free investment management and trading

- Those seeking pre-made expert pies along with individual stock, fund and crypto trading

- Those who favor borrowing and cash management

Vanguard is best for:

- Those who prefer investment management from a comprehensive financial firm.

- Investors with at least $3,000 for the digital platform and $50,000 for the hybrid model.

- Those seeking basic investment management for a low management fee for digital.

- Wealthier investors seeking live financial planning combined with digital investment management for management fees lower than those at traditional financial advisors.

M1 Finance vs Vanguard Robo Advisors: Deep Dive

Fees and Minimums

Winner: M1 Finance wins on both accounts.

M1 Finance

This platform requires on $100 to begin investing. IRA investors will need $500.

The basic investment management service is free. This includes commission-free stock, fund, and expert pie trading.

M1 Plus charges $125 per year and includes:

- A super charged checking account. The M1 Plus account offers a high yield checking account and a debit card with 1% cash back. Finally, M1 plus customers get 4 ATM withdrawal fees reimbursed per month.

- Lower borrowing costs

- Two daily trading windows, instead of one

M1 offers a lot of value in the basic plan, which we believe is suitable for most investors.

Vanguard

| Digital Advisor | Personal Advisor Services | |

| Minimum | $3,000 | $50,000 |

| Fees | 0.20% AUM | 0.30% to 0.05% AUM Declining fees for larger accounts. |

The fees for Personal Advisors Services are lower than several competitors that offer financial advisors. Although SoFi Invest offers fee-free investment management along with financial advisors and career coaches.

The ETFs and mutual funds included in the investment portfolios always charge small fees. These fees go directly to the fund manager. When Vanguard ETFs or mutual funds are used, the management fees go to Vanguard.

Investing

Winner: M1 Finance

M1 Finance

M1 Finance offers over 6,000 investments including individual stocks, ETFs and ready-made expert pies.

We love the expert pies as investors who don’t want to choose funds on their own can be confident that the expert pies are well-constructed investment portfolios.

Sample M1 Finance Expert Pies:

- General Investing – Perfect for well-balanced investments that match up with your risk level (like a typical robo-advisor).

- Plan For Retirement – Similar to a target date fund.

- Responsible Investing – Socially Conscious Investing.

- Income Portfolios – Great for cash flow.

- Hedge Fund Followers – Copy investing strategies of well-known investors, like Warren Buffett.

- Just Stocks and Bonds – 9 Pre-made investment portfolios of just 2 funds from most conservative to very aggressive.

Vanguard Digital Advisor

Vanguard Digital Advisor offers three portfolio options:

- Index fund portfolio

- ESG – Sustainable investment portfolio

- Active and passively managed combination portfolio

Vanguard’s robo advisor provides enough diversification and the actively managed portfolios are a nice addition for those investors who strive to outperform the market averages.

Vanguard Personal Advisor Services

After meeting with your financial advisor, your portfolio is constructed to fit your goals, financial situation, and risk tolerance. The are many fund options including:

- Total Stock Market Index Fund (VTSMX)

- Total International Stock Index Fund (VTIAX)

- Total Bond Market Index Fund (VBTLX)

- Total International Bond Index Fund (VTABX)

- Intermediate-Term Investment Grade Fund (VFIDX)

- Short-term Investment Grade Fund (VFSUX)

- Intermediate-Term Tax-Exempt Fund (VWIUX) (for taxable accounts only)

Fractional Shares

Winner: M1 Finance

Fractional shares means that if a stock is trading for $100, you can buy a partial share of that stock for $50 or another amount. This is handy if you’re a beginner investor creating a diversified portfolio.

With $100 you could buy 10 individual stocks or funds for $10 each.

M1 Finance, enables investors to trade fractional shares when trading stocks or funds.

The computerized algorithms within the Vanguard robo-advisors handle all of the trading and may buy fractional shares based upon the dollar amount you invest. Additionally, fractional shares may be purchased when dividends are reinvested.

Automatic Rebalancing

Winner: It’s a tie.

Both platforms offer rebalancing, back to your preferred mix of investments.

With Vanguard, rebalancing is automated.

At M1, you can choose automatic rebalancing or you can initiate rebalancing at any time with the push of a button.

Rebalancing is the most common service available at robo-advisors and one of the best features.

Margin Account*

Winner: M1 Finance

M1 Borrow allows anyone with an account balance of at least $2,000 to borrow up to 40% of their account value. The money can be used for any purpose. Margin borrowing rates are comparatively low.

This is helpful if you need to pay for a home repair and want to allow your investments to continue compounding.

The Vanguard Investment Brokerage firm offers margin account. But, the robo-advisors don’t have access to borrowing.

Cash Account

Winner: M1 Finance

M1 Finance Plus members have access to M1 Spend.

This service offers:

- FDIC-insured checking account

- Debit card with 1% cash back

- 4 fee-free ATM withdrawals per month

- Bill pay

- Direct deposit

Only Vanguard brokerage clients have access to cash management. Separate cash management isn’t available with the robo advisory platforms.

Account Types

Winner: It’s a tie.

Both Vanguard and M1 Finance robo-advisors have account types broad enough for most investors.

| Vanguard | M1 Finance | |

| Individual, Joint taxable brokerage accounts | X | X |

| Traditional, Roth, Rollover, SEP IRAs | X | X |

| Trusts | X | X |

| High yield cash account** | X |

**Vanguard brokerage offers cash management.

Financial Advisors

Winner: Vanguard Personal Advisor Services

This is the only option in the Vanguard vs M1 contest that includes live financial advice.

Vanguard Digital platform clients can speak with financial services representatives, who may be able to assist with basic financial questions, although this is not “advertised” as a feature on the platform.

Vanguard Personal Advisor Services really takes the “personal” part of their name seriously. Investors collaborate with the financial advisor and get tailored investment advice and support. The real benefits kick in when an investor’s AUM tips over $500,000. While all investors get access to a team of financial planners, those with AUM over $500,000 get access to a dedicated financial planner.

M1 finance offers a roll-over concierge to help with account transfers. They also offer helpful customer service representatives during normal business hours.

M1 customers will need to look elsewhere for financial advice.

Click here for robo advisor with live financial advice.

Mobile App

Winner: M1 Finance

This was an easy contest as the Vanguard Investor app doesn’t offer a specific app for the robo-advisors.

The M1 Finance app is dedicated to the platform. The reviews were generally quite good.

Security

Winner: It’s a tie with a slight edge to Vanguard.

M1 Finance and Vanguard each prioritize security and are insured by SIPC (Securities Investor Protection Corporation) against loss of cash and securities from a broker’s failure. SIPC insurance does not protect against normal investment price declines.

With Vanguard, you can be sure that a large robo-advisor with the most AUM and a premier financial firm has excellent security and offers encryption, SSL validation and: and offers:

- Encryption

- SSL (Secure Sockets Layer) validation

- Security codes

- Security keys

- Account activity alerts

- Trusted contact

While M1 Finance security includes:

- Military-grade 4096-bit encryption

- Two-factor authentication

- M1 Spend and M1 Plus accounts offer FDIC insurance up to $250,000 and additional insurance through Lincoln Savings Bank.

We are comfortable with the security on both Vanguard and M1.

Vanguard Investing-Brokerage Account

We’d be remiss if we didn’t touch on the full-service Vanguard investing options. Like, Schwab, Fidelity, and E*TRADE, Vanguard offers full-service investment products for those that want CD, bond, mutual fund, options, stock, and ETF trading.

These services are in addition to the Vanguard robo-advisor solutions.

You’ll find low cost investment products and services for long-term investors and short term traders at Vanguard including:

- Investor education

- Calculators and research tools

- Any type of account you might need including 529 Accounts and 403b services

- Annuities

- Margin accounts

In fact, investors seeking managed solutions and a full service brokerage firm can get all of their needs met at Vanguard.

In contrast, M1 Finance offers stock, ETF and crypto investing.

FAQ

Does M1 Finance have Vanguard funds?

Which is better, Robinhood or M1 Finance?

Robinhood is best for active traders and those who want access to stocks, funds, options. and cryptocurrency.

For more information read M1 Finance vs Robinhood.

Is Vanguard or Charles Schwab better?

With respect to brokerage firms, I prefer Charles Schwab over Vanguard, but they are both solid choices.

Is M1 Finance a good idea?

M1 Finance vs Vanguard Digital and Personal Advisor Services: Which is Best for You?

M1 Finance and Vanguard are each tailored to different audiences and offer unique features and services. Both platforms are appropriate for long term investors, not active traders.

This makes the Vanguard vs M1 Finance choice easier.

M1 Finance

M1 Finance is the affordable, easily accessible robo-advisor that is good for new investors and expert DIY-ers alike. With customization options and pre-made portfolios, M1 Finance caters to a variety of individuals. This robo also has over 6,000 investments from which to choose including stocks, ETFs and crypto. M1 Spend cash management and M1 Borrow round out the offers.

We believe that the free M1 Finance platform is a good choice for most investors.

Vanguard

Both Vanguard robo advisors have higher investment minimums and fees.

The Vanguard Digital Advisor is worth a look if you would like actively managed, digital or ESG investment options. Additionally, Vanguard Digital requires $3,000 to invest and charges 0.20% AUM, in contrast with the $100 minimum ($500 for IRAs) and free investment management at M1.

We recommend M1 Finance for a basic platform, unless you’re already a Vanguard customer.

If you’re a mass affluent customer with the $50,000 minimum, there’s a lot to like about the Personal Advisor Services. The financial advisor drives the process and investment options are vast. The retirement and financial planning tools are solid. In contrast with traditional financial advisors, fees are reasonable.

Vanguard Personal Advisor Services is a good choice for investors seeking full-service financial planning at a reasonable cost.

Ultimately, the only reason to pay for a robo-advisor might be to access financial advisors.

Read the Complete M1 Finance Review

Read the Complete Vanguard Digital and Personal Advisor Services Review

Related

M1 Finance vs Personal Capital – Robo-Advisor Comparison

Wealthfront vs Schwab Intelligent Portfolios

Betterment vs Wealthfront vs M1 Finance

*Disclosures: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

I have a brokerage account with Vanguard and an account with M1 Finance.

*Using margin involves risks: you can lose more than you deposit, you are subject to a margin call, and interest rates may change. To learn more about the risks associated with margin loans, please see our Margin Disclosure (https://s3.amazonaws.com/m1–production-agreements/documents/Margin_Disclosure.pdf). M1 Borrow available on margin accounts with a balance of at least $10,000. Does not apply to retirement accounts.