In a high-tech society, you likely have direct access to your checking and savings accounts on your phone. It’s important to have financial information available to keep up with the daily pace of life, and your investment portfolio shouldn’t be an exception to this rule. Learn which (or several) of these investment apps – Acorns, Betterment or Robinhood are best for you.

Fortunately, many robo-advisors and apps offer comprehensive, accessible user experiences via smartphone.

Each of these investment apps offer something different:

- Robinhood – Investment trading app

- Betterment – Robo-advisor for investment management

- Acorns – Micro investing or spare change app

With nearly every robo-advisor and micro investing platform offering convenient app access, it can be hard to choose between the many options.

Fortunately, this head-to-head between Robinhood, Betterment, and Acorns will help you determine which investment app will best meet your financial goals.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

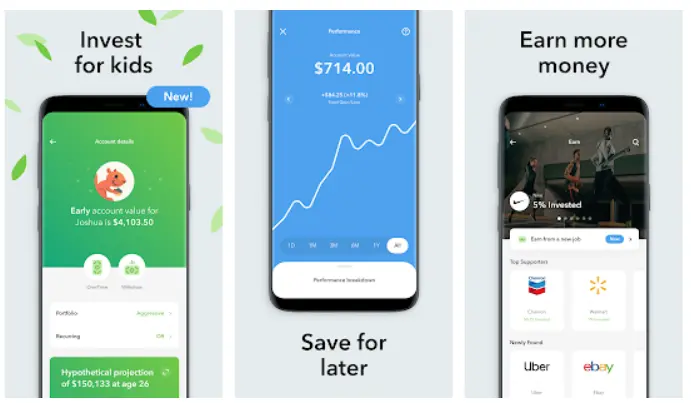

What is Acorns?

Acorns is an app designed to make investing easy, automatic, and accessible to the everyday investor. As its namesake suggests, Acorns strives to turn small investments into oak-sized financial portfolios over the long term.

Acorns is particularly good at helping investors develop a habit of automatic investing. The secret to Acorns’ success is its round-up feature. Round-ups automatically increase your everyday purchases to the nearest dollar and automatically invests the difference or spare change into your invesetment portfolio.

Sign up with Acorns, and get a $20 bonus!

How much you invest depends entirely on what you spend. For instance, a $5.50 purchase would be increased to $6.00 even and $0.50 would be added to your portfolio. Or, you can opt for a round-up multiplier to speed up your investment growth. You can elect to increase your Round-Ups investments by 2 times, 3 times on up to 10 times. In the example of a $0.50 round up, if you multiply the amoung by 10x, instead of $0.50 being transferred into your investment account, you’ll add $5.00. Just make certain that there’s enough cash in your “linked” bank account to fund your Round-Ups choice.

Acorns is great for new investors without much extra cash.

Sign up with Acorns, and get a $20 bonus!

Your Acorns investment account is ideal for beginner investors.

While it may seem like you can’t get rich by investing a dime here and there, Acorns states that the average client invests $30 each month through these Round-Ups alone. For someone who isn’t actively investing, this can make a big difference over time.

Another benefit to Acorns is that it is a micro-investing app, which means that your $2 spare change investments can actually buy fractional shares in larger companies listed on the stock market.

Just realize to build a substantial amount for retirement, you’ll need to increase the amount you invest to more than $30 per month, preferrably in a retirement account like a 401k, Roth or Traditional IRA.

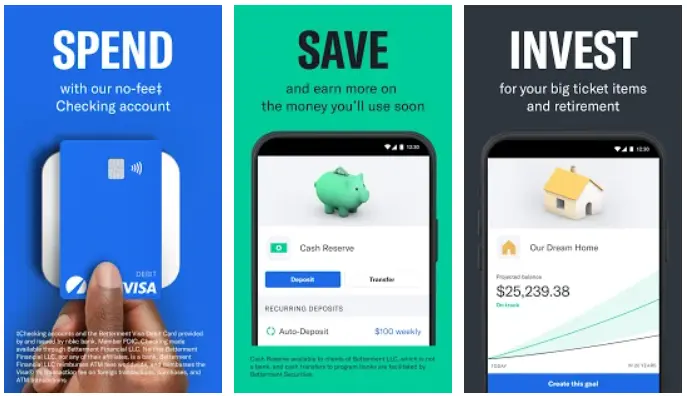

What is Betterment?

This full-service robo-advisor that has been around for more than a decade. They are one of the earliest and largest free-standing robo-advisors. Betterment is a favorite here at Robo-Advisors Pros, due to their robust investment choices and financial planning choices for low added fees.

For one thing, Betterment is a hybrid robo-advisor. The platform blends digital, algorithmic-based advice with advice from human financial planners – for additional fees – at all account levels. While Premium clients get extra features like access to financial planners, for a 0.40% management fee, even Digital customers can purchase low cost financial advice packages.

This feature alone beats Acorns and Robinhood, who lack access to live financial advice .

Betterment also offers Smart Beta portfolios. These portfolios have the potential to outperform the stock market by investing in companies with greater allocations to specific factors such as:

- Good Value: Companies that have both a low price and positive net income.

- High Quality: Companies with potential for stable earnings, growth, and consistent returns.

- Low Volatility: Stocks that don’t demonstrate extreme swings in any direction.

- Strong Momentum: Investments that demonstrate momentum in regard to growth.

Even their non-Smart Beta portfolios are goals-driven, which means your investments are tailored to give you the best chance at meeting your long- and short-term financial goals. Betterment has recently added cryptocurrency and several ESG strategy options for their users.

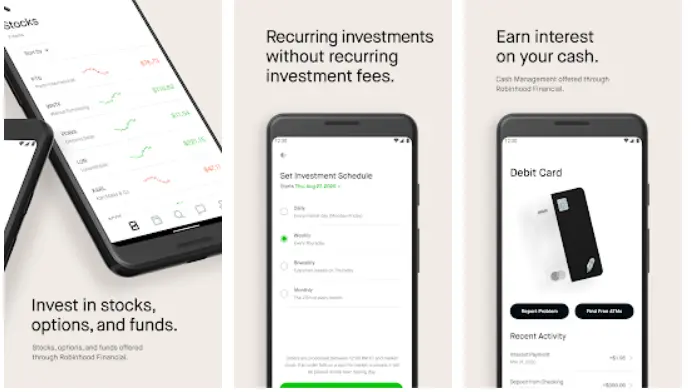

What is Robinhood?

Like Acorns, Robinhood is a micro-investing app. That’s not the only thing going for it, however: Robinhood is also a free trading service! Between no fees at the basic level and no minimum balance requirements, Robinhood is one of the most affordable financial apps for beginning investors.

Robinhood is another app that is good for beginner and advanced investors alike. robinhoods educational portal continues to impress us with access to basic investment concept training.

While they are certainly appealing to a beginning audience because of their no-fee, no-minimum, learn-as-you-go approach, Robinhood is also customizable. This level of customization appeals to advanced users because it allows them to adjust their portfolios to fit their investment preferences.

Robinhood investments include individual stocks, options, funds, and cryptocurrency.

Robinhood recently added a 1% contribution match for their IRA clients.

Robinhood Retirement IRA

The Robinhood IRA match adds 1% of your IRA contribution to your account. IRA contributions must be made from an external bank account. The Robinhood IRA match is not included in your annual contribution limit and it’s typically available for you to invest, immediately. You’re required to maintain the IRA contributions in your account for at least 5 years. So, if you contribute $6,500 to your Robinhood Retirement IRA, then Robinhood will add an additional $65 to your account.

Robinhood 24 Hour Market

Users can place limit orders to buy whole shares of many of the most traded ETFs and stocks, including TSLA, AMXN and AAPL – 24 hours a day, 5 days a week. Trade from 8:00 PM ET Sunday through 8:00 PM ET on Friday.

In addition to complete customization and commission-free trades, Robinhood clients can benefit from extended-hours trading.

Robinhood 24 Hour Market

Users can place limit orders to buy whole shares of many of the most traded ETFs and stocks, including TSLA, AMXN and AAPL – 24 hours a day, 5 days a week. Trade from 8:00 PM ET Sunday through 8:00 PM ET on Friday.

With no trading commissions, 100% of your investment money goes into the market.

Robinhood also offers with cash management services in addition to their trading platform.

As with their investment services, Robinhood aims to be accessible to all: clients won’t need to meet any minimum requirements or pay any account management fees for their cash bank account.

Betterment vs Robinhood vs Acorns – Top Features

| Betterment | Robinhood | Acorns | |

|---|---|---|---|

| Overview | Goals based digital investment manager with access to financial advisors (for added fee) and cash management. | Free app or web platform for stock, ETF, crypto trading. options and cryptocurrency. | Round up, spare change investment app. |

| Minimum Investment Amount | Digital - $0.00 - $10 to begin investing. Premium - $100,000 | $0.00 | $0.00 Round ups begin at $5. |

| Fee Structure | Digital: $4.00 per month for accounts worth less than $20,000 0.25% AUM for accounts worth more than $20,000 or with $250 per month auto deposit. Premium: 0.40% AUM Crypto: 1% aum (crypto) | Standard-$0.00 Gold-$5.00 per month | Personal-$3.00 per month Family-$5.00 per month |

| Top Features | Digital and hybrid investment management with financial advisors (added fee). Socially-responsible, income, smart beta, and crypto portfolios. Tax loss harvesting. Cash management. | Trade stocks, ETFs, options, and cryptocurrency. 1% match IRA Extended-hours trading. Margin account available. | Save and invest money in stock, bond, real estate ETFs and bitcoin fund while you spend on everyday expenses. “Found money” partners, add to your account. |

| Contact & Investing Advice | Phone support M-F and email. Financial advisor access (for added fee). | Email and chat. Call-back phone support available. | Phone support M-F, live chat 24/7 and email. |

| Investment Funds | Bond, stock, and crypto funds. | Stocks, options, ETFs and cryptocurrency. | Bond, stock, and crypto funds. |

| Accounts Available | Single and joint taxable brokerage. Roth, traditional, rollover, and SEP IRAs. Trusts. | Individual brokerage account. | Taxable brokerage accounts, IRAs, custodial, and checking account with attached debit card. |

| Promotions and Website | Free investment management | Free stock promotion. | Visit Acorns Now |

Acorns Top Features:

- Fractional shares, or micro-investing

- Spare change investing through Round-Ups

- Additional benefits for purchases made with participating companies

- Bitcoin ETF available for crypto investors

Sign up with Acorns, and get a $20 bonus!

Betterment Top Features:

- Goal oriented professionally created investment portfolio in line with your risk tolerance.

- Socially Responsible and Smart Beta portfolios

- Individualized financial planning sessions via low fee a la carte packages

- Cash management

- Crypto ETF portfolios

Robinhood Top Features:

- Cryptocurrency trading available

- Stocks, ETFs and options trading

- Extended trading hours – with 24/5 trading on popular stocks and ETFs.

- 1% IRA match

- Margin investing with Robinhood Gold

Robinhood vs Betterment vs Acorns – Who Benefits?

Though each entity has its own selling points, there are also some crucial overlaps in terms of benefits.

If you’re looking for fractional shares, all the money apps on this list are good for you. This means that if you invest $10 in a $100 stock, you’ll own 1/10th of a share. With each of these investment platforms, you can buy fractions of shares in larger companies, giving you access to growth potential with small investments.

Investors who are just getting started or don’t have a large initial investment will benefit from any of these three ways to invest. Neither Acorns ($5 to begin investing), Robinhood, nor Betterment Digital ($10 to begin investing) have minimum requirements for investors. Although, Betterment Premium requires $100,000 for unlimited access to financial advisors and portfolio management.

Robinhood

Investors who want commission-free trading will love Robinhood. This is not limited to standard trading either; cryptocurrency traders will also benefit from the lack of commission fees! This mico-investing app with commission-free trades and broad investment options makes it easy to become an investor.

Be aware that occasionally, beginning investors may borrow and invest too much without proper knowledge, so be sure to take advantage of the educational tools available on the website.

Betterment

We prefer the Betterment investment platform for new investors serious about building wealth. With broadly diversified investment options, many types of investment accounts, rebalancing and tax loss harvesting, this is a great place to build a solid investment portfolio. Those seeking added diversification will appreciate the income and smart beta portfolios.

The low cost financial planning packages are a sound way to answer money questions.

If you have at least $100,000 to invest, you will benefit from the Premium features like unlimited contact with a team of Certified Financial Planners.

Acorns

Acorns prides itself on teaching spenders to be savers. If you’ve had a hard time putting away money in the past, you’ll benefit from Acorns’ Round-Ups feature.

The newbie investor with little money can dive into spare change investing immediately. The earlier you begin investing, the more time your money has to grow and compound!

Sign up with Acorns, and get a $20 bonus!

Fees and Minimums

Minimums Winner: It’s a three-way tie! All three robos have no minimum requirements, although you need a few dollars if you want to start investing!

Betterment requires $10 to begin investing and requires $100,000 for Betterment Premium – which includes access to financial advisors.

Fees Winner: Acorns and Robinhood are fairly evenly matched, with their accounts costing anywhere from nothing to $5 per month.

Acorns Fees and Minimums

There is no minimum investment requirement for Acorns, though your Round-Ups won’t be invested until they reach $5.

Acorns has a very reasonable fee structure. For accounts up to $1 million, the tiered plans are:

- Acorns Personal ($3/month): Investment, retirement (Acorns Later), and checking accounts (Acorns Spend).

- Acorns Family ($5/month): All the above, plus child accounts.

The larger your Acorns account grows, the lower the fees, as a percent of assets managed.

Sign up with Acorns, and get a $20 bonus!

Betterment Fees and Minimums

The Digital product doesn’t require a minimum investment amount – although you’ll need $10 to begin investing.

Premium requires a $100,000 minimum.

Fee structure:

Digital:

- $4.00 per month for accounts worth less than $20,000

- 0.25% AUM for accounts worth more than $20,000 or with $250 per month auto deposit.

Premium: 0.40% AUM

Crypto:

- 1.0% AUM per month – plus trading fees for Digital clients

- 1.15% AUM – plus trading for Premium clients

Financial Advice Packages

Prices range from $299 to $399 per financial advice package

Cash accounts (through partner banks) do not charge management fees.

Robinhood Fees and Minimums

No minimum means you can open an investment account and buy individual stocks with small amounts of money.

The micro-investing app also offers commission-free trading.

Robinhood Gold charges $5 per month and offers:

- Larger instant deposits.

- Professional research from Morningstar

- Level II market data

- Access to margin investing

Acorns vs Betterment vs Robinhood – Deep Dive

Human Financial Planners

Winner: Betterment

Betterment takes an easy victory here, with low-fee access to Financial Planning sessions and unlimited CFP support for Premium clients. Neither Robinhood nor Acorns have access to human financial professionals.

Tax-Loss Harvesting

Winner: Betterment

Betterment takes another victory here, as the only robo out of the three to offer tax-loss harvesting.

Investments

Winner: Robinhood – with Betterment and Acorns a close second.

Answering the call for digital asset investing, all three platforms now offer access to cryptocurrency.

Betterment, Acorns and Robinhood all offer a range of stock and bond ETFs but Robinhood offers more unique investments and self-directed trading. At Robinhood you can trade individual stocks, ETFs and options. Betterment and Acorns offer diversified investment portfolios, created to align with your goals and risk tolerance. Acorn clients include real estate ETFS in their portfolios

Acorns Investment Funds

- Large, medium and small-cap US stock

- Developed and international stock

- REITs (real estate investment trusts)

- Corporate, government, and short-term bond

- Bitcoin ETF

Sign up with Acorns, and get a $20 bonus!

Betterment Investment Funds

- U.S. Total Stock Market, including Large-Cap, Mid-Cap, and Small-Cap Value

- International: Developed and Emerging Markets Stock

- U.S. High Quality Bond

- U.S. Municipal Bond

- U.S. Inflation-Protected Bond

- U.S. High-Yield Corporate Bonds

- U.S. Short-Term Treasury Bond

- U.S. Short-Term Investment-Grade Bond

- International Developed and Emerging Market Bond

- Cryptocurrency funds

- Betterment also offers smart beta, ESG sustainable investment choices and income portfolios

Robinhood Investments

- US Stocks and ETFs

- International Stocks (ADRs) and ETFs

- Preferred stocks

- Options

- Bonds and Fixed Income

- Cryptocurrency

Rebalancing

Winner: Betterment and Acorns.

Both Betterment and Acorns will rebalance your portfolio automatically if your investment allocations get out of whack.

Robinhood’s website implies that clients will need to take portfolio rebalancing into their own hands. This isn’t necessarily a bad thing, as doing so will give you more control over your portfolio.

Sign up with Acorns, and get a $20 bonus!

Customer Support

Winner: Betterment and Acorns

Betterment offers phone support Monday-Friday, either from 9:00 am-9:00 pm ET for checking and cash reserve questions, or from 9:00am-6:00pm ET for investing and general questions. They also offer email and a FAQ help center.

Acorns clients can access weekday phone customer support, email and a FAQ help section as well.

Robinhood is the most difficult to get in touch with; their web-based support form can only be accessed after delving into the FAQs. To speak with a customer support representative, you can request a “call back,” but are unable to call directly. This makes it difficult for clients to get quick help.

Cash Management

Winner: Betterment, with Robinhood a close second.

Betterment offers no-fee checking accounts, with ATM fee reimbursements and a debit card. These accounts are FDIC insured up to $250,000.

Betterment also offers Cash Reserve, a high-yield savings account. These accounts are insured for up to $1 million by the FDIC, as Betterment uses partner banks to maximize insurance. There are no fees or maximum transfers for the cash accounts.

The current Betterment cash reserve interest rate is 4.50% APY.** The rate will vary, based upon market interest rates.

Robinhood also offers a Cash Management account. There are no minimums or fees for this account, and they even offer a whopping $1.25 million in FDIC insurance through the use of five partner banks.

Acorns Spend is an all-digital checking account that comes complete with a debit card. Clients earn bonus investments (up to 10%!) when they shop with this card. Accounts are FDIC insured for up to $250,000.

FAQ

Is Acorns or Betterment better?

Betterment may be the better option if you’re looking for a full-service robo-advisor. You’ll get goal-based investing in line with your risk tolerance, rebalancing, financial advisor access – for additional fees, and fee-free cash management.

Is Acorns better than Robinhood?

they are also geared toward beginning investors and those who don’t have much money.

The real difference boils down to the features you value most. Robinhood is primarily for active, self-directed investors and includes commission-free stock, ETF, cryptocurrency, and options trading.

Acorns, on the other hand is a mobile app that automatically helps you save money, invest and immediately begin fulfilling your investment goals. In fact, Acorns Later is great for beginners who want to invest for retirement.

Is Betterment a good investment?

Which is Better Robinhood or Betterment?

If you want to start investing and try stock, ETF, options or crypto trading without trading fees then Robinhood is a good choice. You even get a share of free stock when you sign up for the platform.

What is the difference between Acorns and Robinhood?

While Acorns is a robo investment app with the option to grow your spare change. The Acorns Spend and Acorns Later are ideal for investors who prefer to automate their spending and retirement investing.

Sign up with Acorns, and get a $20 bonus!

Robinhood vs Betterment vs Acorns – Which is Best?

The bottom line is that each of these apps are designed for a specific type of money management.

If you’re seeking a full-service robo-advisor with many account types, tax-loss harvesting, bank account like cash management (through partner banks), and financial advisors (for additional fees), then Betterment is for you.

If you want to trade investments on your own, then Robinhood would be the best choice for you.

Acorns is suitable for the newest investors just getting started in the financial markets and who wants to round up their spending into an investment account.

Neither Acorns or Robinhood will match Betterment’s access to financial advisors. However, they’re still able to offer quality checking accounts and, in the case of Robinhood, higher-yield interest rates on said checking account.

A Robinhood account is best for you if you want a mobile app to trade stocks and other assets. The free stock offer for opening an account and no management fee are also enticing.

While new investors can get started with Acorns to save money and begin micro investing.

Choosing between Acorns, Betterment, and Robinhood is more challenging than checking a few boxes. It will require closely examining your financial needs and your comfort level with fully-digital investing. Whichever investment platform you choose, the important behavior is to start saving money today to grow your wealth for tomorrow.

Read the Betterment Review

Read the Acorns Review

More Comparison Articles

- SoFi vs Robinhood

- Wealthfront vs. Acorns

- M1 Finance vs. Robinhood

- M1 Finance vs Stash

- Robinhood vs Acorns vs M1 Finance

- Betterment vs Acorns

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.