Expert SigFig Review 2023

SigFig is a robo-advisor that manages your account while it is held in popular brokerage platforms, like Charles Schwab, Fidelity, and TD Ameritrade (soon to be integrated with Charles Schwab). They offer comprehensive portfolio management for reasonable costs. The free SigFig Portfolio Tracker analyzes your investments and recommends changes, for anyone interested in a second investment strategy opinion

The SigFig robo-advisor company was founded in 2007 under the name “Wikinvest,” but became known as SigFig in 2012. The firm currently boasts $2.3 billion assets under management as of December 31, 2021.

SigFig offers live financial advisors for all customers. All you need is $2,000 to sign up for the managed accounts. As an added bonus, the company manages your first $10,000 for free!

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

[toc]

-

Fees

(4.5)

-

Investment Choices

(4.5)

-

Ease of Use

(5)

-

Tool & Resources

(5)

SigFig Review

Best for:

- Account holders with Charles Schwab, TD Ameritrade, and Fidelity

- Investors seeking a hybrid robo advisory with live financial advisors

Pros

- Free financial management tools

- All clients receive access to financial advice

- Excellent tax-management features

Cons

- $2,000 account minimum might make this out of reach for beginners.

- Fractional shares aren’t available.

What is SigFig?

SigFig uses science and data to help new and advanced users simplify investing.

The platform provides two different portfolio management levels, one free and the other paid:

1. SigFig Portfolio Tracker: Free investment tracking and analysis tool. (More details below.)

2. SigFig Automated Investing Managed Portfolio: A comprehensive, low-fee investment manager with many features including tax-loss harvesting.

The unique thing about SigFig Wealth Management is that while they manage your portfolio, they don’t actually hold your money in custody. The managed account is held with either Fidelity, TD Ameritrade Institutional or Schwab. However, if your account is not held with one of these brokers, SigFig will assist in transferring your assets to a participating company.

SigFig Robo Advising Features at a Glance

Who is SigFig Best for?

Investors who want free portfolio tracking without account management.

The free portfolio tracker is great for anyone who wants to monitor their investments, plan for retirement, and check on fees. This tracker has two options: synced portfolios and manual portfolios.

- Synced portfolios link SigFig’s free portfolio tracker to your existing investment accounts and update your holdings as changes are made. These portfolios offer an easy view of your investments in one spot.

- Manual portfolios are not automatically updated. These are good options for individuals who have brokerage accounts that cannot yet link to SigFig, though they’re more cumbersome than synched portfolios.

Even if you don’t want to sign up for a low cost SigFig managed portfolio you can still take advantage of the free SigFig Financial Tracker. It offers access to some of the services available with the paid managed portfolio option.

Another firm with free portfolio tracking and review is the Personal Capital Dashboard.

Investors who work with TD Ameritrade, Charles Schwab, or Fidelity.

SigFig can manage any investments held at Schwab, Fidelity, or TD Ameritrade, so if you already invest with one of these three companies SigFig is a good robo-advisor to consider. These are currently the only investment firms that SigFig works with.

Smaller investors

Small investors, with $2,000 to $10,000, will benefit from the free investment management.

Investors looking for basic investment advice.

All users who hire SigFig to manage their portfolio can call a financial advisor and receive basic advice. This is best for basic money management and SigFig usability questions, not complete financial planning.

Top Robo-Advisors

SigFig Pros and Cons

Advantages

- SigFig allows you to keep your portfolio at Schwab, TD Amertrade Institutional or Fidelity – that’s great if you already have accounts at those firms.

- The management fee of 0.25% is well below the 1.00 – 1.50% charged by traditional money managers.

- The first $10,000 is managed for free, which is great news for smaller-scale or beginning investors.

- Your portfolio is invested in stocks and bonds, but also real estate and municipal bond funds for added diversification.

- You have the ability to adjust your risk tolerance, and thereby change your portfolio allocations. The flexibility to make these changes is important.

- Tax-loss harvesting is a win for taxable investment accounts.

- External Portfolio Analysis analyzes all of your external financial accounts, then provides recommendations on fees and diversification.

- The FREE SigFig portfolio tracker is worth it for anyone, whether you elect to use the paid service or not.

Disadvantages

- If you don’t invest with Fidelity, Schwab, or TD Ameritrade, you will have to transfer funds into one of those platforms and you might incur taxable expenses. This isn’t terribly uncommon, though; most other robo-advisors require you to transfer your funds to their platform.

- The $2,000 account minimum might be steep for those just getting started.

- No fractional share investing available.

- SigFig does not currently offer a cash account or savings account. This might not be a deal breaker, but many robo-advisors are beginning to diversify their product offerings to that clients can keep all their assets under one roof.

SigFig Robo-Advisor Drill Down

Account Types

SigFig supports the following account types:

- Individual brokerage accounts

- Joint brokerage accounts

- Traditional IRAs

- Roth IRAs

- SEP IRAs

- Rollover IRAs

While they do not support 401(k) or 529 plans at this time, they will help clients with existing 401(k)s roll these over to IRAs. They also note that they are working to support these account types in the future.

Fees and Minimums

There are no management fees or minimums for the free portfolio tracker.

Investment management requires a $2,000 account minimum. SigFig offers fee-free management for the first $10,000 of your portfolio. After that, the annual fee is 0.25% of AUM of your account balance. It is charged on the last business day of the month, and deducted from the uninvested cash balance in your account. The 0.25% management fee is low among the robo-advisors with financial advisors.

In addition to this, there are no commissions or other transaction fees charged to your account by SIgFig. Although your brokerage firm might levy additional fees.

Fund advisory fees do apply to the exchange traded funds held in the account, and those have a low average expense ratio of between 0.07% and 0.15%. These fees go to the fund managers, not to SigFig.

Newbies seeking low minimums might consider SoFi Invest (zero minimum and management fees) or Betterment.

Portfolio Rebalancing

Like all robo-advisors, your SigFig account is rebalanced regularly. That means the asset classes are returned to your preferred allocation if they get off track.

For example: say you had a 60% stock and 40% bond mix and over time stocks performed well. Your investments might drift to 70% stocks and 30% bonds. The platform would sell 10% stocks and buy 10% bond ETFs to return to your preferred allocation.

The automatic rebalancing is a sound way to temper risk and keep your emotions out of your investment management.

Dividend Reinvestment

SigFig automatically reinvests your dividends so that you don’t have to worry about it. This is a great feature for investors who want to stay fairly hands-off.

Tax-Loss Harvesting

Like many other robo-advisors, SigFig uses tax-loss harvesting to help investors minimize taxes on capital gains.

Portfolio Tracker

This is one our favorite tools. After linking accounts you’ll have access to:

- Reporting dashboards with many features

- External Portfolio Analysis-SigFig Guidance

- Built-in retirement planner. You can adjust the retirement date, standard of living, risk profile, investment strategy and more.

- Information regarding problems like poor diversification and high management fees.

Security – Is SigFig Safe?

Account security is paramount and because your accounts remain at the brokerage firms like Fidelity and Schwab you can be certain that the account is well protected. The SIPC insures your brokerage account against losses up to $500,000, including $250,000 in cash, due to the failure of the firm.

Of course, when investing in the financial markets, you aren’t protected in the normal ups and downs in value of your stock, bond, and real estate funds.

Customer Service

We like the ease of access to customer service at SigFig:

- Live phone support on the site Monday through Friday 9AM to 5ET.

- Email 24/7.

- Schedule an appointment with a Financial Consultant.

Of course, there are also robo-advisors on the market with more readily available customer service departments. Ally Invest Managed Portfolios contact is available by phone until 11:00 PM on weekdays and during the day on Saturdays.

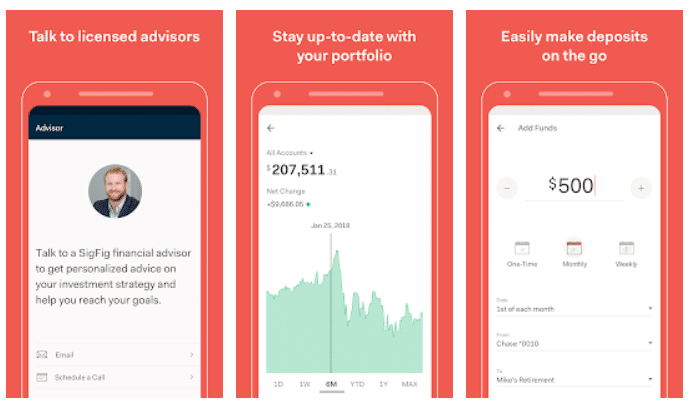

Mobile App

The SigFig Wealth Management App is available for android and iOS devices. You can sync accounts at over 50 leading brokerages for review with the Portfolio Tracker. The SigFig app is secure and encrypts your financial information.

Users generally like the app, although a few complain that the more advanced charts and tracking are only available for the paying customers.

How Does SigFig Work?

The Sign-Up Process

SigFig tries to make it easy to open an account with them. You’ll start by answering a few quick questions regarding:

- Your age

- Your investment time horizon – less than five years, 5 to 10 years, or 10+ years

- Household income and the percentage of your income that you save

- Amount of your liquid assets

- Your risk tolerance

The question on risk tolerance is a self-evaluation that gives you the following choices:

- Very Low – “Any loss would be intolerable.”

- Low – “You would tolerate losing up to 10% of your value in a market downturn.”

- Medium – “You would tolerate losing up to 25% of your value in a market downturn.”

- High – “You would tolerate losing up to 50% of your value in a market downturn.”

- Very High – “You would tolerate losing more than 50% of your value in a market downturn.”

Robo-Advisors with Human Financial Planner Access

There is also an option for clients who are unsure about their risk tolerance. This option provides a four-question survey to help you determine your tolerance.

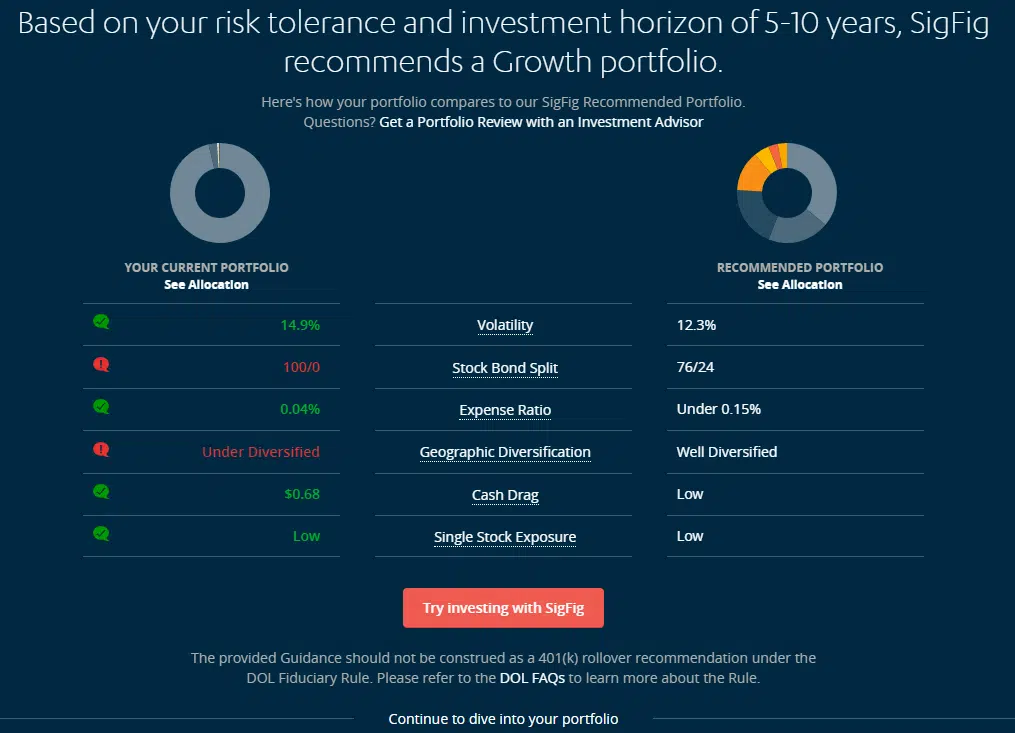

Once you complete the information requested, click the “Build My Investment Plan” button, and view your recommended portfolio.

Your personalized portfolio is based on your money goals and risk tolerance. If you don’t like the suggested plan, you can edit your risk tolerance to generate a new recommended portfolio. You can also change your risk level any time after opening your account by logging in and clicking the Managed tab. From there, click Edit Allocation to change your risk level, and create a new portfolio allocation consistent with that level.

What does SigFig Recommend for Your Portfolio?

The SigFig portfolio recommendations include various mixes or asset allocations of stock bond and real estate funds. The proportions vary based upon your risk tolerance level. More conservative investors will have greater percentages of bond funds while more aggressive portfolios lean towards heavier stock fund allocations.

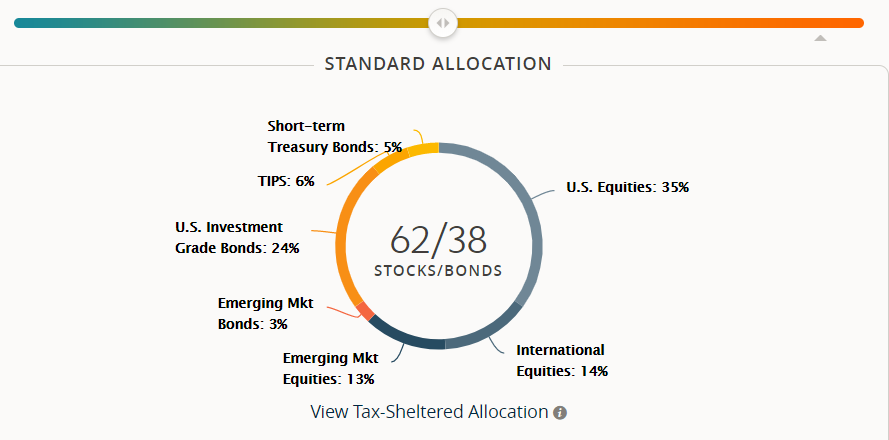

One of the reasons we like SigFig is that you can change your asset percentages with a quick shift of the asset allocation slider bar.

SigFig Asset Allocation – Moderate Portfolio

Sample SigiFig Portfolio Recommendation

The asset allocation for a moderate portfolio includes:

62% Stock Funds:

- 35% U.S. Equity ETF

- 14% International Developed Market International Equity ETF

- 13% International Emerging Market International Equity ETF

38% Bond Fund ETF

- 5% Short Term Treasury Bond ETF

- 6% TIPS (inflation-protected) Bond ETF

- 24% U.S. Investment Grade Bond ETF

SigFig Investment Strategy – ETFs

SigFig uses commission-free ETFs, from Vanguard, iShares and Schwab. The funds boast low advisory fees. The current mix of funds in the Managed Portfolio includes the following funds:

| Asset Class | Fidelity | TD Ameritrade | Charles Schwab |

|---|---|---|---|

| Treasury Inflation Protected Security | TIP | TIP | SCHP |

| US Bonds | AGG | AGG | SCHZ |

| Short-Term Treasuries | SHY | SHY | SCHO |

| Emerging Market Bonds | EMB | PCY | PCY |

| US Municipal Bonds | MUB | MUB | TFI |

| US Equity | ITOT | VTI | SCHB |

| Developed Market International Stock | IEFA | VEA | SCHF |

| Emerging Market International Stock | IEMG | VMO | SCHE |

| Real Estate | FREL | VNQ | SCHH |

Tax-advantaged Investing

SigFig’s Managed Portfolio includes tax-advantaged investing for no additional charge. They use four different strategies in order to provide the biggest tax advantage:

- Tax-Optimized Sales — The algorithm applies tax-efficient strategies whenever there’s a sale of a fund during rebalancing, minimizing your tax liability.

- Tax-Loss Harvesting — This is the process of selling losing positions to offset gains on the sale of winners. This approach minimizes taxable short-term capital gains, and is not used in tax-sheltered retirement plans. (Comparable assets are later purchased to maintain the intended asset allocation). You may opt in or out for this service.

- Tax-Efficient Migration — SigFig concentrates income generating assets in tax-sheltered accounts, while capital gain-generating assets are held in taxable accounts, to take advantage of lower capital gains tax rates.

- Whitelisting — If ETFs you already own are close to SigFig’s portfolio allocation, they will be kept in your account to minimize taxable capital gains.

Bonus; Best Portfolio Management Software for Investors

SigFig Robo-Advisor Review Wrap Up

SigFig is definitely one of the better robo-advisor platforms available. The free tools are an attractive feature, although Personal Capital’s free financial dashboard includes monitoring of all financial accounts, while SigFig analyzes and tracks only investment accounts.

The platform creates a smart investment strategy and is great for creating a diversified portfolio with diverse asset classes in line with your financial goals.

The low-cost platform is a strong competitor for a best robo-advisor list, too. Until you hit the $10,000 mark, your account will be managed for free; after that point, the 0.25% AUM management fees are right in line with the fees charged by competitors.

Ultimately, SigFig is a unique offering on the robo-advisor market. For further information, visit the SigFig website.

Comparisons – SigFig Alternatives

SigFig does have a few worthy competitors.

SigFig’s Key Features

- Free or low-fee account management.

- Access to financial advisors.

- A free portfolio tracker.

How the Competition Stacks Up

- Both Betterment and Personal Capital offer financial advisors.

- Personal Capital has a more comprehensive free financial dashboard than SigFig, including recommendations.

- Betterment has no minimum investment requirement, which is great for new investors.

When choosing the best investment manager for you, consider what features matter most!

Betterment vs. Personal Capital

Try the Robo-Advisor Selection Wizard for a handy way to choose a computerized investment advisor.

Related:

- 5 Best Robo-Advisors for Beginners

- SoFi Invest Review

- SigFig vs Personal Capital

- SigFig vs Betterment

- Ally Invest Managed Portfolios Review

- Axos Invest Review

- Merrill Edge Guided Investing Review

- List of Robo Advisors

- FutureAdvisor Review

- SigFig vs Wealthfront

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

Sources:

- https://d1so5k0levrfcn.cloudfront.net/advisor/adv/ADV_Form.pdf

- https://www.sigfig.com/

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable