In this SoFi Invest vs. Robinhood comparison, you’ll learn whether you need to invest using a full robo-advisor or if a smaller investing tool will do the trick.

Whether you’re just getting stated in the robo-advising world, or you’ve been here a while, you may wonder: what’s the difference between a robo-advisor and an investment tool, and how do I know which I need?

Sometimes, smaller-scale investment apps which solely focus on buying and selling securites are preferable to larger robo-advisors. Investment tools, such as Robinhood, can help you start investing fast.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Other times, a full-service robo-advisor with added financial products, such as SoFi Invest, will better suit your needs.

So, which comes out on top: SoFi Invest or Robinhood?

The answer depends upon the type of investor that are and what you’re seeking in an investment platform.

What is SoFi Invest?

SoFi Invest is the investment arm of Social Finance – the financial company better known as SoFi. The automated investing robo-advisor is only one of SoFi’s many financial offerings, which consist of loans, refinancing, financial advisors, and even career coaches.

There are many investment options included in SoFi Invest:

- Cryptocurrency trading

- Stock bits-individual stock investing by dollar amount, not share price

- SoFi-specific ETFs

- Active investing

- Automated investing or robo-advisor

Such a wide range makes SoFi Invest accessible to investors with varying levels of know-how and comfort.

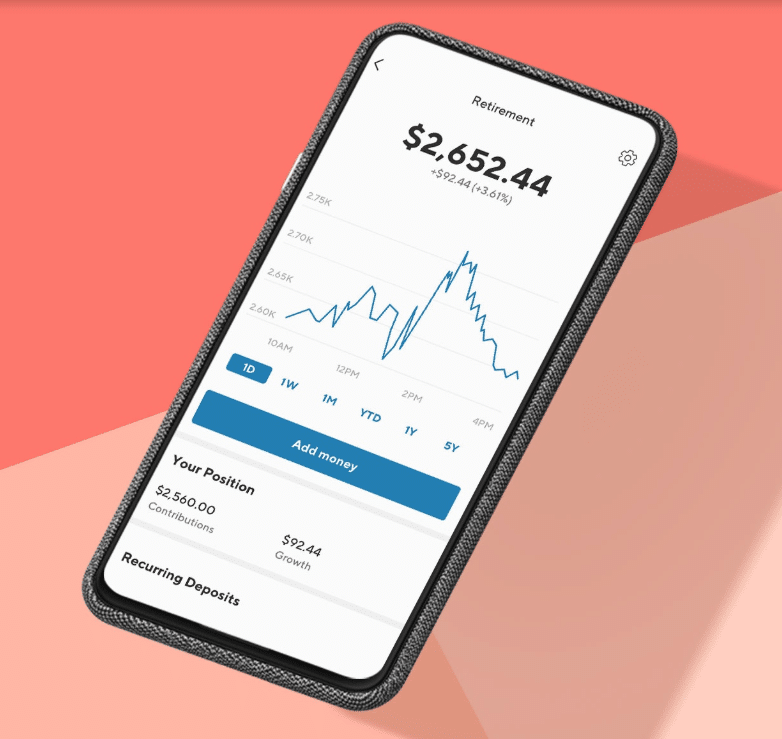

What is Robinhood?

Robinhood is an investment tool or app, not a full-blown robo-advisor. Robinhood is great for self-directed investors who want to trade stocks, ETFs and crypto. Robinhood also offers a high yield cash account and a 1% match on retirement savings. That’s free money!

Like its namesake, Robinhood is meant to help everyday folk increase their earnings – though in this case, not by robbing the rich.

The Robinhood app is geared toward helping clients begin to invest as quickly as possible by making investing free and simple. Clients can conduct different trades through the app, including stop-limit orders, limit orders, and market orders. They also offer cryptocurrency trading as well as options.

Robinhood Retirement IRA

The Robinhood IRA match adds 1% of your IRA contribution to your account. IRA contributions must be made from an external bank account. The Robinhood IRA match is not included in your annual contribution limit and it’s typically available for you to invest, immediately. You’re required to maintain the IRA contributions in your account for at least 5 years. So, if you contribute $6,500 to your Robinhood Retirement IRA, then Robinhood will add an additional $65 to your account.

Robinhood 24 Hour Market

Users can place limit orders to buy whole shares of many of the most traded ETFs and stocks, including TSLA, AMXN and AAPL – 24 hours a day, 5 days a week. Trade from 8:00 PM ET Sunday through 8:00 PM ET on Friday.

SoFi Invest vs. Robinhood – Top Features

SoFi Invest Top Features:

- $0 fees for trading and account management

- Under the SoFi umbrella; additional financial products available

- Fee-free Financial advisor access – for all users

- Multiple investment strategies including active investing

- Robo-advisor

- Cryptocurrency trading

Robinhood Top Features:

- Stock and fund investing

- Cryptocurrency trading

- Simple, intuitive app (available on Android and iOS)

- 24/7 trading

- No account management fees

- Robinhood Retirement IRA offers 1% match

SoFi Invest vs. Robinhood – Who Benefits?

If you want an investment tool with no account management fees, you could benefit from either SoFi Invest or Robinhood. Neither investment app charges account management fees.

You might also choose either option if you want fractional shares, otherwise known as micro investing.

That’s where the differences end. In essence, these are distinct type platforms for different types of investors.

SoFi Invest is Best For

If you want a robo-advisor that also offers additional financial products, you’ll want to check out SoFi Invest. The SoFi company has almost every financial product you’ll ever need!

The SoFi Invest automated investing robo-advisor is best if you want your investments professionally managed. SoFi automated investing creates your investment portfolio in line with your goals, age, and risk tolerance level. Then the robo manages the account. You also have access to live advisors for your money questions.

Live financial planners are available at SoFi, as well, which gives it an advantage over Robinhood. There is no fee to consult with a CFP financial planner at SoFi.

You’ll also like SoFi if you want the opportunity to have part of your investment portfolio professionally managed and also be able to buy and sell securities (including cryptocurrency) on your own.

Robinhood is Best For

If you like to be hands-on with your own investments, Robinhood is an investment tool for you. Robinhood doesn’t offer portfolio rebalancing or financial advisors, so clients need to be comfortable keeping an eye on their own investments.

Robinhood is strictly an investment app, with no guidance in portfolio selection management or live advisors.

Robinhood is best for self-directed investors and traders seeking the opportunity to buy and sell stocks, funds, crypto assets and options. The Robinhood retirement IRA is great for the free 1% match. Robinhood also offers margin borrowing, through the Robinhood Gold – $5 per month plan.

Let’s drill down into the specific features of SoFi Invest and Robinhood, so you can choose which platform is best for you.

Fees and Minimums

Minimums Winner: It’s a tie. SoFi Invest’s minimum is $1, while Robinhood’s is $0.

Fees Winner: SoFi by a slight margin. Both options offer free or extremely low-fee services. SoFi is ahead because they offer access to financial professionals for free.

SoFi Invest Fees and Minimums

SoFi Invest’s minimum investment of $1 is enough for anyone to get started investing right away. They couple this low minimum investment with free account management.

One great benefit to SoFi Invest is that they offer human financial professions to all clients. Most robo-advisors, such as Betterment, charge for such a service.

Robinhood Fees and Minimums

Robinhood does not have a minimum investment amount, though you will need to put in some amount of money in order to start investing! Robinhood offers fractional shares starting at $1, which puts it at the same level as SoFi Invest.

Like SoFi Invest, Robinhood does not charge any account management fees for the basic account level. Clients can upgrade to Gold membership for $5 per month, however. Gold membership gives clients access to professional research, margin trading, and level II market data.

SoFi Invest vs. Robinhood – Robo Investing Deep Dive

Human Financial Planners

Winner: SoFi Invest.

Robinhood does not offer live financial planners. Clients who like to take a hands-on approach to their investments may not mind this; however, others may appreciate access to a financial planner when the market takes a sharp downturn.

Tax-Loss Harvesting

Winner: Neither.

Either SoFi Invest nor Robinhood offer tax-loss harvesting.

Of course, this may not be a bad thing. Most robo-advisors are set up to handle tax-loss harvesting automatically. However, research has shown that tax-loss harvesting may be more efficient when done with human oversight; it may be beneficial to make these sorts of decisions in collaboration with a financial advisor.

Investments

Winner: SoFi Invest offers more investment strategy and product variety.

Although if you’re looking for a self-directed investment trading platform, and not access to an automated digital investment manager, then you’re best off with Robinhood.

SoFi is your choice if you’re seeking an automated robo-advisory platform.

Both SoFi and Robinhood offer trading throughout the day for active investors. Day-traders and those seeking 24/7 trading will be best off with Robinhood Gold.

SoFi Invest Investments

SoFi’s investments span both the active investment stock bits and their automated investment funds. SoFi offers greater choice of assets and investment styles along with live advice.

- Real Estate funds

- High-Yield Bond funds

- SoFi Select 500 ETF

- SoFi Next ETF

- SoFi 50 ETF

- SoFi Gig Economy ETF

- Small-Cap ETF

- Developed and Emerging Markets ETFs

- Total Bond Market ETF

- Cryptocurrency

- U.S. Exchange-Listed ETFs and Stocks

- Exchange traded funds

Robinhood Investments

Robinhood is focused on investing and trading and is best for investors seeking an app-based trading platform.

- U.S. Exchange-Listed ETFs and Stocks

- Options contracts

- Cryptocurrency (i.e. Bitcoin)

- ADRs

- Exchange Traded Funds (ETFs)

Rebalancing

Winner: SoFi Invest is the easy winner here.

SoFi Invest has most of the features we’ve come to expect from robo-advisors, including portfolio rebalancing with their automated investing platform.

Since Robinhood is not a robo-advisor, investors will need to take portfolio rebalancing into their own hands by manually selling off or buying stocks as needed.

Customer Support

Winner: Robinhood

SoFi has one of the most expansive “contact us” pages around. There’s a phone number for almost any issue you might encounter, whether you need help with a mortgage, your investments, or a student loan. Hours vary by department, but many can be reached 7 days per week from as early as 5am to as late as 7pm EST.

Robinhood has 24/7 live chat and call back customer service. You leave a message and then the customer service representative will phone you back. Robinhood initially prompts you to search for online articles to help troubleshoot your concern. Clients must select a category, such as “Bank Transfers & Linking,” and a topic, such as “Transfer Reversal.” Through the live chat, you can access help and leave a phone number for a call back. Email is also available.

Cash Management

Winner: It’s a tie, almost. SoFi wins by a bit, as Robinhood requires a Gold subscription to receive the highest yields.

SoFi Invest offers a high-yield checking account through their SoFi Money product. Clients who have recurring direct deposits of at least $500 or make 10 debit card transactions each month can earn up to 6 times the national interest rate. As with other banks, your money is protected by FDIC insurance.

Robinhood has a high yield cash account. Although, to receive the highest yields, you’ll need to sign up for Robinhood Gold ($5 per month). There are no minimum balances or transfer fees for this account, and your money is FDIC insured.

One added bonus: both of these financial tools invest your money across multiple banks, so your FDIC insurance is higher than the typical $250,000 found at most banks. At Robinhood, your FDIC insurance will cover $1.25 million. For SoFi Money clients, you can expect up to $1.5 million in FDIC coverage.

Lending

Winner: SoFi.

If you have loans or are looking to consolidate debt, SoFi offers a wide range of solutions. They even offer mortgage lending.

For investors who want a broader financial platform with investing plus lending and cash management solutions, then SoFi is the clear choice.

FAQ

Does Robinhood have day trading?

Accounts valued under $25,000 have a limit of 3 day trades within a five-day trading period. There are no limits on day trades for accounts valued over $25,000.

Can I buy fractional shares with Robinhood?

SoFi Invest also offers fractional shares with their Stock Bits.

Should I invest with SoFi Invest?

-$0 fees and minimum investments

-Access to fee-free financial professionals

-Multiple other financial products under one roof

SoFi Invest vs. Robinhood – Which is Best? The Takeaway

SoFi and Robinhood are both sound investment platforms, albeit for distinct investors. Those seeking robo-advisory digital investment management will select SoFi Automated Investing.

Robinhood is not a robo-advisor, but may be a good fit for some investors. Clients can still manage their investments – they’ll just have to be active in monitoring and adjusting their accounts as needed.

Robinhood is also free, which makes it a compelling option for investors who feel comfortable taking matters into their own hands and those investors seeking a trading app.

SoFi automated investing is a full-service robo-advisor, which means that clients get almost all of the bells and whistles: diversified investment options, access to human financial planners, and portfolio rebalancing.

On top of it all, SoFi Invest does that all for $0 in account management fees.

Both SoFi Invest and Robinhood offer live customer service. This is helpful when you want to talk to a live human for platform guidance. We are very impressed with the fee-free access to half hour financial advisory and career consulting guidance.

If you’re seeking an investment app for a joint account, you’ll choose SoFi as Robinhood only offers individual, taxable investment accounts.

If you want a 1% match for your retirement savings, then Robinhood is a solid choice.

When choosing between SoFi Invest and Robinhood, the biggest factor may be choosing between these two preference. Do you want a full-service robo-advisor with additional DIY investing options and financial advisors, or do you prefer self-directed investing with access to options investing?

Read: SoFi Invest Review

More Comparison Articles

- SoFi Invest vs Acorns Comparison

- Betterment vs. SoFi Invest

- M1 Finance vs. Robinhood

- Betterment vs. Ellevest

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable