SoFi Invest vs. Wealthfront – Overview

This SoFi Invest vs Wealthfront review will equip you with the knowledge to evaluate each digital investment manager like a pro! Learn how to choose and why you can profit from a robo-advisor to manage your investments.

With 24/7 electronic access to your finances, algorithmic investment advice, and low-fee access to a myriad stocks and bonds, the appeal of robo-advisors is evident.

However, with everything moving online it’s easy to get overwhelmed. Your checking account may be at one bank, your investments in another, and your student loans at a third – you might feel like you need a personal assistant just to keep track of it all!

In response to this problem, more and more robo-advisors are beginning to offer other financial products on top of automatic investment advice.

Robos who offer loans or checking accounts in addition to retirement planning are great for those who want their financial life to be straight forward and in one place. If that describes you, read on – this SoFi Invest vs. Wealthfront review delves into two robo-advisors who offer more than just investment accounts.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

What is SoFi Invest?

SoFi stands for Social Finance and is best known as a student loan refinance company. Since their inception, however, SoFi has expanded to offer many financial products and services to well-qualified clients.

SoFi Invest is one of the company’s financial segments and includes the following investment options:

- Crypto Investing – Cryptocurrency trading platform.

- Stock Bits – Free stock market investing, similar to Robinhood and M1 Finance.

- Active Investing – This SoFi stock investing platform allows you to buy shares of stock or even partial shares and get started investing on your own, for free.

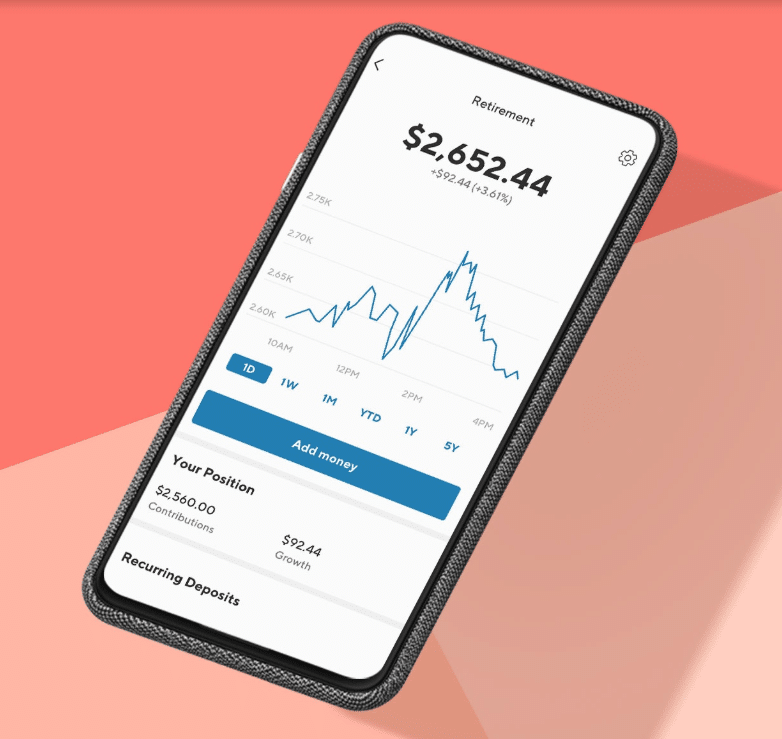

- Automated Investing – The SoFi robo-advisor invests your money in diversified exchange traded funds, or ETFs and manages it for you.

- SoFi ETFs – SoFi offers several ETFs including: SoFi Select 500 (SFY), SoFi Next 500 (SFYX), SoFi 50 (SFYF) and SoFi Gig Economy (GIGE).

The SoFi Invest Automated Investing is the division that’s most similar to Wealthfront, with a complete computer-driven investing plan, in line with your goals and risk level.

While the Active Investing, and Stock Bits lets you customize your investments from a range of stocks, cryptocurrency, and ETFs. SoFi Invest offers fractional shares, just like another micro-investing app M1 Finance.

Click below to visit Sofi’s robo-advisor and active investing portals.

What is Wealthfront?

Wealthfront, which manages over $25 billion in assets, is a well-established robo-advisor. This makes Wealthfront the second largest independent robo-advisor on the market today. The all-digital Wealthfront manages your investing while considering:

- Your goals

- Your age

- Your risk tolerance

- The size of your current investment portfolio

Wealthfront recently added over 100 ETFs and 2 cryptocurrency funds that investors can add to an existing portfolio or use to create their own new basket of investments.

The feature-rich Wealthfront is ideal for saving for college, with a 529 account, a home, retirement, a big remodel or any future financial goal you might have.

Wealthfront’s PATH advisor is an all-digital, automated investment management system. It doesn’t rely on human financial planners to get the job done, which can be seen as either a boon by the tech-savvy, or as a downside by those who prefer more hands-on financial advice.

Wealthfront offers free investment management for accounts worth up to $5,000 with the link below:

SoFi Invest vs. Wealthfront – Top Features

SoFi Invest Top Features:

- SoFi offers multiple financial products, so you can keep your finances within one company

- Varied investing strategies, ranging from passive to active

- No fees for trading or account management

- Access to financial advisors

Wealthfront Top Features:

- Tax-loss harvesting available daily

- 100+ ETFs and cryptocurrency funds for customization

- Loans and cash accounts available

- 529 Plan accounts

- Unique digital PATH financial planner

- Free portfolio review

SoFi Invest vs. Wealthfront – Who Benefits?

Any investor who is looking for a single financial company to manage their investments and other financial needs, such as loans, will benefit from both robo-advisors.

Wealthfront doesn’t offer the range of loans or individual investment options that SoFi does. Although the range of portfolio customization options in Wealthfront’s managed account surpasses those in the SoFi Invest robo-advisor.

SoFi, on the other hand, offers a complete slate of investment options along with many other financial products and financial consultants. In addition to student loans and refinancing, SoFi offers mortgages, home improvement loans, insurance, spending accounts, and even small business financing.

SoFi Invest

If you’re looking for a fee-free investment manager, SoFi fits the bill.

If you want the opportunity for automated investing along with stock, fund and crypto investing, then SoFi is the best choice.

SoFi Invest offers fractional shares and micro investing. Stock bits are fractional shares for investors who can’t or don’t want to pay full price for one share of an expensive stock. This helps new investors get started more easily.

If you want human financial planners, you will also need to turn to SoFi. Though other robo-advisors offer human financial planners, SoFi is the only robo-advisor to do so without charging account management fees.

Wealthfront

If you’re looking for a fully-automatic robo-advisor, you’ll love Wealthfront. In addition to their PATH financial advisor, Wealthfront also has automated investing – a feature that helps clients make sure that all of their money is working for them.

Wealthfront also offers smart beta and risk parity investment strategies, for investors seeking an opportunity to outperform the market returns. Their customizable portfolios offers do-it-yourselfers low fee investment management.

We like Wealthfront because it’s one of the oldest robo-advisors and is a proven company. Their investment board includes Burton Malkiel, one of the foremost investment minds today and author of “A Random Walk Down Wall Street”. So their investment strategy has a lot of history and research behind it.

SoFi Invest vs. Wealthfront – Fees and Minimums

Minimums Winner: SoFi Invest is the definite winner here, with only $1 required for initial investments.

Fees Winner: SoFi Invest is the winner for all sized accounts, as they do not charge account management fees or trading fees. Wealthfront clients can get their first $5,000 managed for free but will pay for accounts over that amount.

SoFi Invest Fees and Minimums

SoFi Invest is one of the most affordable robo-advisors on the market. Initial investments can be as small as $1.

Additionally, SoFi does not charge clients trading fees or account management fees. This makes SoFi Invest one of the few free robo-advisors, though its $1 minimum arguably makes it the most competitive in this category.

M1 Finance is another zero management fee robo-advisor (additional services available for a low fee), though you’ll need $100 to get started.

Wealthfront Fees and Minimums

Wealthfront is still one of the more affordable robo-advisors, with a minimum investment requirement of only $500. Still, this puts Wealthfront out of reach of would-be investors who don’t have that much capital. The smallest investors might be better off choosing SoFi Invest or Betterment, with no minimum investment amount required.

Your first $5,000 is managed free through Wealthfront. After that amount, the robo-advisor charges 0.25% AUM.

SoFi Invest vs. Wealthfront – Robo Investing Deep Dive

SoFi Invest vs. Wealthfront – Human Financial Planners

Winner: SoFi Invest takes an easy win here, as Wealthfront does not offer human financial planners.

Wealthfront has used automated investment advice and algorithmic rebalancing since their inception, and they’re good at it! Unfortunately, that means that clients don’t have access to certified financial planners. Although Wealthfront customer service representatives typically have a Series 7 investment license.

SoFi Invest does offer clients a chance to talk to human financial professionals. This is particularly impressive in light of their fee-free investment management fees.

SoFi Invest vs. Wealthfront – Tax-Loss Harvesting

Winner: It’s Wealthfront for the win here. SoFi does not offer tax-loss harvesting.

Wealthfront’s take on tax-loss harvesting can best be described as “the more often, the better!” Wealthfront relies on daily tax-loss harvesting, which they believe gives them an edge over other robo-advisors. Tax loss harvesting offsets taxable gains with losses and can boost investment returns. It’s only applicable in taxable brokerage accounts, not IRAs.

SoFi Invest, however, does not have tax-loss harvesting at this time.

Reminder: tax loss harvesting only applies to taxable accounts, not retirement accounts.

SoFi Invest vs. Wealthfront – Investments

Winner: Wealthfront –While both include a wide range of investment types, including real estate, Wealthfront is the winner in this category. SoFi Automated Investment options are more narrow than those available at Wealthfront.

Individuals seeking do-it-yourself investing might choose SoFi Active Investing.

SoFi Invest Automated Investments and Categories

- Real Estate

- High-Yield Bonds

- SoFi Select 500 ETF

- SoFi Next ETF

- SoFi 50 ETF

- SoFi Gig Economy ETF

- Small-Cap ETF

- Developed and Emerging Markets ETFs

- Total Bond Market ETF

- and more

SoFi invests the automated portfolios in approximately 11 ETFs according to your goals, time frame, and risk confidence level. If you’re seeking a broader selection of investments and styles, you’ll need to invest through the SoFi Active Investing portal.

If you want portfolio management with a wider range of investments and styles, you might prefer Wealthfront.

Wealthfront Investment Categories

- US Total Stock Market

- Foreign Stock – Developed Market

- Foreign Stock – Emerging Market

- Dividend Appreciation Stock

- US Treasury Inflation Protected Bond (TIPs)

- US Government Bond

- Municipal Bond

- US Corporate Bond

- Foreign-Emerging Market Bond

- Real Estate

- Natural Resources (Energy)

Low fee funds from reputable companies are included in the standard Wealthfront portfolio. Investors can also choose a smart-beta strategy, risk parity, individual stocks for large accounts, cryptocurrency funds and more than 100 ETFs. These additional strategies will then be managed by the Wealthfront platform with rebalancing and tax-loss harvesting.

SoFi Invest vs. Wealthfront – Rebalancing

Winner: It’s a tie.

Both SoFi Invest and Wealthfront will rebalance your portfolio if your investments drift from your preferred asset mix.

For instance, if you want your portfolio to be a conservative 25% stocks and 75% bonds, but your investments change to a 20/80 or 30/70 allocation, the robo-advisor will automatically readjust your portfolio so it is back in alignment with your goals.

SoFi Invest vs. Wealthfront – Customer Support

Winner: It’s too close to call.

Both Wealthfront and SoFi Invest are dedicated to providing excellent customer support.

Non-customers can contact Wealthfront via email by using a form on their website. Wealthfront claims that all electronic questions will be answered within 24 hours. Wealthfront phone program specialists are available week days during normal business hours. It’s important to note that Wealthfront’ phone specialists are all credentialed investment professionals, trained to handle both investing and platform related questions.

SoFi Invest’s hours vary based on what sort of help you need. They have different email and telephone lines available for general, home loan, money, and investment support, and the hours for these departments vary. That being said, you can usually get in touch with someone any day of the week, from 5am to 7pm EST.

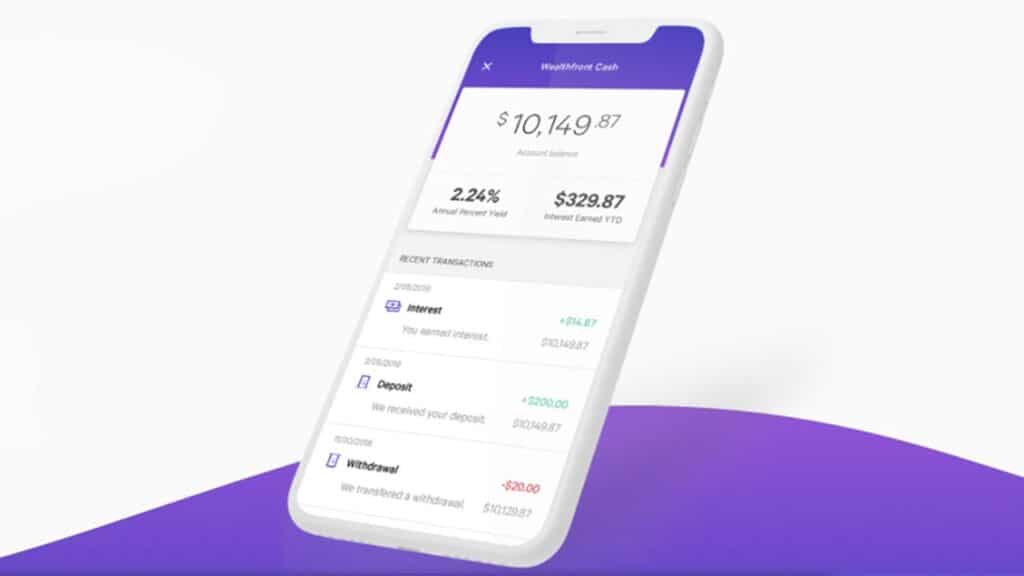

SoFi Invest vs. Wealthfront – Cash Management

Winner: It’s a tie.

No matter which of these two robo-advisors you pick, you’ll have access to a cash management account.

- Wealthfront’s cash account is a high-yield account, with no account fees. Wealthfront offers up to $2 million FDIC insurance through partner banks ($4 million for joint accounts.)

- SoFi Invest also has a high-yield cash account account.

In the future, when interest rates rise, you’re find the cash account returns increasing as well.

FAQ

Who has better account types: SoFi Invest or Wealthfront?

SoFi Invest has limited account types; this robo-advisor offers both automated and active account management. Clients can open individual or joint taxable accounts, or Roth, traditional, or SEP IRAs.

Is SoFi Invest Worth It?

Is Wealthfront trustworthy?

Wealthfront has worked to earn their clients’ trust over the years. That said, investment values and returns go up and down, regardless of the investment firm.

Which Robo Advisor is Best? The Takeaway

SoFi Invest takes the lead in many of our ranking categories and is the victor in this showdown.

The SoFi robo-advisor is jam-packed with features: clients have access to human financial professionals, can invest in fractional shares, receive frequent portfolio rebalancing, and can even open a host of other financial accounts.

If that wasn’t enough, SoFi Invest is also a fee-free robo-advisor and requires only $1 to get started. What’s not to love?

Even though Wealthfront can’t beat SoFi Invest in terms of fees, minimums, or access to human financial planners, this robo-advisor is our best all digital robo advisor, with robust features.

Wealthfront has been established as a robo-advisor for a longer amount of time, which has given the company ample time to fine-tune their automated investment program. Wealthfront also offers a single stock selling plan for investors with too much company stock. The firm also also offers direct indexing for larger accounts, which reduces costs!

Wealthfront customers have more portfolio options like sustainable investing and 100’s of ETFs from which to customize existing portfolios or to create new ones. Wealthfront will rebalance and manage both the custom and Wealthfront created portfolios.

We also love the diverse account types Wealthfront offers clients. If you’re looking for college savings or trusts, you’ll need to turn to Wealthfront over SoFi Invest.

Ultimately, the best robo-advisor is the one that fits your needs!

Related

- SoFi Invest vs Acorns

- Betterment vs. Wealthfront vs. M1 Finance

- Wealthfront vs. Vanguard

- Betterment vs SoFi Invest

- Ally Invest vs Betterment vs Wealthfront

- SoFi Invest vs Robinhood

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Wealthfront Disclosures:

Robo-Advisor Pros receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. Robo-Advisor Pros is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA / SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront conveys funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Please see the Deposit Account Agreement for details.

Other eligibility requirements for mobile check deposit and to send a check may apply.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $2 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.