SoFi Robo-Advisor Review

The SoFi robo-advisor is rebranded as SoFi Automated Investing.

The SoFi Automated Investing (formerly SoFi Invest) adds 6 verticals to the SoFi investing platform. The investing options continue to transform SoFi from a lending company to a full service financial destination.

This review will delve into the SoFi Automated Investing robo-advisor and the other SoFi Invest products.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

What is SoFi Invest?

The SoFi Investing category includes the SoFi Automated Robo-Advisor and more:

- Crypto Investing – Cryptocurrency trading platform.

- Stock Bits – Free stock market investing, similar to Robinhood and M1 Finance.

- Active Investing – This SoFi stock investing platform allows you to buy shares of stock or even partial shares and get started investing on your own, for free.

- IPOs – Access to competitive initial public offering shares of new companies.

- Automated Investing – The SoFi robo-advisor invests your money in diversified exchange traded funds, or ETFs and manages it for you.

- SoFi ETFs – SoFi offers eight ETFs: SoFi Weekly Dividend (WKLY), SoFi Weekly Income (TGIF), SoFi Select 500 (SFY), SoFi Next 500 (SFYX), SoFi Social 50 (SFYF), FoFi Web 3 (TWEB), SoFi Be Your Own Boss (BYOB) and SoFi Smart Energy (ENRG).

In this SoFi Automated Investing Review you’ll learn about Sofi Invest Automated Investing. You’ll discover the Sofi Invest features, management fees (there aren’t any!), and find out who SoFi Invest automated investing is best for. We’ll also touch on a brief overview of the other SoFi Invest platforms; active investing and SoFi ETFs.

SoFi Automated Investing Review

Name: SoFi Invest

Description: SoFi Invest offers automated investing, crypto, and active investing.

-

Fees

(5)

-

Investment Choices

(5)

-

Ease of Use

(4.75)

-

Tool & Resources

(4.5)

Summary

SoFi Invest is best for:

- SoFi customers

- Cost conscious investors

- New to intermediate investors

Pros

- Fee-free investing

- Great diversification

- Free investment advisors

Cons

- No tax-loss harvesting

- Limited account options

The SoFi Story

Short for Social Finance, Inc., SoFi is best known for providing student loan refinances. SoFi was founded in 2011, as an online lending platform. In fact, SoFi has grown to be one of the most innovative and comprehensive financial platforms in the industry. In addition to SoFi Invest, the company has various loans, insurance, and cash management options.

The platform has grown to more than 4 million members and funded more than $50 billion in loans. SoFi is making a name for itself.

The SoFi Invest automated investing platform recently placed number one in the “best robo-advisor performance” in two categories. Recently, SoFi became the first startup online lender to receive an AAA rating from Moody’s.

For only $1, you can open up an account with SoFi Wealth Management. And better still, your account will be managed for free! This gives SoFi a seat at the free robo-advisors table.

~SoFi website

SoFi Automated Investing Review – Features at a Glance

| Overview | Free automated investment management robo-advisor platform with financial advisors |

| Minimum Investment Amount | $1 to open account - $5 to begin investing |

| Fee Structure | No management or transaction fees |

| Top Features | Live CFP advisors with personalized service; access to SoFi member benefits; career planning. |

| Free Services | Free account management, Financial and Career Consultants, and member benefits |

| Contact & Investing Advice | Phone, Monday through Friday, Chatbot and email 24/7. Financial advisor by appointment. |

| Investment Funds | Diversified low-fee exchange traded index funds-ETS; stock purchases available through SoFi Active Investing |

| Accounts Available | Individual and Joint taxable accounts; Traditional, Roth and SEP IRAs |

| Promotions | Regular ongoing promotions |

What Differentiates the SoFi Robo-Advisor from Competitors?

Fee – Free Investment Management

SoFi Automated Investing portfolios are managed for free. This is a perfect arrangement for investors who are looking for professional investment management but don’t want their investment returns reduced by fees.

Popular independent robo-advisors, such as Betterment and Wealthfront, frequently charge roughly 0.25% AUM to manage accounts, so SoFi is a competitive alternative for investors who don’t want to pay someone to manage their money. In addition, the SoFi robo-advisor has no trading, custodian or commission fees.

Learn: Robo-Advisor Q + A

To speed up the video, click on the “settings” gear at the bottom of the video. Choose “playback speed”. Select your speed (I prefer 1.5).

Live Advisors with Personalized Service

Though SoFi Automated Investing is a robo-advisor, they also offer live financial advisors to handle your questions and concerns.

It helps to have a live person to talk to about your portfolio. You can schedule a free 30-minute meeting with a Certified Financial Planner for any investment or money question. This can be particularly important during times of market turbulence and decline. Market drops are perfectly normal events, but sometimes it helps to have someone available to remind you just that.

Although other hybrid robo-advisors offer human financial planner appointments, SoFi is the only digital investment manager with fee-free financial consultants.

Broad Asset Allocation – Growth Stocks and High Yield Bonds

The SoFi robo-advisor adds the mid-cap growth ETF, SoFi Next 500 (SFYX). In a rising stock market, this fund might boost typical market capitalization index fund returns. There’s also a small cap fund. Small cap stocks have a history of outperforming the market over long periods of time. Meanwhile, high-yield bonds offer the opportunity to increase fixed income investment returns.

SoFi Investors Lose Tax-loss Harvesting

SoFi Wealth Management does not offer tax loss harvesting at this time. This can be a negative for some investors, particularly since it is now offered by an increasing number of SoFi’s robo-advisor competitors such as Personal Capital and Axos Invest.

SoFi Loan Services

One of the advantages to investing with the SoFi robo-advisor that you will have access to SoFi’s various loan programs. SoFi is fast becoming one of the most popular options to refinance student loans. But apart from these, the company also offers personal loans and mortgages.

If you don’t have any student loans to refinance, the personal loan program can be particularly attractive. SoFi offers personal loans for up to $100,000, with low rates. In addition, while other P2P lenders typically charge between 1% and 6% for a loan origination fee, SoFi doesn’t have one.

SoFi personal loans are unsecured and can be used for just about any purpose. They may not be what you’re thinking about when you’re looking for an investment management service, but they are an excellent option to have nonetheless.

Who Benefits from the SoFi Robo-Advisor?

Wondering who SoFi is best for?

SoFi Invest can work for anyone who is seeking free professional investment management with a combination of human advisors and digital investing.

In fact, SoFi is the only fee-free robo-advisor that offers financial advisors and career coaches, that we are aware of. The financial advisors carry the highly regarded CFP designation.

More specifically, the service seems particularly well-suited for new and small investors since the SoFi minimum is one dollar and there are no investment management fees.

The SoFi Invest Platform is perfect if you want a portion of your money managed by the SoFi Automated Investing robo-advisor and you also want to buy and sell stocks, funds and cryptocurrency on your own!

The Stock Bits from SoFi Active investing makes it easy for new investors to get their feet wet in the investment markets. For just one dollar you can buy a portion of a publicly traded company like Tesla or Netflix.

The SoFi robo-advisor is a no-brainer robo-advisor for anyone with a SoFi loan who wants loans, cash management and investing with one firm.

Advanced investors looking for a comprehensive trading platform, options and individual bonds should look elsewhere.

SoFi Automated Investing Drill Down

How SoFi Automated Investing Works

You can create an account at SoFi Automated Investing and take the initial questionnaire without providing any personal information beyond your name, email address and password. Answer the four question financial goals, timeline and risk questionnaire and receive your recommended portfolio.

Click on “View details” to drill down into the asset allocation and ETFs contained within the portfolio.

Curious about another portfolio? You’re able to view all of the ten risk-adjusted portfolios before formally signing up and providing your Social Security number. There are five portfolios for taxable accounts and five more for IRAs.

We like that users can take the initial quiz and view all of the portfolios before signing up. This is a feature not available at some other robo-advisors.

Goal Planning

SoFi Invest prides itself on helping you invest for important future goals. The most popular goals include:

- Planning for retirement – or early retirement!

- Saving for a home down payment

- Investing for your dream vacation

- Planning for a child’s education

- Pay for a wedding

Diversified Investment Mix

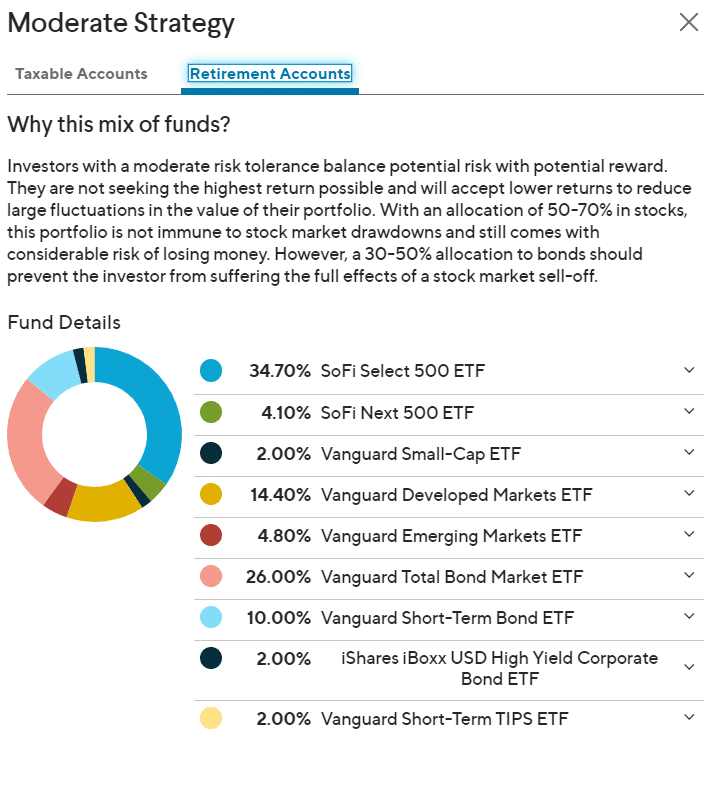

Your SoFi Invest automated investing portfolio is based on your risk tolerance. Your portfolio is comprised of a broad range of low cost investments. These distinct ETFs are managed by the platform’s portfolio team.

When you open a SoFi Automated Investing portfolio, there is no ability to purchase investments beyond those that are recommended by the service. That means that you will not be able to include individual stocks, or funds of your own choosing, within your portfolio.

Although, if you want a portion of your investments managed with computer-driven algorithm investing and you also want to try your hand at stock picking, you can also open a SoFi Active Investor account.

The SoFi robo-advisor invests in diversified ETFs. The mix of these funds is proactively managed and will be changed as either world economic conditions change or the outlook of platform management changes.

Your portfolio is built from SoFi, iShares and Vanguard ETF’s that follow up to nine investment sectors, each tracking the performance of distinct asset classes. The investment asset classes include:

- US stocks

- Growth stocks

- Small cap stocks

- Developed and emerging market stocks

- Corporate bonds

- Inflation protected bonds

- High-yield bonds

- Short-term treasury bonds

- and more

Your individual investment portfolio is based on a mix of factors, including your investment goals, age and risk tolerance. Similar to other robo-advisors, SoFi Automated Investing uses Modern Portfolio Theory or MPT in building your portfolio. MPT emphasizes systematic diversification, rather than chasing “hot stocks”.

Each portfolio contains from four to nine ETFs and are apportioned according to risk level from Conservative to Aggressive. The Conservative Portfolio is 100% investing in bonds, while the Aggressive option is 100% invested in equities. We don’t suggest that most investors create such extreme asset allocation. Bonds will temper losses in an aggressive, all=stock portfolio. While adding stocks to an all bond portfolio will increase capital appreciation and growth to an income ETF mix.

In case you’re wondering – and given that SoFi is a well-established P2P lender – SoFi Invest Automated Investing does not invest any part of your portfolio in the loans that are offered by the lending platform.

SoFi Diversified Portfolios Explained

Each portfolio from Conservative to Aggressive represents a distinct mix of stock and bond ETFs. Conservative investors have greater allocations to less volatile bond ETFs, while aggressive investors portfolios include greater allocations to stocks. Stocks typically provide greater long term returns, along with short term price volatility.

The Moderate Strategy asset allocation is the typical 60% stock, 40% bond asset mix. This type of investment portfolio is appropriate for an investor who prefers a moderate amount for risk, or volatility, or an older investor.

Periodic Rebalancing

Your portfolio will be reviewed daily and rebalanced at least quarterly back to your preferred investment mix in the event that one asset is more than five percentage points above its intended allocation. Rebalancing is done more frequently in the event that one asset class moves in a major way, or if management decides to change the mix of the funds within your portfolio.

SoFi Automated Investing Accounts

SoFi offers individual and joint investment accounts.

The SoFi retirement accounts include:

- SoFi IRA

- SoFi Roth IRA

- SoFi Rollover IRA

- SoFi SEP IRA

Click here and check out the SoFi Invest Platform.

SoFi Robo-advisor Returns

Many investors consider returns a good way to sort robo-advisors. Yet, your SoFi robo-advisor performance will vary based upon when you begin investing and your asset allocation. So, despite the return reports, it’s quite difficult to uncover the prior returns on your specific asset allocation including your investment dates. Even if you could get returns on your exact portfolio, there’s no guarantee that those prior returns would continue into the future. In fact, it’s more likely that prior out performing asset allocations, will not repeat.

The lack of investment management fees gives SoFi a headstart on returns, as fee-based competitors will show returns net of fees. The portfolios might also include fee-free SoFi funds. Every dollar that’s going into an investment managers pocket isn’t in the markets, growing your wealth. When comparing SoFi robo-advisor returns with other firms with the same asset allocation, their returns are typically within the top 25% of all competitors.

You can expect that over the long-term, the returns of your SoFi Automated investments will align with those of the underlying funds. Stock and bonds are volatile and returns will go up and down. That’s why we recommend keeping money you need within the next five years in cash, CDs, or very short term bond funds.

SoFi Automated Investing Fees

There are no investment management fees.

SoFi is waiving management fees for for several of their proprietary funds. While the Vanguard and iShares ETFs levy low management fees.

There are nominal charges for paper statements and account closures.

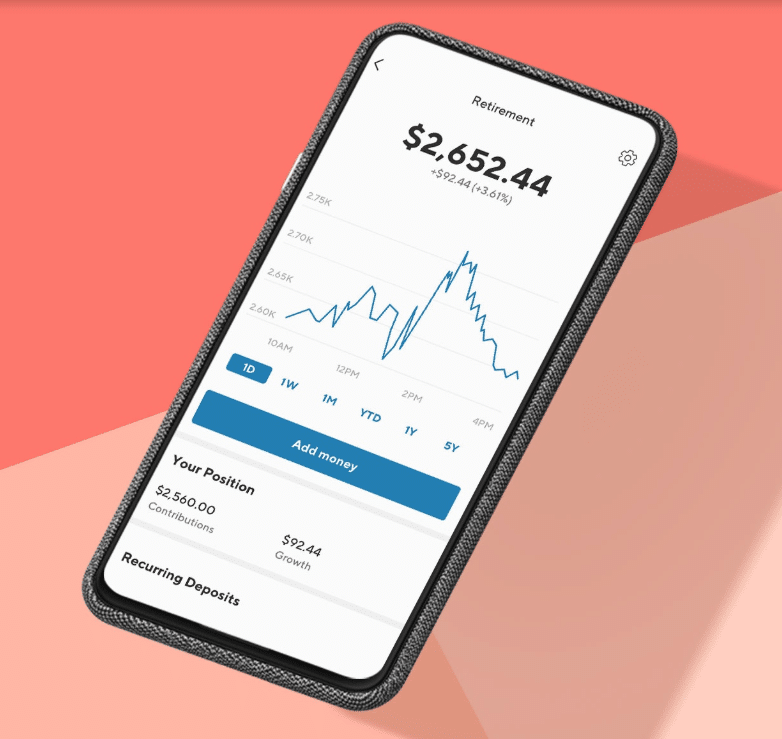

SoFi Mobile App

Your SoFi Invest account can be accessed by mobile app. You can download their mobile apps for iOS and Android either through the iOS App Store or on Google Play.

Once your account is set up, you will be guided through a process to set up a four-digit pin number that is specific to your mobile device.

You can even set up a Touch ID/Fingerprint sign-in on both Apple and Android devices that have fingerprint scanners. You must also enable Touch ID/Fingerprint on the app. Once you do, any fingerprints stored on the device can be used to access your account.

The SoFi app is great if you use SoFi Invest, have loans, or use their high yield cash accounts. There’s even a feature that allows you to track and categorize your spending. Although, due to the fact that there’s only one app for all SoFi products and services, the mobile platform can be a bit clunky at times.

Is SoFi Invest Safe?

Though your account is held with SoFi Wealth Management, a Registered Investment Advisor, the actual broker for the account is SoFi Securities, LLC, while the account custodian is Apex Clearing. Both are members of the Securities Investor Protection Corporation (SIPC), which protects your account from broker failure for up to $500,000 in cash and securities, including up to $250,000 in cash.

These are protections against company failure or malfeasance. All investments are subject to losses that arise from asset price declines.

As it the case with most financial firms, SoFi provides two-factor authentication and high level encryption. You’ll also receive fraud protection.

Sign Up – How to Invest in SoFi

When you are ready to fund your account, you’ll need to provide additional information. SoFi is available to US citizens or permanent resident aliens. SoFi Invest will also need to confirm your bank information, which is a typical requirement for investment brokerages of all types.

The SoFi automated investing sign-up process is fast and completed online. Choose your account type. Provide personal information including Social Security number, name, address and financial status.

Next, link your bank account, transfer funds and you’re good to go.

Once the account is set us, you can transfer funds and begin investing.

More SoFi Invest Offers

Following are two related products from the SoFi brand:

SoFi Stock Active Investing

If you’re looking to invest on your own in stocks and ETFs, the SoFi Active Investing option allows you to purchase stock bits. Stock bits are fractions of stocks. Instead of buying a certain number of shares, for instance, stock bits allow you to purchase a set dollar amount. There are zero commissions and you can start investing with $1.

SoFi Money

This additional SoFi product is a high yield savings account with zero fees. You can save, spend and earn through this bank-type product.

FAQ

Is SoFi a good investment?

How does SoFi Invest make money?

-Interest from univested cash.

-Rebates from investing partners.

-SoFi crypto charges a 1.25% fee that goes to SoFi Invest.

Can you buy SoFi stock?

You can buy stock through your Stock Bits or other brokerage firm, without paying fees or commissions. You can even buy partial shares.

Is SoFi really free?

SoFi Invest Review Pros and Cons

SoFi Automated Investing Pros

- The zero management fee is a huge advantage.

- Access to financial advisors/consultants is attractive.

- SoFi Automated Investing includes stocks and bonds, like most robo-advisors, but they also offer growth and small cap stocks along with inflation-protected bonds. These ETFs are rarer in the robo-advisory sphere.

- SoFi only requires one dollar to get started, making it a unique robo-advisor with zero fund management fees, $1 minimum and financial advisors.

- Access to high yield savings accounts and other financial services makes the Sofi Automated Investing platform desirable.

Bonus; Top 5 Robo-Advisors With Low Investment Minimums

SoFi Automated Investing Cons

- No tax-loss harvesting for non-retirement accounts.

- No socially responsible ETFs within Automated Investing.

- No week-end phone customer service hours for SoFi Invest.

- The aggressive portfolio is 100% invested in stocks while the conservative portfolio is 100% invested in bonds. The 100% stock aggressive portfolio is too risky for most investors. While the 100% fixed investment portfolio is too conservative for all but relatively short term investors.

- Limited account options. Many robo-advisors offer greater account selection.

- The CFP financial advisors are not suited for comprehensive on-going financial planning for complex situations.

*In August 2021, SoFi Wealth was fined $300,000 by the SEC for transferring SoFi automated investing client assets from unaffiliated third party funds into their own proprietary ETFs. This caused taxable capital gains for those clients. When the investigation was opened, SoFi reimbursed affected clients for the additional tax payments that they incurred.

SoFi Automated Investing Review Wrap Up

The SoFi robo-advisor could be a good choice for new and small investors. You can open up an account with as little as $1. The $0 account management fees are also beneficial for all investor—small or large alike.

SoFi also offers social events in large communities. Especially enticing for younger investors is the opportunity to chat with career counselors. Ellevest is the only other robo-advisor with this benefit.

Larger more seasoned investors may want to look elsewhere. While free account management is certainly appealing, the platform currently does not offer tax-loss harvesting. This might be a disadvantage for investors with large positions in taxable investments.

As mentioned in this review, SoFi is also a P2P lending powerhouse. Since student loan refinances are SoFi’s specialty, this could be a good robo-advisor for recent college graduates with student loans to refinance looking to begin investing. Additionally, existing SoFi clients seeking a robo advisor might take a look.

We recommend SoFi Invest, but with a bit of caution as it is one of the newer robo-advisors. Additionally, the SEC sanctions, accusing the firm of breaching it’s fiduciary responsibilities gives us cause for concern. As with any investment decisions, it’s important to examine your own circumstances, weigh the pros and cons, and make a reasoned decision.

SoFi vs. Betterment – How it Compares

Related

- SoFi vs Acorns

- Betterment vs. SoFi Comparison

- M1 Finance and Betterment

- M1 Finance Roth IRA Review

- Morgan Stanley Access Investing Review

- SoFi vs Robinhood

- SoFi vs Wealthfront

- Best Robo-Advisor Returns

- SoFi Weekly Dividend ETF (WKLY) Review

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.