Overview

Have you been pondering investing and have not put aside a dime yet?

Let me guess – you have no money, and you know very little, if anything, about the workings of the stock market.

You are not alone. According to recent studies, close to half of all Americans don’t invest in the stock market and a quarter of all American adults have nothing saved for retirement, according to a recent Forbe’s article. Not having enough money to invest and lack of understanding of the stock market are the most frequently cited reasons for that.

I understand; there is no way you could just drop over $2,000 on a share in Amazon, right? What if we told you that you do not need so much money to start investing? You can begin investing with a few dollars and get educated about stocks and shares in the process.

With micro-investing, you no longer need to buy one share in Amazon; you can buy as large or as small fraction of stock as you can afford. Micro investing platforms and apps have largely democratized investing by allowing you to invest small amounts regularly and buying fractions of shares.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Not surprisingly, there has been a proliferation of micro-investing apps. Here we offer an overview of the main features and investing benefits of three such micro-investing apps. (Click on the links if you’re ready to visit the micro-investing apps’ websites):

- Robinhood – Buy and sell stocks, ETFs and Crypto

- Acorns – Invest spare change into stock and bond funds

- Stash–Robo automated and self-directed investing app

Sign up with Acorns, and get a $20 bonus!

We also compare Stash vs Robinhood vs Acorns to help you decide which of these is the best micro-investing app for you.

Robinhood vs Acorns vs Stash Comparison

| Robinhood | Acorns | Stash | |

|---|---|---|---|

| Overview | Free app or web platform that allows users to trade stocks, ETFs, options and cryptocurrency. | Automated investment management robo-advisor that invests your “spare change” in a portfolio of exchange traded funds (ETFs). | Money management, banking and investing app. |

| Minimum Investment Amount | There is no minimum investment amount. | $1 Minimum $5 for Smart Portfolios | No minimum. |

| Fee Structure | No account management or commission fees. $5/month - Robinhood Gold | $3/month-Personal $5/month-Family | $3/month - Growth $9/month - Stash + |

| Top Features | Extended-hours trading, ability to trade stocks, ETFs, options, and cryptocurrency. | Round ups alllow you to save and invest money while you spend on everyday purchases. Access part time job opportunities. | Self-directed and automated stock and ETF selection. Crypto and banking. Educational resources. |

| Contact & Investing Advice | 24/7 Chat bot and call back phone support. Email. | Available by on-site email or by phone, 6:00 AM – 5:00 PM PST, Monday through Friday. | Phone, mail and chat bot daily. Receive phone # through chat bot. |

| Investment Funds | Stocks, options, ETFs and cryptocurrencies. | Low-cost, commission-free ETFs from Vanguard, Blackrock + iShares. | Stocks and ETFs. |

| Accounts Available | Individual account. | Taxable brokerage accounts, IRAs, and a checking account with attached debit card. | Individual brokerage account, retirement accounts and custodial accounts. |

Robinhood Overview

Robinhood is a commission-free micro-investing platform offering access to US stocks and ETFs traded on the NYSE and Nasdaq. You can also trade cryptocurrency on the Robinhood App. While Robinhood does not appear to take from the rich to feed the poor, this commission-free micro-investing app has set out to empower the investing underdog, e.g., people who have little money to invest.

Like other micro-investing apps, Robinhood offers fractional share trading. What sets Robinhood apart are two important innovations:

- First, Robinhood pioneered fee-free trading, which has been emulated by brokerages like Fidelity and Charles Schwab,.

- Second, Robinhood introduced instant deposits of up to $1,000. It means that your deposits show in your Robinhood account, and are accessible, immediately, not three days after the transfer.

In some circles, Robinhood is viewed as the catalyst for the ongoing transformation of the investing landscape.

Bonus: Robinhood vs. M1 Finance – Best Free Investing Apps

Acorns Overview

Have you ever tried saving by emptying your change in a jar at the end of the day?

I have. And let me tell you that it adds up quickly and you don’t miss it.

It is the psychological trick Acorns, a versatile micro-investing app, uses to enable you to spend smarter, save regularly, and invest for the future.

Sign up with Acorns, and get a $20 bonus!

Using Acorns is straight forward and simple – you connect the micro-investing app to your debit and credit cards and start automatically saving the difference to the nearest dollar every time you shop. Or, you can increase your round up amount to 2x through 10x. To boost your investing more you can also make a one-off transfer or regular contributions.

In Acorns speak, this is known as Round-Ups. Your Round-Ups are invested in a portfolio tailored to your situation and appetite for risk.

Acorns also offers a checking account and debit card to its array of offerings. This account saves, earns, and invests for you.

Acorns really may be a vehicle to build your big future using your small change. It is also great for beginner investors who want to start immediately, compounding their small investments for wealth tomorrow.

Sign up with Acorns, and get a $20 bonus!

Learn more: Acorns Review

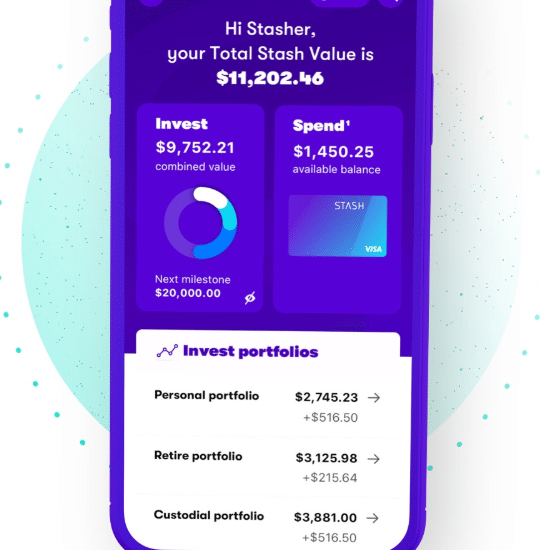

Stash Overview

Stash is a ‘do it all home for your money’ helping you to achieve your financial goals by sound money habits, using technology, and investing education. It was designed to make money management and investing simple, straight forward, and a matter of habit. Stash users can invest in stocks, ETFs and crypto on their own, or within an automated robo-advisor called “Smart Portfolio.”

The app offers online banking as well as micro-investing options. If you have not been investing because you have no money to spare, using Stash, you can start with $5.

Stash is an appropriate banking and investing choice for people who have little money, limited knowledge about investing, and are willing to learn. It offers fractional share investing, manual, or automated by using Auto-Stash, investment selection, and quality money education.

It’s no surprise that 86% of Stash users are first-time investors. Stash appears to be positioning itself as a ‘nursery school for investors’ and taking pride in it.

Features

Acorns: Features

Acorns: Account Minimum

There is no account minimum requirement to open an Acorns account. However, to start investing, you need to have a minimum of $5 in your account. (Your Round-Ups are saved in a holding account till your savings reach $5.)

Acorns: Investment Options

Acorns offer five ETFs pre-set portfolios that, reputedly, were designed with help from Harry Markowitz, winner of the Nobel Memorial Prize in Economic Sciences. These are:

- Conservative portfolio comprised entirely of bonds.

- Moderately conservative portfolio consisting of 40% stocks and 60% bonds.

- Moderate portfolio that includes 60% stocks and 40% bonds.

- Moderately aggressive portfolio with 80% stocks and 20% bonds.

- Aggressive portfolio built entirely of stocks.

The platform is designed to suggest a portfolio for you based on your answers to a few simple questions.

There is no option to invest in individual stocks, bonds, mutual and index funds, or other investment vehicles.

Sign up with Acorns, and get a $20 bonus!

Acorns: Fees

Acorns offer commission-free trades, and there are no minimum account fees either. Just like Robinhood. Acorns charges a monthly subscription fee:

- $3/month-Personal

- $5/month-Family

Acorns: Types of Accounts

Acorns offer three different plans with several types of accounts.

Here is, at a glance, what Acorns offers:

Acorns Accounts and Plans

| Personal - $3 per month | Family - $5 per month |

|

|---|---|---|

| Acorns Invest - taxable investment account transfers round ups to investment portfolio | X | X |

| Found Money - bonus investments from partners | X | x |

| Acorns Later - Roth or traditional IRA retirement account | X | X |

| Acorns Spend - Fee free debit card and checking account | X | X |

| Acorns Early - UTMA/UGMA childrens custodial account | No | X |

Acorns: Customer Care

Acorns offer good customer service for an online platform. There is ‘Acorns support’ where you can find information, and instruction, for every stage of the process – from signing up through the different accounts, to frequently asked questions.

In case this is insufficient, Acorns offer an email customer service.

There is also a customer service telephone number, but it is hidden under ‘Gift cards’ and at the end of this section at that. It is much easier to get the telephone number by a Google search. Lines are open Monday to Friday between 9:00 and 5:00.

Acorns: Educational Resources

Acorns offer access to articles on personal finance written by experts in the field under their ‘Grow’ section. While personal finance education is considered an important part of planting the acorns of your future money oak, it is not as central to the philosophy of Acorns as it is for Stash.

Acorns: Noteworthy features

It is worth noting the following features of Acorns:

- Round-Ups. It is undoubtedly a great trick to encourage people who are not ‘natural’ savers to spend wisely and put away there change.

- Customized portfolios. There is no messing about, and no attempt to please everybody – Acorns offer only customized portfolios to their customers, clearly targeting micro investors who know little about the stock market and are not that keen to learn.

Click to start building wealth now:

Acorns Pros and Cons

Here is what we love about Acorns:

- Acorns round ups go directly into an inestment account-making investing automatic

- Offers retirement accounts

- Offers a checking account and debit card.

- “Found money” partners add mney to your account

Here are the features on which we are not too keen:

- Subscription fee that is small but can have a large effect on micro-investing

- Limited investing options

Sign up with Acorns, and get a $20 bonus!

Robinhood: Features

Robinhood: Account Minimum

There is no minimum amount required to open an account with Robinhood, and there is no minimum balance fee.

In practice, you need a dollar to get into the stock market. Even better, using the fractional share investing options, you can invest in the ‘big ones’ like Apple, Amazon, and Google, even if you have only a few bucks to spare.

Robinhood also offers margin trading, and for that, you need a minimum of $2,000. Margin trading is best for more aggressive investors.

Robinhood: Investment Options

Robinhood offers stock trading, ETFs, cryptocurrency, and options trading. The cryptocurrency trading service allows you to buy and sell all major cryptos, including Bitcoin, Ethereum, and Litecoin.

Robinhood does not provide access to mutual funds.

Robinhood: Fees

Robinhood offers commission-free US stock trades. (Regulatory fees still apply.)

There are a couple of hidden fees worth mentioning. There is a $50 fee to trade foreign stock and a $75 fee to transfer your account to a competing broker. There is also a $5 charge for issuing paper statements.

Overall, however, Robinhood’s fee structure benefits the user – no account fee, no commissions, and no minimum amount fee.

Robinhood: Types of Accounts

Robinhood offers two types of taxable investment accounts:

- Their basic account is free and provides access to all investment options, free trading, and access to business news, performance summaries, and watch lists. This account offers the possibility to set limit orders, which is rather good for a free account.

- There is also the Gold account to which you could upgrade for $5 per month. It will allow you an instant transfer of up to $50,000, access to margin trading, and market analytics.

Robinhood: Customer Care

Robinhood offers 24/7 live chat and call-back phone service.

Customer care is not among Robinhood’s strong points – but they are working to improve.

Robinhood: Educational Resources

Robinhood offers quite a lot of educational content. The articles are good for beginners and more advanced investors alike, and help to inform investors about the risks and strategies of investing.

Robinhood Retirement IRA

The Robinhood IRA match adds 1% of your IRA contribution to your account. IRA contributions must be made from an external bank account. The Robinhood IRA match is not included in your annual contribution limit and it’s typically available for you to invest, immediately. You’re required to maintain the IRA contributions in your account for at least 5 years. So, if you contribute $6,500 to your Robinhood Retirement IRA, then Robinhood will add an additional $65 to your account.

Robinhood 24 Hour Market

Users can place limit orders to buy whole shares of many of the most traded ETFs and stocks, including TSLA, AMXN and AAPL – 24 hours a day, 5 days a week. Trade from 8:00 PM ET Sunday through 8:00 PM ET on Friday.

Robinhood: Noteworthy Features

- User-friendly app with fee-free trading

- Excellent educational content

- 1% IRA contribution match

Robinhood Pros and Cons

Here is what we love about Robinhood:

- Commission-free investing

- Variety of stocks and ETFs

- Crypto trading

- 1% IRA match

- 24 hour trading

Here are the features on which we are not too keen:

- Customer service can be problematic

- Might make trading too easy, causing inexperienced investors to trade frequently and lose money

Stash: Features

Here is what Stash has to offer the micro investor.

Stash: Account Minimum

There is no minimum amount, but, in effect, you need $0.01 for most stocks while those priced over $1k require $0.05 minimum. Stash buys shares in the stocks and ETFs made available on the platform and splits these for the investors.

It is how instead of buying an Amazon share for $2,000, you can purchase one-thousandth of it for $2 – you still end up owning some of the stock. You can also build from there.

Stash: Investment Options

Stash offers opportunities to invest in stocks, bonds and ETFs.

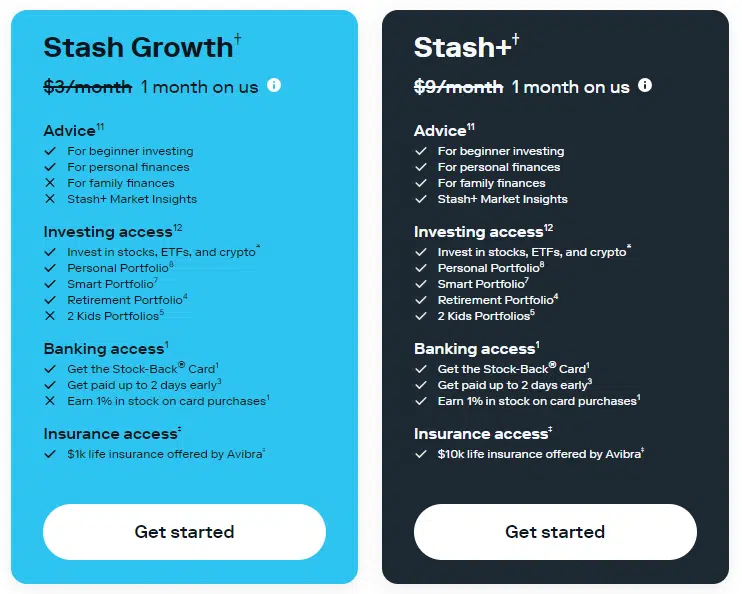

Stash: Fees

$3/month – Growth

$9/month – Stash +

Stash: Types of Accounts

Stash offers investors three types of accounts:

- Investment account

- Retirement account

- Custodial account

Investment accounts come with fractional shares, offer access to more than 400 stocks and funds, and can be automated. The final selection of your investments is left to you, but a lot of guidance, knowledge, and information are available to help you make up your mind.

Retirement accounts, available with Growth and Stash+ plans, are like the investment accounts but, besides, offer tax benefits through Roth IRA and Traditional IRA. Help and guidance are available to help you select the best account for you and to maximize your tax savings.

Custodial accounts, available with Stash+, allows you to open investment accounts for your kids.

Stash: Customer Care

Stash customer support includes phone and email access Monday to Friday between 8:30 and 6:30 EST. Phone ; the customer support channels work on Saturdays and Sundays between 11:00 and 5:00 EST.

Stash: Educational Resources

Stash has quality educational resources on general personal finance, ongoing money management, and investing. The material is clear, easy to understand, and to the point.

Stash: Noteworthy Features

Here are the Stash features worth noting. These are also the features that give Stash an edge when compared to Robinhood and Acorn:

- Education: Stash, in my mind, is a bit like a nursery for ‘grown-up’ investors. While it allows you to select your investment, it also provides an extensive and well-targeted resources repository teaching customers about money management and investing.

- Emphasis on habit building: Through automation and learning, Stash enables healthy money management at investing habits building. Hence, Stash can be used by young adults to develop money habits and set on the way to financial health.

- Portfolio Construction: Stash offers a lot of basic guidance on picking investments including how to choose investiments in line with your values.

Stash Pros and Cons

Here is what we love about Stash:

- Educational resources

- Emphasis on habit formation

- Variety of accounts and investing options

- Customer support

- Combining manual and automated selection of stocks and ETFs

Here are the features on which we are not too keen:

- Small fees still add up

- Stash tries to offer everything to everybody

Stash in a nutshell:

‘We help you to help yourself.’

While Robinhood and Stash offer a basket of useful money and investment services. Robinhood offers fee-free accounts and trading, and access to crypto and options trading. Robinhood also encourages investors to save for retirement with their 1% IRA match. Stash offers both stock, ETF and crypto trading, along with banking and automated investing.

Frequently Asked Questions

Do you still have questions about Stash vs Robinhood vs Acorns?

Here are some frequently asked questions about these three micro-investing platforms on which we did not touch in the review.

Is it safe to invest with Stash?

Stash is FDIC insured, and your deposits are covered up to $250,000. Furthermore, Stash uses state of the art encryption for your data, and its cybersecurity is Payment Card Industry Data Security Standard compliant.

Robinhood and Acorns have remarkably similar levels of security.

Can you transfer from Stash to Robinhood?

In practice, the process is not straight forward, and there is a fee (sometimes covered by the receiving broker), you can transfer only stocks that match, and you cannot transfer fractional shares to Robinhood.

Is it good to invest in Robinhood?

Which is better Stash or Acorns?

Ultimately, your own preferences and investment behavior will determine which micro investing app is best for you. Stash is good if you want to trade stocks and ETFs and have your money managed automatically.

Is Acorns better than Robinhood?

If you’re an investor who doesn’t need management or bells and whistles and appreciates the “free” trading, then Robinhood might be better than Acorns for you. is also best for investors who want to buy and sell cryptocurrency and trade options.

Ultimately whether Acorns is better than Robinhood, or vice versa depends upon your own needs and preferences. The best micro investing app is the one that fits your needs.

What is the difference between Acorns and Robinhood?

There are several differences between Acorns and Robinhood.

Acorns saves for you using Round-Ups, e.g., rounding up your spending to the nearest dollar. The saved money is transferred into a managed investment portfolio.

Robinhood is a trading app, for self directed investors. If you want to invest on your own, Robinhood makes sense. If you want an app to round up your spare change and invest it for you, then choose Acorns.

If you’re seeking a more comprehensive robo-advisor: Check out our free Robo-Advisor Selection Wizard, answer 4 questions and find out thich robo-advisor meets your needs.

Stash vs Robinhood vs Acorns Wrap up

This is how Stash, Robinhood, and Acorns compare according to their core characteristics.

There’s no clear winner, as they each offer solid features and services for distinct types of investors. And each platform enables younger younger or new investors to save and invest. Acorns offers a psychologically appealing approach to saving and investing, the ease of investing afforded by the customized portfolios, the retirement account offering, and the good customer service and security.

Acorns offers an ideal way to begin investing automatically with small amounts of money.

If you have little money and are keen on learning about investing and selecting stocks and ETFs, the contest between Stash, Robinhood and Acorns may go to Stash.

If you have little money to invest, have some knowledge of the stock market, and like to play with crypto investing then Robinhood may be where you should look.

If you have little money and prefer your saving and investing relatively painless (and conservative) Acorns is probably the best one for you.

Finally, what matters most is to overcome your investing hurdles and start investing for your future.

Go directly to the micro investing app website:

Related

- Robinhood vs Acorns vs M1 Finance

- 10 Best Financial Planning Apps

- 6 Best Robo-Advisor Investing Apps

- SoFi vs Robinhood

- M1 Finance vs Stash

- Wealthfront vs Acorns

- Acorns vs Qapital – Saving and Investment

- M1 Finance vs Robinhood

- Robinhood vs Betterment vs Acorns

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.