On October 6, 2020, TD Ameritrade became a wholly owned subsidiary of The Charles Schwab Corporation.

TD Ameritrade Robo Advisors – Digital Advisor and Personalized Portfolio – are not accepting new customers. All interested robo-advisory clients are being referred to the Schwab Intelligent Portfolios and the Schwab Intelligent Portfolios Premium Robo-Advisors.

Top Robo-Advisors

TD Ameritrade Selective Portfolios – Hybrid Robo Advisor

The TD Selective Portfolios is the only TD Ameritrade robo-advisor, at present. It is a digital plus human advisor platform. This platform requires a minimum of $25,000 and offers users access to a team of financial advisors.

The other managed account available at the firm is TD Ameritrade Personalized Portfolios which requires a $250,000 minimum investment and offers personalized financial planning with a dedicated financial consultant.

This TD Ameritrade robo-advisor review will focus on the Selective Portfolios.

[toc]

TD Ameritrade Selective and Essential Portfolios Review

-

Fees

(3.75)

-

Investment Choices

(5)

-

Ease of Use

(4.5)

-

Tool & Resources

(4.75)

Summary

Best for:

- Current TD Ameritrade customers

- Investors seeking a robo with branch office access.

Pros

- Selective portfolios offer both passive and active stragies

- Part of large financial services firm

- Branch offices

Cons

- Financial consultants might lack CFP credential

- Selective portfolio fees start at 0.90% AUM

One of the advantages to using a robo-advisor offered by a major investment brokerage firm like TD Ameritrade is that you can access all the services of a large investment brokerage firm. For example, TD Ameritrade has more than 100 branches located in major metropolitan areas accross the U.S. DIY investors can also trade individual stocks and funds through the brokerage firm with zero commissions. TD Ameritrade is also the home to the renowned thinkorswim trading platform.

TD Ameritrade Selective Portfolios Robo-advisor | Features at a Glance

| Overview | Robo-advisor with human advisor |

| Minimum Investment Amount | $25,000 |

| Fee Structure | 0.90%-0.30% AUM. Depends upon strategy and amount invested. |

| Top Features | Digital and hybrid investment management. Passive and active strategies. SRI available. |

| Free Services | Vast library of educational resources. |

| Contact & Investing Advice | Phone and chat 24/7. Branch access. |

| Investment Funds | Diversified, low-cost mutual and exchange traded funds. |

| Accounts Available | Individual & joint investment accounts. Roth, Traditional, SEP, Simple & rollover IRAs. Trusts. |

What Differentiates TD Ameritrade Selective Portfolios Robo-Advisor From Competitors

TD Ameritrade Selective Portfolios is comparable to a traditional financial advisor with a technology investment management add on.

TD Ameritrade and Charles Schwab Products and Services – One of the greatest advantages of investing with TD Ameritrade Selective Portfolios is being part of the TD Ameritrade and Charles Schwab families. The integration of the two firms will roll out over several years, but promises to keep the best features of both platforms. You’ll continue to find diversified investment brokerage services including self-directed investing, banking services, branch access, and financial advisors.

Range of Investment Styles – Investors can find ETF and mutual fund portfolios, passive and actively managed offers, income portfolios and more.

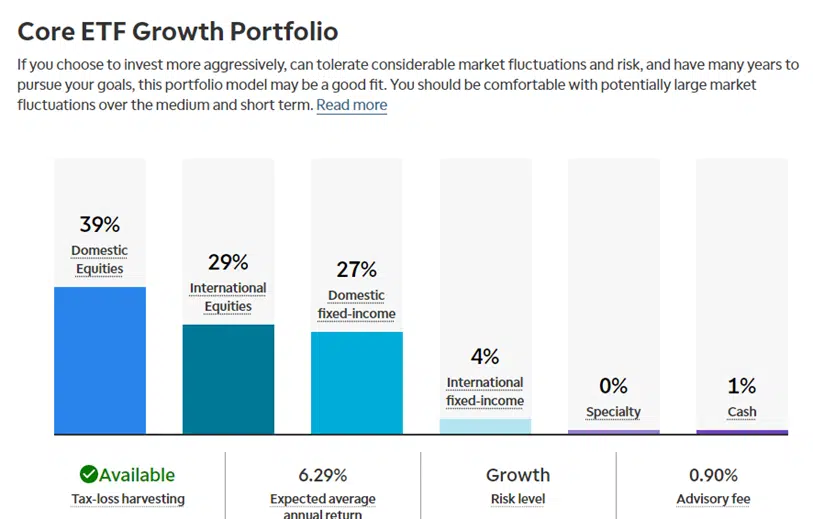

Tax-loss Harvesting – This certainly isn’t unique among robo-advisors but what makes it stand out is that the service is offered on all taxable accounts, regardless of account balance. Other firms offer the service, but often only on larger account balances. And some robo-advisors – like Vanguard Personal Advisor, Merrill Edge Guided Investing and E*TRADE Adaptive Portfolios – don’t offer it at all.

Broad Account Selection – TD Ameritrade Selective Portfolios offers a wide range of personal, business, trust, custodial and additional account types.

Many Portfolios Available – This robo-advisor plus human advisor offers five distinct strategies, each with five risk levels. To meet certain investment goals, These portfolios might include actively managed options or passive index fund strategies.

Financial Consultants – Investors have unlimited access to financial advisors, in-person at a TD Ameritrade branch and by phone. These financial advisors hold Series 7 and Series 66 licenses and might hold the CFP designation. Although other robo-advisors also offer financial advisor access including Betterment and Ellevest.

The financial Consultants assist clients in creating financial goal plans and engage in broader discussions about a range of wealth management issues.

Who Benefits from the TD Ameritrade Robo-Advisor?

Existing TD Ameritrade clients, seeking a hybrid robo-advisor with managed portfolios and human financial advice might consider the TD Ameritrade offer.

The large number of portfolio options including active and passively managed choices could be a good choice for investors who strive to beat market returns.

Investors seeking a financial consultant to plan with and branches to visit, will find a lot to like at TD. Add in round the clock customer service and users who want guidance, advice, and easy access will appreciate this platform.

Investors with smaller accounts might consider lower fee competitors like Schwab, Vanguard Personal Advisor, Ellevest and SigFig.

The TD Ameritrade Selective Portfolios are suitable for investors with more complicated financial situations and those investors seeking in depth personal financial planning.

TD Ameritrade Selective Portfolios – Drill Down

Tax loss Harvesting. Available for taxable accounts and can lower your tax bill.

Rebalancing. TD Ameritrade Selective Portfolios offer automatic rebalancing. The frequency varies depending upon the portfolio selected. In plain English, this means that your investments are bought and sold to keep your preferred asset mix in line with your initial choices.

Customer Service. 24/7 phone and chat customer service is unique among robo-advisors and a positive if you work odd hours.

Account Types. The account options are vast including taxable accounts, the full range of IRAs, trusts, custodial accounts and several business IRAs.

TD Ameritrade robo-advisor Investments. Includes a range of low fee ETFs and mutual funds. Many funds are from Vanguard or BlackRocks’s iShares, and are subject to change. They are selected based on recommendations from Morningstar, and have a rock bottom weighted average expense ratios. You will also find actively managed funds.

Learn about: Robo-Advisors With Human Financial Advisors

Socially-Responsible Investing. TD Ameritrade Essential Portfolios also offers socially-responsible investment options. These portfolios focus on “EGS” investment principles that focus on Environmental, Social, and Governance issues.

Sign-up Process

Signing up for TD Ameritrade Selective Portfolios is a simple online process. Chat and phone assistance is readily available.

Bonus: Best free Portfolio Management Software

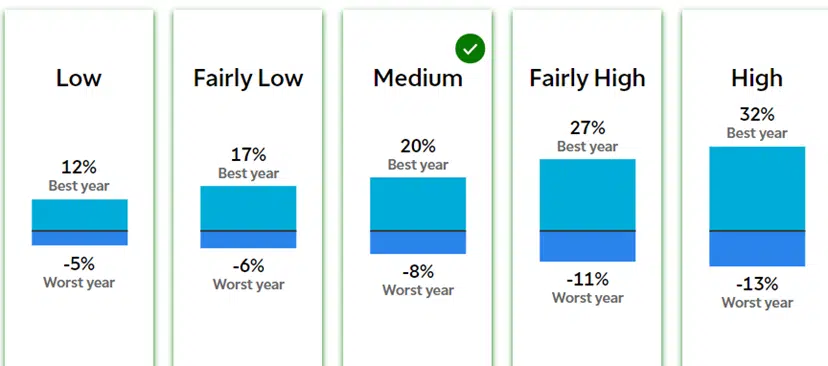

First, enter your name and age. Then choose your goal from among these choices; retirement, education, large purchase, or general investing. The remaining questions include how long the money will be invested, your income and savings. The risk questions wrap up the questionnaire. To help choose the appropriate risk level, you can view expected best and worst case scenarios for each risk level.

Next your presented with the portfolio choices for your risk level with data about the investment styles. You can change your risk level to view different asset allocation mixes.

Investment Portfolios

Portfolio variety is where the TD robo-advisor distinguishes itself. Each portfolio is available in various risk levels, with more aggressive options including more stocks and the more conservative portfolios leaning towards bonds and cash. Each choice includes time horizon, expected best, worst and average returns.

- Core ETF Portfolio

- Core Mutual Fund Portfolio

- Opportunistic Portfolio – Actively managed to target trading opportunities as market conditions evolve.

- Managed Risk Portfolio – Actively managed to limit portfolio volatility with downside protection.

- Supplemental Income Portfolio – Conservative portfolios designed for income seeking investors with moderate growth.

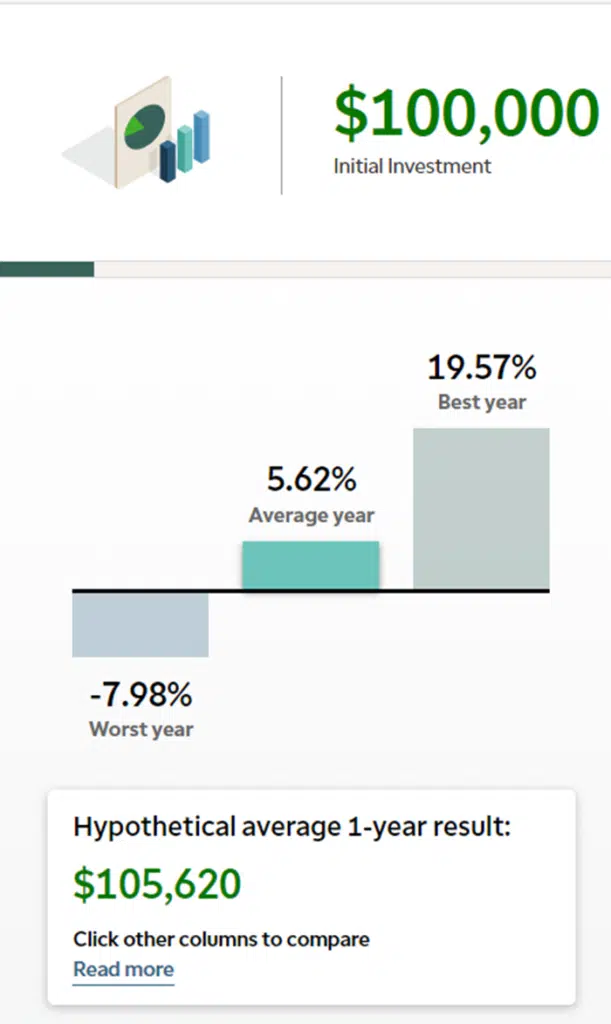

After inputting your initial and recurring investments you’re presented with hypothetical returns for your selected portfolio including worst, average, and best year projected outcomes. You can also state how much you’d like to have in your account at the end of your selected time period.

Visit the Robo-Advisor Selection Wizard, take a quick quiz, and find out which robo-advisor is the right one for you.

Potential client can access a lot about the distinct portfolios including asset allocations, even before signing up.

Even before signing up, they do a good job of explaining the portfolio investment styles and possible outcomes. The only deficit is that before funding, users can’t view the specific funds that go into the portfolio.

Fees and Investment Minimums

Unlike many other hybrid, digital plus human guided investment managers, TD Ameritrade Selective Portfolios requires a $25,000 investment minimum.

The management fees depend upon which portfolio is selected and the account value. The Core, Opportunistic and Managed Risk Portfolios fees range from 0.90% to 0.55% AUM for accounts worth more than $500,000. While the Supplemental Income Portfolio fees start at 0.75% AUM and drop to 0.30% for accounts worth more than $500,000.

These fees are in line with those charged by Personal Capital Advisors, which also provides a robust free investment management dashboard for the public. Although there are quite a few hybrid robo-advisors with lower fees.

Bonus: Robo Advisor Fees from Lowest to Highest

Performance

We appreciate that the TD Ameritrade robo-advisors update performance data, Although we don’t recommend choosing arobo-advisor solely based upon historical performance. Easy access to performance data is rare and can be found on this page.

TD Ameritrade Robo-Advisor | Pros and Cons

Pros

- The TD Ameritrade and Schwab tie-in provides institutional stability, as well as brokerage and banking services provided through the TD Ameritrade and Charles Schwab products and services.

- 24/7 customer contact by phone or chat. This is a welcome feature with automated investing.

- Local branches, for investors who prefer face-to-face contact over online/phone only.

- Customers receive in depth financial planning assistance.

- Tax-loss harvesting is available on all taxable accounts, regardless of account balance.

- The Portfolios use ETFs and mutual funds recommended by Morningstar Investment Management, to remove any proprietary products and bias.

- The supplemental income portfolios are great for those investors seeking a lower risk, cash flow portfolio. This is rare among robo-advisors and found at Betterment as well.

- Opportunistic Portfolios offer the chance to outperform the market returns.

Cons

- The Selective hybrid fee starting at .90% is on the high end of robo-advisors with human advisor access. Ellevest Premium charges 0.50% and Betterment Premium levies a 0.40% of AUM.

- Actual ETFs and mutual funds are not disclosed until your account is opened. It might be helpful for investors to know specifically which funds their money will be held in.

- The Selective Portfolios financial advisors are not all CFPs, a higher credential than Series 7 or Series 66 licenses. In contrast, Ellevest and Personal Capital’s financial advisors are all CFPs. However, TD Ameritrade states that their reps are trained to handle typical client questions.

FAQ

Is the TD Ameritrade robo any good?

Should I invest in a robo advisor?

Did TD Ameritrade get rid of Essential Portfolios?

TD Ameritrade Robo-Advisor Review Wrap Up

Existing TD Ameritrade customers seeking financial planning and a digital robo-advisor might consider the Selective Portfolios.

But, the TD Ameritrade Selective portfolios charge higher fees than many competitors and their advisors might have fewer credentials than their peers at other hybrid models.

In fact, if you’re seeking a robo-advisor with human financial planners, Personal Capital has a lot going for it including Certified Financial Planners for all of their clients (plus the free investment management dashboard that’s available whether you sign up for investment management or not). Schwab Intelligent Advisors Premium also offers Certified Financial Planner access and a low subscription pricing model, which is downright cheap for larger accounts.

If you’d like additional information, or if you’d like to sign up for the service, visit the TD Ameritrade Selective Portfolios website.

Related

- Ally Invest Review

- Betterment vs TD Ameritrade

- Chase You Invest Review

- Merrill Edge Guided Investing Review

Sources

https://www.tdameritrade.com/content/dam/tda/retail/marketing/en/pdf/TDA4855.pdf

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.