Which Robo-Advisor is Best for You?

It can be hard to filter through all the available robo-advisors. Wealthfront vs Schwab are both good firms and among the top five robo advisors, by assets under management (AUM).

When faced with so many choices for investment management options, minimum balances, and extra features, you may start wondering: Are free robo-advisors worth it? Do I really need human financial advice, or can I DIY my investments? What extra features are worth paying for?

Today we will be comparing robo-advisors from two big names: Wealthfront and Charles Schwab.

Wealthfront is one of the oldest independent robo-advisors, and Schwab Intelligent Portfolios, is backed by well-known investing firm Charles Schwab.

After reading this article, you’ll have answers to questions like:

- Which is better: Wealthfront or Schwab?

- Is there a catch to Schwab’s $0 management fees?

- Do I need a robo-advisor with a human financial planner?

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

What is Wealthfront?

Founded in 2008, Wealthfront is an independent robo-advisor with approximately $28 billion in assets under management (AUM). This puts them just below Betterment, another independent large robo-advisor, in terms of robos with the most AUM.

Wealthfront is an all-digital robo-advisor, which means it does not offer access to human financial planners although Wealthfront has an outstanding digital financial planner, PATH. Wealthfront specializes in digital financial tools as well; clients can access loans or high-yield savings accounts along with IRAs, trusts, and 529 accounts.

Wealthfront investors can select from hundreds of ETFs to customize their portfolios, or create a new one, for Wealthfront to manage.

In addition to these varied accounts, Wealthfront also offers goal setting and a homebuying guide to help coach clients through larger life milestones.

What is Schwab Intelligent Portfolios?

Owned by Charles Schwab, Schwab Intelligent Portfolios has over $68.5 billion in AUM in 2020. This robo-advisor places second in our ranking of robos with the most AUM.

Schwab Intelliegent Portfolios offers two robo-advisor plans:

- Schwab Intelligent Portfolios – Fee-free digital investment manager

- Schwab Intelligent Portfolios Premium – Subscription-based digital investment manager with unlimited access to Certified Financial Planners

Clients can open many different account types through the robo-advisor; customers who want additional services will benefit from the host of financial products available at Charles Schwab.

Schwab Intelligent Portfolios vs Wealthfront – at a Glance

Wealthfront Top Features:

- Savings accounts, loans, and 529 College accounts set Wealthfront apart from competitors

- All-digital financial planner

- Hundreds of additional ETFs to add to or create new portfolios; Includes crypto funds.

- Daily tax-loss harvesting

- Individual stock investing for large accounts

- Smart Beta and Risk Parity funds

Schwab Intelligent Portfolios Top Features:

- Branch access

- Free account management on Intelligent Portfolio Digital

- Unlimited Certified Financial Planners (CFPs) for Schwab Intelligent Portfolio Premium clients

- 24/7 live phone support

- Exceptionally broad diversification

- Monthly income paycheck available

Wealthfront vs. Schwab Intelligent Portfolios – Who Benefits?

Wealthfront

You will benefit from Wealthfront if you don’t have a large initial investment or just want to dip your toes into robo-advising. With a $500 minimum, Wealthfront certainly isn’t the robo-advisor with the lowest minimum; however, it’s much more accessible for small investors than the Schwab robo advisors, which requires $5,000 to get started.

Investors who prefer an all digital investment strategy will benefit from Wealthfront. Wealthfront is an all-digital robo-advisor, so the entire investment process – from portfolio suggestions to tax-loss harvesting – is run by technology.

If you want the chance to beat the market and mediate risk, Wealthfront offers Smart Beta and Risk Parity funds, along with the opportunity to choose additional ETFs.

Choose Wealthfront if:

- You’re a small investor

- You want a 529 college savings account

- You want automated investment management, high yield cash management, and lending, within one platform

- You prefer to avoid cash in your robo-advisor portfolio

- You want to customize your investments with ETFs

Schwab Intelligent Portfolios

If you can meet the $5,000 minimum and are seeking fee-free digital investment management, then Schwab Intelligent Portfolios, digital is a viable choice.

If you have the $25,000 minimum and prefer financial advisor access, then you’ll choose Schwab Intelligent Portfolios Premium. The Schwab Intelligent Portfolios Premium package comes with unlimited guidance from CFPs and uses a monthly subscription style for their fees. For only $30/month and a $300 one time set up fee.

All Schwab robo advisory clients need to accept an eight to ten percent cash allocation in their portfolio. The cash portion is typically invested in an interest bearing cash fund.

Choose Schwab if:

- You like all your financial products within one larger institution

- You prefer live financial advice and have the $25,000 minimum

- You prefer a robo-advisor and the chance to trade stocks, funds and bonds through one company

We like both robo-advisors and believe that you would be satisfied with either.

The best robo-advisor for you depends upon what you prioritize most in your investment management.

Wealthfront vs. Schwab Intelligent Portfolios – Fees and Minimums

Minimums Winner: Wealthfront.

Fees Winner: Schwab – if you’re okay with a cash allocation.

The fee-free Schwab basic robo is the winner if you have over $5,000 to invest for the Intelligent Portfolios. For the Premium, smaller accounts are less expensive at Wealthfront, but as AUM (assets under management) rise, the percentage fee declines at Schwab Intelligent Portfolios Premium.

For clients of the Schwab Intelligent Portfolios, all clients must be comfortable with roughly an eight to ten percent cash allocation in an interest bearing fund. During rising markets, this can be a cash drag on performance, although when markets are volatile or declining, the cash will offset the portfolio value declines.

Wealthfront Fees and Minimums

- Minimum: $500 for investment account. No minimum for Cash account.

- Fee: 25% AUM. No fees for Wealthfront Cash account.

You can open a portfolio at Wealthfront with a minimum investment of $500. Though there are other low-minimum investment robo-advisors – such as Fidelity Go, which only requires $10 to begin investing – a $500 start allows for healthy beginning investment.

Wealthfront’s fees are 0.25% AUM, regardless of how much money is in a portfolio. However, there are regular promotional offers.

The wealthfront cash account is fee-free.

Schwab Intelligent Portfolios Fees and Minimums

- Minimums: $5,000 for Schwab Intelligent Portfolios digital; $25,000 for Schwab Intelligent Portfolios Premium.

- Fees: $0.00 for Schwab Intelligent Portfolios digital; $30 per month plus one time $300 set up fee for Schwab Intelligent Portfolios Premium.

Schwab’s robo-advisor comes in two tiers, both with substantially better fees than most big-bank robo-advisors.

The basic robo-advisor, Schwab Intelligent Portfolios, requires a minimum investment of $5,000. There are no account management fees for this service.

Schwab Intelligent Portfolios Premium requires a minimum investment of $25,000. This service follows a subscription plan model, which means that clients will pay $30 each month for as long as they want premium services. There is also a one-time $300 fee for setting up the Premium account.

As account size grows, the $30 per month becomes a smaller percent of AUM. For example at a $100,000 portfolio, the $360 annual fee is .36%, higher than the management fee at Wealthfront. As your Schwab premium account grows, the $30 per month fee, becomes a much lower percent of AUM. Although Schwab Premium offers financial planners.

As previously noted, all Schwab Intelligent Portfolios clients must accept an eight to ten percent cash allocation to an interest bearing fund within their portfolio.

Nearly all exchange traded funds (ETFs) charge very small management fees, that go directly to the fund management company. Both Wealthfront and Schwab recommend low-fee ETFs.

Wealthfront vs. Schwab Intelligent Portfolios – Robo Investing Deep Dive

Human Financial Planners

Winner: Schwab Intelligent Portfolios Premium.

Schwab Premium clients with at least $25,000 to invest are eligible to speak with financial advisors, at their convenience. Their fee of $30/month is reasonable for this service.

However, clients who might only want occasional human financial assistance would be better off with Betterment. Betterment offers a la carte financial planning packages for those who want a one- or two-time check-in with a professional. SoFi, also offers unlimited financial planners, with no minimum and no management fees.

Tax-Loss Harvesting

Winner: Wealthfront, due to frequency and affordability.

Although both robos offer tax-loss harvesting, Wealthfront offers it to all clients regardless of account size. Wealthfront also performs tax-loss harvesting daily, if needed.

Schwab Intelligent Portfolios only offers tax-loss harvesting to accounts with over $50,000. This makes it impossible for smaller-scale investors to benefit from this feature.

Remember that tax loss harvesting, only applies to taxable, not retirement accounts.

Investment Funds

Winner: Wealthfront

Both Schwab and Wealthfront have a diverse set of investment funds. Of course, they offer the basic funds you’d expect, such as stocks and bonds; however, they also have more untraditional investments, such as real estate investments and Schwab offers a small gold allocation.

Within the core portfolios there are some unique investments for each robo. Schwab clients have the option to invest in master limited partnerships, and gold, while Wealthfront clients can invest in natural resources.

Schwab’s core portfolio offers greater diversification that Wealthfront. But Wealthfront clients can add additional ETFs to an existing portfolio or create a new one for Wealthfront to manage. This puts Wealthfront in the lead with access to a greater number of ETFs. For investors seeking crypto exposure, Wealthfront also offers several Grayscale cryptocurrency funds.

Wealthfront

Wealthfront core portfolio investments are diversified across the U.S. and globally as well as covering various asset classes.

| Investment Fund Category | Index Fund Ticker Symbol |

|---|---|

| US Total Stock Market | VTI and SCHB |

| Foreign Stock - Developed Market | VEA and SCHF |

| Foreign Stock - Emerging Market | VWO and IEMG |

| Dividend Appreciation Stock | VIG and SCHD |

| US Treasury Inflation Protected Bond (TIPs) | SCHP and VTIP |

| US Government Bond | BND and BIV |

| Municipal Bond | VTEB and TFI |

| US Corporate Bond | LQD |

| Foreign-Emerging Market Bond | EMB |

| Real Estate | VNQ and SCHH |

| Natural Resources (Energy) | XLE and VDE |

Schwab Intelligent Portfolios

Scwab offers a wider range of investments and asset classes than Wealthfront. Yet, beyond a certain point, there’s no guarantee that more asset classes will outperform a robo advisor with fewer funds. Thus, the tied ranking.

| Category | Primary ETF | Secondary ETF |

|---|---|---|

| STOCKS | ||

| US Large Company | SCHX–Schwab U.S. Large-Cap | VOO–Vanguard S&P 500 |

| US Large Company–Fundamental | FNDX–Schwab Fundamental U.S. Large Company | PRF–PowerShares FTSE RAFI US 1000 |

| US Small Company | SCHA–Schwab U.S. Small-Cap | VB–Vanguard Small-Cap |

| US Small Company–Fundamental | FNDA–Schwab Fundamental U.S. Small Company | PRFZ–PowerShares FTSE RAFI US 1500 Small-Mid |

| International Developed Large Company | SCHF–Schwab International Equity | VEA–Vanguard FTSE Developed Markets |

| International Developed Large Company -Fundamental | FNDF–Schwab Fundamental International Large Company | PXF–PowerShares FTSE RAFI Developed Markets ex-U.S |

| International Developed–Small Company | SCHC–Schwab International Small-Cap Equity | VSS–Vanguard FTSE All-World ex-US Small Cap |

| International Developed Small Company–Fundamental | FNDC–Schwab Fundamental International Small Company | PXF–PowerShares FTSE RAFI Developed Markets ex-U.S |

| International Emerging Markets | SCHE–Schwab Emerging Markets Equity | IEMG–iShares Core MSCI Emerging Markets |

| International Emerging Markets–Fundamental | FNDE–Schwab Fundamental Emerging Markets Large Company | PXH–PowerShares FTSE RAFI Emerging Markets |

| US Exchange-Traded REITS | SCHH–Schwab U. S. REIT | VNQ–Vanguard REIT |

| International Exchange-Traded REITS | VNQI–Vanguard Global ex-U.S. Real Estate | IFGL–iShares International Developed Real Estate |

| US High Dividend | SCHD–Schwab US Dividend Equity | VYM–Vanguard High Dividend Yield |

| International High Dividend | HDEF-xTrackersMSCI EAFE High Dividend Yield Equity ETF | VYMI-Vanguard International High Dividend Yield |

| Master Limited Partnerships | MLPA–Global X MLP | ZMLP–Direxion Zacks MLP High Income |

| FIXED INCOME | ||

| US Treasuries | SCHR–Schwab Intermediate-Term U.S. Treasury | IEI-iShares 3-7 Year Treasury Bond |

| US Investment Grade Corporate Bonds | SPIB-SPDR Portfolio Intermediate Term Corporate Bond | VCIT–Vanguard Intermediate-Term Corporate Bond |

| US Securitized Bonds | VMBS–Vanguard Mortgage-Backed Securities | MBB-iShares MBS |

| US Inflation Protected Bonds | SCHP–Schwab U.S. TIPS | IPE-SPDR Bloomberg Barclays TIPS |

| US Corporate High Yield Bonds | HYLB-X trackers USD High Yield Corporate Bond | USHY-iShares Broad USD High Yield Corp Bond |

| International Developed Country Bonds | IAGG-iShares Core International Aggregate Bond | BNDX-Vanguard Total International Bond |

| International Emerging Markets Bonds | EBND-SPDR Bloomberg Barclays Emerging Markets Local Bond | EMLC-VanEck Vectors JP Morgan EM Local Currency Bond |

| Preferred Securities | PFFD-Global X US Preferred | PSK-SPDR Wells Fargo Preferred Stock |

| Bank Loans | BKLN–PowerShares Senior Loan | N/A |

| Investment Grade Municipal Bonds | VTEB–Vanguard Tax-Exempt Bond | TFI–SPDR Nuveen Barclays Municipal Bond |

| Investment Grade California Municipal Bonds | VTEB-Vanguard Tax-Exempt Bond | TFI-SPDR Nuveen Bloomberg Barclays Muni Bond |

| COMMODITIES | ||

| Gold and Other Precious Metals | IAU–iShares Gold Trust | GLTR–ETFS Physical Precious Metal Basket Shares |

Rebalancing

Winner: It’s a tie!

Both Wealthfront and Schwab Intelligent Portfolios monitor their clients’ portfolios daily and will rebalance as necessary.

Customer Support

Winner: Schwab is undefeated in this category.

It’s hard, if not impossible, to beat Schwab in terms of customer support. The Schwab Intelligent Portfolios, brokerage services, and trading services phone lines all have 24/7 availability. If you’d prefer virtual customer support, they have that too – also with 24/7 availability!

Schwab also offers branch access nationwide.

Wealthfront’s customer service is available Monday through Friday from 10am to 8 pm EST. Its important to note that all customer service representatives have a minimum of a Series 7 securities licence and some are Certified Financial Planners. That means that you’re likely to receive some investment guidance on the phone in addition to help with technical questions.

Cash Management

Winner: Wealthfront.

Wealthfront might be a surprising victor in this category, since Charles Schwab is such a large financial institution. However, this is one moment where Wealthfront’s all-digital platform really pays off.

With no overhead costs, Wealthfront can offer high-yield savings accounts, FDIC insured through partner banks, that pay relatively high interest.

To learn more about this feature, read our Wealthfront Cash Account Review.

In comparison, in order to receive a high yield at Schwab, you’ll need to open a separate brokerage account and choose a high yield money market account or certificate of deposit. The cash included in the Schwab Intelligent Portfolios typically doesn’t deliver the highest cash yields available.

Wealthfront Cash account offers FDIC insurance through partner banks. Wealthfront invests your money through partner banks which provide $2 million in FDIC coverage for individual accounts and $4 million FDIC coverage for joint accounts.

Both Wealthfront and Schwab also provide SIPC insurance which protects your investments from company failure or bankruptcy. The FDIC insurance also covers up to $250,000 investment account cash.

FAQ

Is a free robo-advisor worth it?

Free robo-advisors can still offer careful account monitoring, provide a diversified batch of investment options, and have excellent account security. Schwab Intelligent Portfolios does all of this and more.

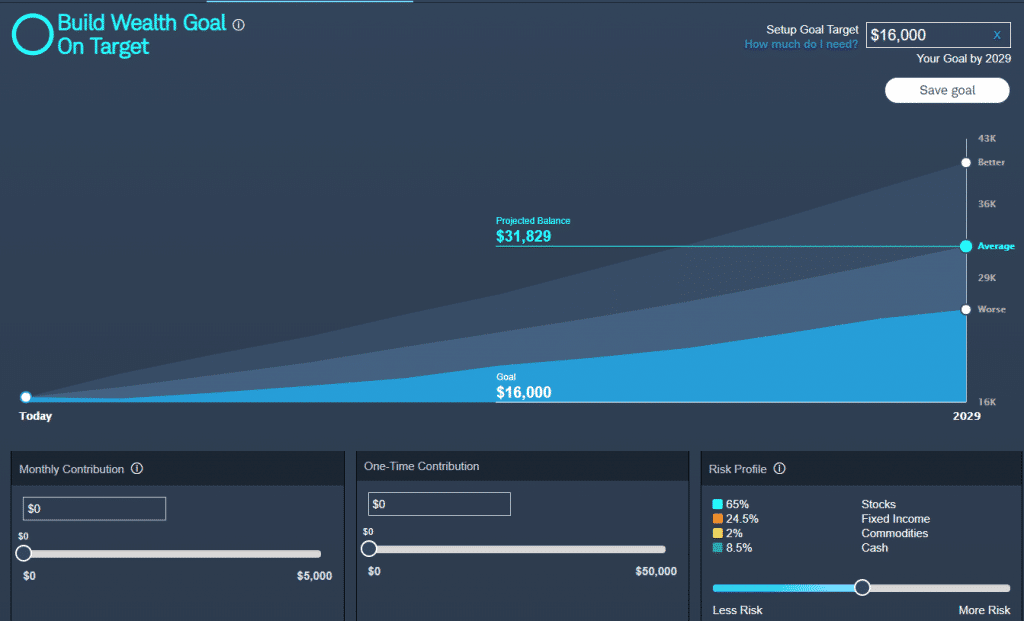

Which robo-advisor has the best client dashboard: Wealthfront or Schwab Intelligent Portfolios?

That said, since Wealthfront does robo-advising first, and Schwab has many services, we prefer the Wealthfront dashboard, as it is more comprehensive.

How do I decide which robo-advisor is best for me: Schwab, Wealthfront, or something else?

You might be tempted to use robo-advisor performance to choose which robo to go with. While these numbers are good indicators of a robo-advisor’s potential, remember that the market can fluctuate even in the most stable market – and most robo-advisor returns reflect their underlying asset allocations and investment fund percentages, not the strength of the robo advisory firm.

Wealthfront vs. Schwab Intelligent Portfolios – Which is Best? The Takeaway

When put head-to-head, Wealthfront and Schwab Intelligent Portfolios are practically tied. They both have the basic features one would expect in a robo-advisor, yet each stands out in a unique way.

When it comes to low minimum investments, tax-loss harvesting, and cash management, Wealthfront is clearly ahead of Schwab. If these features are important to your financial situation, that’s a great indication that Wealthfront might be the best choice for you.

However, Schwab Intelligent Portfolios is free at the basic level, which is enticing, if you’re comfortable with an eight to ten percent cash allocation. Clients with at least $25,000 to invest may be more interested in working with a robo-advisor who offers financial advisory access and is designed to assist wealthier clients.

Investors seeking live financial advisors would choose Schwab Intelligent Portfolios Premium. Learn more about the Schwab Intelligent Portfolios Premium features on the Schwab website.

Schwab also wins in the customer service category, with 24/7 availability by phone or online chat. Wealthfront’s access to customer service representatives is more opaque, with undisclosed phone hours available only for existing customers.

Is there a happy medium? The good news is that yes, many robo-advisors combine the best of both Wealthfront and Schwab. If you like low minimum investments, reasonable account management fees, and access to financial planners, you might check out a robo-advisor like Ellevest or Betterment.

Sign up for fee-free high yield cash management:

Read the full Wealthfront Review.

Read the full Schwab Intelligent Portfolios Review.

More Comparison Articles

- Schwab Intelligent Portfolios vs. Betterment

- M1 Finance vs. Robinhood

- Wealthfront vs. Fidelity Go

- Wealthfront vs. Vanguard

- M1 Finance vs Schwab

- SigFig vs Personal Capital

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Wealthfront Disclosures:

Robo-Advisor Pros receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. Robo-Advisor Pros is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA / SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront conveys funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Please see the Deposit Account Agreement for details.

Other eligibility requirements for mobile check deposit and to send a check may apply.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $2 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.