Maintaining an investment portfolio, at least correctly, is difficult. That is why portfolio management tools are so crucial. Not only do we need to identify the best stocks or ETFs to buy for our portfolio, but we have to maintain that portfolio properly to ensure we get the best returns.

Fortunately, Ziggma does both of these for us, and the platform is so solid I've decided to dedicate an entire article to a Ziggma review. The tool has free and premium versions, and this review will shed some light on the various features of this outstanding portfolio management tool.

Summary Ziggma is an ideal investment app to boost the ability to manage your portfolio. The online platform is easy to use and offers helpful features for all types investors. If you’re a long-term investor looking to simplify the management of your portfolio, Ziggma is a tool for you. The platform offers research, screeners, model portfolios, portfolio tracking, back testing capabilities plus so much more, making it easily worth the small monthly (or annual) plan. For half the cost of a Netflix subscription, you can make notable improvements to your portfolio in no time at all. Pros Cons

Ziggma Review - Is This Portfolio Manager Worth the Subscription Today?

Ziggma portfolio tracking software's core purpose is simplifying your portfolio management duties as a self-directed, long-term investor. It solves the core problems of long-term investors struggling to track their portfolios properly, thus costing them returns.

This review provides the information you need to know to decide if you should give Ziggma a chance to simplify your investment journey. It covers the individual features, the free and premium plans, the pros and cons, and its comparisons to competitors.

Lets get started.

What is Ziggma?

Ziggma is an efficient, affordable portfolio management platform designed to ease the process for self-directed, long-term investors. The online tool has everything to assist you in achieving your investment goals. The platform has free and premium tools, so it's suitable for everyone.

Many investors struggle to manage their portfolios for any considerable amount of time because they lack effective ways to optimize risk-adjusted returns.

Hence, Ziggma lets you aggregate your portfolios from numerous brokerage accounts, analyze them, and develop new investment ideas using their stock research features.

The platform aims to save you countless hours you would otherwise spend filtering data or understanding complex graphs and charts. The user-friendly software manages your portfolio efficiently and offers valuable insights for potential investments.

Ziggma's basic version is free, and if you need more advanced features, the premium version offers more portfolio management tools at very reasonable prices.

If this sounds like enough for you, just click the button to take a free trial run of Ziggma.

If you still want to learn how Ziggma works in-depth, lets carry on.

Reviewing Ziggmas key features

Below are the six key features of the Ziggma portfolio management tool:

- Ziggma portfolio tracker

- Ziggma stock research

- Ziggma model portfolios

- Ziggma stock screener

- Ziggma stock scores

- Ziggma portfolio simulator

Let's dig into each one of them individually.

Ziggma Portfolio Tracker

The Ziggma portfolio tracker helps you track your holdings' performance and KPIs (key performance indicators) across all your accounts.

Here's what the feature offers:

Investment control

The portfolio tracker's unique dashboard lets you securely link multiple accounts from over 20,000 financial institutions (brokers and banks). Thus, you can track all your investments in one place to see their performance and allocations. It makes adjusting and rebalancing a breeze.

Enhanced monitoring

Set Ziggma Smart Alerts for dividend yield, PE ratios, stock prices and more, saving countless hours when it comes to screening and monitoring. The tool offers passive portfolio monitoring by setting triggers and alerting you when specific stock metrics are hit.

Portfolio income

The Ziggma dividend tracker shows your cash flow from dividends for the next 12 months. The portfolio tracker helps you by eliminating the need to manually track it. No more spreadsheets, no more paid services to keep track of your income.

Best-of-breed stocks

Ziggma helps you reduce the time spent researching stocks. The premium plan allows you to access the Ziggma Stock Scorecard. You can view what Ziggma feels are the best stocks in a particular industry and utilize over 40 Key Performance Indicators it provides. The indicators cover financial strength, profitability, growth, and valuation.

Ziggma Stock Research

The Ziggma Stock Research feature aims to do one thing. Simplify your stock research. The company utilizes seasoned financial analysts to develop its stock research platform. The feature streamlines your research with the following:

- Get more done in significantly less time, with key financial ratios arranged by profitability, financial capacity valuation, and growth.

- A list of strengths and weaknesses of each particular company.

- Get best-of-the-best stocks with Ziggma's advanced peer comparison tool. This makes analyzing a company or stock against its competition a breeze.

The stock research feature offers the following:

Data quality

The Ziggma Stock Research tool provides institutional-grade data for a very affordable price. The platform's free company profile pages have a lot of data necessary for your research. They show well-structured KPIs by profitability, financial capacity valuation, and growth, similar to an institutional research report.

Unique industry-level data

Boost your research by getting best-in-class financial information on the platform. Look at interest income for banks and loan-to-value (LTV) for REITs, among many other specific financial ratios that don't necessarily make sense across all industries.

Quarterly data

Access quarterly and annual data for free with Ziggma. The software's proprietary stock research and stock scores help you capture all the relevant data points. Coupled with easy access to earnings data, you'll be making better decisions in no time.

I find this one of the most useful tools on the platform, and would urge people to try the platforms 7 day free trial to see if its for you. To do so, just click the button below.

Ziggma Model Portfolios

Looking for new ideas? Ziggma Model Portfolios has different makeups of portfolios available for all types of investors.

Also, their guru portfolios can inspire you, coming from the best investors of all time like Buffett, Loeb, and Dalio.

Here's what this Ziggma feature has for you:

Guru portfolios

Grab some motivation from the best! Ziggma Model Portfolios show the top positions of the most successful investors globally, including Warren Buffet, Steve Cohen, Paul Singer, and others.

Although you should always do your own due diligence, it helps to know what the best of the best are buying and see if it suits your portfolio. Also, you benefit from having an extensive shortlist without doing any actual work.

Model Portfolios for investor types

The platform's model portfolios are based on investment principles, risk appetite, themes, and more. They provide ideas for building an ideal portfolio at any stage of your investment career.

Some portfolio examples include sustainable high-yield stocks, value stocks with minimal climate impact, or profitable growth stocks. You can use these models to create the optimal portfolio for you.

Ziggma Stock Screener

Ziggma stock screeners make finding the stock that best fits your portfolio easy by filtering based on standard financial metrics and custom data points.

The feature has the following to offer:

Sliding scales

The free stock screener filters give you results in seconds. Its primary purpose is to provide you with a practical screening experience. Instead of endless dropdown menus full of financial ratios, the app eases stock research by emphasizing qualitative measures.

Stock score

Allows you to save time when it comes to your research by screening for stocks that Ziggma finds attractive. Although this isn't where your research should stop, it certainly helps to have a pre-screened list to work off of.

Screener saving

Ziggma lets you save your best investment search screens/ideas so you can view them later. That way, you don't have to initiate a new screen if you want to return for more ideas.

Grab a 7 day free trial of Ziggma and see how their stock screener works

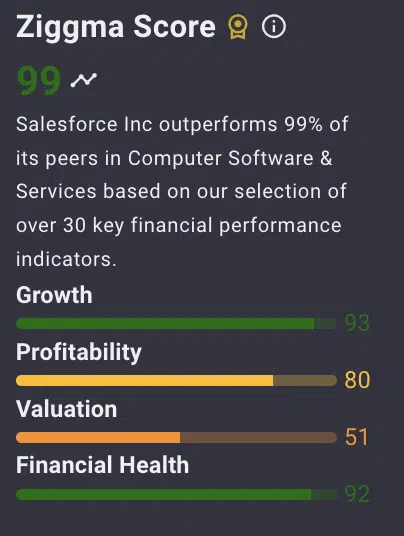

Ziggma Stock Scores

This feature simplifies research by focusing on top-scoring stocks through institutional-grade, qualitative stock research.

Ziggma stock scores provide the following:

The stock scorecard

Ziggma's scorecards show you what Ziggma thinks are the best stocks in an industry at that point in time. As a result, you can gain access to higher-quality companies and build a more robust portfolio in less time.

They do the hard screening for you. Ziggma's score also compares your target stock's performance with its competitors in the industry. That can include profitability, growth, valuation, and financial position sub-scores.

Essential trends

Identifies fundamental trends by focusing on particular areas of the company's stock scores. Can let you know if a company is trending upwards or downwards in a particular area, giving you more insight and the ability to make more informed decisions.

The stock score can help you eliminate bias in your research, save you hours of time, and monitor your overall portfolio quality.

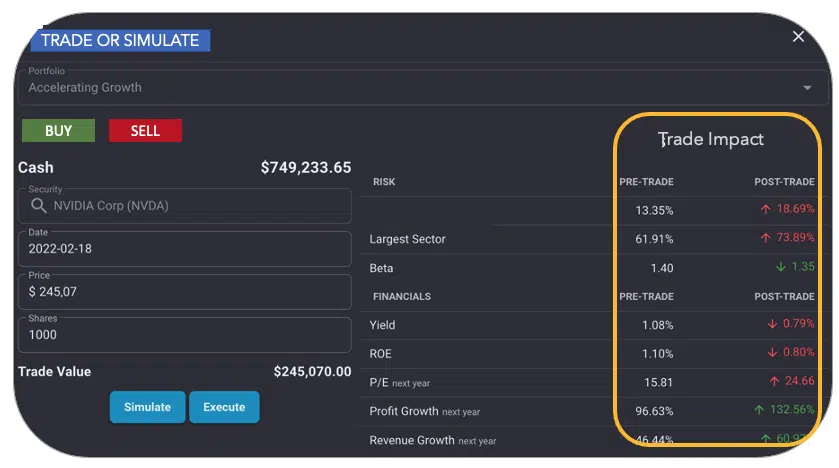

Ziggma Portfolio Simulator

Being able to simulate particular results based on specific investments is something institutional investors have done for decades. With Ziggma, it's finally available to retail investors.

Ziggma Portfolio Simulator is a premium feature that gauges how a transaction affects your portfolio allocations, growth, average yield, and more.

Here's what the simulator offers:

Making the right trade

The feature helps you build an ideal portfolio by gauging a new investment's impact on your portfolio. It evaluates the impact of an investment on portfolio holdings' profitability and growth, diversification, and portfolio risk.

Obviously, past returns do not guarantee future returns. However, simulating results can give one a better idea of how something could impact one's portfolio.

Backtesting

A Portfolio Simulator retrospectively gauges specific strategies' effectiveness and optimizes them if necessary. Backtesting is helpful when you have a particular strategy in mind and want to see how it has performed historically.

I think the portfolio simulators is one of the more handy tools for testing specific strategies before deploying them with real money. You can run this tester with a free trial of Ziggma. Just click below to claim it.

How Much Does Ziggma Cost?

Ziggma has a free and premium plan. The free version is available for all, while the reasonably priced premium version offers more advanced features. They also have a free trial available to those wishing to try the premium version.

Ziggma Free

The free Ziggma plan is enough if you only need basic stock screening and investment tracking, but if you want anything reasonable, you'll want to look to the paid version. The free version offers the following features:

- Brokerage accounts or IRA linking

- Portfolio Holding Stock Scores

- Organized stock research data

- Swift stock and ETF screener

- Multi-asset portfolio tracker

- Ad-free market Big Board

- Dividend tracker

Ziggma Premium

Ziggma's paid version costs $9.90/mo or $7.49/mo on annual plan. The platform offers a 7-day free plan to make an informed decision.

Considering this platform's features, $7.49 a month is a very attractive price. I know some platforms offering a quarter of these features at the same price.

The premium version package includes all the free features plus the following:

- Unlimited investment accounts linking

- Full access to the Ziggma stock scores

- Saving your screening settings

- Portfolio simulator

- Top 50 stock lists

- Model portfolios

- Backtesting engine

- Smart alerts

Ziggma Pros and cons

No platform is perfect. So, let's go over the pros and cons of Ziggma to see where the platform excels and where it can improve.

Pros

- Free screening and portfolio tracking tools with broker integrations to keep you on top of your portfolio.

- A stock scoring system based on fundamental metrics to make your life easier regarding research.

- Compare stocks across industry peers to help you find best-of-breed stocks.

- Top 50 stocks list to generate investment ideas to build yours.

- A unique and insightful KPI to gauge the industry's top performers.

- Reasonable monthly and annual plans compared to its competitors.

- User-friendliness

Cons

- The stock screener could use some more metrics. It is very useful but also relatively basic

- Absence of stock picks or personalized guidance

- Shallow backtesting and simulation features

- Lack of international stock coverage

How to use Ziggma

You can use Ziggma in the following ways:

- Find in-depth fundamental and technical data on companies you like using Ziggma's easy-to-use research platform.

- Use Plaid to link multiple investment accounts to view historical performance, daily balance, and current holdings scores.

- Create a virtual portfolio instead of linking your accounts or prefer paper trading.

- Access various research tools using different tabs and dropdown menus.

Who Is Ziggma Best For?

Ziggma is best for long-term investors seeking unique tools to keep them on top of their investment portfolios. The portfolio tracker's primary focus is simplifying portfolio management for self-directed, long-term investors. It uses an algorithmic scoring system to rank and give stock data, which ultimately doesn't eliminate investors' need for research but saves them time.

The platform offers ideal solutions to long-term investors who find tracking key portfolio metrics difficult. Thus, it helps track portfolio splits, dividends, target prices, and portfolio companies' financial health. The tasks can become complex and time-consuming as your portfolio's size increases.

The app's portfolio tracker ensures you stick to and achieve your investment goals. Also, it allows multiple account holders to aggregate a holistic view of their portfolio in one place.

How does Ziggma compare with its competition?

Ziggma vs. Seeking Alpha

The main difference between Ziggma and Seeking Alpha is historical data coverage. Ziggma provides five years of historical data while Seeking Alpha covers ten years of financial data. However, regarding stock research, both apps provide financial data and ratios, future earnings estimates, and more.

Stock analysis is another difference between the two platforms. Seeking Alpha provides a wider variety of stock analyses than Ziggma. Keep in mind, however, that Seeking Alpha sources its stock research externally, allowing outside writers to contribute to the platform and provide their opinions.

Ziggma vs. Sharesight

The main difference between Ziggma and Sharesight is mostly the user interface. Ziggma has more up-to-date features than Sharesight, which seems old-fashioned due to its unattractive user interface (UI). Additionally, Sharesight offers Excel-based data uploads instead of an Application Programming Interface or directly connecting to a trading site.

Moreover, the trial plan has only ten stocks to manage, which is too low to judge the app's ability to analyze. Ziggma has better UI, trial features, and capability, in my opinion.

Ziggma vs. TipRanks

The main difference between Ziggma and TipRank is the amount of data they provide. Although Ziggma provides a substantial amount of data, TipRank provides more. Thus, the latter is better for traders and technical analysis.

The other differentiating factor is the pricing plan. Ziggma has a free and paid plan, with the free one giving you access to most of its features. The premium version costs $9.90/mo or $7.49/mo annually.

On the other hand, TipRank doesn't offer a free plan. Instead, the platform has two paid plans, including premium and ultimate. The former is the most popular and costs $30/mo, while the latter is $50/m.

Overall, the pricing is much more expensive with TipRanks, and for those who are looking to track their portfolio and shortlist stocks casually, it's likely not worth the costs.

If you have even a $20,000-$30,000 portfolio, a $600 USD price tag for a platform will eat away a ton of your investment returns.

Conclusion

Ziggma is an ideal investment app to boost the ability to manage your portfolio. The online platform is easy to use and offers helpful features for all investors. If you're a long-term investor looking to simplify the management of your portfolio, Ziggma is a tool for you.

Our Ziggma review exhausts all the app's features and how to use them, and we hope you found it useful. Fortunately, you can access most of the portfolio analysis and research tools on the free plan, like the stock screeners and stock research tools. However, the premium version offers more advanced features such as stock scores, model portfolios, and the Top 50 Stock List. In my opinion, it's well worth it to upgrade, as the free version is a little too simple even for the most basic of investors.

The paid version has a 7-day free trial plan to help you make an informed decision before subscribing for real.

FAQs

What is the best way to track my investments?

The best way to track your investments is using one of the following methods:

- Online tracking services like Empower or Ziggma

- DIY using spreadsheets

- Personal finance apps

- A trading journal

- Desktop apps

How can I track my stock portfolio for free?

You can track your portfolio for free using the following investment tracking tools:

- Empower (formerly personal capital)

- Morningstar portfolio tracker

- Kubera portfolio tracker

- Google Finance

- Ziggma

- Sigfig

Which is the best portfolio tracker?

Empower (Personal Capital) is the best portfolio tracker overall because of its free dashboard (Empower Personal Dashboard). The hands-off dashboard is among the best and most effective personal finance apps. Additionally, the portfolio manager is free. You can read my comprehensive review on their free tools here.

How much does Ziggma cost?

Ziggma's paid subscription costs $9.90/mo or $89.88 annually. The platform has two pricing options: Free and paid. A paid version gives you access to more advanced features like Ziggma stock score, portfolio simulator, model portfolios, and top 50 stock list.

They also have a 7 day free trial, which you can grab here

Are portfolio trackers safe?

Yes, most portfolio trackers are safe. Since there are trackers for casual and professional investors, look for software features, fees, and encryption protocols to ensure their safety.